Category: Financial Services Sourcing Strategies

Commercial banks seriously need to up their digital game to meet the B2B needs of their customers

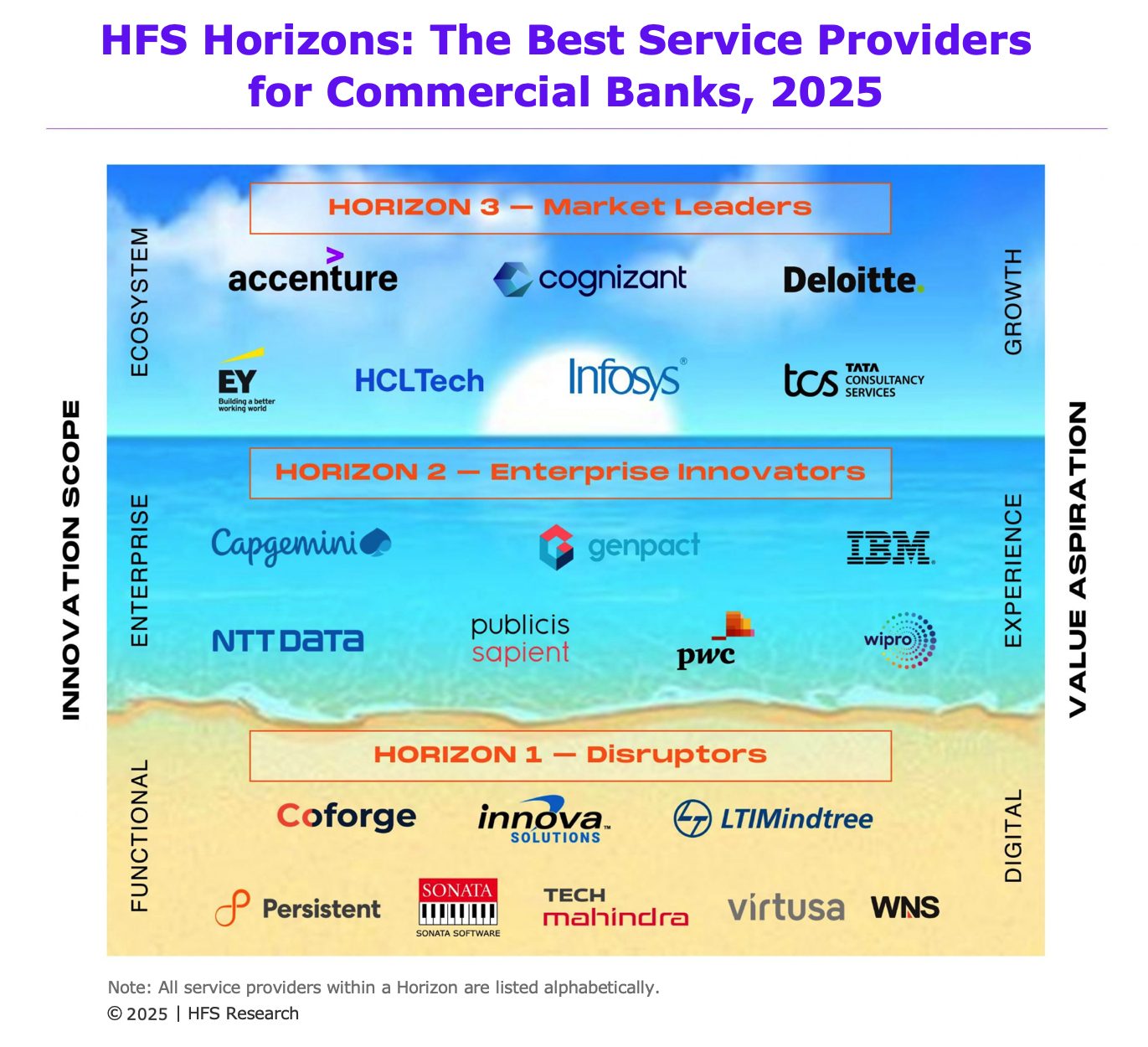

HFS conducted a significant deep-dive Horizons Study into the needs of commercial banks and the best IT and business process service providers to support them: HFS Horizons: The Best Service Providers for Commercial Banks, 2025. This report evaluates the capabilities of 22 service providers across the HFS commercial banking value chain based on a range of dimensions to understand the why, what, how, and so what of their service offerings.Read More

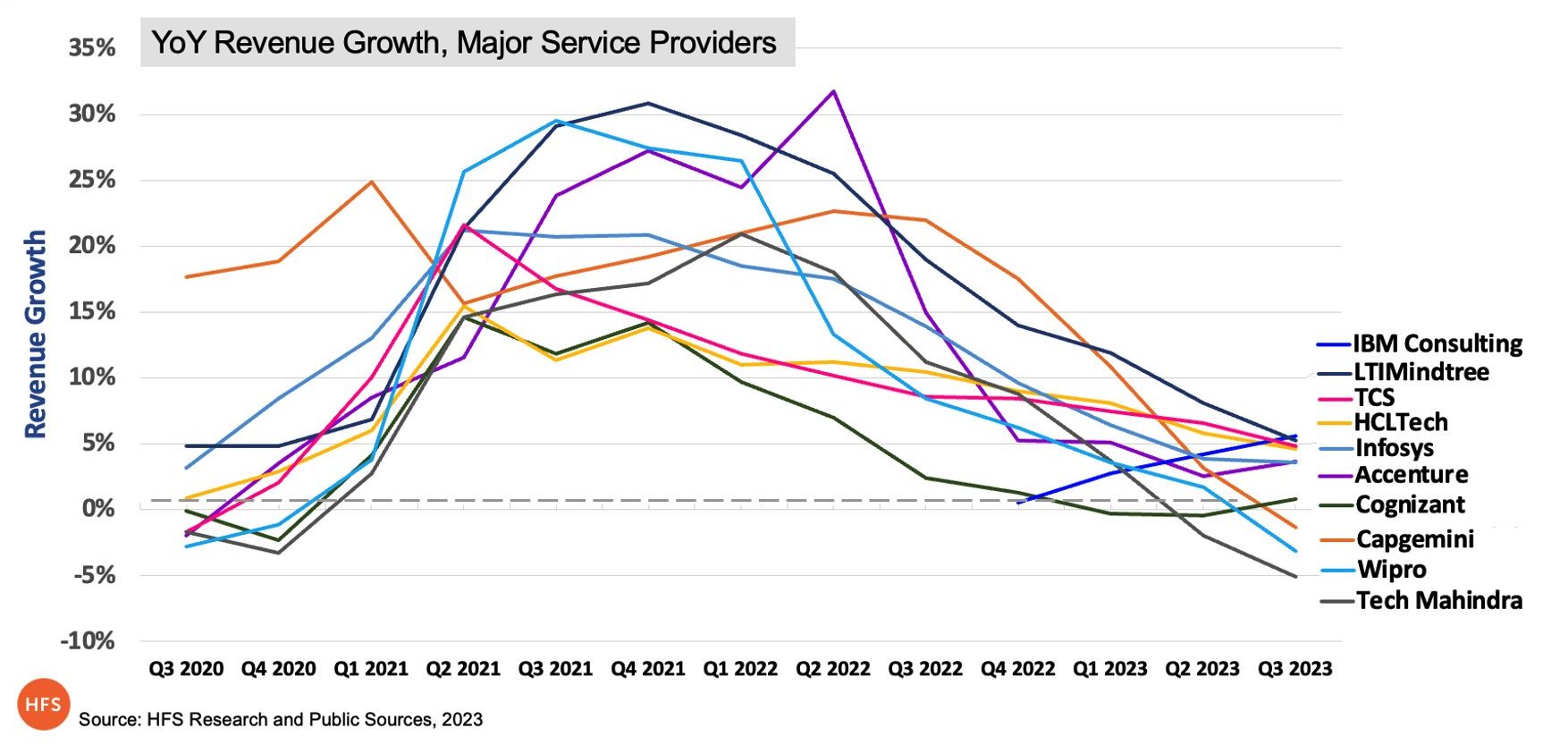

Services firms are out of runway. They must forget Labor Arbitrage and conform to Technology Arbitrage

The fundamental value creation lever in the legacy Labor Arbitrage era has been the centralization of people in a global delivery model. The fundamental value lever in the Technology Arbitrage era is all about architecting and orchestrating the rapidly changing technology ecosystem in line with the client’s business model. It’s past time for the IT and BPO Services industry to jump to a new S-curve driven by Technology Arbitrage if they wish to get back to another season of hockey stick growth.Read More

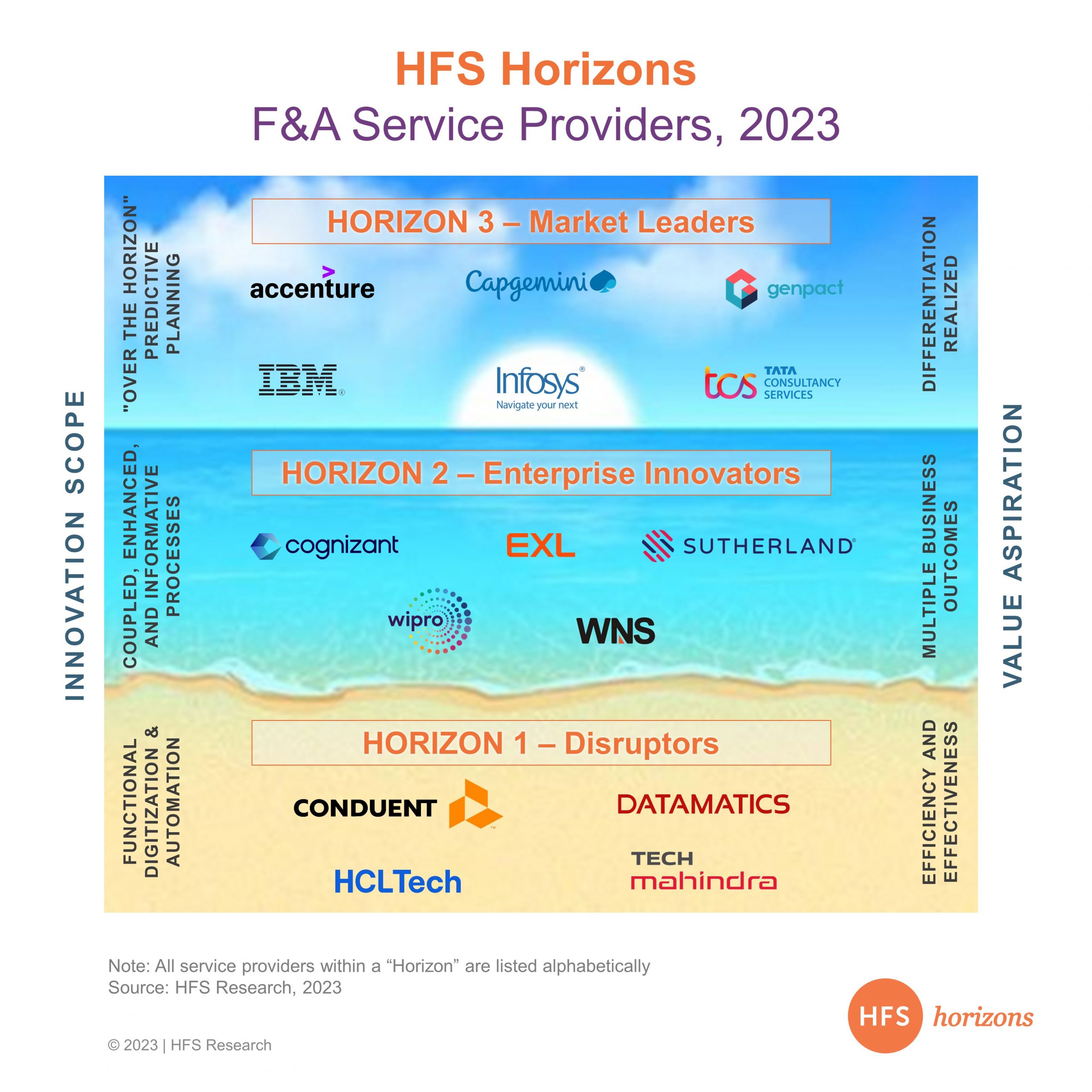

Accenture, Capgemini, Genpact, IBM, Infosys, TCS—the F&A entourage leading the way to Horizon 3 outcomes

HFS conducted an exhaustive research exercise into 15 of the key service providers in the latest Horizons report on F&A Service Providers, 2023, by diving deep into the capabilities of each and how they have contributed to the changing F&A landscape over the last year. Read More

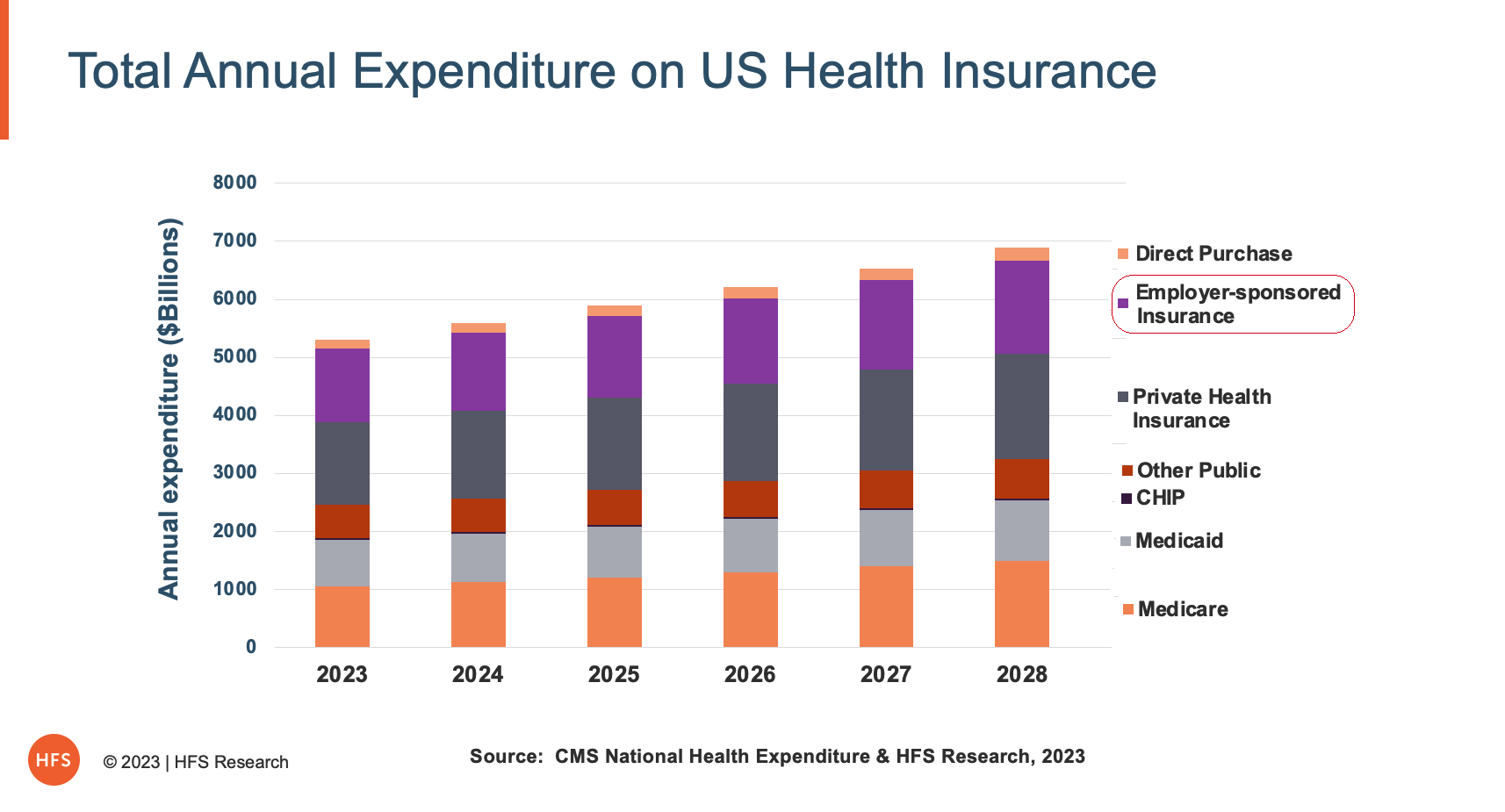

Employers can save $350 Billion a year if they shift to a self-insured healthcare model

Self-insured employers have a generational opportunity to course-correct on the health and care needs of their employees in an apolitical, sustainable, and materially cost-effective mannerRead More

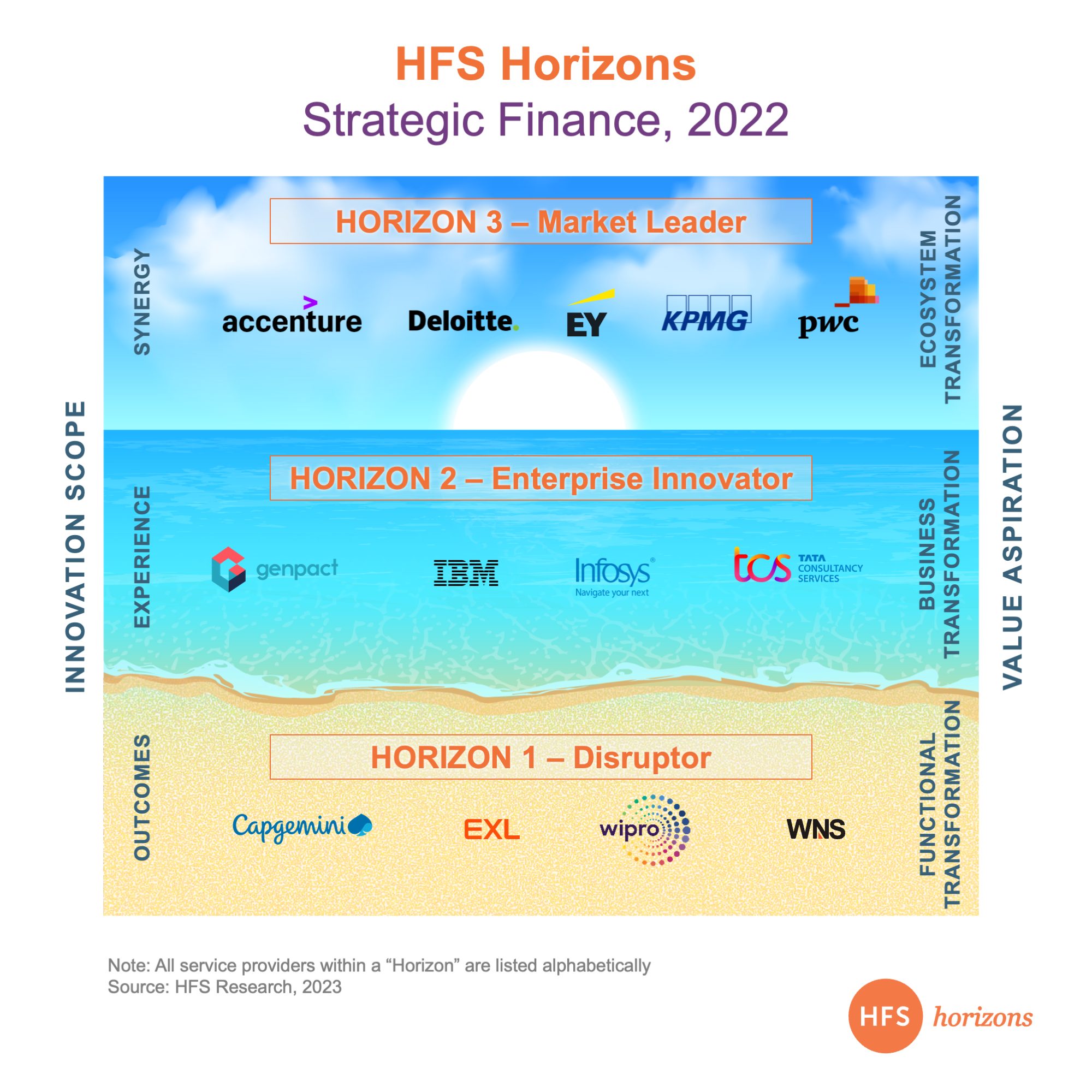

Who’s leading the pack for strategic finance services?

The HFS Strategic Finance Horizons report analyzes services provider capabilities shaping the financial planning and analysis industry and their proven capabilities to help their enterprise customers access critical financial data at speed. HFS assessed 13 major service providers' prowess in the strategic areas of FP&A. Read More

Will Infosys revitalize the mortgage processing market with ABN Amro’s Stater, or is this merely sweating a commodity asset?

Infosys has just announced a joint venture with ABN Amro for mortgage administration services. HFS investigates the motivations...Read More

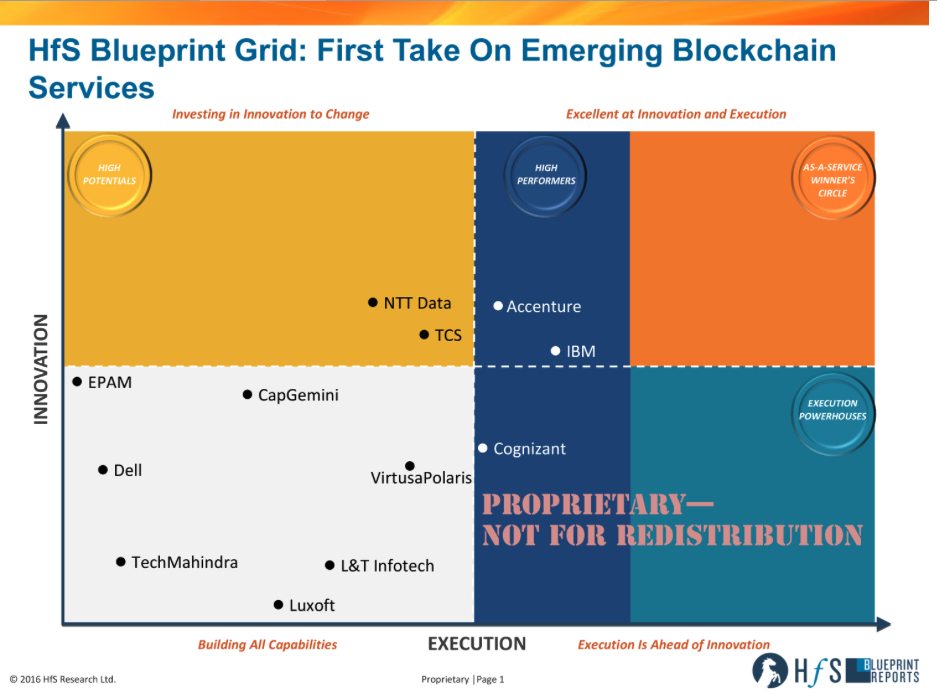

Accenture, NTT, IBM, Cognizant and TCS making the early moves with Blockchain Services

HfS unveils the first ever view of service provider capability with Block ChainRead More

You can bet your mortgage-as-a-service on Accenture, Wipro, Cognizant and TCS

Mortgage As-a-Service Blueprint for 2016: The Evolving Service Provider LandscapeRead More

Blockchain Microwave Chickens?

Because blockchain is a difficult concept to understand, many people do not seem to understand what it actually is, except that it will "revolutionize" lots of things...Read More

Can HPE + CSC dominate the digital underbelly, or has that ship sailed?

These two firms need to be slammed together with an urgency and focus not yet seen in our industryRead More