Did you know that the average time a US employee spends reading up on their company health insurance coverage is 15 minutes… and costs their employer $20K a year?

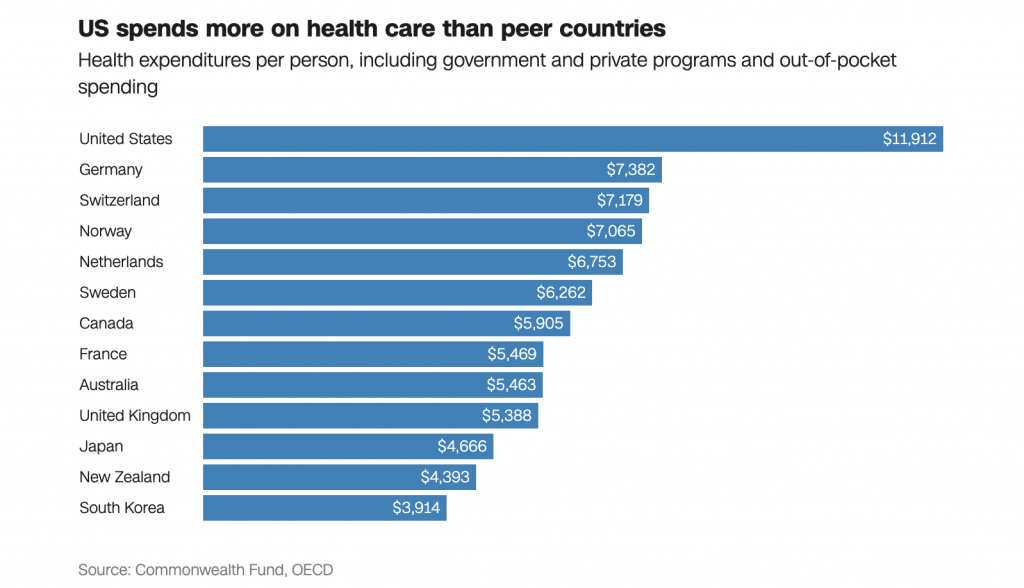

So you can imagine most US employers don’t spend much more time considering these policies either (I know I certainly don’t!). The issue is we all take the healthcare insurance system for granted; we pay these exorbitant rates to these mega-corps and just assume this is a cost of living and doing business. OECD data shows that in 2021 alone, the US spent nearly twice as much as the average OECD country on health care – and three times higher than even Japan and South Korea:

However, our incredible healthcare program leader, Rohan Kulkarni, has moved heaven and earth to force people (including me) to think about this supreme waste of hard-earned income and point us to the whopping 40% savings on offer, in the region of $350 billion a year, if we move from these exorbitantly expensive group plans to a self-insured model where we take a bit more risk for a huge amount of savings.

And when the “risk” is essentially the health of our workers, that’s a pretty good place to focus on as an employer in today’s high-stress work environment, where the cost of living is skyrocketing, and we’re struggling with creating more sane work models that do not involve ten communications mediums open at any one time…

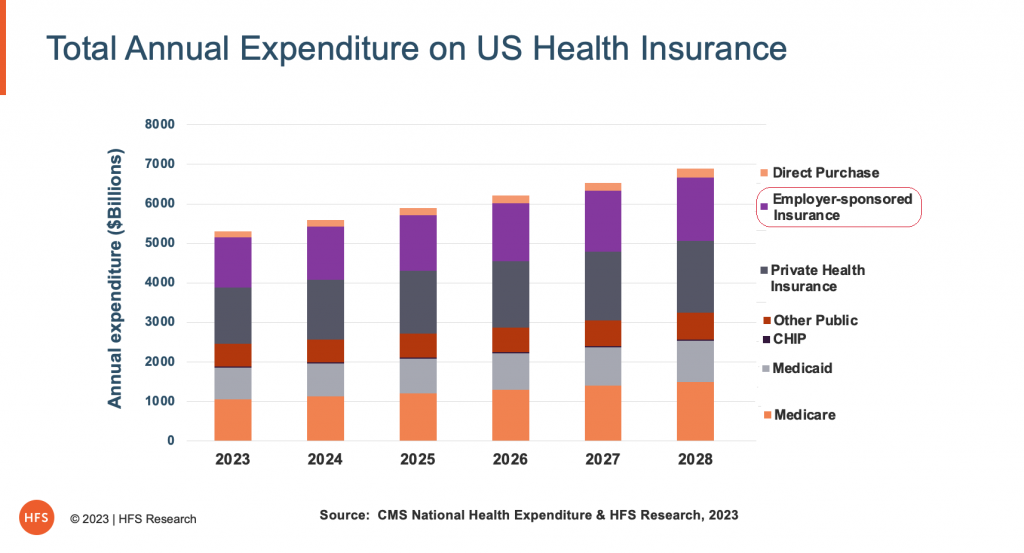

Net-net, few of us realize US health insurance is a $4 trillion dollar annual market this year and is likely to surpass $7 trillion in the next five years. Folks… let’s face it, we’ve been subjected to a mammoth insurance con job for decades, and now we have the opportunity to do something about it:

So let’s hear more from Rohan on how this all works and why we need to take this shift to Employee-sponsored insurance very seriously…

Why the evolution to employer-sponsored healthcare is so prominent

In the US, our healthcare is covered through four primary funding vehicles;

- Medicare, if you are a senior,

- Medicaid, if you are amongst our most vulnerable,

- Group Plans (commercial insurance) if you work for an employer who buys insurance for you or, increasingly,

- Self-insured employers who are underwriting the medical risks of their own employees.

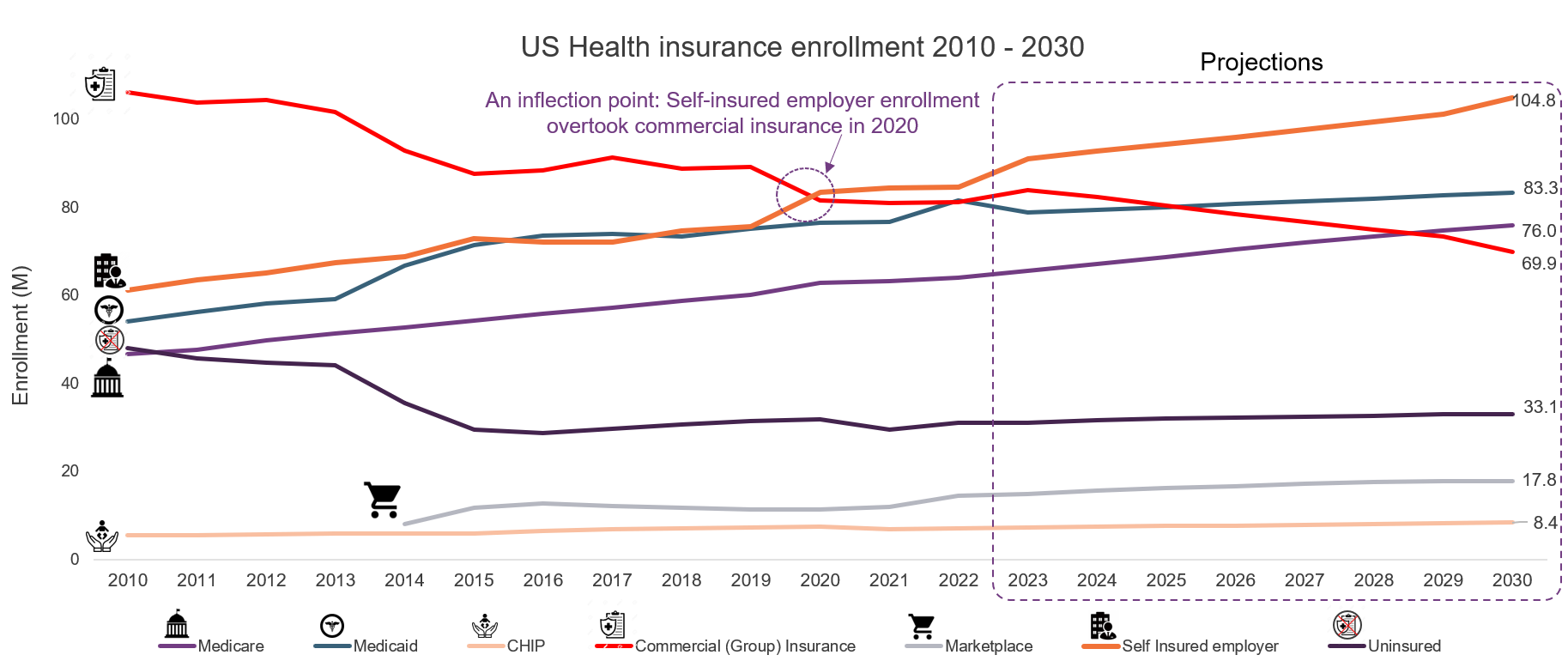

In 2020, enrollment in self-insured employer plans passed group plans, becoming the largest segment of the market (see Exhibit 3) with the potential to alter how we buy, deliver, and consume healthcare.

Exhibit 3: Healthcare coverage configuration has evolved, and it will continue to change materially over the coming decade

Data: CMS, US Dept of Labor, CBO, Kaiser Family Foundation

Source: HFS Research, 2023

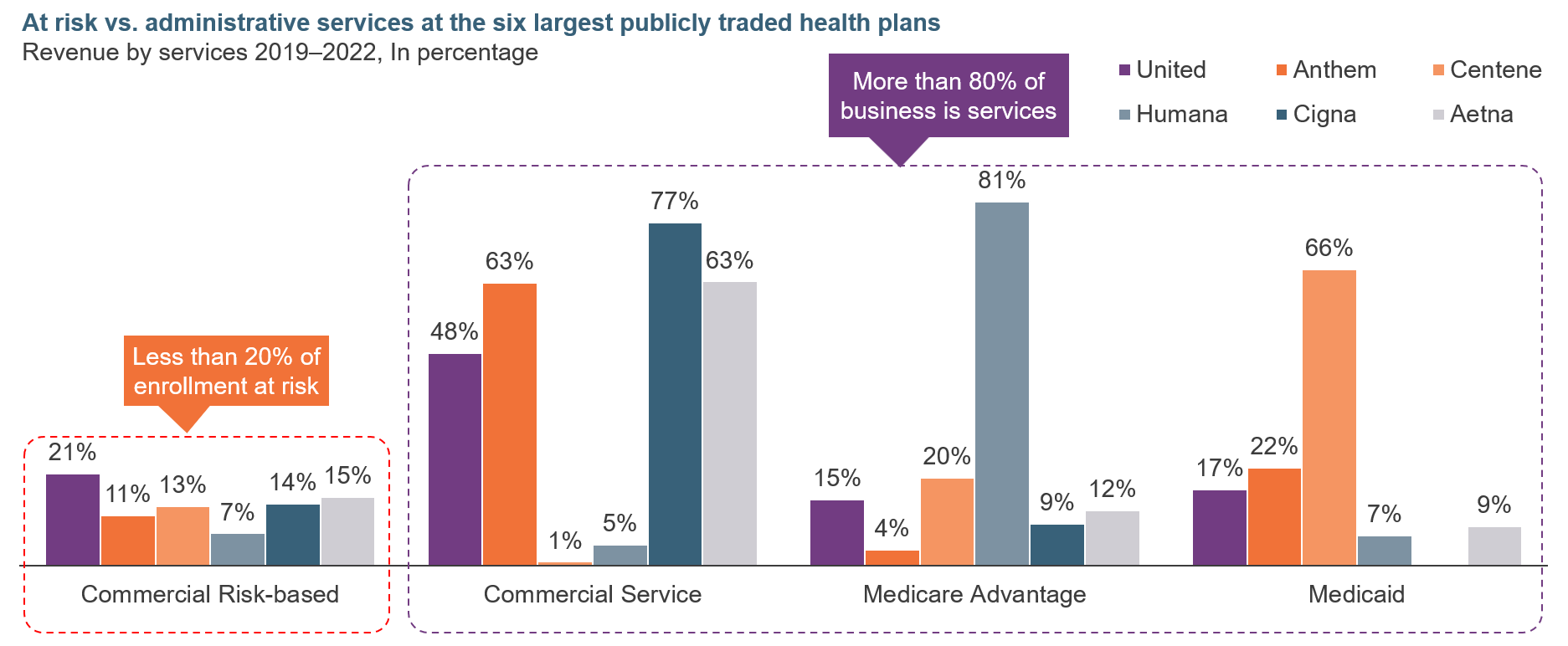

This reconfiguration of the marketplace will have enormous implications over time, some explicit and some subtle. Consider one such large yet subtle change (see Exhibit 4) that can open options for employers seeking non-health insurance partners to address their employee needs. National and large regional legacy health plans are becoming service providers as their risk business declines and their value proposition dilutes. Consequently, self-insured employers must look beyond their legacy relationships to new ones that could provide better health and care delivery models at more predictable and lower costs.

Exhibit 4: Health plans are now essentially a services business competing with service providers.

Data: Company 10K reports

Source: HFS Research, 2023

The shift in healthcare funding can have significant financial benefits for self-insured employers

Self-insured employers continue to buy their services through health plans despite underwriting their employee’s medical risk. The services that are generally acquired include provider network (list of doctors and clinicians), benefits management (administered by benefits administrators), and back office functions (claims processing, compliance management). These legacy administrative services add significant costs with diminishing value across the triple aim of care (cost of care, experience of care, and health outcomes).

Some newer models are beginning to get some traction. They include direct employer-to-provider (health systems and hospitals) contracts for either disease conditions or whole health through some form of capitation, fixed fee constructs by disease condition, and hybrid models that split up primary care and acute care. As employers explore new models to acquire and deliver care to their employees, they will likely see material benefits across multiple financial dimensions.

- Cost savings: A hybrid model that includes digital health-enabled primary care funded through subscription fees and a high deductible health plan can save employers up to 40% of their healthcare costs annually when fully operationalized.

- Increased productivity: A sick employee is an expense for employers through both lost productivity and cost of care. However, a healthy employee equates to adding to the topline revenue by delivering uninterrupted.

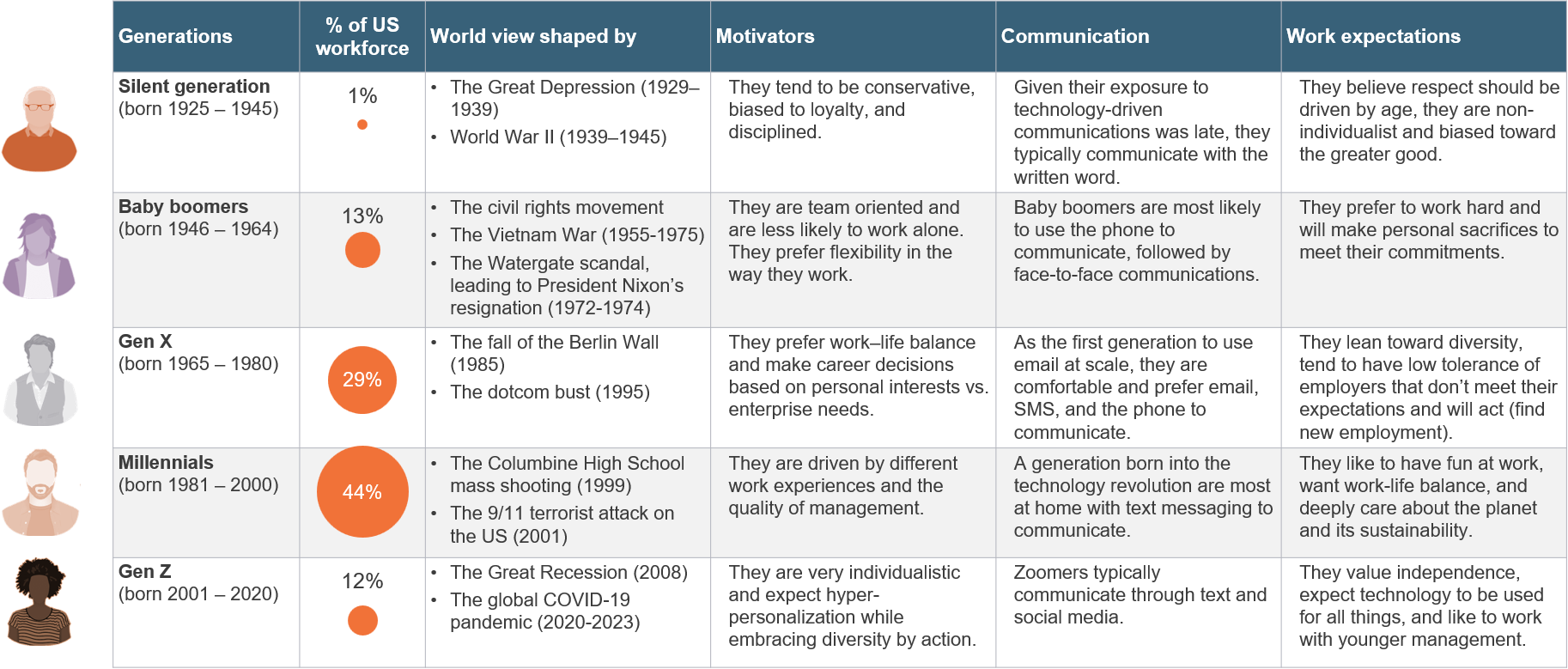

- Strengthening employee experience: There are five generations in our workforce today (see Exhibit 5) with different career aspirations, levels of engagement, and expectations. Legacy healthcare models that are a one-size-fits-all paradigm have been rendered ineffective as measured by health outcomes; Centers for Disease Control and Prevention (CDC) has indicated that 6 in 10 Americans have a chronic condition (Diabetes, Hypertension) and life expectancy has declined to 1996 levels. Employers that can adopt a model that addresses employee needs proactively using social determinants of health, need-based care intervention, and technology to manage disease conditions effectively will likely drive better employee experience, improve retention, and be a choice employer.

Exhibit 5: A multi-generational workforce is diverse, evolving, and has different expectations—a one-size-fits-all approach does not work

Data: US Bureau of Labor Statistics, Purdue Global, Pew Research Center

Source: HFS Research, 2023

While the opportunity to address health and care needs is extraordinary, several challenges need to be addressed

The prospect of revolutionizing healthcare in America without politicizing it and driving better health outcomes at a lower cost is exhilarating. Employers are in a prime position to make that a reality; however, it is not without perils. The challenges of an employer becoming a de facto healthcare provider in addition to delivering value aligned to their core competencies are long and must not be taken lightly.

- Fragmented segment: While self-insured employers are a segment in a macroeconomic sense, the reality is that they are buying individually or through some group purchasing vehicle. So, while the demand is large at an aggregate level, at a tactical level, employers will likely not have enough scale or resources to manage the process.

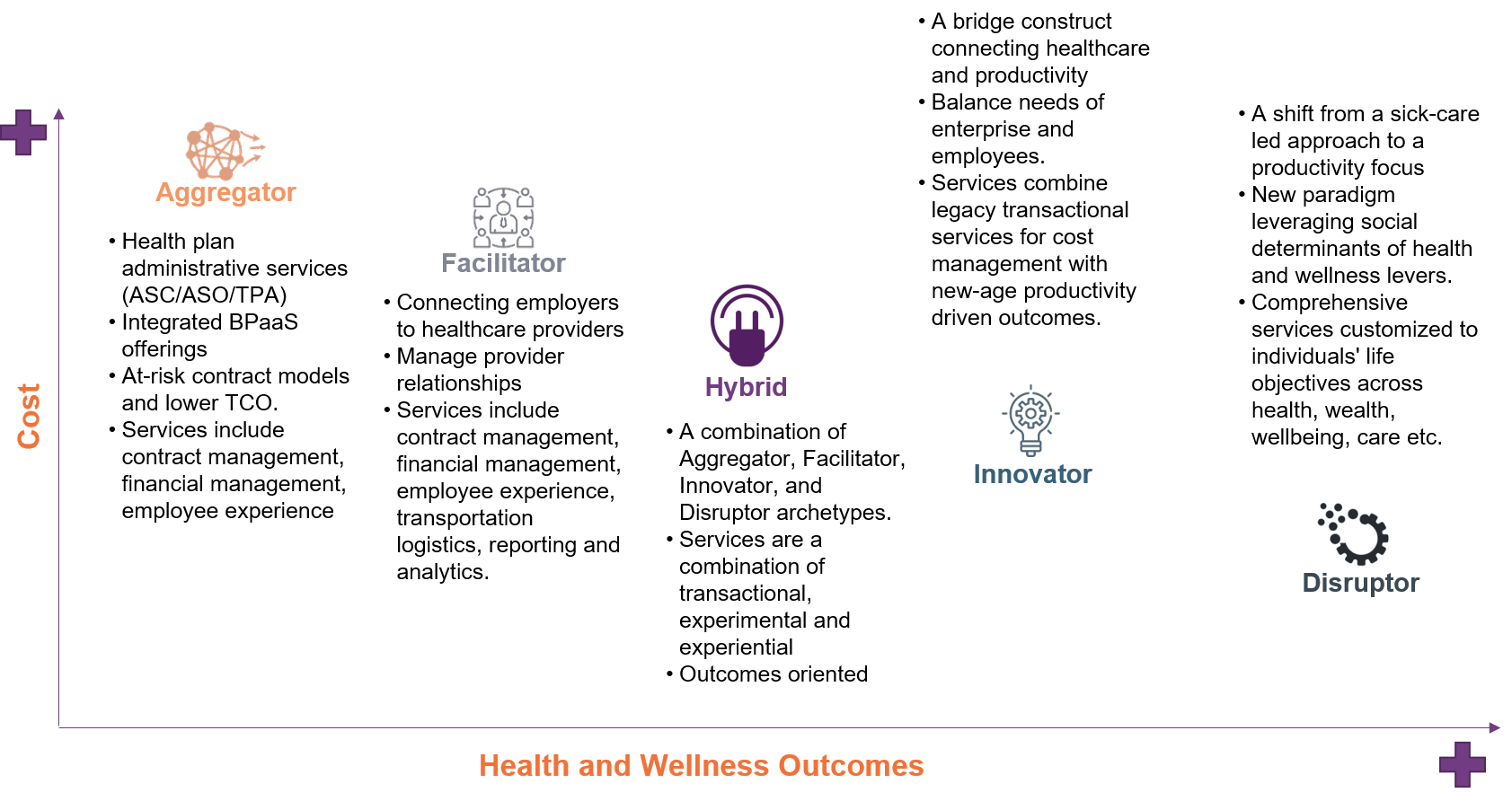

- Don’t know what to buy: Employers accustomed to the legacy methods of sourcing (health plans and benefit administrators), will struggle to design, source, and deliver health and care services on their own. Still, depending upon the type of employer (see Exhibit 6), their options may vary to exploit the opportunities.

Exhibit 6: Self-insured employers can be segmented into 5 archetypes whose opportunity profiles are different and require different solutions and services

Source: HFS Research, 2023

- Limited solutions: HFS Research has estimated the self-insured healthcare services market to be about $600B and growing, yet nontraditional solutions remain muted. A new category of service providers is taking shape (Carrum Health, Transcarent) that will leverage technologies to make some headway while the traditional service providers remain entrenched in the legacy markets. Employers must therefore remain steadfast in their search and not lose focus.

- Another transformation: Employers may think of the solutions in terms of healthcare, but operationalization will be an enormous enterprise transformation effort. It will likely be a multi-year journey from piloting to scaling to driving change management to increase adoption and optimization of the new paradigm. All of which are fraught with risk.

Bottom line: Self-insured employers have a generational opportunity to course-correct on the health and care needs of their employees in an apolitical, sustainable, and materially cost-effective manner.

The legacy ecosystem of health plans, benefit administrators, and healthcare providers is fraying rapidly. Alternative models are showing signs of expanding as employers take baby steps to experiment. We will likely see rapid movement over the next few years as employers lose patience with the legacy models whose value continues to decline, CFOs take a lead role in making benefit decisions, and a new generation of service providers will leverage bold thinking and emerging technologies to make an impact.

Posted in : Business Process Outsourcing (BPO), Buyers' Sourcing Best Practices, Financial Services Sourcing Strategies, Healthcare, Healthcare and Outsourcing