Posted in : Business Process Outsourcing (BPO), intelligent-automation, IT Outsourcing / IT Services, OneOffice

Introducing the Tech Stack to power Native Automation, Data and Process Design: The OneOffice Platform

He’s got the Cloud in his soul… his name is Joel

Joel Martin heads for the Cloud with HFS to lead the Cloud strategies practice

It’s funny when you meet these people across all corners of the globe during your career and you get that feeling that you’ll cross paths again in the future.

I first met Joel in 2002 when I was a Bio-IT analyst (yeah, I actually did that) in Australia working for IDC and Joel was running the PC tracker for the ANZ region.

Fast forward 19 years and Joel, and after his 10-year IDC stint, a couple of cyber-security and research startups; and a product marketing stint at Microsoft, got in touch about something that had nothing to do with the role for leading our new Cloud Practice was being advertised… I even asked him if he knew anyone when I thought “Hang on Joel, what are you doing these says…”.

Phil Fersht, HFS: Before we get to all the work stuff, Joel, can you share a little bit about yourself….your background, what gets you up in the morning?

Joel Martin, Vice President Cloud Strategies, HFS: Great question Phil, thanks for asking.

About me, well, I like to think that I am a classic overachiever. I have built a career from a humble beginning to one that has allowed me to live, work, and experience cultures and peers in Europe, Asia, Australia, and North America. I love immersing myself in a new culture, have been fortunate to lead operations, sales, and research teams across the world, and thoroughly enjoy the customers I have engaged in finding new revenue opportunities.

I grew up in a small town in the United States, proud son of a Red Cross executive. As such, I got involved in community service from an early age, which continues to be important to me. Travel is something that I also grew up with, as early in my life, we lived in Germany and then across the U.S.

While at university, I built a partnership between the University in Leipzig and Houston, leading to my joining an international student-led program based out of New York City. This allowed me to travel extensively in Eastern Europe in the early and mid-90s, and honestly, I haven’t looked back. I started my technology career in Prague, Czech Republic, with IDC in 1997 and moved to Australia in 1999 and Toronto in 2004. Building a career in research, consulting, and practice leadership. Then I moved to Microsoft, where I was product marketing lead for the ERP business for Canada. In fact, I was part of the initial plans to move that product to the Cloud. After that, I was recruited by TechInsights, an Ottawa based Intellectual Property firm, to lead global marketing and product management. During this stint, I was part of the executive team that sold the business to a Private Equity firm and was retained to build exit strategies for different business lines.

During this time, both the company and the business I led went through significant digital transformation, taking our products and systems to the Cloud. This was a major undertaking as we fundamentally changed our financial, operations, HR, and customer-facing tools and experiences. That was 2015-2016, hard to believe nearly 5 years have passed.

Over the most recent 3 years, I ran workshops, managed client engagements, and wrote blueprints on building better supply chain relationships. I also supported a new program that focused on the impact of emotional connections between users that the software tools they use. Our hypothesis was that it is essential to look beyond the capabilities and features and understand what emotions drive satisfaction—a crucial component for marketing, sales, and buyer synergies.

Now I am excited to join HfS! As you and I worked together in the early 2000s in Sydney, while our paths diverged, we’ve found ourselves working together again.

As for what gets me up in the morning, I am an early riser, so after that first coffee cup, I like to explore problems with a fresh perspective. You know, before the in-box and to-do list from your boss dulls your creativity.

You’ve had a very global analyst career spanning several countries and continents… can you share some of your experiences over the years… what would you do all over again, and what would you definitely avoid?

When I look back at the crazy times of hitchhiking between meetings in Eastern Europe in the 90s to negotiating with a crooked cabbie in the middle of the night on a highway in China about the fare, there are undoubtedly many memories. And many things I would AND WOULD NOT do again!

The most important thing I always found while working abroad was being willing to listen. Not just to the customer or executive in the meeting, but to the colleagues, cabbies, and folks you meet while spending time in their country. Understanding another’s views based on their experiences, society, and culture has allowed me to apply my experiences in ways that have built more successful outcomes. In my experience, we often rush into conversations with our opinions and should take more time to listen.

So I do my best to avoid talking until asked. Instead, encourage the sharing of experiences, challenges, and opportunities. By making this investment, together, we can then build a prosperous relationship. Without doing so, it can be hard to establish the trust needed to collaborate equally and fruitfully.

How did you end up back in research after spending time with Microsoft?

My career’s second decade was on the supply side of the market. At Microsoft and TechInsights, I succeeded in developing products, managed partner programs, and delivering on go-to-market strategies. Something I’d advised on in my first decade at IDC, but with little real experience.

So, after developing skills as a business leader responsible for multi-million dollar P&Ls and a global workforce and taking some time off after leading the efforts to sell a line of business, research just came naturally to me. I found myself interested in a more holistic view of strategy, from product design and development to competitive go-to-market to contracting and negotiations.

Contracts, I have found, are often overlooked by business and tech leaders. While they can be boring, having read 1,000s of them, I have a good sense of what to look for in terms of fairness and remediation. Understanding the legal aspect of the relationship must be a big part of any cloud strategy. Technology and business leaders should be investing time to study the impact their supplier agreements may have on success!

You’ve chosen to focus heavily on the Cloud at HFS… can you share your passion here? What are your goals?

Technology has been seen as a game-changer to business models and service delivery for the past 2 decades. In fact, being a fan of Star Trek continue to be amazed at how much of today’s technologies were dreamed up by the series in the 60s. However, one thing Star Trek missed was the importance and power of the Network.

It is the Network, not called the Cloud, that is changing the game. This goes beyond computing power and ease of delivery/access; it means this nearly ubiquitous platform can power the workforce and business process needs of organizations, governments, and supply chains. At HFS, I’ll be working to link the One Office, Triple-A-Trifecta, and native automation efforts into a context that both the technology leader and business leader can execute upon.

Exciting stuff! And very meaningful as we toss “digital transformation” out the window and focus on a real evolution of the business, powered by process excellence and underpinned with Cloud technologies.

What role do you see analysts playing as we emerge from this pandemic? Same old game, or is something new brewing?

Obviously, my perspective is biased based on my experiences and how I have been successful. I believe companies will benefit the most from analysts with backgrounds as business leaders themselves. I also believe the Cloud is fundamentally a state-less technology; as such, possessing global experience is essential to adding context to those selling, buying, deploying, and supporting these strategies.

I like to think of myself less as an analyst and more as a part of a strategic team of advisors. Articulating the “what next” in terms of workforce, process, and technology is what an executive should value over just getting another opinion about how they address today’s problems in isolation.

This is what attracted me to HFS. I look at my peers and their experiences across industries, professional backgrounds, and geographic locations. We are well-positioned to offer wisdom over just intelligence. And this is what I feel an organization should be seeking these days when it seeks to augment its data and insights with an outside 3rd party.

What do you think we’ll be talking about when we gradually revert to a world beyond our screens? Will we get a resurgence of energy and excitement, or will we crawl out of our caves blinded by the sunlight?

The fundamental change is that the business knows that the Cloud is no longer a digital service delivery tool. Instead, it is essential to service, workflow, employee and customer experience, and success. Customers and employees are intertwined in a cloud-based supply chain. They do not need in-person experiences as often, nor will they seek them out. Gone are trips to solve tactical problems, glad-hand a business opportunity, or pitch an early-stage project.

Our screens are part of the business now. When travel returns, it will be for strategic reasons, such as fostering trusted relationships, motivating our teams, and gaining experiences by listening, not selling, to the other person.

Well, it’s great having you onboard Joel – looking forward to some intense research in 2021!

Posted in : Cloud Computing, IT Outsourcing / IT Services, Outsourcing Heros

HFS Vision 2025 is here: The New Dawn to become a OneOffice Organization

Posted in : OneOffice

And here’s an hour of my life I thoroughly enjoyed. I hope you to do… with Cognizant CEO Brian Humphries.

Posted in : IT Outsourcing / IT Services, OneOffice

Infosys can save the UK from Economic Fossilization. Here’s how

In today’s world of constant fake news it was refreshing to get some real news that literally made me choke on my 57th microwaved frozen chicken jalfrezi of the year. The fact that this real news emanated from the Daily Mail (the UK equivalent of the New York Post or Air India’s in-flight magazine) was an indicator of how bad today’s media has become. Also, the fact that my head of marketing actually reads the Daily Mail gives me serious concerns for our 2021 marketing strategy…

Anyway, let’s get to the point. Our Chancellor of the Exchequer (CFO for you corporate types), “Dishy” Rishi Sunak is married to the daughter one of India’s IT industry’s founding godfathers, none other than Akshata Murthy, daughter of Narayana Murthy, the man who created Infosys. Like that happened and no one’s noticed until someone at the Daily Mail discovered this… and they wed in 2009.

The UK is in a mess so bloody big we need to redefine “mess”

If a depression-driven Covid catastrophe wasn’t bad enough, the mother country is going into a catatonic depression so bad, it may lead to an economic fossilization (that is my term for something worse than a depression) when we throw a no-deal Brexit into the mix… due end of 2020.

Anyone observing the thrilling performance of the Indian-heritage service providers this year will observe how the leaders have somehow kept the IT outsourcing industry actually growing a little bit, despite a predicted 8-10% nosedive that analysts many predicted. And this owes a huge amount to its standout performer of 2020, Infosys, which has chugged along signing megadeals and reinforcing its commitment to the cloud at a time when enterprises are desperate for a partner to help them pivot at breakneck speed into the cloud model.

Anyway, as a disillusioned British born analyst (and global citizen) I suddenly see hope…

I have a lot more faith in these entrepreneurs from Bangalore than the current old-boys network running Her Majesty’s economy into the ground. I always knew Rishi was the only smart one in there, and now we have the evidence.

So… now good old Infosys has no choice butto bail us out as they married into… the UK!

I am sure they will appreciate some free advice on the governance team that can drag us quickly out of our current predicament, so here’s an initial strawman architecture:

UK Prime Minister: Ravi Kumar S. No one spins it better than old Ravi… all he has to do is bulldoze our media with pics of his new baby girl all over twitter and have us guessing forever on the mysterious “S”…

Chancellor: Pravin “UB” Rao… this man can keep a ship sailing through any storm. This current crisis stuff is child’s play compared to rogue CEO’s in private jets and dodgy Israeli automation purchases..

Head of the UK Coronavirus Task Force: Vishal Sikka… time to dust off the former CEO to convince the UK public that we needn’t worry about Covid as “AI will provide the answer” (after showing up 30 minutes late to every briefing).

Brexit Secretary: Salil Parekh… who better to carve us out of the EU than the king of the carve-out deal himself? He’ll even do the deal on the golfcourse showing the rest of Europe how it’s done.

Head of Cybercrime: Mohit Joshi... who better to arm our cyber-defenses than the man who can iron-wall any bank still running on Cobol mainframes? Easy, just move all our sensitive data onto Finacle and the Russians and Chinese will go crazy trying to figure out what the hell we just did…

Vaccine Distribution Czar: Radhakrishnan “Radha” Anantha… who better to command the British vaccination process than InfosysBPM kingpin Radha himself, who will ensure everyone needs to “calm down and just focus on the outcomes”. If things get a bit dicey, he will take questions from his kitchen where we’ll be far more interested in what on earth his kids are sneaking out of the fridge while he’s too busy talking to us…

But what about Rishi himself?

Oh, he’s far too smart for us. Can’t you get him to take over from that Modi guy? Rishi makes money appear from magic, you know?

Posted in : Outsourcing Heros, policy-and-regulations

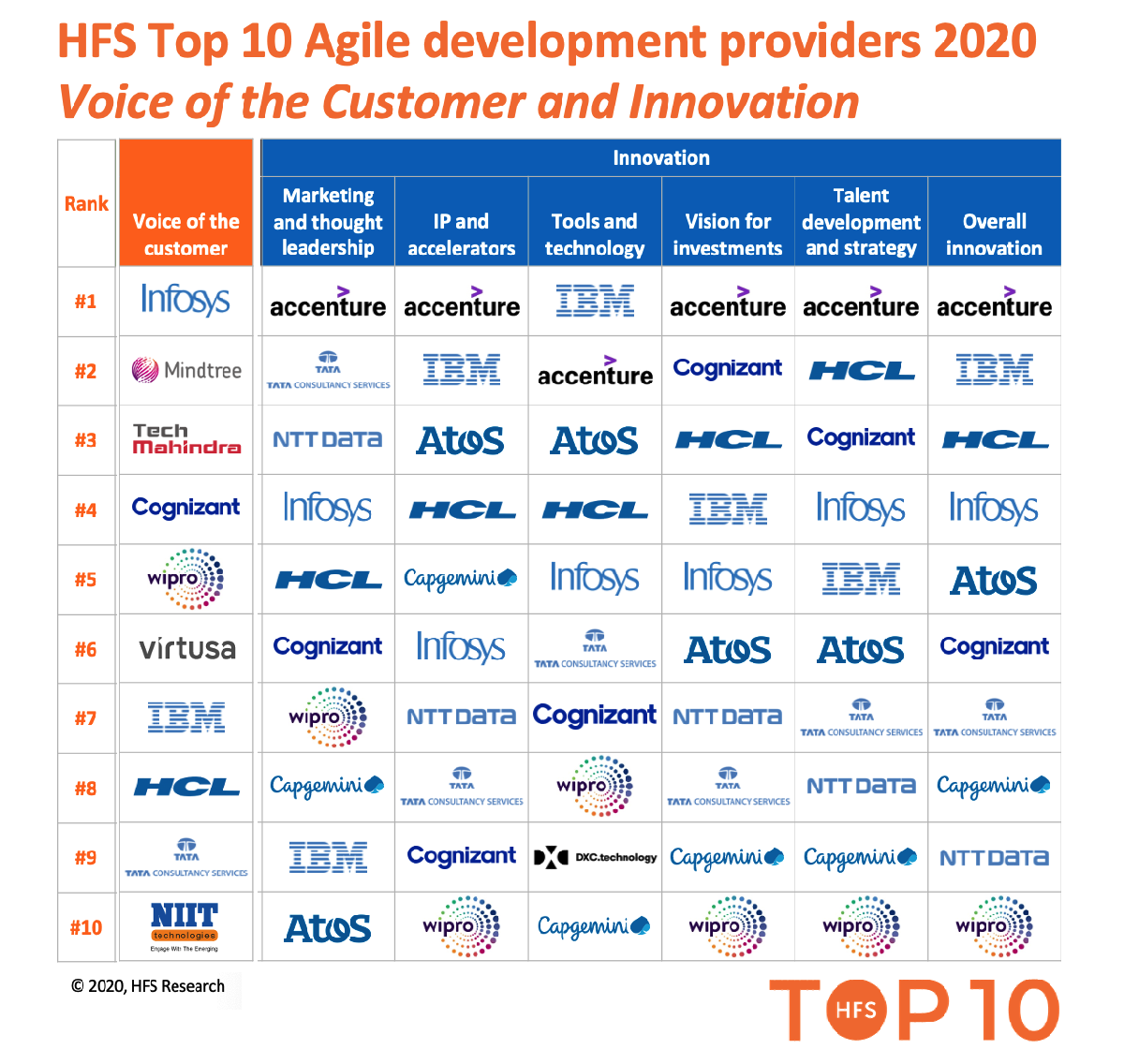

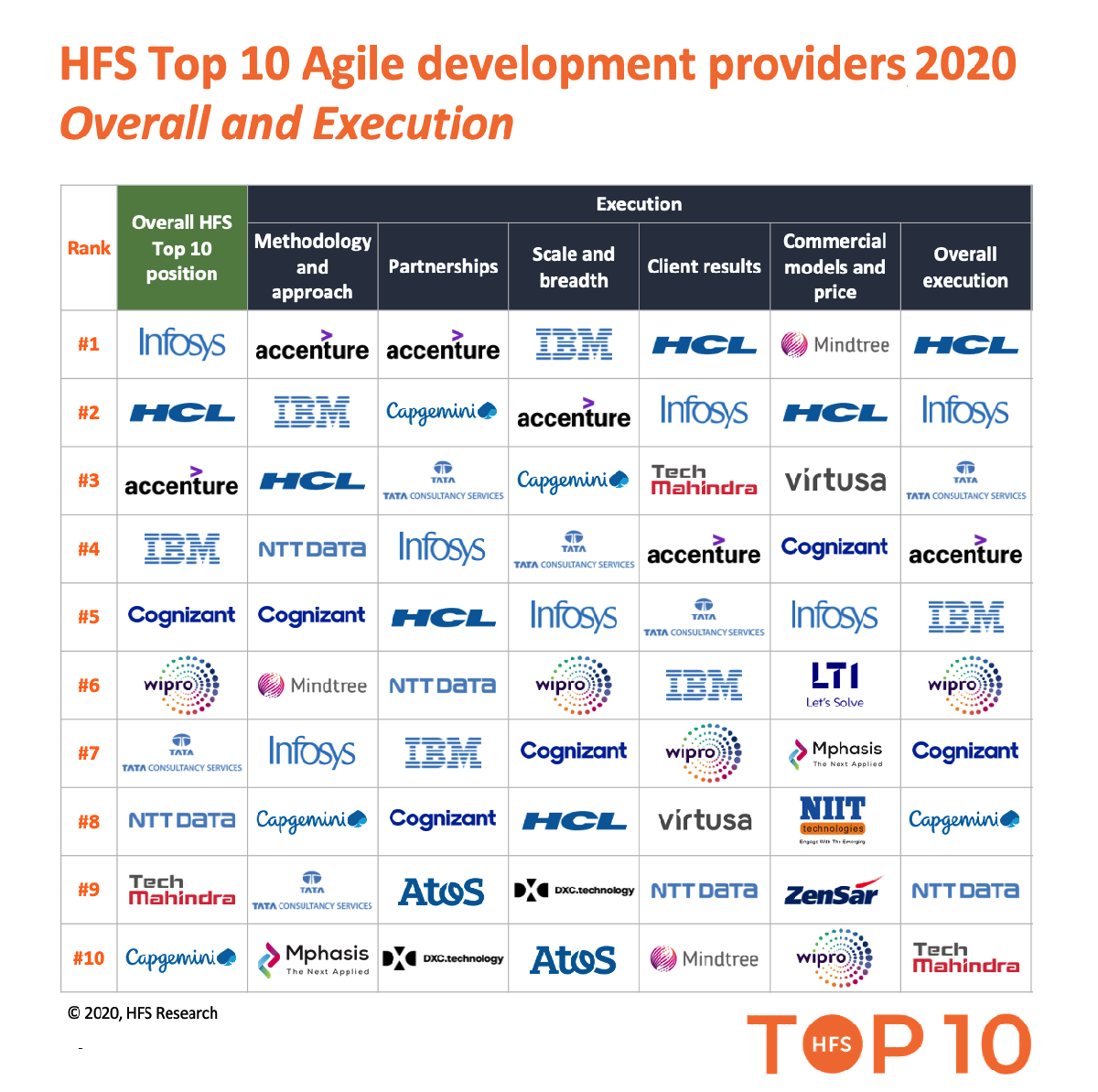

The Agile Gabriel calls the leaders who’ll take you into the Cloud faster

Today’s environment is based on rapid decisions to move processes and apps into the cloud as fast as possible to keep companies functioning in a remote-working economy. That means it’s all-hands-on-deck to use all available resources to make this happen as cost-effectively as possible. The principles of agile development have never been as important.

Cloud computing is basically the Internet being used as the system for delivering processes, software, data, and other services. Being ‘agile’ means being able to use all resources as and when required. It also means not having to use them when not being used, and not pay for them. So how can we expect today’s service providers adopt agile development to help our enterprises make the leap to the cloud as effectively and rapidly as they can? Let’s ask HFS analyst Martin Gabriel who led the recent Top 10 report in Agile Development Services:

Martin – why has agile become so talked about in the recent past? Hasn’t this been around for ages?

Yes, that is very much true. In a nutshell, due to the following reasons, it took center stage – a) Because of the agile success rate in software development space, and b) the traction in organizational agility. It has proved that agile methodology enhances productivity and alpha, and if adopted appropriately, it reduces overall cost over a period of time. The agile concept has come a long way, it has evolved all the way through software development, but now has branched beyond IT and other departments like marketing, legal, HR, and much more. As the concept is getting increasingly popular across business areas, companies have started to witness higher returns because of this. However, this was only feasible because of the embracement it garnered from C-suite members in recent times. That being said, not all big firms embraced it, companies like IBM and GE witnessed a drop in their revenues as per a report on “Market capitalization of big firms.” On the contrary, firms like Amazon and Microsoft, who adopted agile practices at the top level, have delivered significant results over a period of five years. Companies like Netflix and Spotify were born agile, and they were far from being bureaucratic and hierarchical and are one of the fastest-growing. I believe these are some of the key reasons in recent times it’s been discussed a lot in my perspective.

And has anything changed significantly with the pandemic, or is agile now even more relevant in the current environment?

As we know, agile software development is all about being iterative and collaborative at work. During the pandemic, few agile teams struggled but bounced back faster. But few of them were not doing that well before COVID as well, and the pandemic triggered its downfall too. On the other side, teams that performed well before COVID have developed trust due to the work from home coming in to the play and also plugged mental health management models in the team that shaped them to perform better during the crisis.

While we see this in the organizational perspective, certainly, the pandemic has pushed the organizations to play with an unfamiliar swiftness, and that is how organizational agility became inevitable in today’s environment. Many non-agile organizations adopted agile operating model out of necessity, and it has significantly helped them to cope with the crisis regardless of industries.

With agile operating model adopted completely or partially, companies led with a smooth transition, efficient work management, and met customer needs within set timelines. In fact, within an organization, agile business units performed significantly well than the non-agile business units. We cannot deny the fact that non-agile organizations struggled to manage the remote work environment and resource prioritization.

The Challenge of performing well in crisis with agile models does not end here. The real test will begin when the same organizations who adopted the agile way of working out of emergency might have to figure out the most sustainable model that suits them after things settle down. The current operating model was only developed out of emergency and was not a well-planned one in the long run.

So, what impressed you – and disappointed you – the most when you conducted the briefings and enterprise reference calls during the recent T10 report? Did you feel the industry has been making a lot of progress with agile or is it more “lip service”, Martin?

What impressed me – Well, I have lot to discuss on this, starting from enterprise adoption rate of the Agile methodology to success rate, client relationship, providers’ willingness to go overboard, and to my surprise, commitment and impressive client relations. This is where some of the mid-tier players were able to demonstrate and deliver better than the tier 1 players – this does not mean that tier 1 players were less impressive or have not wooed their clients. Sometimes the complex management structure takes away the perk and makes it intricate and challenging to achieve desired results faster.

Flexibility, when I say flexibility, here I am talking about the willingness to flex resources if needed, flexible pricing, free hands-on choosing resources for their projects, open environment where developers from providers’ side were able to push back if that’s not the right approach and the willingness to go out of the box rather than sticking only with the contract.

These are some of the positive angles that few providers were able to pull off.

What disappointed me the numbers they gave for their agile resources. While conversing on providers’ strength in their agile practice, it was observed that the numbers of trained agile associates were a little unrealistic. Few providers mentioned more than 80% of their application development work in agile, whereas few of its peers only mentioned around 35%. These numbers lie in two ends and difficult to analyze.

Large organizations are still focusing on pleasing clients instead of being true to the name of agile engagement. Few agile team members were unable to have difficult conversations with their clients, instead, they agreed to every task thrown at them without explaining the challenges behind. In fact, they did not create room to push things back if they were unrealistic.

In my humble opinion, clients are very mature compared to many service providers. They have vast know-how and understand the ground-level challenges and common market problems better and on top of that, they have a willingness to cooperate.

Sometimes, client references given by the providers refuse to participate as there were no prior intimations given. These instances reflect that providers sometimes assume clients are happy and ready to share happy testimonials.

Across providers’ offerings, frameworks, partnership ecosystems, and capabilities are the same. End of the day it’s about customer satisfaction, overall experience, and pricing.

Answering the last part of your question, the Agile model indeed progressed over the years. It has almost replaced the traditional waterfall methodology. The agile failure rate is only 8%. Yes, it has its challenges too. Initial costs, unclear objectives that lead to constant changes, scaling across different teams and locations, resistance to change, and lack of executive support are some of the challenges.

Martin is actually pretty cool you know…

And which providers, Martin – in your view – distinguished themselves the most? And why?

Infosys, HCL, and Accenture bagged the top 3 ranks in our top 10 studies. Sometimes simple things make a huge difference, and in our agile study, that’s exactly what happened. I reiterate that customer feedback, pricing, and flexibility differentiates providers. Methodology, approach, partnership ecosystem, scale and breadth, IP, and accelerators are very close calls among the top players. It is tough to differentiate for buyers and even me as an analyst. Little you can make difference wherein the thought leadership, investment roadmap, and willingness to go that extra mile is the one that differentiates among the top players. Matter of fact, fourth, fifth, and sixth rank holders were very close to each other. They were equally good in most of the assessed parameters.

As we evolve rapidly into this new hyper-digital environment, how would you like to see agile evolve and a practice? What is your advice to young professionals in this space?

Well, agile is not limited to individual teams (say product development team) anymore; embracing the agile practice organization as a whole is the way.

Advice to young professionals – Coders who are developing agile competency will differentiate themselves and have a better advantage over others. Also, we are embracing organizational agility; therefore, an agile foundation or awareness is going to be inevitable.

Furthermore, some of the skills are often taken casually or being ignored. Agile team members must equally focus on developing soft skills like managing difficult conversations, the ability to present your work to a wider audience if needed. Being a good developer or coder isn’t sufficient anymore. Agile is about constant change and iteration and for that these skills are ideal.

And how would you describe the similarities between agile development and the rapid scaling up investments? How can we use agile to get to our “North Stars” faster these days?

In short, the Agile concept took years to reach where it is today. Even today, some of the top IT service providers agreed that only ~36% of their application development work is in agile. Similarly, scaling up agile has its own challenges. In the past, sr. leaders were very stringent in approving the budget. Last four-five years with proven agile results and an agile mindset, C-Suite members are open to scaling, and the COVID crisis further pushed the process.

Answering your second part of the question. We witnessed results in organizational agility over a period and it’s one of the big fuss in the industry right now. Also, in the recent pandemic, agile organizations were the ones who were able to swiftly move/adapt to the remote workspace than others. Leaving challenges aside, the benefits of organizational agility is faster adoption of changes, capitalization on new trends, and incline towards an innovative firm. I believe, in short, organizational agility is the best way to reach our North Stars, faster. There are a lot of steps and approaches to be followed, that is another discussion altogether.

Premium HFS subscribers can click here to download the Top 10 report in Agile Development Services

Posted in : Agile, Cloud Computing, IT Outsourcing / IT Services, OneOffice

So what’s coming coming next folks? Stay tuned right here as the fogs clears for the New Dawn…

Posted in : OneOffice

Chatting to Vinnie Mirchandani on how the IT and business services industry has coped with a pandemic

One of my oldest blogging sparring partners is the gnostic Vinnie Mirchandani of Deal Architect fame. We caught up a few days ago to talk about the impact of Covid on the services and outsourcing industry, how to lead through these challenging times, and how to embrace the faster, cheaper, more competitive tenets of digital to exploit these market conditions:

Posted in : Business Process Outsourcing (BPO), IT Outsourcing / IT Services

Meet Sudhir Singh… the Coforge King

Watching the rise of the mid-tier services providers – especially in the midst of a pandemic – has been nothing short of impressive. Firms that got written off a few years ago because “only the top tier only got to the table”… are now at that table. In fact, I could name several who broke protocol to become sought after partners with reputations for going way above the standard service and regular win engagements against the juggernauts. Just read our post about the surge in growth for mid-tier IT service providers.

With 50% growth in the last three years, Coforge – formerly known as NIIT Technologies – is no exception here. In the midst of a $600M platform and (in spite of) a global pandemic, they hit the refresh button with a new name that aligned with their identity. Changing one’s name is a brave move, but when your British clients have called you “Nit” for a couple of decades and you have a supercool CEO who plays field hockey and racketball, you just gotta do it…

Within 3 years, CEO Sudhir Singh has led Coforge has taken this firm well past the $500m barrier, so let’s get the story behind the strategy, the rebrand, and how the Coforge King sees the industry unraveling…

Phil Fersht, CEO and Chief Analyst, HFS Research: Thank you Sudhir for taking the time today to speak with us. You have recently gone through a rebranding and I would like to find out why Coforge and you decided on a name change, particularly in these economically uncertain times. And a little bit about how you have fared since you have taken over the role…

Sudhir Singh, CEO and Executive Director, Coforge: Very good to be speaking with you Phil. We spoke about the name change around February when we met in Mumbai. This was an exercise that we were very excited about because all of us had this gut feeling that we are not going to be getting too many opportunities in our careers to rename a $600 million platform. This was a nine-month exercise, which was very interesting for us.

We had several compelling names in the mix. It was the connotation of the name and what we wanted to point out that was primarily important. If you play back some of the names, I think it will give you a flavour of how we approached the exercise. We had very interesting names like Sibyl, meaning a female oracle, and I must confess that that name I really liked, which we found very intriguing as it had a very forward-looking view. There were other names I remember discussing with you, like Boldwave and Brightspeed, which had a strong connotation around looking creatively, innovatively, boldly at the future – which again was interesting.

“Coforge, to us, stands for ‘working together to create lasting value’. That partnership element to all of us… that is well reflected through the partnership across employees. The one thing we’ve always prided ourselves on is that we’ve had the lowest employee attrition across the IT services industry, not just for a few years, but for the past decade.”

And then we had Coforge, which was in some ways the third name in the mix. Coforge, to us, stands for ‘working together to create lasting value’. That partnership element to all of us – the leadership team across the organization and the employee set – was extremely important. And the reason why I say this, is well reflected through the partnership across employees. The one thing we’ve always prided ourselves on is that we’ve had the lowest employee attrition across the IT services industry, not just for a few years, but for the past decade.

“We also thought that partnering, which is what the ‘Co’ element in Coforge connotes, was very important because it stood for extreme client-centricity. This is what we are known for…”

We also thought that partnering, which is what the “Co” element in Coforge connotes, was very important because it stood for extreme client-centricity. This is what we are known for, given the best-in-class NPS scores that we have recorded over the years. It also talked about the exceptionally deep partnerships that we have structured, over the years, with the likes of Pega and DuckCreek.

“Summing it up, Coforge stands for working together to create lasting value, working together across employees, working together with clients, working together alongside partners, working together with entities that have come in and been acquired by Coforge over the years, and making them successful.”

Summing it up, Coforge stands for working together to create lasting value, working together across employees, working together with clients, working together alongside partners, working together with entities that have come in and been acquired by Coforge over the years, and making them successful. We have the stellar record of having almost all transactions done successfully over the last ten years where external teams became part of the Coforge family. That, Phil, is the why part of it.

As far as the why now is concerned, which you talked about, we have been on a very accelerated growth path for the last three years. And, we have also been on a very strong change journey; change when it comes to operating culture, change when it comes to strategy, change when it comes to how the internal and the external world has perceived us. We thought this was a good time, when we have some downtime, to step back, to reflect collectively, to rename ourselves and make that change that’s already been injected into the organisation more explicit.

“In the last three years, we’ve grown from being a $400 million to a $600 million firm. So we’ve grown about 50%. It has essentially been organic growth, the $200 million that we have added.”

Finally, the third question is on how we have fared. The last three years for us have been fantastic, and not just because of the financial metrics. I believe we spoke for the first time three years back. In the last three years, we’ve grown from being a $400 million to a $600 million firm. So we’ve grown about 50%. It has essentially been organic growth, the $200 million that we have added. We now are at a place where – and I have consciously held off on this for the last three years – we are running a huge internal campaign that we are calling a path to a billion. What we have done over the last three years – in terms of making changes, in terms of making sure they hit the road, in terms of making sure they get translated into impact, in terms of financial metrics as well – has now set us on that path.

We set off on this journey where we said we will not just focus on being specialist technology providers, but we will select a few industries and make sure that we are very good when it comes to translating the applicability of those technologies in the industry context or the client context. That’s paid out extremely well for us… We think that’s what allowed us to differentiate ourselves…

It’s been a very interesting, a very fun ride for all of us, all 11,000 employees across Coforge, over the last three years.”

We’ve also done some very interesting things in terms of making sure that the strategy that we were talking about wasn’t just something that stayed as a talking point but got translated. Three years back, we set off on this journey where we said we will not just focus on being specialist technology providers, but we will select a few industries and make sure that we are very good when it comes to translating the applicability of those technologies in the industry context or the client context. That’s paid out extremely well for us by our estimates. We think that’s what has powered our growth. We think that’s what allowed us to differentiate ourselves. So, it’s been a very interesting, a very fun ride for all of us, all 11,000 employees across Coforge, over the last three years.

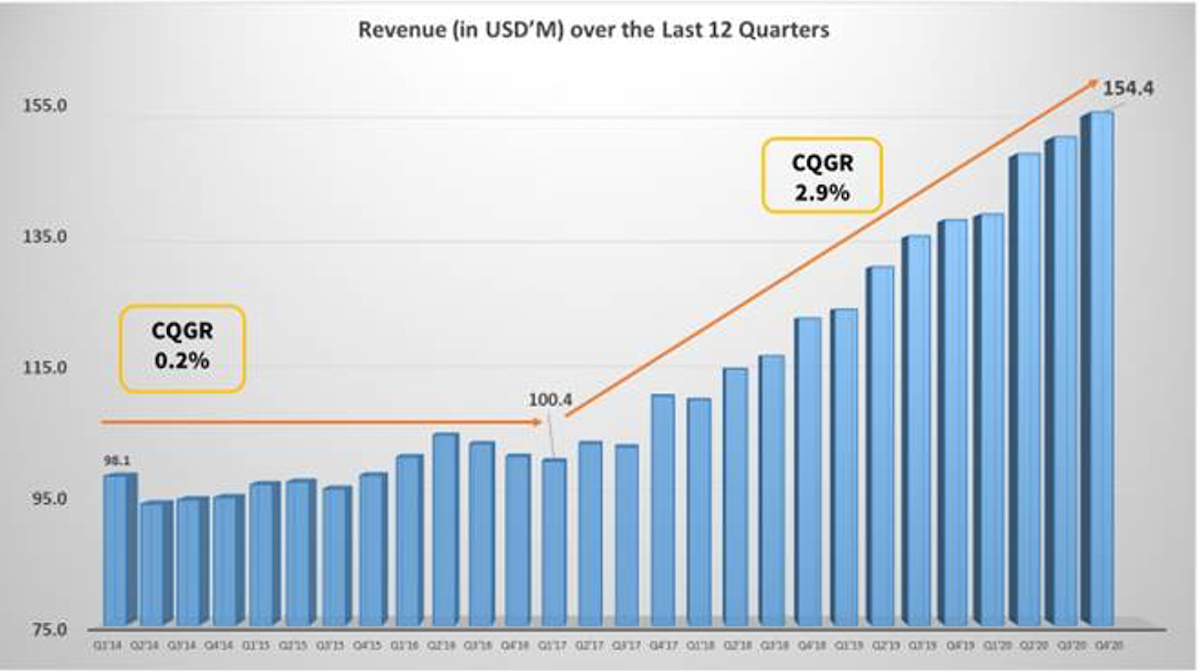

Exhibit 1. Coforge’s revenue growth under Sudhir’s leadership

Phil Fersht: Fantastic, Sudhir. That’s great to hear. And, you know, we don’t hear too much about where you came from, Sudhir, and how you ended up running this business. You also have a fairly entrepreneurial family as well. I’ve met your brother Sudip once or twice in the past, and he’s a CEO in a similar industry. Can you share a bit more about your background and why there are services in the family blood right?

Sudhir: Sure. Our dad was in the Indian Army, Phil. We grew up bouncing from cantonment to cantonment, every two years in India, just about every remote and not-so-remote part of India. And my brother and I – and I specifically – went through the same markers that were prescribed for most kids in India growing up. I am an engineer and completed an MBA from IIM Calcutta in 1995. I joined Hindustan Lever, which was a job that had just about nothing practically to do with technology, and that’s where I spent the first six and a half years of my life. Levers, which is what Hindustan Lever in India was called then, was, and I suspect still is in many ways, the executive training factory for corporate India. Not just technology services, but if you look at the broader Indian corporate space, the firm that’s possibly contributed the most number of CEOs in the Indian corporate space has been Levers. I found those six and a half years spent in Levers truly formative in just about every sense of that word.

To give you a quick flavor, I was in sales and marketing, and we used to have this very interesting four-month stint when you joined the firm as a salesperson. You were given about 70 Indian rupees, which was the equivalent of 2 dollars a day, and you had to live in a hotel. In my case, I was sent to this very interesting sliver between Bhutan and Bangladesh for four months, called Cooch Behar, live on it, and sell every day in the markets. As a Sales Manager, I suspect I have personally been to every population greater than 500 people across Western India.

“As I reflect back on them, those first six and a half years [at Hindustan Lever] were extremely instructive. …When it actually comes to understanding the importance of execution and making sure that when one commits to a goal or a strategy, one delivers as a team on that strategy irrespective of change, irrespective of constraints. I think that culture is something I picked up from there.”

As I reflect back on them, those first six and a half years were extremely instructive. There are a lot of things that we all learned about that we talk about over the years. But when it actually comes to understanding the importance of execution and making sure that when one commits to a goal or a strategy, one delivers as a team on that strategy irrespective of change, irrespective of constraints. I think that culture is something I picked up from there.

The second thing that I picked up, and I suspect that stayed with me, has been the emphasis around what today we call client-centricity. In the 90s, in that industry, in that context, it was called knowing the customers of your customer. So, my customers were retailers; their customers were the people who actually bought the stuff that we placed in those shops. Those two things stayed with me.

From there, I had a fantastic nine-year stint with Infosys. I went from managing brands and selling products in rural India straight to the States with Infosys in 2001. I was initially managing one of the marquee financial services clients that they had and subsequently, the payments and the cards service line within BFS. That, in turn, was followed by a six-and-a-half-year stint with Genpact where I was the Chief Operating Officer of their capital markets business. For the last three and a half years, I’ve now been with Coforge, which is the erstwhile NIIT Technologies. So that’s a quick snapshot.

And you’re absolutely right, Phil. Sudip, who is my brother, is the Chief Exec at ITC Infotech. He has also talked to me very fondly about the interactions he’s had with you.

Phil: Oh, good. [Laughs]. There are lots of colorful personalities in our industry, and I think it’s actually been a bonding time, the number of conversations we’ve been having with folks about not just how we’re going to get through this as firms, but also as an industry. I think we have to look at each other a bit, and sure, we compete, but also we have to figure out how we can all take some advice on how to survive together. Providers always want to sell services the way they’re structured, the way their P&Ls are set out, the way they like to go to market. But ultimately, it’s very hard to influence how clients want to buy. Are you seeing a distinct change in this emerging market? Are clients looking to pay for things differently? Are they looking at having greater visibility into the people you have or the technologies you have? Are you seeing things distinctly shifting?

“On the IT side, the interesting change that I have seen over the last six months is what I like to call the ‘try-before-you-buy’ phase. It’s almost the equivalent of a phase zero.”

Sudhir: We are seeing some interesting shifts, Phil, and a few long-term trends getting underlined a little more. I’m sure you relate to that, you hear about that as well, Phil. On the IT side, the interesting change that I have seen over the last six months is what I like to call the ‘try-before-you-buy’ phase. It’s almost the equivalent of a phase zero, where you go in with a certain solution or a POC, or a working prototype, or a piece of IP.

There is an increased preference for getting that working prototype within the client premises – to have it work for a short burst with live client data – to assess whether it is going to work, whether it is relevant, and whether it is going to add value, instead of just being another thing that gets added to the ecosystem. So, I think that has been the most fascinating shift, especially, on the IP side of our portfolio, a ‘try-before-you-buy.’ A phase zero before a phase one isn’t something that we encountered too much before the pandemic came in.

“The other thing that we are seeing, which I think has been very interesting, is that the high-end consulting services, especially architecture services, …is the piece where the willingness to engage with architecture SWAT teams has gone up significantly.”

Another change that we are seeing is ‘the dedicated resource model’, which still occupied a significant amount of the revenue pie across the organization, is getting replaced, especially on the classical development side where more of a capacity-based pricing construct is coming in. Maintenance has seen a stronger pay per ticket kind of model. And the other thing that we are seeing, which I think has been very interesting, is that the high-end consulting services, especially architecture services – that I have always had a very pronounced bias of having people in the here-and-now and co-located – is the piece where the willingness to engage with architecture SWAT teams has gone up significantly.

I think digital transformation continues to be an ask, not just in travel, insurance, BFS, healthcare spaces, but people are looking for an IT service provider who can be reliable when it comes to the classical delivery and can keep the lights on, manage operations and yet also have the ability to drive transformation at the same time. Now, this isn’t new, it’s always been an ask. But the fact that the delivery has to be robust, and to some extent resilient, has just got a little bit more underscored during the pandemic.

Phil: And do you see a period of consolidation happening in services? I have mixed views on this, in that I think we’re seeing some successful investments in niche companies who can add pockets of value, but not necessarily in these full-scale mergers that we’ve seen in the past. I think with Virtusa, for example, we saw a hefty investment being made by Baring and some other things happening in some of the mid-sized businesses. Do you think that we’re going to see a wave of consolidation, or do you think this is more around investors seeing this as a fairly safe place to park their investment in the next two or three years? Is it more the latter, do you think, or are we still waiting to see how this one unravels?

Sudhir: I think the jury is out on that, Phil, and I suspect the jury has been out on that for the last five to ten years. Investors have made very, very good returns on mid-tier players like us. I think we are a prime example, just looking at our valuation as an organization. There is a case to be made for both, and you know this as well as I do. On the mid-tier side, my submission always has been that the growth that can be driven as a function of white-glove service customization, so that we can provide customized attention, should command a premium. The speed with which we can change the culture – we can talk digital but change the culture of operating teams – is an asset.

“Investors have made returns – significant returns – on mid-tier players like us. The growth – coming from white-glove service, the ability to transform at speed, cultural aspects that need to be transformed, and now the ability to draw top-drawer talent in line with what tier 1 firms in the past have done – creates very solid case for mid-tier players.”

And finally, I think the big shift that’s happened over the past few years is the ability of mid-tier players like us to attract top-drawer talent, especially given some of the ownership changes that have happened in the background, again has changed. So, I would say, reflecting back, investors have made returns – significant returns – on mid-tier players like us. The growth – coming from white-glove service, the ability to transform at speed, cultural aspects that need to be transformed, and now the ability to draw top-drawer talent in line with what tier 1 firms in the past have done – creates very solid case for mid-tier players, as well.

Phil: Sudhir, as we look beyond pandemics and things that I think we want to get past, what would you like to say is your one wish you’d like to see in this industry when we get beyond 2020, and we get more of a longer-term view of where we’re going? What’s your one wish for things we can change for the better, that can make us keep the best and the brightest in our business, and make these more attractive and fulfilling careers?

Sudhir: The most important thing for us as the folks operating in industry, that we possibly want to dwell on, is how to make this industry and a career within this industry more aspirational, Phil. Because the talent catchment that we are operating in, increasingly these days, is a talent catchment where the product players also operate.

“It is not just tech specialization that IT service players like us bring to the table, it is also the industry appreciation. And there can be, for lack of a better word, no stronger consultant to a client than an engineer who understands both the technology and also appreciates the context in which it is being applied.”

It is imperative that, as a bunch of leaders in the industry, we work to more explicitly call out how IT service employees who are creating a career in IT services can actually drive transformation at scale and faster, almost equal to if not more, and drive more impact than product players alone might be able to, because we are already embedded in the businesses, in the organization that we’ve been servicing, for a long time. So the number one ask, at least in my head, is we need to figure out a way to make careers in our industry more aspirational, to explicitly call out the ability to transform businesses that is very unique to us, because we are so strongly embedded in some of these organizations.

The second thing that I think we should start calling out is the fact that it is not just tech specialization that IT service players like us bring to the table, it is also the industry appreciation. And there can be, for lack of a better word, no stronger consultant to a client than an engineer who understands both the technology and also appreciates the context in which it is being applied. So, we need to call that out more explicitly, we need to position that more clearly. Those two things, I think, are the ones that we need to focus on.

I think it’s also a great opportunity.

“IT services, compared to BPO services, have always lagged behind when it comes to equality across genders, for example, in terms of the employee mix. The fact that we can now openly offer more flexibility, the fact that we can now openly offer work-from-home as a semi-permanent or permanent option should also help us address some of those diversity issues that we’ve faced in the past.”

We’ve all been able to step back; we’ve all been able to work effectively and make sure that the work-from-home model, the flexible model that’s come in, allows us to start approaching a broader catchment. IT services, compared to BPO services, have always lagged behind when it comes to equality across genders, for example, in terms of the employee mix. The fact that we can now openly offer more flexibility, the fact that we can now openly offer work-from-home as a semi-permanent or permanent option should also help us address some of those diversity issues that we’ve faced in the past. Those are the three things that I would point out.

Phil: I think that’s fantastic, Sudhir. And just one final question. Why did you ultimately decide on the name Coforge? Was there anything in there that really struck you, that beat out these other suggestions?

Sudhir: Well, you’re right, I think a lot of it has to finally do with a gut instinct there, Phil. Coforge was a name where we were trying to call out the partnership piece that I talked about; however, we were slightly conflicted around the potential connotations of the “forge” part of it in a technology services organization. “Forge” can have a somewhat old-world-ish connotation. But we liked the “forge” piece because, all said and done, while we do want to drive transformation that is digitally-led, we would like the results of those transformations to create a lasting impact. Hence that was the reason why Coforge won over some of the other names that I remember sharing with you, like Sibyl and Boldwave which, again, were extremely attractive from our point of view.

Phil: Yeah. Boldwave was good as well, I liked that one, and Sibyl reminds me of Basil’s wife in Fawlty Towers, which may have been memorable. Coforge does make me think about people forging things together, which makes me think about partnerships. I think it’s a good name. And I’m very pleased to see you guys have found a good path in this tough market to keep your growth story going and keep thinking about the future. It’s been great watching it and getting to know you guys better. I thank you for your time today and very much look forward to getting together with you in person, at lunch or dinner sometime, when we can finally look back on 2020. [Laughs].

Sudhir: I’m looking forward to that, as well, Phil. Very good to see you, and I do look forward to meeting you in person. Thank you so much for your time.

Phil: Awesome. Thanks, everybody 😉

Sundhir Singh and Jaspreet Singh of Coforge joined by Phil Fersht and Sia Rastami of HFS

Posted in : IT Outsourcing / IT Services, Outsourcing Heros

After Groundhog Day… what happens next?

Watch the replay of this HFS Live purely unfiltered, unsponsored real talk with real industry leaders to help us unravel the emerging landscape:

Host:

Guests:

Traci Gusher, Leader AI and Enterprise Innovation KPMG

Chirag Mehta, Product Leader Google Cloud

Jesus Mantas, Chief Strategy Officer GBS, IBM

Malcolm Frank, President of Digital Business, Cognizant

Mike Small, CEO Americas,Sitel

Posted in : Cloud Computing, OneOffice