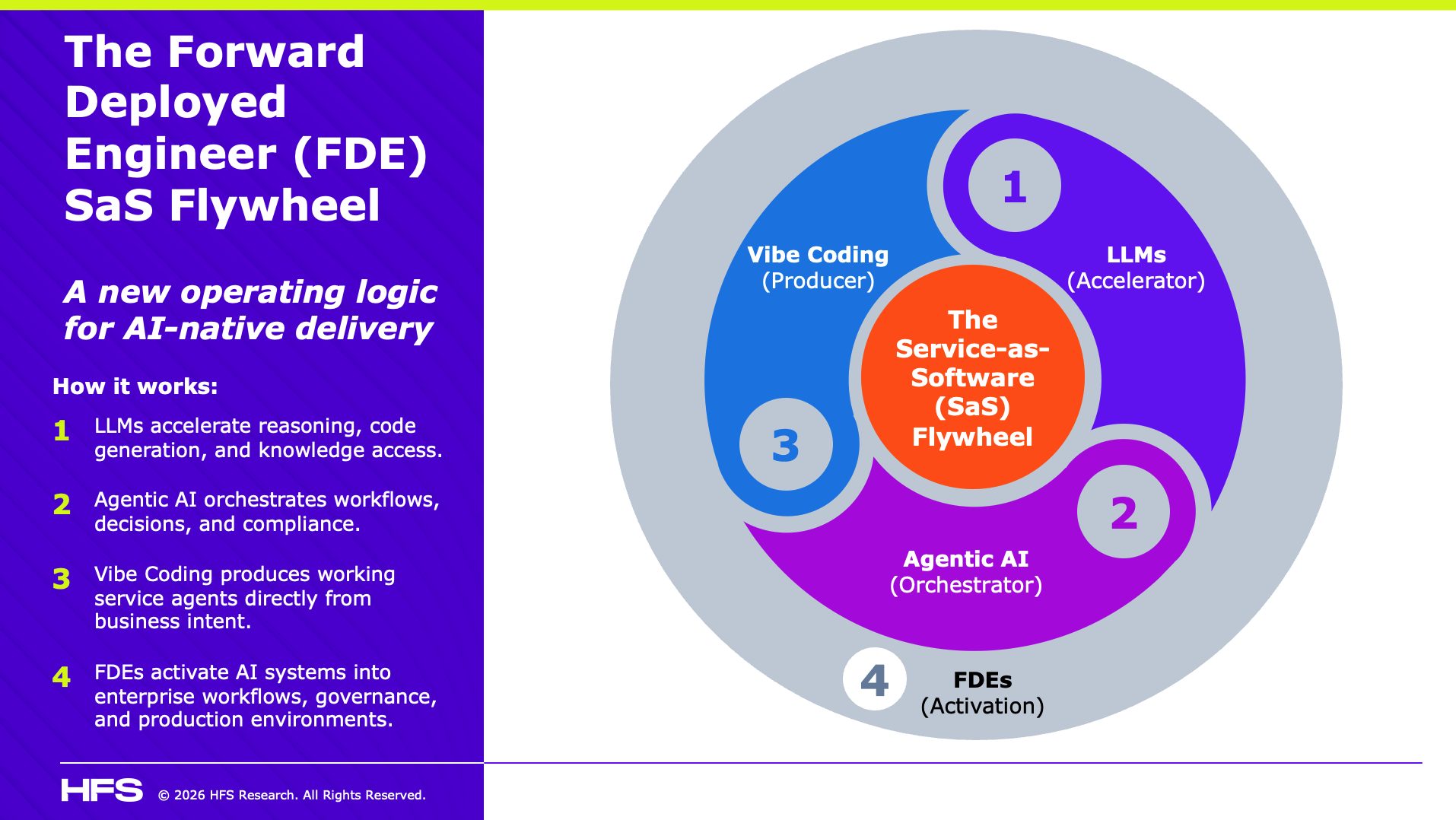

Stop treating FDE as optional: Your AI Flywheel will not spin without it

Who actually wires AI into your live systems, governs it in production, and makes it keep working when the AI software vendors leave the room? The answer is Forward Deployed Engineering (FDE). If your transformation strategy does not have it, you are building an AI theater, not an AI operating model. Read More

The HFS AI Trust Curve: AI isn’t failing… leadership is

The HFS AI Trust Curve rewards an organization that achieves an outcome in which AI can influence decisions. The firms breaking through the curve are not doing so because they have superior algorithms. They are doing so because leadership has resolved the human questions: Who owns the data? Who owns the insight? Who owns the outcome? Until those answers are explicit, AI remains advisory theater. Read More

Welcome to the last 18 months of labor-intentive services

The defining question for 2026: can services relationships demonstrate Services-as-Software capability and accountability for business results, or are both sides still pretending their effort-based contracts deliver "transformation"? Because those providers and buyers who can't answer that question by mid-2027 will find themselves explaining to boards why their "strategic partnerships" became obsolete. Read More

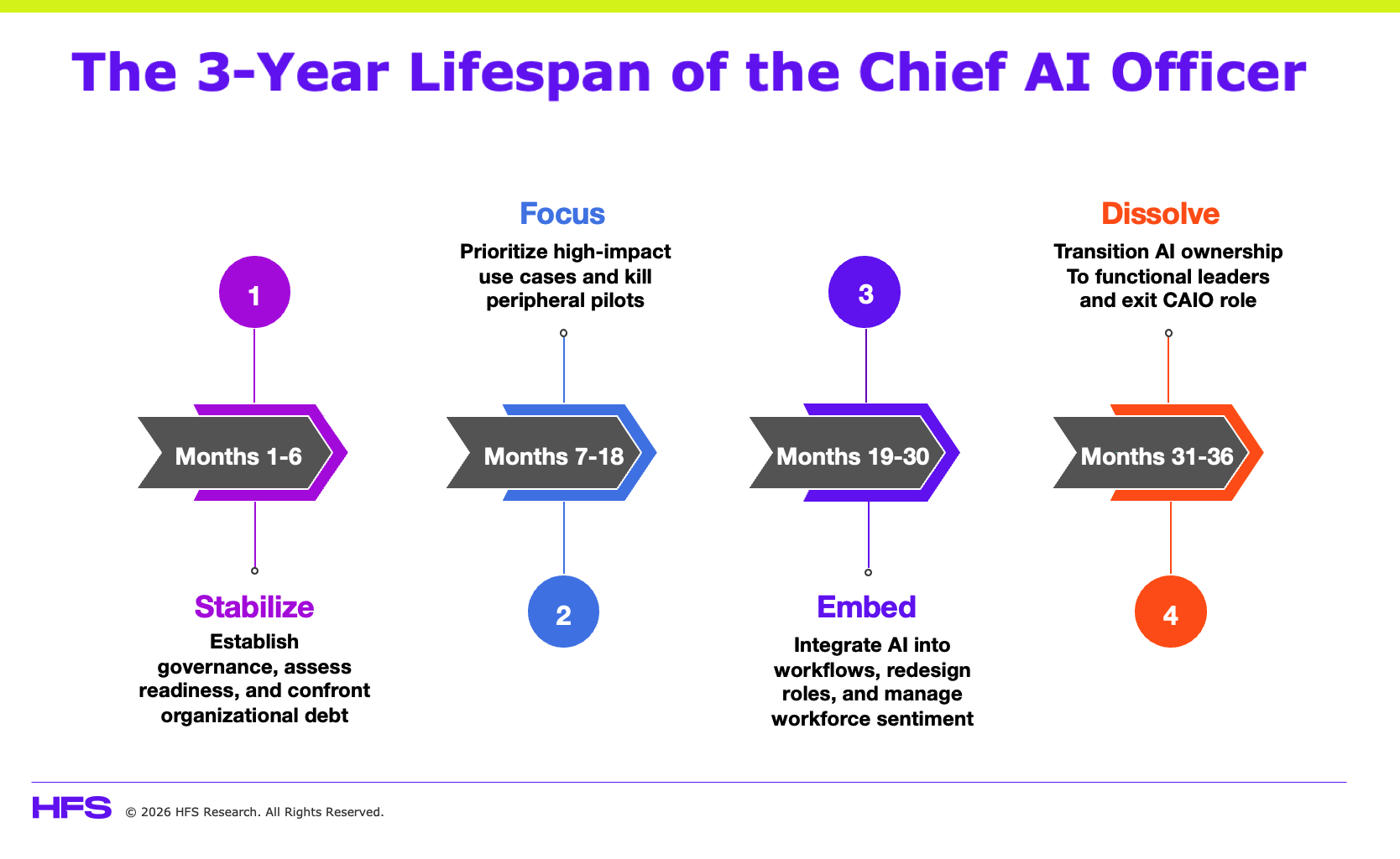

Say CIAO to the CAIO in 36 months

Only appoint a Chief AI Officer if you're committed to giving them COO/CEO-level authority to kill initiatives, force standards, and drive uncomfortable organizational change, and only if you're prepared for the role to disappear within 36 months as AI embeds into every functional leader's responsibility. Read More

Don’t confuse America’s robotaxi chaos with innovation – China already chose certainty over debate

Big tech leaders are betting you'll jump into AI-fueled robotaxis. However, these represent one of the first genuine examples of AI requiring behavioral change at a societal level. However, the technology isn't yet ready to scale, consumers are hesitant to trust it, and we haven't addressed the deeper question: who's accountable when the algorithm gets it wrong? Read More

Agentic AI without real-time data is useless… IBM now owns the real-time

IBM’s purchase of Confluent is the clearest signal yet that the AI race is no longer about models, it is about data flow. If AI is the engine, Confluent is the gas pump, and IBM just bought the plumbing for real-time, trusted, enterprise-grade data movement, which is the one capability most generative and agentic AI platforms have been lacking. Read More

How a twenty-year-old Is forcing enterprises to rethink automation

David Cushman, Executive Research Leader at HFS Research, speaks with 20-year-old prodigy Brayden Levangie, founder of Levangie Labs about building a “cognitive architecture”... a platform delivering genuinely autonomous agents that can learn, reason, and act in the world. Read More

When your lift-and-shift still stinks: How AI can finally fix the mess you outsourced

Let's be blunt... your outsourcing engagement stinks pretty bad. You’re three years into your five-year deal and you’ve got a low-cost service provider managing your old ways of working, complete with manual approvals, 23-step handoffs, meager 3% annual efficiency improvements, and weekly Excel wars. If your KPI dashboard looks cleaner, that’s only because you’ve spent more on Power BI. But here’s the good news... AI might finally be the disinfectant we’ve been waiting for. Read More

AI will never save bad leadership: Pay your leadership debt to put Humans at the Helm

Leaders are overpromised on technology and underdeveloped on humanity. That gap is what we term "leadership debt" and it’s the most expensive liability no CFO can measure. The leaders who win in the AI era will not be those who master neural networks, but will be those who master themselves. Leadership is not a byproduct of transformation, it is the precondition for it. The AI economy will be led by humans at the helm. Here we discuss the critical six leadership behaviors to succeed in the AI age... Read More

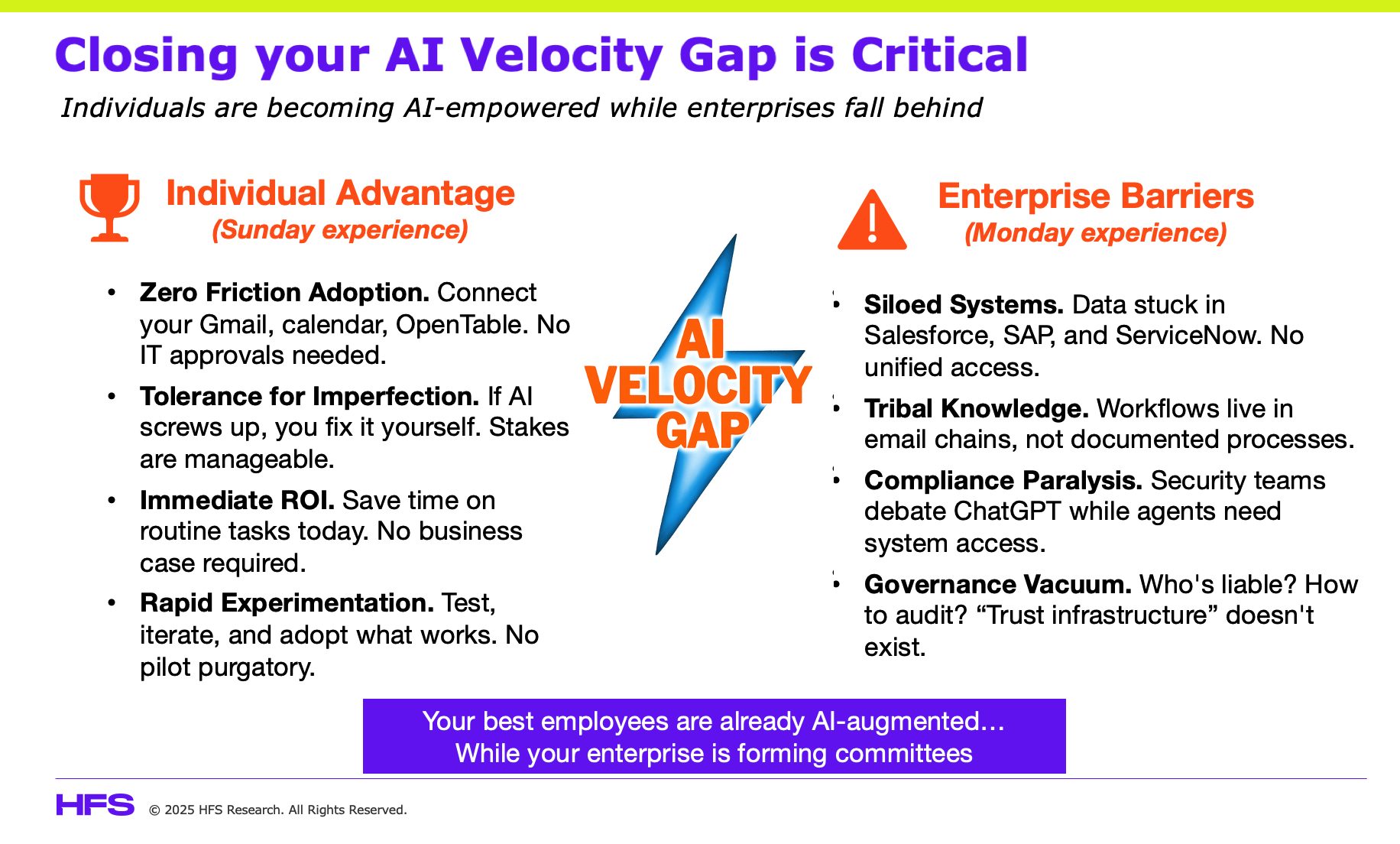

Start measuring your AI Velocity Gap before your market measures it for you…

On Sunday, employees live the AI dream: frictionless, instant, empowering. They connect Gmail, Calendar, and OpenTable without asking permission. They fix mistakes, automate workflows, and see instant ROI on everyday tasks.On Monday, they crash into enterprise reality: data silos, email chains, compliance debates, and governance frameworks that exist only in PowerPoint.Your best employees are already AI augmented. Your enterprise is still forming committees.This is your AI Velocity Gap, and it's probably widening every day... Read More