Posted in : Absolutely Meaningless Comedy

Posted in : Absolutely Meaningless Comedy

Posted in : Absolutely Meaningless Comedy

Which camp are you in?

At HfS we see customers who externalize business or IT processes as falling into three distinct camps:

1) The “Lights On” camp. Let’s make no bones about it, we just want to drive out expense without any costly disasters occurring. We don’t see any strategic value in these processes, and as long as it’s cheaper to have someone else run them and they don’t impede our business, then we’re happy with that outcome. We only want a small governance team that causes us few headaches and keeps the lights on. We don’t want to hear about problems, or additional investment requirements. We’ll revisit the engagement when the renewal is up to see if we squeeze a few more bucks out of the supplier. If the whole things messes up, the chances are we’ll all be long gone, in any case, and our successors can deal with it. As long as our shareholders are happy with the immediate returns, that’s the main thing.

2) The “Efficiency” camp. We don’t see a hell of a lot of competitive differentiation in these processes, but we do recognize that there’s more than an initial 30% we can lop off the budget if we’re smart about this. So let’s plan for phased process improvement and additional layers of processes to externalize in the future. We’ll build a governance team of Six-Sigma blackbelts to oversee a 5 year cost-efficiency plan. Maybe we’ll take 20% savings now and reinvest 10% in inhouse skills and some consulting support to ensure further efficiency gains will be made down the road.

3) The “Transform” camp. We’ve learned that simply moving work offshore is only a short-term cost reduction measure – these costs will eventually reappear if we only perform an onshore-to-offshore staff exchange. We’re simply not going to “kick the can down the road” for someone else to deal with them. We’ve learned that failing to invest in process improvement, once we’ve moved processes into either into our own shared service center, or into the hands of a third-party provider, will result in the stagnation of that business function. We’ve also learned that outsourcing as much work as some providers and outsourcing advisors tell us we can, isn’t always going to provide the answer – it’s outsourcing those processes that make sense, and working with the provider to inject their ideas and capabilities into improving our overall business function. And our providers need to understand our institutional processes and issues (no matter how messed up they may be) – or, at least, provide us with account managers who have that capability. They need to understand how to help us improve our business outcomes, based on the combination of our inhouse teams, our shared services and what we have externalized to third parties.

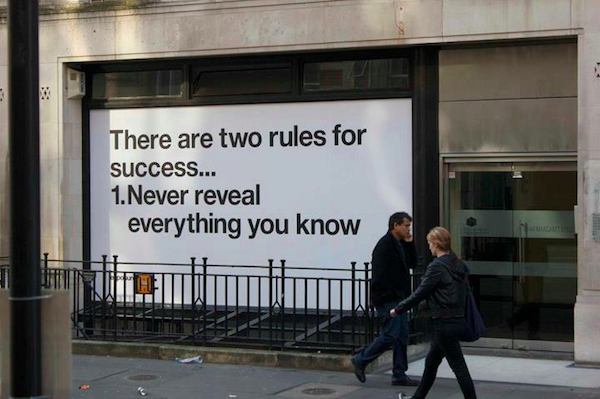

Our recent study, which we conducted with ACCA, canvassed the business objectives of close to 700 organizations with over $500m in annual revenues spread across the globe. We asked them what their prime business objectives are, based on their outsourcing or shared services initiatives, related to their finance functions:

So let’s take a look at how these camps are with regards to how today’s organizations operate their global finance functions:

Predominant model = Outsourcing. Around two-thirds are focused heavily on keeping costs on plan and ensuring efficient performance, and a good 50-60% of them place importance on standardizing process, meeting compliance goals and keeping the quality of service to the organization high. However, less than half place importance on transformation (38%), globalizing processes (45%) and improving finance capability (43%). This strongly implies that most of those firms operating their finance in a predominantly outsourced model are in the “Lights On” and “Efficiency” camps.

Predominant model = Shared Services or Hybrid Shared Services & Outsourcing. The differences between these models and the outsource-only model are striking. Firstly, these organizations are a lot more purposeful across all business objectives, which strongly suggested they feel in much more control over the finance functions and are striving to make both efficiency and transformative improvements. Secondly, it’s those organizations with a balance between Shared Services and Outsourcing, which have the most pronounced determination to achieve overall finance transformation (73%), improve their finance capability (78%) and globalizing finance processes (69%). Not only that, but they are also more focused than anyone with achieving efficiency (86%), standardizing processes (77%) and keeping costs low (72%). It’s strikingly clear that it’s the Hybrid organizations that are achieving the balance between being efficient, but also are viewing their finance function in a much more strategic light – hence these organizations appear to cross over both the “Efficiency” and “Transform” camps.

The Bottom-line: As Business Transformation Services are born, Labor Arbitrage Outsourcing Services can be ring-fenced

It’s almost as if many organizations in the outsource-only category are giving up the ghost on making innovations or strategic improvements to their finance. True, many orgs may be new to outsourcing and are merely focused on getting through the day, and also true, most outsourcing deals are (annoyingly) signed by senior executives who delegate the governance to operations teams with little clue as to what the business objective were, so only focus on meeting contractual metrics. It’s as if their world has been frozen, and they have now become resigned to maintaining the status quo.

This have some pretty serious ramifications to the outsourcing business – those buyers who only care about cost and basic risk mitigation (the “Lights On” guys) will probably never change (unless they get acquired by firms with more ambitious finance goals). So providers should give them what they want – reactive account managers who’ll jump through hoops to keep labor costs down and hit those SLA green lights, for the sole purpose of making everyone look good (even though most of those SLAs were pretty pointless in the first place).

Conversely, those organizations that have retained a good proportion of their shared services still hold out hope that they can find new ways of delivering value to their organizations, and they can leverage the capabilities of their providers to help them (read our earlier piece on this topic).

Hence, the rallying cry to the industry known as “outsourcing” is simple:

Buyers must re-evaluate their provider mix. Decide which camp you are in and create the right environment to succeed. If you are a buyer and want more than “Lights On” outsourcing, then find a provider which has the domain and consultative capabilities to work with you. If you’re stuck with a provider which simply doesn’t have the skills and capabilities devoted to you that you need, then you have a serious problem and you need to find a way to either ring-fence them and find additional third-party talent, or get rid of them altogether.

Providers must ring-fence their clients to allocate their talent appropriately. If you are a provider and want more clients in the “Efficiency” and “Transform” camps, ensure you have dedicated your higher caliber talent to supporting your existing clients in those camps, and they will form the base with which you’ll win your next 10-20 deals. You’ll always have a good portion of “Lights On” clients (you know who they are), so give then what they want and devote your higher caliber talent elsewhere. If clients want basic services at the lowest prices, then give then just that! However, it’s high-time to segment the industry so we can all focus on delivering value, and not solely cost-cutting.

Click here to read more findings from the ground-breaking HfS Research / ACCA Global “Sourcing Success in Finance Study” by clicking here.

Posted in : Business Process Outsourcing (BPO), Captives and Shared Services Strategies, Finance and Accounting, Global Business Services, IT Outsourcing / IT Services, Outsourcing Advisors, Sourcing Best Practises, sourcing-change, the-industry-speaks

Ron Walker (foreground) patiently waits for his KPMG colleague and former EquaTerra CEO Mark Toon (background)

Picture the scene… the first time I met Ron Walker was back in about 2005 at a Hawaiian Luau in Southern California (I think it was meant to be an EquaTerra “strategy” offsite). From my recollection, the guy was clearly hungover, looked like he’d frequented one-too-many MickeyD drive-thrus as he schlapped around the States doing sales calls, and was sporting a Bermuda shirt and shorts to boot.

Seven years later, I find myself at some conference in Florida, when this suave, well-shaven, slimline gentleman approached me donning a sports jacket with brass-buttons and a consultant’s grin on his face. Now there’s one transformation the outsourcing business can be proud of: Ron Walker as a Big-4 Consulting Partner.

Yes indeed – Ron Walker, one of the original EquaTerra founding executives has lived the sourcing dream… from start up advisors and providers right through to a global management consultancy. So we thought it high-time we caught up with Ron to talk about his colorful career and how the EquaTerra/KPMG merger was faring over a year on… and how different the sourcing world is looking today compared to those crazy days of the outsourcing boom.

Phil Fersht: Ron – you’ve been around the sourcing industry for quite sometime now. Maybe you could get everybody a little bit of insight into your background and how you got into this industry and a bit about your early career.

Ron Walker: Hey Phil – I actually started my career in the aerospace industry and was fortunate enough to work in the office of the president, where we did some initial shared services and outsourcing work. I then moved over to Arthur Anderson where I worked in the business consulting group and had a successful run working on both the consulting side and the outsourcing piece. I helped build the shared service centre that Arthur Anderson was setting up for General Motors, which was one of the largest finance outsourcing opportunities at the time. As part of that process, I made several key contacts and had the opportunity to ‘found’ the initial finance and accounting pure-play start up called LeapSource. I was part of that initial launch, until we transitioned it over and that didn’t quite go as successfully as we had quite hoped – it was during the Exult stage on the HR side.

After Arthur Anderson, I went to (order-to-cash provider) Creditek when the company was being openly courted by Genpact. I worked with the folks from TPI and ultimately connected with my former partner Mark Toon (who was at TPI at the time) and helped found EquaTerra in 2003. So, I’ve been part of EquaTerra from the very beginning. I think I was officially employee number 6 in the line up there. Most of the roles were developing and I enjoyed multiple roles and activities during the EquaTerra experience. Ultimately, when EquaTerra became a part of KPMG, I kind of went full circle… now I’m running the F&A practice within the KPMG shared services and outsourcing advisory space.

Phil: Going back to those heady days when EquaTerra was founded, how would you describe the industry today compared to what it was like then?

Ron: When we founded EquaTerra, at the time outsourcing was definitely becoming the tool of preference for many the executives to help quickly and easily wring out costs in the organization. The challenge was that most of the business process outsourcing that was done at that time was really driven from an IT mentality, and people weren’t really taken into consideration the complexity of business processes. EquaTerra was actually founded as both a shared service and outsourcing advisory firm but because of the business trends at that time, outsourcing advisory was the predominant work that we did.

A lot of companies weren’t capable of understanding how to do a contract with a service provider on the business process side versus the IT side, which was much more mature and easier to measure as far as some of the service levels are concerned. We went to work creating governance models and service levels and really pioneered a lot of the thinking that is taking place today. What I’m seeing today, now we’re 8-10 years further on, is that shared services models are swinging back into fashion. Businesses are looking more at a blended model of how they are delivering services and – in the back office particularly – they are looking at shared services and process improvements, technology platforms and some specific outsourcing – which isn’t only centered on driving out costs. It’s come full circle -particularly when you look at what happened during the last financial crisis: A lot of companies quickly went offshore or outsourced and didn’t do it quite the right way because they were trying to gain cost benefits – and their service delivery models and their quality of service have suffered since. I’d say most of the activity we’re seeing in the marketplace right now is related to fixing some of those service delivery quality issues that they have been experiencing over the last few years because they were really focused on cost versus quality.

Phil: Back in the day, we all really thought everything was going towards an outsource model, didn’t we?

Ron: Yeah, we really did. We were all looking at (basically) leveraging the global scale, capabilities and the platforms that the service providers were either implementing, or claiming that they were going to implement, to drive the future. That was what we really thought was going to take place. It just never quite took off. It certainly has a place and it’s quite effective in a lot of situations, but we haven’t seen the growth that we thought we would see – at least early on.

Phil: So what changed? Why did we move from the ‘everything should move to outsourcing’ to this blended approach we have today? We just completed a massive research study, we spoke to nearly 2000 finance professionals and only 10% of them felt that a BPO model was predominant for them, while 50% leaned towards shared services as their predominant model, with BPO being viewed as more of an augmenting capability for them.

Ron: If you go all the way back to why outsourcing was so attractive… we were in such a growth mode and companies growing hand over fist and just trying to keep up with demand and the gogo years of the Internet bubble. Outsourcing was the predominant way of getting folks in and the growth covered a lot of mistakes. Then many organizations went off and did just that, and they started scrutinizing their service delivery models and becoming less naïve – they started understanding that the service provider, although doing a good job for the most part, had their flaws and issues as well. It just didn’t quite work out for everyone, and we had several failures, which made other organizations a little bit wary as to what they were going to do going forward.

So they (buyers) started getting more intelligent, and in this day and age of information sharing is the ability of collaborating with colleagues and advisors and simply going to classes and looking up stuff on the Internet. They became a lot more knowledgeable about what the right things were to do. The promise of BPO never really delivered the full cost benefits and they certainly had their delivery challenges… and then they started looking at their own service delivery models and abilities to change. They did see things, the technology started to become cheaper, such as forms of cloud operating or software operating platforms that they could move to, and it became easier to just look at other options which hadn’t been available in the past. Where the outsourcing model had been attractive in the past it didn’t quite deliver, so companies started looking at options they could do themselves – or in pieces.

Phil: Do you think it is the same for IT as well or do you think the IT space has gone down to a much more aggressive model towards outsourcing?

Ron: Both are still growing, it’s not as if they are going away – they will still be a predominant option for many companies. I think IT has a larger implementation base than business processes, and it is more mature and easier to operate, particularly when you look at infrastructure. However, it’s still going to be a long time before companies reach their IT nirvana – especially with the new opportunities presented by the cloud. They still have infrastructure support requirements and it is a relatively inexpensive option to go to an outsourcing provider. They’ve got they’ve got scale, capabilities and they’re a lot more able to measure the success of that versus the business processes, where it’s less tangible to define what success looks like. I think ITO will continue to be a predominant part of options and it provides significant cost advantage just because of the large scale, operability and the way service providers are able to offer their services.

Phil: Do you think the BPO space is ever going to get to the scale of the IT space or do you think it is too complex in nature at this point?

Ron: I don’t know. I know in several industries we’re talking about the business process platforms becoming more predominant. If you look at some of the financial services, health care areas that will be an option. It’s too early to tell whether it will be larger or not. As some software providers start to offer different solutions, I think that organizations are going to look at that as solutions rather than these BPO (business) platforms – it’s simply a lot cheaper to implement a piece of software to improve a process, than to try and change the whole process and outsource the processing at the same time.

Phil: Do you think the key is really labour arbitrage? Let’s be honest, it worked in IT because you are literally subbing out specific onshore skills with the same skill offshore minus half the cost. It’s just harder to do that with processes that aren’t so cut and dried.

Ron: You can’t underestimate labour arbitrage but that’s a one trick pony. You get the labour arbitrage – it’s a one-time shot. This is where many organizations are challenged. They are able to take advantage of that labour arbitrage lets say up to 70 or 80% if they were just comparing labour, but where they fail a lot of the time, is to do the proper planning and put in the proper procedures, and that starts to add cost… and then you do loose efficiencies by putting in either offshore or offsite. That labour arbitrage begins to diminish over time. You can’t underestimate it because that’s an area where you can hide a lot of mistakes because you can get such a large cost-savings benefit from something initially. What we’re finding, is once you’ve done that, it is extremely hard to improve your processes or transform processes because service providers, or even your own captive shared service centers, are incented on maintaining their own FTE base, regardless of what your contract says. They measure their success on how many FTEs they have doing the process.

Some service providers are different than others, but what I’ve just described is the mentality of the majority of them. This kind of labor arbitrage makes it very difficult to make business process improvements and add software components that can further streamline process and eliminate unnecessary FTE costs. Some of the highest activity we’re seeing with our clients (at KPMG) is that as they are reservicing their entire service delivery model – pulling stuff back onshore or pulling stuff back inhouse, because they simply can’t get the service providers to cooperate with them on a rational basis to put in new software platforms or to eliminate positions entirely.

Phil: So now you’ve moved into a management-consulting environment. Are you starting to see some of these issues differently than you did before?

Ron: Yes we are. Moving into KPMG and seeing the benefits of a much broader consulting organization, with much more diversified skillsets than we had at EquaTerra, we are seeing a much broader picture of what the options are for clients today. I don’t think that’s just the KPMG effect for us, I think that is truly where the market has been moving.

Phil: What have you heard from clients (particularly the larger ones) that they have too much dependence on offshore, and need to change the model. Is that something you’re seeing?

Ron: Balance is one of the discussions but its really about a value for services decision. Particularly the large organizations, a lot of them put a lot overseas to reduce costs and they just didn’t do it properly so their service delivery model is not as successful as they had hoped… so they are relooking at that and bring it back onshore. Bringing it back onshore is a lot cheaper now than it was, say, 5 years ago. Our onshore rates and ability to deliver services has become more effective these days, and then when you look at critical operating models, it just makes sense to keep some folks closer than others. And the other thing that we learned through our financial service clients is they had a hard time in rationalizing their own recruitment model and subsequent ability to train and retain staff so they can promote them through the ranks. So when they put so much offshore, they lose some of that ability.

Phil: Just to talk a bit about your experience, EquaTerra was such a heartbeat of the business during the last decade and externally the perception has been that it’s been embedded pretty successfully into the KPMG organization. But there was a very distinct culture in EquaTerra that had been developed over the years. Do you feel that has been maintained well?

Ron: It is different, there’s no denying that, but let’s just start with some of our numbers. We had a very highly experienced team at EQ (20+ years on average) and what we did expect, as we moved into KPMG, was a different culture …but I think it was the right time.

I think most of our folks have adapted and were looking for a change and many of our experienced senior people were looking for a career reinvigoration by sharing their experiences within the KPMG model. They are able to work within KPMG and leverage their knowledge and resources to younger folks and help them along with their careers. It’s been more positive than I ever expected and an easier fit than I expected. That’s not to say there are not challenges, there always are. KPMG is much more conservative than EquaTerra ever was and they have a lot more processes and policies to follow… and we weren’t accustomed to that as a startup. That has probably slowed some of our actions down but, frankly, some of that had to be done. It will probably take another 6-12 months to really shuffle everything out through the process.

I’ll ask you, you’ve been integrating with us on a frequent basis… have you seen us lose some of our EquaTerra culture through the businesses you’ve been talking to?

Phil: I have definitely seen some maturity in some of the EquaTerra folks that I bump into. For example, there was a large gathering of (former) EquaTerra people recently in Florida and it really hit home to me how the group had been kept together. The feeling I came away with was they had retained much of that spirit and culture and were settling in well into a bigger, more mature organization and were gearing up very much to increase market share in the industry. And a lot of the former talent that had actually left the company had come back.

Ron: Right! I’d say that some of the KPMG leadership knew that there was an enthusiasm within our organization and a love of the work that we do and platform we have. Today, the clients we can now interact with has really reinvigorated some of the folks. I think we’ve done a great job of just looking at the current industry opportunity and how KMPG has provided us new pathways to keep our career fresh.

Phil: Ron, I wanted to talk a little bit about the future and this global business services framework – I know KPMG has been very hot on this topic. We just completed this study and coming out of the results, one of the things that really hit home to us was the increased recognition from finance leaders of the capabilities that providers brought to them – whether they operate shared services or outsourcing. What gets us scratching our heads is that this means service providers need to start to sell to shared services organizations more effectively, which means there needs to be a change in how this stuff (outsourcing) is actually talked about and positioned within an organization. At the same time I think clients have to understand more about how service providers operate in order to get more out of them. What is your take on this? Where do you really see this moving particularly from a finance perspective?

Ron: I think the challenge is that a lot of times companies don’t know how to get that best bang for their buck out of the service providers that they’re engaging with, which is why we see the dichotomy there. The other aspect of it that I still think is always the stopping point is technology. When you look at where you get true benefit: the people, capabilities and knowledge – that’s moveable but the technology is such a large component. Within finance, you’re pretty much stuck on the original ERP that the company has because its usually too expensive to replace or roll out, so service providers are either forced to utilize the legacy system of a company or if they want to go through a new implementation, its typically very expensive. What might change on that is NetSuite or Workday finance that is going to have the ability to make that a lot cheaper and offer a potential platform service for the service providers. In the end, I think it is an issues for every organization… although they say they want to do it, it is very difficult and challenging to try and integrate, whether it is a service provider or a new technology on a cost-effective basis, unless they are fully committed. There are easy things: for example, you can outsource T&E, AP, AR etc, but when it comes back to that legacy ERP system, until there is an option for fixing that, I don’t see a wholesale switch out.

Phil: Finally, when you look back at your career, would you have done anything differently?

Ron: Probably everything, but I really enjoyed the journey so I don’t know. I have really enjoyed the career and the progression between Arthur Anderson and EquaTerra. Frankly, the first few years of my EquaTerra experience had been the most satisfying of my entire professional career but I’m having the same kind of fun and interest and professional growth within KPMG, so I wouldn’t have predicted this path, but I probably would have made it a little less tenuous in some cases (looking at some of the start ups I had done) but, overall, it has been a spectacular experience and I probably got 10x number of years of experience for my age just because of the things we’ve been able to do.

Phil: One final final question. If you were given 1 billion dollars tomorrow what’s the first thing you would do?

Ron: Probably a long vacation with my family because we’ve been working really hard for the last year or so. I need to think about what I would do with the rest of it.

Phil: Ron Walker, thanks for the time today – a frank and rewarding conversation I know many of our readers will enjoy!

Ron Walker (pictured left and right) is Principal, Shared Services and Outsourcing Advisory at KPMG. Click for bio

Posted in : Business Process Outsourcing (BPO), Finance and Accounting, IT Outsourcing / IT Services, Outsourcing Advisors, Outsourcing Heros

Are we in the Cloud yet?

With all the quick-thinking and finesse of an Italian analyst in a Hollywood Hills salami shop, here’s HfS Research’s Tony Filippone imparting the scoop on why SAP just bought Ariba…

With its $4.3 billion cash offer, SAP answered every procurement technologist’s question, “Who is going to buy Ariba?” While this acquisition will rupture the procurement technology universe, HfS believes the real question that supply chain and finance professionals must ask is, “Now that SAP finally has a credible commerce network, can I eliminate and automate processes I’ve been busily outsourcing?”

It Didn’t Happen Overnight

Give credit to Ariba’s leadership. Over the last few years, Ariba’s CEO Bob Calderoni and President Kevin Costello bet the farm on cloud technology and the networked economy. With the introduction of cloud-based 10s1, they took their focus off gritty areas, like category management, usability, and procurement process management, and jumped into technology’s cloudy fray. This was a “check the box” exercise for any technology company. Yet, the real jewel was Ariba’s supplier network. With the help of procurement teams bent on mandating its use among suppliers, Ariba’s supplier network swelled to $319 billion in commerce transactions spanning 730,000 companies. Ariba’s network fees doubled. SAP noticed.

In the meantime, Calderoni sold Ariba’s services arm to Accenture 18 months ago. This clarified Ariba’s technology-focused strategy. It also eliminated the largest objection larger technology firms had about acquiring Ariba – the services. Technology firms want nothing to do with services as they can neither manage nor sell them effectively. In the end, Ariba became a feature-rich, cloud-based platform with one of the world’s largest B2B commerce networks.

What It Means to the Industry

SAP customers gain network capability that automates their O2C and P2P processes. With an installed license base of 190,000 customers, SAP enters the cloud technology world with a real commercial network. This exposes SAP’s industrial, manufacturing, and CPG clients to a modern method of conducting O2C and P2P business. SAP’s customers are likely to rapidly adopt the network. In the wake of SAP customers’ adoption of the Ariba network, business owners should seek to consider bolder, more transformations alternatives to outsourcing their finance and accounting processes. Quit emailing POs, and start electronically flipping them to eliminate manual effort and obtain the true contract value you negotiated.

Other technology players are left picking over the leftovers. SAP eliminated one its competitors, while IBM’s Emptoris acquisition eliminated another. Two heavy weights are gone, and in their wakes lay a large number of low-priced, niche procurement solutions that are left to fight it out. While buyers will always have some interest in pure play solutions, choices for enterprise buyers are more limited. Expect the smaller players to focus on usability and niche process solutions, like supplier relationship management. However, seamlessly automating a company’s global payables team through an established network dwarfs the differentiation of better-looking user interfaces.

Outsourcing service providers face a new landscape. With SAP customers poised to adopt a network, finance and accounting outsourcing service providers will face lower volumes of manually transactions. Service providers that can help buyers transform their processes are positioned best to service clients and win new ones. However, this isn’t a simple technology issue solved by templates. Supplier network adoption and onboarding is a complicated, tactical task and finance and procurement teams will need operational expertise to handle the transition. In addition, SAP’s partner model for its On-Demand services may open new opportunities for service providers that had previously relied on Ariba’s cloud suite.

Procurement and supply chain gets shoved into driver’s seat. With SAP’s sales force pushing Ariba’s network, expect CPO’s to feel the pressure to take more control of their firms’ end-to-end P2P strategy. Whereas few enterprises currently consolidate sourcing, procurement, and payables teams, Ariba’s network will force organizations to reconsider if they want to tap into the true value of seamless source-to-pay processes. More importantly, supply management executives will be given a better network to manage direct goods and services. As a result, CPOs and supply chain leaders will feel the pressure to manage source-to-pay in an end-to-end fashion.

The Bottom-Line: SAP’s Acquisition is a Good One

After the dust settles and SAP integrates Ariba’s sourcing, procurement, and contract management capability into its suite (or vice versa, which could create quite a bit of dust, but represents a fine network-based model for B2B commerce), SAP and Ariba’s customers come out as winners. Customers will get better features, a more broadly adopted cloud-based delivery model, and a rapidly expanding commerce network that reduces the inefficiencies of manual P2P processes. However, despite all the hype SAP has created about its On-Demand solutions, can the German software firm really manage a network and B2B community-based solution?

Posted in : Business Process Outsourcing (BPO), Cloud Computing, IT Outsourcing / IT Services, kpo-analytics, Procurement and Supply Chain, SaaS, PaaS, IaaS and BPaaS, Sourcing Best Practises

So for the first time since the ’08-09 crash, we’re finally starting to see the impact of a commodotizing services market, as HP makes plans to shed 30K jobs this week.

HP may have had some war wounds inflicted on itself with the standardized services models of today, but there is still the opportunity to position itself to win the higher value engagements of tomorrow

However, I believe HP is a symptom of a commodotizing and standardizing IT/business services industry – it’s recent woes have forced it to take corrective action that many of its competitors will surely have to also take in the future.

The bottom line is that several providers of HP’s ilk are getting overbloated – and have been for a while – and simply can’t continue to remain competitive in today’s market under the old rules of yesteryear. It’s time to trim the fat. And while other analysts are claiming HP is an anomaly in the services business, I don’t agree – we’ll see several other service providers make corrections to their workforce sizes in the coming months. The old “butts on seats” services model has to transform or we’ll all be on a race to the lowest common denominator.

Meg Whitman is doing what she was hired to do – straighten the ship, re-energize the management talent and getting HP on a roadmap to competitiveness. However, this is the start of a long process to correct the utterly rudderless policies of Léo Apotheker’s short-lived, but very damaging, spell as CEO. While a 10% layoff is tough to take, this is likely not going to be the last workforce correction we’ll see from Whitman this year.

How has HP found itself as the first Tier One IT Services provider (since the recession) to start shrinking its workforce?

Léo Apotheker had left HP in a sorry state from which it is proving tough to recover. During his ill-fated 10-month leadership spell leading up to his dismissal in September of last years, he’d helped wipe 40% off of its stock valuation and $30bn from its market cap. His corporate leadership decisions were well documented in HfS, and the resulting financial performance has proven tough from which to recover, with little upward movement since Meg Whitman’s appointment as CEO.

HP is a victim of its own success as it helped create today’s commodity services market. The Tier 1 IT outsourcing providers (Accenture, CSC, HP and IBM) are slowly discovering their success in standardizing the IT outsourcing market is no longer demanding such bulky staff delivery requirements. The movement away from asset heavy deals and heavy staff transitions no longer necessitates the mammoth-like deals of yesteryear.

HP’s previous leadership failed to build on its EDS acquisition, which has ceded much of its market position. EDS was one of the original pioneers of ITO, typifying the mega-million dollar IT infrastructure deals of the 80’s, 90’s and early 2000’s. However, as that business suffered from squeezing margins and the focus away from heavy asset-transfer, EDS developed one of the industry’s stellar SAP development and maintenance practices. And when HP, also a major proponent of SAP services, acquired EDS in 2008, it was expected the combined outfit would go from strength to strength as a powerhouse enterprise IT/business services provider. Instead, we witnessed the likes of Infosys, TCS and Wipro infiltrate the SAP services market; Accenture and IBM develop genuine offshore competitiveness to fight the Indian low-cost wave; while Deloitte and Capgemini have remained competitive as consultants and integrators. HP, CSC and a few other “old school” ITOs became paralyzed in a state of denial as their market competitiveness was quickly eroded.

With Mark Hurd obsessing about HP’s hardware business, and his successor Apotheker seemingly trying to turn HP into a software firm (or at least we’ll credit him with trying to achieve something), HP clearly lost focus on its EDS business, while a global recession wasn’t exactly helping matters. Additionally, HP’s BPO business has remained relatively stagnant since the EDS merger – and is only now showing signs of a resurgence with Whitman placing new management talent to energize its clients and refocus its staff.

The move to the Cloud has further leveled the playing field. Cloud computing deals are further placing the onus away from enterprises purchasing hardware assets and their related labor intensive services. Moreover, the new wave of Cloud deals is signaling an end to long-term lock-in contracts and more choice to the enterprise buyers. We actually see this as an opportunity for the quality infrastructure providers, such as HP, investing in tech personnel who can develop Cloud-based apps and infrastructure environments for clients. Cloud isn’t further commodotizing the game – it’s democratizing it, giving buyers more choice and easier access to talent, away from contract lock-ins and inferior services. The commodity offshore players are scared of Cloud (remember our old friend, HCL’s CEO Vineet Nayar?), where you can’t compete simply by hiring armies of ABAP programmers fresh from college.

The Bottom-line: HP is addressing its problems – and it won’t be the only provider going down this path

Finding differentiation between standard IT services these days is almost impossible. Armies of Indian delivery personnel and competitive rate cards provide the engine of today’s standardized IT services industry. Those providers with the smartest pricing and personnel factories will win that game. The real differentiation points are unraveling higher up the services stack with the development of offerings that achieve business objectives, based on outcomes that are tied to them. It’s going to be those providers that can integrate services, with domain specialities to solve complex problems (not all businesses can slam in an SAP or Oracle and be done with it), and those companies seeking to make radical changes to their internal operations to compete globally, where they can take advantage of globalized shared services and outsourcing, and the disruptive potential of Cloud. HP may have had some war wounds inflicted on itself with the standardized services models of today, but there is still the opportunity to position itself to win the higher value engagements of tomorrow. That game has only just begun…

Posted in : Business Process Outsourcing (BPO), Cloud Computing, IT Outsourcing / IT Services

We still haven’t quite forgiven those of you for not being one of the 1,200 people who signed up to hear six of the most influential IT and business services savants debate on the future of sourcing and services. I mean – what else were you doing? Was it really that important?

However, in our spirit of forgiving even the unforgivable, here’s a replay of the event – just click on the image below:

And as usual, we’re giving far too much away for free, so…here’s your own copy of THE-SERVICES-SAVANTS-SLIDES.

Posted in : Business Process Outsourcing (BPO), IT Outsourcing / IT Services, Outsourcing Advisors, Outsourcing Heros

The HfS 50 Blueprint Sessions 2.0 will be a continuation of the hugely successful summit that took place at the Soho Grand in New York in April 2012, where 41 senior recipients of outsourcing services, joined by six of the leading outsourcing services providers on the second day, started the ground work for a Blueprint document that delivers a roadmap for the future direction of the outsourcing industry. And as you can see, it was a blinding experience…

Posted in : Business Process Outsourcing (BPO), IT Outsourcing / IT Services, Outsourcing Events, Outsourcing Heros

We’re awarding an HfS bravery medal to ISG analyst Stanton Jones for pointing a nuclear missile at the credibility of Gartner’s recent Magic Quadrant for Managed Hosting. Stanton doesn’t mince words as he declares:

We’re awarding an HfS bravery medal to ISG analyst Stanton Jones for pointing a nuclear missile at the credibility of Gartner’s recent Magic Quadrant for Managed Hosting. Stanton doesn’t mince words as he declares:

“Did you know that of the companies listed on the Managed Hosting Magic Quadrant referenced above, less than half would be capable of supporting a transformational infrastructure sourcing initiative with a multinational company, or that only 10 percent could support the same for a global company?”

Stanton then seizes the opportunity to pitch his firm’s own capabilities: “ISG is comfortable (and confident) in making this statement because we’re on the ground every day with both buyers and sellers of IT services. This unique position gives us unprecedented insight into what suppliers are really capable of delivering to clients — clients that trust us to help them vet providers in a fair, transparent way to make sure the vendor will help them solve their ultimate business problem.”

While I have no doubt that Stanton’s knowledge of providers’ IT sourcing capabilities is top-notch (I have always been impressed by the caliber and culture ISG’s people), I think we need to look at this accusation in a broader context:

1) ISG lives in a world where it’s all about outsourcing – how about the other 72% of enterprises? Our recent studies show that only 28% of large enterprise rely predominantly on an outsourced model for IT infrastructure. While Stanton correctly states that ”less than half of these providers would be capable of transformational infrastructure sourcing initiatives”, he conveniently ignores that fact that most of Gartner’s clients – and the majority of large enterprises, probably don’t care too much about these capabilities. They may just want a quick no-nonsense glance at managed hosting providers. I’m sure Gartner’s clients who do care about “transformative sourcing cababilities” would call them up to find out more.

2) ISG makes the vast majority of its income facilitating and negotiating outsourcing transactions – doesn’t this bias its research? I can speak from personal experience that it’s really tough trying to produce “unbiased” research when working for a company that makes most of its money from clients undertaking outsourcing engagements. The bottom-line is your firm is vested in the success of outsourcing, and your research will always be pressured to advocate the benefits of outsourcing. At the end of the day, the consultants want to wave research in front of their clients that supports the case for doing an outsourcing transaction, because that’s how they get paid. However, for those companies who’ve already made the decision to outsource, or are renegotiating existing outsourcing contracts, ISG’s research is likely to be highly pertinent and relevant.

3) All quality consultants conduct good research and thought-leadership, but they’re not trying to badge themselves as research companies. In sourcing, some of the best research comes from the likes of PwC, KPMG, AT Kearney, Deloitte etc – in fact, we even showcase some of it at our BPO Resource Center. However, they do research to enhance their eminence and consultative credibility, and they make every effort to make it widely available and accessible to enterprise decision makers. I don’t think I have ever read a detailed piece of ISG (or TPI) research in my entire career beyond their quarterly index calls. I am sure it’s great, but it’s not easily accessible or widely available to the industry at large. If they truly want to become a research firm, then let’s have a gander at some and we can all form our own opinions.

The Bottom-line: Outsourcing specialists need to base their business models more broadly than solely on outsourcing if they want to take on the traditional analysts

Love them or loath them, Gartner serves the vast majority of IT buyers, whether or not they outsource. Moreover, Gartner is predominantly a research firm and IT strategy advisor, who I haven’t ever seen facilitate an IT outsourcing deal (I’ve seen them dabble in it in the past, but they never really got anywhere). ISG is a great outsourcing consultant, and has consistently been the industry-leader for facilitating IT outsourcing transactions for the last couple of decades.

Stanton Jones is Analyst, Emerging Technology at ISG

While Gartner could clearly do a better job researching the sourcing transformational capabilities of providers, ISG could similarly do a better job producing research for the 72% of enterprises who haven’t done a lot of IT outsourcing. If I’m a CIO and need some unbiased validation of my overarching IT strategy, I’ll be likely to call Gartner (among others) for an independent viewpoint. If I was doing an outsourcing deal and needed specific advice and data around how to do my transaction and develop my shortlist, ISG will surely be on my list of experts to call.

As we have painfully laid out here time and time again… it’s not all about outsourcing!

Posted in : Business Process Outsourcing (BPO), IT Outsourcing / IT Services, Outsourcing Advisors

One of the most influential and popular figures in the development of India’s services business over the last couple of decades is Basab Pradhan. I personally got to know Basab when he became part of the esteemed blogging syndicate “Enterprise Irregulars” last year, where I was impressed by his pragmatic and visionary approach to global sourcing, as he was finalizing his new book “Offshore: India’s Services Juggernaut“.

Basab made his name in the industry by climbing the ranks at Infosys during its hyper-growth years, where he led the global sales and marketing function until 2005. This year, Infy managed to persuade him to rejoin the firm to be instrumental in helping position the firm for this new phase of the industry.

So we managed to convince Basab to park his Chevy Volt electric car for few minutes, which he passionately drives around the Bay area, and claims to have recently clocked 108 miles per gallon. We were also joined by his colleague, co-scribe and Kindle-fanatic, Gaurav Rastogi, who’s spent the last nine years leading global sales effectiveness and learning for Infosys.

Phil Fersht (HfS): How is the Chevy Volt doing? If it blew up tomorrow, would you get another one?

Basab Pradhan: It’s doing great! I am up to 108 mpg. The news of it blowing up in tests were highly exaggerated. No such worries here.

Phil: So…tell us about your recently published, co-authored book, Offshore: India’s Services Juggernaut.

Gaurav Rastogi: The premise is very simple. While many books have been written about India and offshoring, very little has been said about how the Indian offshoring industry came to be, what it means for a company to be Indian, what impact this industry has had on the Indian economy, how it works, where it’s at right now, and what makes it successful. And the headlines you read about offshoring are the equivalent of bumper sticker stories. So we set out to characterize, demystify and explain the Indian offshoring industry.

Basab: We talk a lot about how the industry is changing, and the shifts are quite perceptible if you observe the industry. For example, at the early part of the 21st century, it was all about the new offshore or global delivery model (GDM), and the cost savings, flexibility and other advantages it could bring to buyers, But it’s no longer about the GDM. In fact, buyers today, especially in the U.S. and U.K., assume a GDM is built into their solutions, and they don’t select service providers based on those they feel can safely take them across the GDM chasm. Now, they’re buying on the capabilities they used to before GDM came along – what’s the value, does the service provider understand my business, does it understand the particular solution, does it have the right people to lead the project, etc.

Phil: Where do you think India is going to go next with its development in the global sourcing industry? Which areas do you think are going to be most successful for the country, and where do you think we may be in a bubble?

Basab: There are quite a few interesting things coming along, such as offshoring of marketing processes in the life sciences industry and technical support offered directly to consumers. But while there are great opportunities in these types of emerging, non-hanging-fruit areas, you can’t just throw people at them. You need specialized skills and a delivery model solution that can address the advanced needs and requirements.

Phil: We’ve seen an increasing number of Indian providers open facilities across the U.S., in Massachusetts, in Michigan, and even your new center in Atlanta. How is this impacting the sourcing business for India?

Basab: One of the chapters in our book, called India Versus Rest of the World, looks at your question from several different aspects. First, we believe that hiring in our clients’ markets will only go one way – up – because of many reasons. With the kind of work we do with clients, it’s getting to the point where the sophistication of the solution is such that you need people with industry skills, not just technical skills, and the sophistication of the industry and how it works in advanced markets is ahead of that in developing markets like India. Of course proximity matters and you want to be closer to your clients, and so you have to hire more in the markets. In-market hiring also reduces risk, and it’s just good business. In fact, we see that hiring in the markets is going to keep going up at a higher proportion compared to the growth of the company.

Gaurav: Another way we look at this question is the blurring of boundaries, how the company of the future is likely to have a global workforce, a global management structure and global ownership…none of it is Indian. We believe that the definition of what makes a company Indian is weak, that it will continue to weaken, and that it will be increasingly difficult to tell which companies are Indian and which are not.

Basab: Earlier this year you had a post on your blog about Indian companies being the New Phoenicians…and there’s a lot of truth in that. These firms, whether they’re headquartered in India or not, whether they’re largely Indian management or not, they are the new trans-nationals. They are companies that belong nowhere but are comfortable everywhere. That’s where I think a lot of this is headed.

Gaurav: A term we use in our book is “Frankenfirm”. A company with headquarters in one country, a CEO from another, the largest market in yet another, and the workforce in a fourth. That’s what companies that started out in India or have a big base in India are soon going to look like that.

Phil: In our view, the IT services industry has pretty much been ceded to India. While Western providers are trying to come in and undercut the Indian providers’ prices, the buyers are saying, “Look, these guys were smart, they got in 10 years ago, they have institutional knowledge of our processes, we like working with them, there’s an energy about them, and a ‘forgiveness factor’ has developed over time.” Do you think it’s going to be as easy for Indian firms in emerging BPO areas like those you mentioned earlier – such as marketing processes for life sciences companies – or will it be a challenge down the road?

Basab: Before the Indian IT industry made any headway into package implementation – SAP, Oracle, etc. – we had the same type of question. Could we have the same success with it as we did with ADM? But companies were doing 10’s of millions of dollars worth of implementation at the same client for a year, and lowering the cost of delivery by a tenth was just waiting to happen. So we had to build and hire the skills to be able to do it, we also did things our own way, e.g., establishing our own academies for training, and we built a thriving business out of it. So going back to the notion of blurred boundaries and what is an Indian firm… what differentiates a company is its ability to understand the business problem, create solutions and put value at a lower cost on the table for the client. It’s going to happen in emerging BPO areas as well.

Phil: Going back to our philosophy about the New Phoenicians, with which you agreed…we’ve seen over the last 50 years or more many nations, like Singapore and Japan and more recently China, rise in the industrial world with big economic growth spurts, largely due to development of a culture of hard work, effort and innovation. But many of these countries have become complacent, and are now struggling to find new growth. Do you think India runs the same risk of reaching a level of complacency, or do you think the culture, make-up and DNA is different?

Basab: I think it’s very important to recognize India’s success in offshore services has come about without the government’s support. Which means that it’s due almost entirely to alignment of demographics and market forces. That said, can India become complacent? Absolutely. But at this point the demographics are in the right direction, there are large companies now operating in India so the management culture you talk about has become prevalent, and there are hundreds of thousands of people working in and feeding this industry. So in that sense, the dynamo is beginning to roll and it will take time before it winds down.

Phil: We’ve spoken privately about the fascinating race going on between the big SWITCH* providers. How do you see this playing out? Infosys is one of the big growth success stories of the last decade, but you’re running into fierce competition from the likes of TCS and Cognizant, as well as Accenture from a Western standpoint. How can Infosys keep its edge and differentiate itself from the rest of the pack?

Basab: You’re very right that this industry has become much more competitive. In the early days, it was like there was this gold rush where there weren’t yet any stakes in the ground. But suddenly all the ground – or most of it – was seemingly taken, and what is left is harder to mine for gold. That’s kind of the situation we’re in. There’s hand to hand combat going on in every account, and we have to figure out ways to keep increasing the value we provide to our clients, and focusing on the right things such as the people in the company, how we organize our efforts in the market, how we continue to focus on quality and embedded IP. At the end of the day you won’t hear stories about quality. But that’s why clients give you business. If you fail at delivering something, no matter how fancy it was, you’re not going to get more business, because there are hungry competitors in the account waiting to take it up. So we are going keep our focus on quality AND a shift to business outcomes.

Phil: In terms of the next wave of growth for the big Indian firms, we’re seeing much greater willingness to invest in large clients, particularly in areas where there are significant domain requirements and business process needs. And in many ways it makes sense because you can take on a big client, make a profit and gain a lot of the domain skills you need to grow. It almost seems like the days of acquiring other providers are numbered. Do you think we’ll see big acquisitions come back into this space, or will growth come more organically from clients?

Gaurav: I think it will differ from company to company, based on their individual appetite for growth and what they want to do from a stock market and shareholder standpoint. Infosys has a lot of cash in the bank, so if we were to acquire more companies it would be to gain capabilities, skills and geographical coverage…not for growth.

Phil: Would you write another book?

Guarav: That is, if people are still reading books in the future. My guess is that people will have the patience to read essays in the form of Kindle Singles, but would not dare to consume too much non-fiction in one setting. Would want to write a series of inter-connected essays? Absolutely!

Phil: If you had to bet your mortgage on it, what will the outsourcing industry really look like in 10 years?

Basab: Big. Lots of technology mixed in. Much less hub-and-spokey compared to today.

Gaurav: The industry will be dramatically different from how it is today. Companies that are now beginning to look alike will separate once again into leaders and laggards. The blowback against globalization will become stronger initially, but will abate in the longer term. An economic boom or two would help with that. Meanwhile, the software industry is already changing dramatically, and that will have serious consequences for the IT outsourcing industry as well. India may still lead as a destination, but major companies will have a global footprint, which includes serious local hiring in major markets.

What I can’t resolve in my mind is how the companies will continue to manage an intelligent workforce of 200k-1 million people without resorting to an efficient bureaucracy (an oxymoron) or to a dictatorial style (and how long that can last). What may happen is that the larger companies may find their size untenable and, bacteria-like, choose to undergo binary fission into more manageable enterprises. Or, all of us may finally figure out how to make money from ideas instead of people’s time. We talk about this in the book in our chapter on hiring. Needless to say, these are purely my views, and do not represent the views of my employer, or to our clients.

Phil: Gents – it’s been a pleasure chatting with you both and I look forward to having our HfS readers load up your new book on their Kindle apps!

The book “Offshore: India’s Services Juggernaut”, is available in book stores and on amazon.com.

Click here for more information

Basab Pradhan (pictured top-left) is Senior Vice President, Head of Global Sales, Marketing and Alliances at Infosys – click here for bio.

Gaurav Rastogi (pictured top-right) is Head of Learning Services at Infosys – click here for bio.

*SWITCH refers to Satyam, Wipro, Infosys, TCS, Cognizant and HCL

Posted in : Business Process Outsourcing (BPO), IT Outsourcing / IT Services, Outsourcing Heros, Sourcing Locations