Posted in : HfSResearch.com Homepage, HR Strategy, The As-a-Service Economy

Ready for the transition to As-a-Service?

The industry’s first Workday services blueprint: A new breed of As-a-Service providers has disrupted HR delivery forever

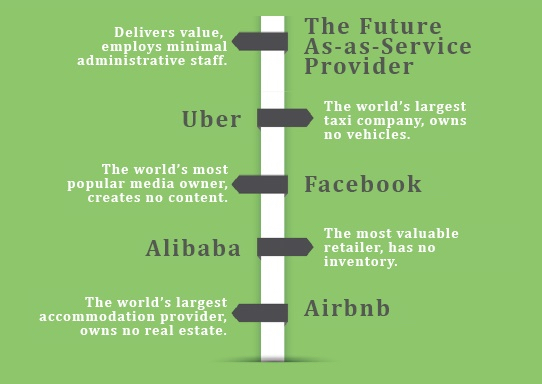

Just a few short years after ADP introduced the basic fundamentals of Business-Process-as-a-Service to the corporate back office with its managed payroll offerings, Workday has rapidly introduced HR-as-a-Service to the corporate, world with its comprehensive HR platform suite, creating a whole new ecosystem of service providers eager to slake the Workday thirst of so many HR heads.

Just a few short years after ADP introduced the basic fundamentals of Business-Process-as-a-Service to the corporate back office with its managed payroll offerings, Workday has rapidly introduced HR-as-a-Service to the corporate, world with its comprehensive HR platform suite, creating a whole new ecosystem of service providers eager to slake the Workday thirst of so many HR heads.

Mention the very words “Workday” to any HR executive today and their eyes light up – they need a Workday go-live on their resumé, just like CMOs need Salesforce experience and most CIOs, in the past, an SAP or Oracle roll-out. However, what’s truly disruptive about the new HR-as-a-Service environment that has sprung up practically overnight, is the emergence of a whole new breed of As-a-Service providers now feasting on the lunch of the traditional providers. What once cost $50m for a complex technical implementation, can now be done for a fraction of the price, with the bulk of the investment being refocused on post-implementation support and HR transformation.

Being able to tap into consultative support that can help with organizational design, or workforce analytics, that is delivered via virtual on-tap models, in addition to the bread-and-butter fulfillment work, has changed the game forever – and for those only just waking up to this seachange, it is already too late.

So let’s take a look at how the Workday services environment is shaping up with the industry’s first ever Blueprint report into Workday services, with the help of HfS principal analyst and report co-author, Khalda de Souza:

Khalda…. why do so much research into Workday?

Enterprises are increasingly interested in SaaS applications, as they promise speed, cost effectiveness and simplicity. We’ve seen great and growing interest in SaaS for HR functionality over the last several years and momentum behind the Workday HCM product has been especially strong. Today there are medium and large global enterprises alike deploying Workday, mainly because of its functionality, attractive user interface and its common code instance. Customers are increasingly fed up with constantly adding complexities to their application environments which is often the result of some of the on premise options.

Most Workday deployments to date have been for North America-headquartered enterprises, in some cases including their international offices. In the next year we expect deployments in other regions to increase, particularly in Europe. In addition, other Workday modules are also in growth mode, including Workday Financial Management. So this is the right time to highlight the trends and the leading providers for plan, implement, manage, operate and optimize Workday services in this exciting growth market.

So if SaaS is so easy, why do enterprises actually need a service provider?

Workday wants to help its customers to be as self-sufficient as possible. To this end it has developed the innovative Workday Community, which is an online resource for all customers to ask questions, share experiences and even find partners. Customers can also find resources on the Workday Consulting Services Marketplace. These are invaluable – and our research shows, very popular – resources, but there are still massive opportunities for service providers to provide additional value-add services.

While SaaS applications are generally easier to deploy than on premise applications, it does not mean that enterprises do not require any in-house services skills at all to make the SaaS adoption successful. Unfortunately, some enterprises have learnt this the hard way, by radically reducing their in-house IT team when deploying SaaS. Workday service providers have seen demand across the value chain of services, from consulting through to BPO services. For example, enterprises need to understand the implications of using a SaaS application including the organizational change management that may entail. Workday partners with a deep knowledge of HR and/or finance have also brought deep functional expertise in a holistic manner to customers.

So who are these partners offering to Workday the organization… and how did they do?

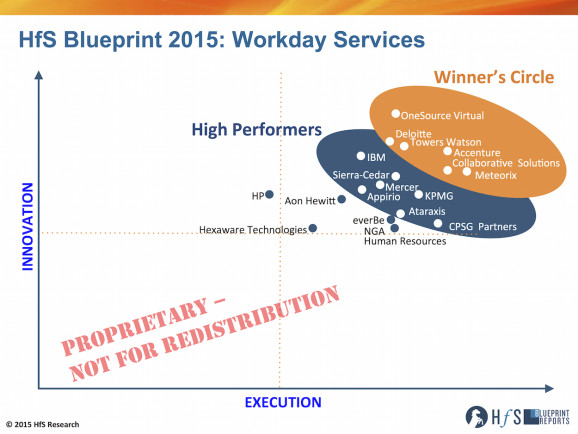

Workday’s services ecosystem is one of a kind. For starters, it’s a closed ecosystem, with Workday carefully selecting and inviting partners to join the club. To date there are 28 deployment partners, including Workday boutiques (such as Ataraxis and OneSource Virtual) , HR specialists (such as Aon Hewitt), consultants (such as KPMG) and global general service providers (such as Accenture and IBM). Moreover, all partner consultants are trained by Workday so that they all use a consistent deployment methodology to maintain the same high standard. As a result, there isn’t a weak partner, as they are all at least technically very capable. The differentiators lie in commitment to developing proprietary technologies, customer engagement methodologies and having a clear vision for the market.

In our Blueprint, the boutique partners shone, especially for their commitment to making customers’ Workday experience a success. The HfS Blueprint Axis shown today captures a healthy mix of each category of service provider in both our Winner’s Circle and our High Performers, highlighting the need for the global partners to not take their usual dominant position for granted.

The members of our Winner’s Circle for Workday Services include: Accenture, Collaborative Solutions, Deloitte, Meteorix, OneSource Virtual and Towers Watson.

Our High Performers include: Appirio, Ataraxis, CPSG Partners, IBM, KPMG, Mercer and Sierra-Cedar.

In our Blueprint we also profile the capabilities of other Workday partners including: Aon Hewitt, everBe, Hexaware Technologies, HP, NGA Human Resources as well as of Workday itself.

Thanks for your great insight, Khalda. So… to sum up this Blueprint research, how do you see this market evolving further down the road?

Most Workday engagements to date have focused on consulting and implementation services. We are now seeing an increasing demand for application management and BPO services. Some of the partners have these capabilities but have not necessarily fully marketed them yet as the demand has not been there. We expect these partners to strengthen their offerings and step up the marketing effort. As the Workday financial management (FM) product also grows in demand, partners with both the HR and finance capabilities will be in a stronger position to offer Workday as a platform. Overall, partners with international capabilities will have increased opportunities to grow in the growing Workday services market. For those partners with a gap in any of these capabilities, they will have to at least have an answer for it all – that being, build it, acquire it or partner for it.

HfS readers can click here to view highlights of all our HfS Blueprint reports.

HfS subscribers click here to access the new HfS Blueprint Report, “HfS Blueprint Report 2015: Workday Services“

Posted in : Business Process Outsourcing (BPO), Cloud Computing, Digital Transformation, Global Business Services, HfS Blueprint Results, HfSResearch.com Homepage, HR Outsourcing, HR Strategy, IT Outsourcing / IT Services, kpo-analytics, SaaS, PaaS, IaaS and BPaaS, Sourcing Best Practises, sourcing-change, Talent in Sourcing, The As-a-Service Economy

Robo-Britannia: Is Britain leading the As-a-Service revolution?

There are a lot of negative viewpoints on Britain’s capabilities to rebound as an economic superpower, after its heyday leading the world into the industrial revolution a very, very long time ago now. However, when it comes to driving out costs, privatisation and outsourcing of labor, and mercilessly adopting new tools and techniques to make themselves more efficient, their leading organizations are pretty damn good at jumping on the train.

There are a lot of negative viewpoints on Britain’s capabilities to rebound as an economic superpower, after its heyday leading the world into the industrial revolution a very, very long time ago now. However, when it comes to driving out costs, privatisation and outsourcing of labor, and mercilessly adopting new tools and techniques to make themselves more efficient, their leading organizations are pretty damn good at jumping on the train.

And while the British government is the world’s biggest customer of offshore outsourcing (in fact its government has created a whole outsourcing economy of its own), Britain is also home to several of the upcoming automation software firms, such as Blue Prism, Thoughtonomy and IPSoft (a major presence there), the artificial intelligence firm Celaton, and several start-up robo boutiques, such as Genfour, Symphony and Virtual Operations.

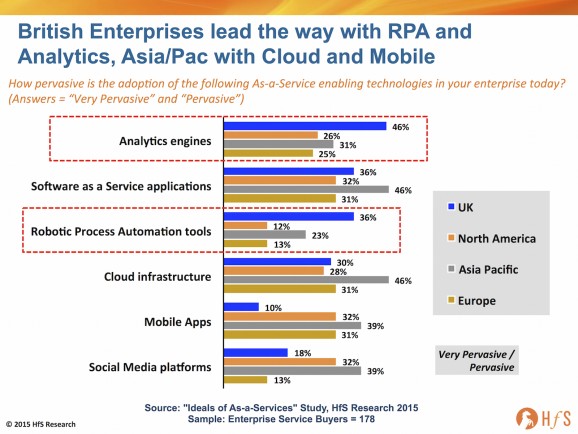

Yes, people, when it comes to being first on the bandwagon for experimenting with solutions that can drive out cost and improve productivity, the UK – amazingly after all these years – still leads the way. Our soon-to-be revealed As-a-Service study, which canvassed the viewpoints of 716 industry stakeholders, including 178 major enterprise service buyers, clearly shows how much more pervasive the adoption of both Robotic Process Automation (RPA) and analytics tools are among British enterprises, compared to enterprise service buyers in the other major global regions:

The Bottom-line: As-a-Service is changing the service industry dynamics forever, making it possible for smart businesses to get ahead of the disruption curve

As we delve into these unprecedented survey findings, it’s becoming abundantly clear that the evolution to As-a-Service will be a long and painful one for many buyers, providers and advisors, but the core fundamentals are about enterprises operating with more speed and predictability, a higher quality of processes and more value-based provider relationships, that can enable them to “plug-in” to the services experience.

Enterprises which have opened themselves up to a lot of global outsourcing relationships in recent years, for example many UK-led businesses, are clearly forging ahead more aggressively with the next wave of As-a-Service value, which is building the foundation for smarter automation, more realtime, meaningful analytics capabilities and a much more accessible, standardized cloud driven delivery infrastructure. As-a-Service is a global phenomenon and the future Fortune 500 in 3-5 years’ time will be made of of many nimble As-a-Service driven firms, which are globally ubiquitous, where most services are sourced, and delivered via intelligent cloud models. Yes, the Germans will probably still make great cars, and the American leading in life sciences, the Chinese in hardware manufacturing etc., but the true As-a-Service driven organization? Now that can be anywhere…

Posted in : Business Process Outsourcing (BPO), Cloud Computing, Digital Transformation, HfSResearch.com Homepage, IT Outsourcing / IT Services, kpo-analytics, Robotic Process Automation, SaaS, PaaS, IaaS and BPaaS, smac-and-big-data, Social Networking, Sourcing Best Practises, sourcing-change, Talent in Sourcing, The As-a-Service Economy, the-industry-speaks

Chris cracks the Cap-ability code

On the week when Capgemini opened its wallet to make one of the largest services deals in history, with the $4 billion acquisition of IGATE, we thought it high time to focus on one business division that’s really been on fire the last couple of years – Business Process Outsourcing.

With Capgemini’s proven capabilities delivering global Finance & Accounting services (see our recent Progressive F&A Blueprint), one of the areas where the firm has needed to invest is in the industry sectors, so I, for one, am excited to see how Cap integrates IGATE’s insurance BPO delivery.

But the one aspect of BPO that keeps us grounded, is the simple fact that’s it still really about people and relationships – about talent and trust, which is why we went out and spoke to 540 business stakeholders on the topic – and you can read the report here. So, without further ado, let’s talk to geologist-cum-Capgemini’s BPO CEO, Chris Stancombe, on how his division is faring under his leadership and how he views the emerging disruption in the market…

Phil Fersht (CEO, HfS): Good afternoon Chris. Great to have you back with HfS – I think it’s been at least a year since you took the reigns as the CEO of Capgemini’s BPO business. Maybe you could start by giving us a bit of an update on how that’s really fared. In the last year, we have seen some really strong performance from your firm, from our analyst vantage point. Maybe you could share a little bit with our audience how it’s evolved internally, how you have built out the team and where you feel you are today with the business.

Chris Stancombe (CEO Capgemini BPO): Thanks for that Phil. It’s good to be back. I have been here now for ten years. And as you kindly said it’s quite a success story really with the growth that we have experienced and the position that we have established for ourselves in the market. When I took over from Hubert Giraud, we had a plan that the two of us had worked on together. With Hubert moving on and also our CFO, Oliver Pfeil, taking on a new role there was quite a significant change at the top so the first thing I wanted to bring was stability.

When we moved into the three year plan, my most conscious thoughts were how do we build on our strengths and go broader and deeper within our portfolio to bring more value to our clients. So clearly we have a number of areas of strengths. F&A is one of those, analytics is another as well as Supply Chain and HRO.

So it was really taking those strengths and being honest with ourselves around where could we really compete strongly in the market and then determining how we go broader. And to me broader really is in two areas. Firstly, focusing on value-add services that unlock new benefits for clients. And secondly, on the volume side, making sure that we leverage our size and capability to deliver processing cost effectively.

In terms of going deeper, things are working very well as we introduce better linkages with our Application and Infrastructure Services colleagues, and all the things that we have been doing on technology like robotics and artificial intelligence and how we bring that into play. We also benefit greatly from developing deeper capabilities for specific industry sectors. As you know, we group our portfolio around sectors which means we can really deepen our knowledge base and develop some very specific, very interesting propositions.

Phil: So do you feel things have really changed all that much, from a client needs perspective, in the last three years? There is obviously a lot of noise in the market around disruption and technology-driven solutions, but when you talk to clients, do you see a dramatic change in their needs? What do you think is moving the industry?

Chris: I would say there is definitely more desire for transformation now. I mean, there is widespread acceptance that just moving some process to an outsourcer and that element of the process being done better and cheaper is not the whole answer. So I think it’s more of a recognition of choosing a partner that can deliver some of the service cheaper and better but also working together to deliver a real transformational impact.

When it comes to technology-driven disruption, one of the big consequences is the speed with which transformation needs to be delivered. The Cloud means a lot of things to a lot of people. Many think you can just summon up an App and then load the app on your mobile. You have a BPO app. And then it’s done and you immediately implement. I think patience is much much lower.

So I think we have seen much more pressure for speed and the ability to convince clients that you can deliver transformation quickly at low risk. As you know, some of our assets around the Global Enterprise Model have really helped us in that because clients can see the route map against which we plan that transformation.

Phil: Chris, you know one of the areas where Capgemini fared very well in our recent F&A blueprint was in the area of talent – and when you read our new report, you’ll see we did pick up very strongly that there was a lot of satisfaction from BPO professionals, in terms of their intellectual challenge. But there was also some ambiguity where it led to in the long term, especially from less experienced staff. How do you view this, when you look at the career paths of the BPO professionals? Do you think this is something people try for a while and then move on to something else, or is BPO evolving into a genuine long-term career choice for many, and will become more widely recognized by our fellow professionals over time?

Chris: Well, Phil, my view is we have created a new profession. I have been in BPO now for 13 years and I view myself as bit of a latecomer to it. There are a lot of people that have been in BPO where that’s the only career they know. They joined as graduates, they stayed in the profession, they have a fantastic client service mentality, they are very innovative, they are very agile. They are keen to work towards continuous improvement. They recognize they want to move into new clients in new sectors. It’s a very exciting industry to be in.

I think what we need now is to create some structure around the profession like other professions do such that therefore there is a bit of prestige. You know if you become a lawyer you are a qualified lawyer and then you have got letters that go after your name, if you are a qualified accountant similarly. I do think we need to start challenging ourselves. What are we doing for the next generation such that people are proud to be in BPO in the same way that lawyers are proud or doctors are proud and engineers are proud? It should be a similar type of professional approach. And I think that’s what we need to bring to BPO now.

Phil: Yeah – it seems that providers like yourselves are doing a good job of creating career paths because it’s your core business. You deliver BPO, Finance, IT “as-a-service” for your clients. Whereas, on your client end it’s often not their core business. It’s support operations. So do you think part of the issue is that providers are getting good at creating the career path, but it’s actually more of a struggle on the buy side to sort of figure out what it means to them?

Chris: I would say obviously it’s much much better to use a BPO provider than try and do it yourself. But in areas where you have a global business service it often becomes a separate company- a captive with its own dynamics, its own leadership. And I do think that rather than just having an accounting and finance captive and then an HR captive under separate leadership, it can all be put under a global businesses service leadership with IT as well. I have seen some very dynamic organizations that create opportunities because in those cases obviously you don’t have the multi-client multi-sector opportunity but at least you do have the multi-disciplinary opportunity.

So I think the less choice you give, then the less interesting it is for people to develop their careers. The very least you need to do is create a global business services organization.

Phil: Chris, so what do you think of the measures that both buyers and providers can take to improve the level of trust in a relationship? What do you see working?

Chris: It’s still a people’s business, isn’t it Phil? So you still have to have the good cultural match between the people in the engagement and the people on the client side. The tone has to be set from the top. So making sure you have regular meetings at the senior level, CFO to CEO. They set the tone. You talk to each other regularly. Make sure that you are transparent and open and have the right people on the account with aligned coaches. Sometimes it’s rotating two or three people through the account until you have the right people working together. So it is being sensitive on both sides you know. I mean the people have to want to work together, they have to want to build a partnership, and be aligned around the same measures. And then if you get people on both sides pulling in the same direction the tone is “We’re in this together. Let’s move it forward” When people like each other, spend time together, and build a relationship then that’s how you get that trust.

Phil: So do you think clients, in general, are warming to a more a trusting relationship with their providers?

Chris: I think it does depend on the client and what the client wants. But the good news is more clients are now open to that part of the transformation. They recognize the value of the people and their longevity, their different experiences, the knowledge they bring, and the assets that we have built. The right client wants to be able to leverage and tap into that value. So I think the evaluation of suppliers is not just around “what’s your price and what service will you agree to”. Increasingly it will be about what assets are you bringing and how you are going to help us transform ourselves, how are you going to help drive that change, create that vision for us because you’ve got a better view of what ‘good’ looks like. It’s the moment where they think “wow, that’s what we want to be like”.

Phil: And you know when we look out maybe a couple of years, how is the conversation going to evolve? Do you think it will get more and more into how much RPA can you do, how good are your analytics? Or do you think that stuff is all going to become absolutely staple to the BPO diet, and it’s going to shift beyond that? Where do you think this conversation is going to evolve to in a couple of years?

Chris: I think CFOs are going to be asking themselves “How are you going to help me drive my customer satisfaction index with the business?” The discussion in two or three years will be how are you going to help me with my measures around the customer satisfaction feedback I am getting from the business units? Also how are you going to help me with my ethics and how are you going to portray the right culture in my organization so your culture and our culture are aligned strongly? I think we are seeing now interestingly when you look at risk and compliance that more and more people are saying actually it’s the culture of an organization that manages the risk better than any policies or policing that you may put in place. If you have the right culture in your organization your risk is lower. And whether that’s ethics and compliance or it’s CSR, all of those things are important and they lower your risk.

So to me the top three critical questions that the CFO should be asking are: How do I build better customer satisfaction with my business? How do I drive value to my shareholders? And how do you help me create the right culture in the organization such that my risk is mitigated?

Phil: This has been great, Chris. I really appreciate the time today. And I look forward to sharing this with the network. It’s been really good to hear your views and how your business is faring.

Chris Stancombe (pictured) is Chief Executive Officer, BPO Division, Capgemini (Click here for bio)

Posted in : Business Process Outsourcing (BPO), Finance and Accounting, HfSResearch.com Homepage, HR Strategy, Outsourcing Heros, Robotic Process Automation, Talent in Sourcing

Never doubt an HfS merger prediction! Capgemini really is buying iGATE

As we correctly predicted last week, Capgemini and iGATE have announced their nuptials after finding many areas of common interest to consummate a long-term flourishing relationship.

In short, this merger further builds on our weekend argument that service providers need to blend the best parts of each other to address better the journey to the As-a-Service Economy, and not solely the really disruptive stuff that could be 5-10 years out on the horizon. OK.. there’s more chance of me being the next Gartner CEO than IBM actually buying TCS, but we wanted to set out the argument why a bout of lovely big service provider marriages could provide an ideal distraction from the spate of depressing quarterly results, while allowing for them to co-develop their investments in areas of real value.

At HfS, we believe this acquisition makes a lot of sense for Capgemini to address several holes in its global service portfolio, shoring up its India presence and adding some serious pep to its US clientele (and brand), financial services capabilities and analytics depth.

What Capgemini Gets From iGATE

North American Clients

iGATE derives over 70% of its revenues from North America with anchor clients such as General Electric and RBC and particular strength in financial services and manufacturing. By contrast, Capgemini gets around 20% of its revenues from North America with the stated intention to grow that very significantly and rapidly across the services portfolio.

Indian Delivery Presence

Capgemini has worked hard over the last few years to build its presence in India starting from the acquisition of Kanbay back in 2006. Today it has 55,000+ FTEs in India as compared to 30,000+ at iGATE. The iGATE delivery footprint may be especially interesting to Capgemini who have been trying to grow their presence in Tier II cities in order to reduce labor costs and iGATE may be an accelerant to this effort.

Analytics

Through its Business Intelligence, Extract Transform and Load and Enterprise Datawarehouse work, iGATE has penetrated into some really large accounts in industries like quick service restaurants, and is now moving up to higher value analytics work for these same clients. This would bolster Capgemini’s already strong BI and analytics practice, particularly with US client, and add ~2500 analytics FTEs, which is always a plus.

Vertical Business Process Outsourcing

Capgemini has historically been a horizontally-oriented BPO service provider with a comparatively limited vertical capability, offering a proven market leading F&A capability, but less impressive in industry-specific BPO areas. iGATE brings real depth in financial services vertical BPO, especially insurance, where the firm been making investments for the last several years as a TPA and a provider of transactional services For example, iGATE has also recently opened a center of excellence for insurance BPO in Dartmouth, Nova Scotia, a first class delivery location for higher value work, and is very active in embracing onshore/nearshore talent to supplement it’s offshore delivery engine. iGATE would also bring vertical business processes (with analytics) in other verticals such as healthcare and life sciences, which would also compliment Capgemini’s growing needs.

Governance, Risk and Compliance services

This was was one of the key ‘emerging services’ areas for Capgemini in the last couple of years, and HfS believes it wanted to build particular depth in domain-specific regulatory compliance services for financial services. iGATE’s client footprint in financial services may be an accelerant for these efforts.

Engineering Services

iGATE can complement the Capgemini’s Engineering services practice which is oriented significantly towards aerospace and utilities clients. By contrast, iGATE engineering services serves medical devices and mining clients including several marquee clients. However this is still a small offering out of the grand total and so it is unlikely to be a significant source of strategic benefit immediately.

No more Capital Letter Confusion

Everytime I try to type “iGATE” I have to double-check where to put the capital letters. Thanks for erasing this headache!

What Capgemini Won’t Get From iGATE

Automation and Cognitive

Capgemini is making strides bringing Process Automation into especially its BPO operations but so too are their competitors especially in Cognitive where the Capgemini vision isn’t clear today. We like what they are doing in process automation but iGATE isn’t going to be a force multiplier to this capability and in fact the integration may distract the team from making advances in this critical investment area today.

The Bottom-line: A solid acquisition to shore up the old model and address the transition to the As-a-Service Economy, but more is needed down the road

Most of the leading service providers today are looking at niche buys that specifically add software IP or a vertical capability, such as Cognizant/Trizetto, or Infosys/Panaya. However, in Capgemini’s case, there are still some significant holes in its portfolio to fill out, most notably a more powerful presence in India, a stronger portfolio of US enterprise clients, and a deeper foothold in financial services. iGATE brings these to the table.

Net-net, we applaud the boldness of this move, and hope, for Capgemini’s sake, the French mothership can integrate the two firms effectively. However, we also hope Capgemini can quickly focus on some specific niches that have real As-a-Service elements so them, such as strong analytics depth in discrete functions, and further industry vertical strengthening. In addition, we are still awaiting the firm to pack its punch in automation and cognitive, where it is beginning to talk a big game, but needs to demonstrate some real investment plans.

Posted in : Business Process Outsourcing (BPO), HfSResearch.com Homepage, IT Outsourcing / IT Services, The As-a-Service Economy

#Crazymergerideas – Why IBM should acquire TCS

When IBM announces a 12th consecutive quarterly decline, when practically every other service provider is trying to mask layoffs and austerity plans as strategic moves to delink revenue from headcount, you have to hold your hands up and admit the services industry is going through a secular transition that is going to get considerably more painful, before it eventually reemerges in the As-a-Service Economy.

Service providers need to address the transition years we are currently in, to reach the As-a-Service promised land

With consolidation of the current environment clearly very much on the minds of senior leaders in the service providers (e.g. Capgemini and iGATE widely mooted to be close to tying the knot), it’s pretty clear that we’re distracting ourselves from entering the As-a-Service world anywhere as quickly as we should be. There are simply too many operations and IT careers tied to legacy ERP and business processes, and too many providers making too much money feeding off this legacy, for the change to happen at anything bar a snail’s pace. There simply is no burning platform for change – no Millennium Bug, no Dot.com bust, no Great Recession in the offing (perish the thought…).

It is my belief that we’re at the start of a ten-year cycle of interim change as operational human labor is gradually replaced by automated platforms that are in turn augmented by analytical and creative talent and cognitive computing. The smart service providers are those which are going to address this ten-year phase of transition head-on and not get distracted by maximizing their position in the old model.

So let’s pick on the biggest service provider of all in the middle of this industry transition, IBM, to assess its options:

The cool stuff is all great, but the dollars are relatively small

While IBM is making many right moves investing for the long-term, it’s this long drawn out medium-term period that’s the real problem. Watson, Apple and Twitter alliances, its new $3bn IoT unit, Softlayer etc. all create As-a-Service mojo, but it’s going to take years to get to the revenue levels that can replace the traditional services dollars that are in gradual decline.

IBM needs to work with clients at the pace they are comfortable with, if it wants to maintain its wallet-share with them. The problem with the current business is that prices are getting squeezed and second tier providers are getting desperate and practically buying deals with the hope of making them profitable down the road and keeping their investors happy.

The solution: Buy TCS and create a dominant giant to crush its competitors

It’s simple – make a move on the largest, most aggressive and dynamic of the Indian-heritage providers: TCS. Together, they would crush the market across all aspects of delivery, all verticals, all technologies because their individual forays in the As-a-Service world could play off each other and get scale even quicker. They would have skill at massive scale and could undercut the competition on key deals – almost at will – if they needed to. Together, they would have the footprint for global delivery, transformational talent, low-cost transactional labor, proprietary automation and cognitive capability, analytics, BPO, cloud platforms, mobility, digital consultants, unique software solutions and product engineering… the list is endless. An acquisition would also give the incentives to restructure the existing labor base of both providers through a very active program of automation.

The Bottom-line: This industry needs a mega-merger (or three) to change the game

Let’s face facts, we’re in a worrying downward spiral in the services business as enterprises and service providers face unprecedented challenges on this inexorable journey to replace operational and IT labor with products. Rather than price-compete each other out of business, the service providers need to figure out how to blend the best parts of each other – especially from the As-a-Service world – to get ahead of the change and the pain, and there is nothing like mega-mergers to mask the change that is needed for a few quarters to keep the Wall St investors at bay. Providers need to buy some time and some air-cover to get this right, and what better than complex mergers?

Now would IBM really buy TCS? Probably never, as there is simply too much history in both providers, and this is just too bloody big. Plus, it would create a leadership challenge of unprecedented proportions in this industry. But this industry needs change, it needs real disruption like this to shake us to our foundations and force the new thinking and new behaviors the As-a-Service Economy demands. Let’s hope this impending consolidation has this impact and we’re having a very different discussion in a few months… let’s keep the conversation rolling!

Posted in : Business Process Outsourcing (BPO), Cloud Computing, Confusing Outsourcing Information, crazymergerideas, Digital Transformation, HfSResearch.com Homepage, IT Outsourcing / IT Services, smac-and-big-data, sourcing-change, The As-a-Service Economy

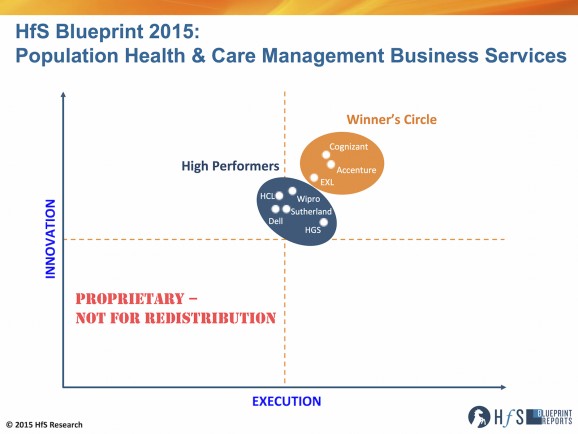

Accenture and Cognizant battle it out in Population Health’s Winner’s Circle… with EXL knocking

With the HfS Blueprint season now in full swing, we can celebrate the coming-out party of one of our rising star analysts, Barbra McGann, who’s put together one of our finest pieces of research (yet) looking at the rampant Population Health and Care Management business services industry:

There’s such a loud call for change in the U.S. healthcare industry these days, Barbra. Please tell us a little bit about what you see going on…

Healthcare is just too complex. Through the Patient Protection and Affordable Care Act, we all have the right to access healthcare, but for a lot of people it’s still difficult and expensive to do so. Healthcare providers and payers are on a mission to take the “sting” out of healthcare. The goal is to make healthcare more personal, user-friendly and cost effective. That’s a monumental task and requires change in the way many of them do business. It will take some creativity and new approaches to get it done.

Of all the activities in healthcare, Barbra, why did we zero in on Population Health and Care Management?

Organizations need to help individuals engage and manage their own health – empower them to be healthier. This is the scope of population health and care management. Population health involves understanding who needs what kind of support to live a healthy lifestyle, reaching out and connecting early when there is potential need for medical support. Care management covers the coordination of care for people who are managing chronic conditions, helping them achieve better health, and the authorization of that care from the financing entity. While there used to be a pretty clear distinction between healthcare providers addressing population health and health plans covering financing and care management, these two are overlapping more and more with the focus on the individual as a whole rather than on a single stage.

So How can service providers help healthcare organizations get more personal with consumers, members, and patients?

Service providers have been providing BPO support for healthcare organizations for years now to operate more efficiently and lower costs. And to do it, they have hired clinical executives and staff, developed industry certification and training programs and technology enabled IP, and established onsite and global centers. We believe they have the capability now to work closely with healthcare organizations of all sizes to help them be successful. Service providers have proven they can partner to help increase adherence to care plans, reduce readmissions, and reduce administrative costs, for example. They work with sets of population data to help design models that identify and drive interventions, and make calls to targeted patients to remind them about appointments and help them figure how to get there, and provide smooth back office operations for utilization management with a combination of skilled clinical and non-clinical resources and automation.

How is this Blueprint going to help current and potential services buyers?

There’s a lot of discussion about healthcare IT capability for population health, and not much about BPO. So we took a look at which service providers are offering business services and experience addressing:

- Consumer engagement and interaction: identifying whom to target and reaching out with assessments, wellness programs, and medical interventions

- Utilization management: processing authorizations, reviews, appeals and grievances administration for medical care

- Care Coordination: referring and enrolling members and patients in programs, helping them navigate and manage their care and administration, planning and documenting discharge after hospitalization, and remote patient monitoring

- Performance management and operational analytics: measuring outcomes, analyzing, reporting, and providing insight on metrics for administrative and compliance purposes.

It’s a collection of activities that together help healthcare organizations manage outcomes focused on well-being, health, and care – wellness in every day life or specific times like pregnancy, adherence to care plans and medications, emergency room visits, hospital stays, and readmissions, for example.

How did the Blueprint analysis turn out?

There are 8 service providers who stepped up to the opportunity to share their current capability – skilled resources like clinicians and healthcare data scientists and technology IP and platforms – as well as vision for the future of population health: Accenture, Cognizant, Dell, EXL, HCL, Hinduja Global Services (HGS), Sutherland Global Services, and Wipro.

Winner’s Circle:

- Cognizant, a flexible, adaptive risk taker; led by technology and building up the strategy and consulting layer

- Accenture, an engaging thought leader with a full suite of services and community connections

- EXL, leveraging platform-based business services, analytics, and relevant depth in financial services into healthcare

High Performers:

- HGS, a quiet, smooth, dedicated operation with unique linkages to hospital for talent, delivering what’s asked.

- Wipro, partnering with software / SaaS provider to offer patient-centric platform-based business services

- HCL, tapping into and evolving client systems and customers with a technology led healthcare program focused on patients

- Sutherland Global Services, creating consumer, patient, and provider experience through close collaboration

- Dell, with a technology led, data driven, partner-oriented approach

What separates the Winners Circle members from the High Performers is the depth and breadth of experience in healthcare business services within this value chain, clarity of vision for population health and care management in the healthcare industry, and collaboration with clients to date. Each of these service providers has capabilities that can match a business need or challenge of a service buyer. The key is to make the right match.

Thanks for your insight, Barbra. So to sum up this Blueprint research, how do you see this market evolving further down the road?

For the most part, population health management has been the realm of healthcare providers, while payers drove care management. Healthcare providers in an annual ‘check up’ looked for opportunities to identify and intervene in potential on-set of health issues. Payers identified candidates for care management after an event through claims analysis. But all healthcare organizations, and pharma and medical device companies, need to help in achieving a healthier society. So, activities are overlapping and shifting as healthcare becomes more proactive and individualized.

To be successful, services buyers and services providers will need to build tightly knit ecosystems and interoperable networks of technology, process, and people. We will see an increase in hybrid operating models, therefore, that combine internal and external resources. This enables them to get to know and connect with patients in a more individual and friendly fashion, and take the “sting” out of healthcare.

HfS readers can click here to view highlights of all our 23 HfS Blueprint reports.

HfS subscribers click here to access the new HfS Blueprint Report, “HfS Blueprint Report 2015: Population Health and Care Management Business Services“

Posted in : Business Process Outsourcing (BPO), Healthcare and Outsourcing, HfS Blueprint Results, HfSResearch.com Homepage, kpo-analytics, smac-and-big-data, Sourcing Best Practises, The As-a-Service Economy

Tom Reuner rolls up to rev up our research

As you all undoubtedly know by now, at HfS we are relentlessly dragging the world of IT and business operations kicking and screaming into the As-a-Service Economy. So what better than to convince the only other analyst with real chops in autonomics and cognitive computing (who wasn’t at HfS) to come and become part of our bandwagon of belligerence?

Not only does the arrival of Tom Reuner corner the analyst market in autonomics and cognitive computing for us, he also brings real depth in IT services and adds to our growing European analyst presence. He’s also a terrific bloke with great taste in premier league football teams.

So, without further ado, let’s hear a bit more about the latest excellent addition to the HfS analyst ranks…

Welcome to HfS, Tom. What on earth went wrong in your life to have ended up doing this? Tell us a bit about your background…

Cheers Phil, I am really excited to join HfS. And well, unlike my lovely wife I hadn’t learned anything proper. Back in the days I was expecting to become a lecturer in history and as part of that I planned to stay for half a year in London to do research for my PhD. But as so often in life things turned out quite different. For personal reasons I ended up staying in London and had to completely change direction. To cut a long story short my first job took me to a company I had never heard of before at that time: Gartner. I never looked back and the rest is “history”.

I just love being an analyst, meeting constantly new people and track technology evolutions through the course of time. I am getting a kick of being able to help client think in different directions and to help them to overcome their business challenges. After Gartner I had a stint at the buy side with KPMG Consulting. But my heart was always with being an analyst and I had the privilege to work for some outstanding organizations and with some inspirational people. My career took me to IDC to hone my consulting skills, I ran my own company for a while and learned lots from marketing to boring cold calling. Before joining HfS I worked with some great folks at Ovum, where I had the freedom to develop thought-leadership in sourcing and IT Services.

Why did you choose to join HfS… and why now?

The first time I heard suggestions that you guys were tracking me and supposedly considering making me an offer was late in the summer last year. I must admit that it must have been one of the most thorough due diligence jobs in the industry. But on a serious side, when you approached me about joining HfS, I sat up straight and it didn’t take me long to make up my mind up. Over the years and from out the outside I always highly appreciated what HfS had achieved: Being recognized thought leaders, leading the way in evolving the analyst model through the leverage of social media and to constantly push the boundaries to stay ahead of the game. And having been given the remit of expanding HfS’s research coverage across the “As-a-Service-Economy” was the icing on the cake.

What are the hot topics that you will focus on in your new analyst role…and what trends and developments are capturing your attention today?

As suggested I will be responsible for driving the HfS research agenda for the “As-a-Service Economy” across SaaS applications, cloud eco-systems and IT. For the last two years parallel to the efforts by Phil and Charles, I spend most of my time developing a research agenda around process automation and cognitive computing in both IT and business processes (and on purpose I am avoiding the moniker RPA here). We will not only be combining our insights but broadening our focus to the emerging technologies around artificial intelligence and how all these technologies impact the transformation of knowledge work. For me the fundamental question is what comes after labor arbitrage?

With all this talk about disruptive solutions, will the world really look that different in five years’ time?

Some people call me a dinosaur (among other things) but largely I expect most innovations – be it cloud, digital or RPA – to end up in blended models leveraging both traditional as well as hugely disruptive models. Far too often the industry is looking for simplistic answers, the quest for the next panacea, but life is more complicated. The biggest challenge remains how to transition from legacy environments and how transform the clunky ERP backbones that appear to be like millstones around the neck of many clients. And it is exactly that journey that we focusing on at HfS when we are talking about the emergence of the “As-a-Service-Economy”. It is easy to point to beacon clients or to organizations that are born in the cloud, but how are plain vanilla organizations that are representing majority in the market dealing with all these issues? But as to be not shying away from your question, in five years’ time the industrialization will have accelerate strongly, on the buy side consolidation will fundamentally alter the landscape while a new breed of advisors will be finally aiming to tackle the business alignment of IT.

What are you working on first for our clients?

Expanding the coverage on process automation will continue be both a strong focus as well as a means for differentiation. And artificial intelligence as bundled option in RPA or as disruptive innovation will be high on my agenda. But the first Blue Print is likely to be around cloud orchestration and brokerage underlining HfS’ holistic view as to how the “As-a—Service-Economy” might take shape. However, most importantly a significant part of my time will spend on discussions with clients and prospects as to how best to map out the journey into this new “Economy”.

And, what do you do with your spare time (if you have any…)?

I wish there would be more spare time as travelling continues to take up a big portion of my time. But on those precious occasions my wife and I love hang out with and entertain friends and family. I feel very privileged that I have married into lovely but huge family. We recently moved house just to be able to accommodate all those visitors. Thus my duties revolve around driving to the airport to pick up family and to be the cook in our house. But if I am honest this probably just a futile attempt to distract me from the sufferings of being a Spurs supporter used to times of despair and depression.

Welcome to HfS, Tom. Delighted to have you choose us as your analytical home and join our As-a-Service revolution =)

Tom Reuner is Managing Director, IT Outsourcing Research, at HfS – you can view his full bio here, email him here and follow his tweets here.

Posted in : Cloud Computing, Digital Transformation, HfSResearch.com Homepage, IT Outsourcing / IT Services, kpo-analytics, Outsourcing Heros, Robotic Process Automation, SaaS, PaaS, IaaS and BPaaS, smac-and-big-data, sourcing-change, Talent in Sourcing

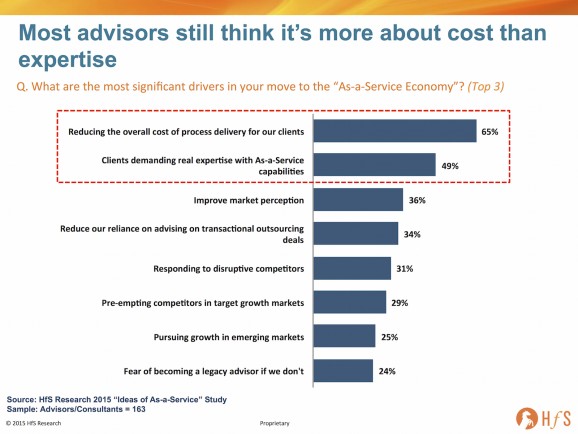

Why most advisors are just so Un-as-a-Service

If I told you that only 13% of sourcing advisors have plans to invest in cognitive computing and 15% in Robotic Process Automation skills, you wouldn’t believe me, right?

If I told you that only 13% of sourcing advisors have plans to invest in cognitive computing and 15% in Robotic Process Automation skills, you wouldn’t believe me, right?

We’re just about to close off our new study that probes into the ideals of the As-a-Service Economy where 716 industry stakeholders reveal how they are faring with their As-a-Service readiness, intentions and aspirations. And one major services market influencer, the local friendly sourcing advisor, is seriously missing the mark when it comes to sawing off some of the old, to embrace the new. Simply put, at least half of today’s advisors are pretty much, well… Un-as-a-Service. Let’s take a closer look:

Advisors have been schooled on driving out their clients’ costs, as opposed to adding real expertise and value. Encouragingly, 49% of advisors are getting sucked into As-a-Service because their clients are demanding it, but the sad fact of life is that two-thirds of them still think it’s still really all about driving out cost. As-a-Service is all about providers delivering and buyers receiving more productive, more intelligence, more cost-effective services through the use of smarter automation, analytics and business context – and there is, typically, a considerable amount of pain and transformation the client needs to endure to attain that next threshold of productivity.

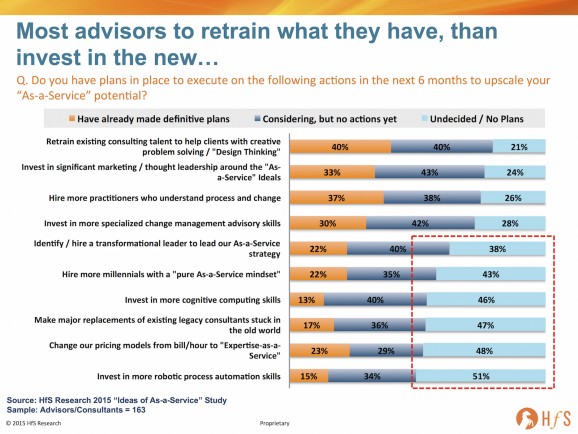

Hence, the mechanisms advisors need to offer clients to steer them through an As-a-Service transformation, require a very different type of resource investment, than simply adding more deal guys who’ve er… done lots of deals. So let’s see where our beloved sourcing advisors are placing their bets to make themselves more relevant to satisfy their clients’ As-a-Service needs:

Most advisors are only focused on making cosmetic changes to their existing practices. As you can see here, it’s all about making a few tweaks to what they have, as opposed to making genuine upgrades to their pool of talent and capabilities: 80% are focused on / thinking about retaining their existing team, 76% on puffing up their marketing, and a similar number on hiring process-focused and change management-focused consultants.

A large majority of advisors are unwilling to make fundamental investments to change they way they work with clients. Conversely, only one-in-five actually have plans to hire a transformational leader to shepherd their move to As-a-Service (which I find incomprehensible), or invest in millennials who have As-a-Service potential ingrained into their DNA. Even more depressing is the fact that only 13% have plans to invest in cognitive computing skills and 15% in Robotic Process Automation. And to cap it off, only 17% are actually seeking to counsel out their dinosaur consultants still stuck in the old world of labor arbitrage and big clunking scale deals.

The Bottom-Line: Our industry is lacking the leadership to make the right investments to break away from the legacy outsourcing model

There just seems to be the complete absence of a burning platform to force the change so many industry stakeholders need to make, to prepare for the future model. While there is still money to be made eking out a living feeding off the scraps of legacy outsourcing deals, many advisors, similarly to many providers, are failing to make the adjustments and investments that will position them to compete for As-a-Service engagements as they increase in demand. While this isn’t a short term crisis for these firms, my fear is that when the old stuff does peter out, it’ll be far too late for many advisors (and providers) to make the changes they need to make to survive.

I don’t believe this is a conscious decision by many advisory firms not to make the right investments, it’s more they simply do not know how to find the right talent and leadership to make it happen for them. Many know the change is coming, but simply are in denial that they can force through the internal investments that they need to make. And many still have senior executives whose careers got stuck in a 1990’s timewarp, and simply haven’t evolved their own knowledge, skills and experience. It’s like going to a dentist and not being able to see a digital X-ray of your teeth… would you keep buying services from someone who hasn’t read a text book, or had some form of new skill development over the last couple of decades?

If I was a betting man, I’d predict a very different landscape of advisors competing for market leadership in a couple of years at the current rate of legacy-ness and Un-as-a-Service-ness we’re experiencing today.

Posted in : Business Process Outsourcing (BPO), Digital Transformation, HfSResearch.com Homepage, IT Outsourcing / IT Services, kpo-analytics, Mobility, Outsourcing Advisors, Robotic Process Automation, SaaS, PaaS, IaaS and BPaaS, smac-and-big-data, sourcing-change, Talent in Sourcing, The As-a-Service Economy, the-industry-speaks

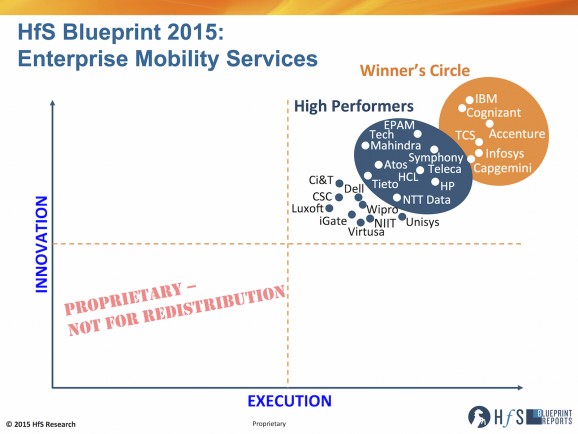

The 2015 Enterprise Mobility Services Blueprint: IBM, Cognizant, Accenture, TCS, Infosys and Capgemini in the Winner’s Circle

The world of enterprise mobility continues to unravel at a breathless clip, with a host of application, infrastructure and niche specialist service providers claiming to deliver (much) more than a bunch of Blackberries, mobile servers and basic help-desk support to enterprise clients.

Enterprise mobility has quickly propelled into the corporate mainstream, with almost every consumer-facing, employee-engaging, supply-chain-enabling process requiring critical mobility interfaces and integration points to avoid becoming obsolete. And with so many processes now going completely native to the mobile world, from membership programs for healthcare insurance schemes, through to governance productivity tools, through to tax management applications etc., the mobility prowess, from a business transformation aspect, is the Holy Grail the winning service providers are seeking to stay ahead of this fast-commoditizing digital marketplace.

So, without further ado, let’s focus on how the 2015 enterprise mobility services environment is shaping up with HfS’ digital research guru, Ned May’s, new release of the 2015 Enterprise Mobility Blueprint:

Hi Ned, what has changed in the enterprise services mobility market over the last year?

I am pretty amazed at how fast the market has shifted. In the year that’s passed since my last Blueprint, we now see a majority of enterprises undertaking efforts to integrate their mobility portfolios deeper into legacy systems. Few enterprises were at that stage a year ago when it was the build out of point solutions that dominated the activity sourced from service providers in mobility. Even just a year ago, efforts to integrate these apps were largely aspirational but now it is a major area of effort between service providers and enterprise clients.

This increase in market demand for more sophisticated solutions translated into impressive results for some leading service providers. For example, IBM’s mobility revenues grew over 300% in 2014 to reach $2 billion. That makes Mobility a significant contributor to IBM’s services revenue. In short, the opportunity has arrived and I expect the current level of activity around mobility to continue. “Digital” may have become the de facto term service providers use to describe their practices around enabling technologies but when you peel this activity back a layer you quickly find the bulk of activity has a significant mobile component. Whether an enterprise is looking to drive increased efficiency across a current processes, open up new customer channels, or developing a new business model, more often than not today it involves some type of mobile device.

And how did the Blueprint analysis turn out?

The big surprise this year was how well the largest service providers faired. In a rapidly shifting market you might expect smaller and perhaps nimbler service providers to excel but what we saw was the largest service providers fared the best. Topping this off was the success of IBM which I already mentioned grew over 300% in 2014 and that is off a base of $650 million in revenue the year before. That grow would be impossible off the back of new Apps alone. It is a result of the big push from clients for deeper enterprise integration.

At the same time, we saw a second tier of service providers emerge in an area of what I’d call focused scale. These were all large enough to drive efficiency across their delivery models while addressing the myriad of related technologies but not necessarily in the same breadth of industry or end-to-end fashion as the largest service providers. Arguably, these second tier service providers are in great positions position for 2015 as the maturing market looks for further specialization.

So what are your key takeaways from this study and what should we be watching for in the next few years?

One of the most significant takeaways our analysis yielded was a realization that the relative positioning of service providers has become greatly compressed. Every service provider analyzed offers significant capabilities across our criteria for both execution and innovation.

Our Winner’s Circle of Service Providers included: Accenture, Capgemini, Cognizant, IBM, Infosys and TCS. Our High Performers were: Atos, EPAM, HCL, HP, NTT Data, Symphony Teleca, Tech Mahindra and Tieto.

Yet, the differences are getting more difficult to discern and that makes for a buyer’s market at least for the next year or so while integration remains king. We expect this to change in 2016 as a few service providers begin to demonstrate the unique advantages they gained by extending their definition of mobility to include the Internet of Things. Until this occurs the market will be led by those service providers who can drive the greatest efficiency around areas like running App Factories, providing Testing-as-a-Service and embedding security across every interface.

Another takeaway is that we don’t expect to see a great deal of commercial demand for mobility-led transformation in 2015. When enterprises tapped their IT departments to rationalize the disparate mobile efforts underway, they inadvertently put the brakes on innovation. IT organizations are notoriously conservative and as they work to integrate the mess, they are reluctant to let go of any recently reclaimed control. This means we don’t expect to see significant activity around transformation just yet and that could be a lost opportunity as enterprises spend perhaps too much energy on neatly tying together loose ends rather than embracing these new mobile technologies as a way to drive fundamental change. The only caveat here would be for those enterprises that have a strong Chief Digital Officer in place. Where this type of leader exists we expect to see some healthy conflict between running processes more smoothly and running processes in new ways. But again, the bulk of activity in 2015 will be around developing apps more efficiently and integrating them into existing systems.

HfS readers can click here to view highlights of all our 22 HfS Blueprint reports.

HfS subscribers click here to access the new HfS Blueprint Report, “HfS Blueprint Report 2015: Enterprise Mobility Services“

Posted in : Business Process Outsourcing (BPO), Cloud Computing, CRM and Marketing, Digital Transformation, Global Business Services, HfS Blueprint Results, HfSResearch.com Homepage, IT Outsourcing / IT Services, Security and Risk, smac-and-big-data, Social Networking, Sourcing Best Practises, The As-a-Service Economy, The Internet of Things