Why the analyst advisor industry is getting obliterated by AI… and how to save it

The analyst and advisor industries, reliant on IP and research to market their products, are in serious trouble, and many firms will cease to exist in a couple of years. What's really worrying is the recent speed of development with AI platforms, agentic software, and LLMs, which is, quite frankly, making the use of analysts and advisors increasingly irrelevant. Read More

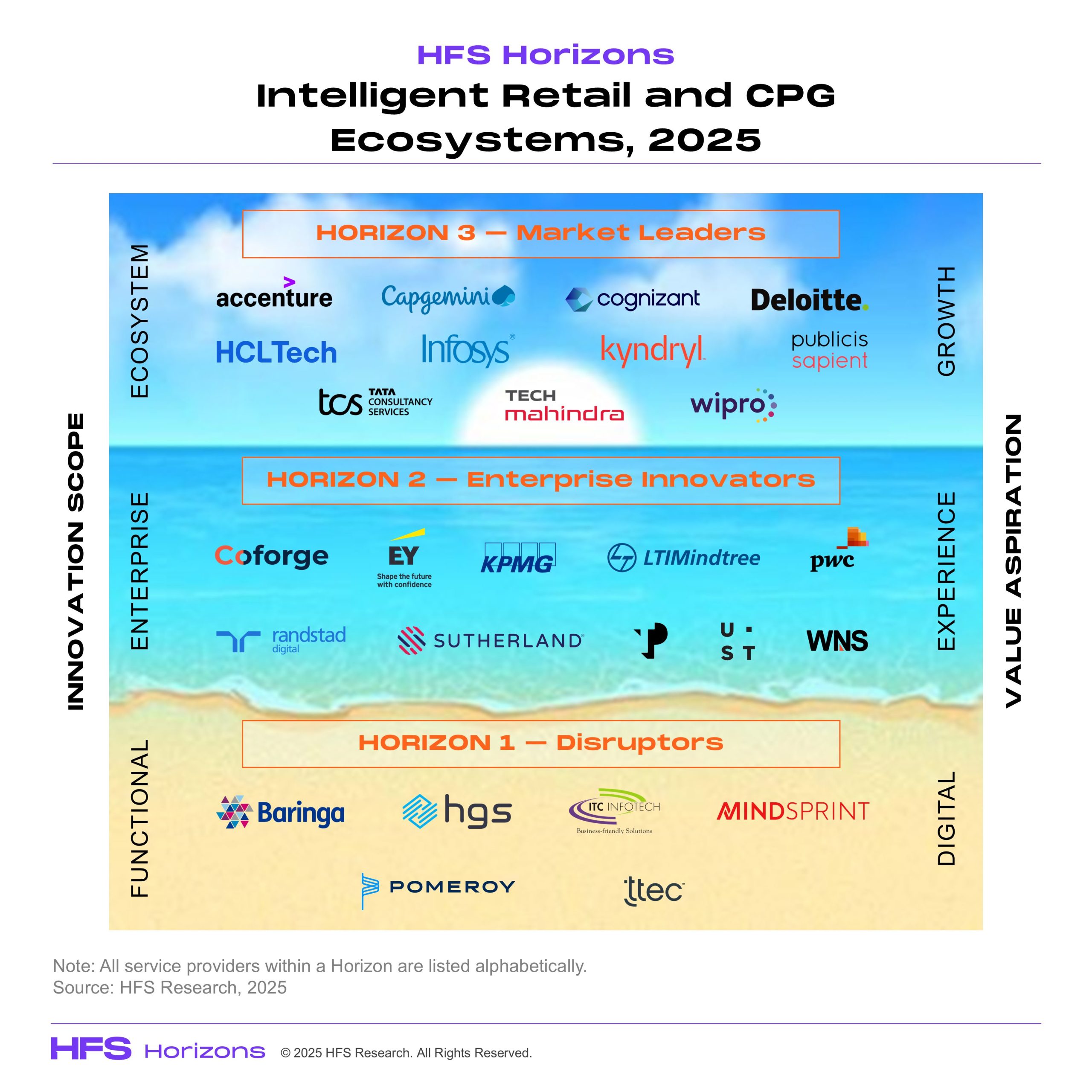

Tech-deprived CPG and retail encroach each other’s territory in search of growth

Prepare for a breakthrough year in the Generative Enterprise—powered by the potential of agentic AI to deliver end-to-end, self-improving, cross-silo processes to achieve business outcomes, the promise of deregulation, and greater access to infrastructure of the Stargate program, and a new wave of LLM innovation exemplified by China’s DeepSeek. Our Generative Enterprise Services Horizons report 2025 identified several trends: how service providers are meeting enterprise needs, effectively training people, what enterprises need more of from their service partners, and what customers and partners have to say about their service experiences. Read More

Can Manish reinvent Accenture to deliver reinvention?

I am personally excited for my good friend Manish Sharma taking on the challenge of bringing together Accenture’s crown jewels of Strategy, Consulting, Song, Technology, and Operations to spearhead its Reinvention Services capability. Today's services playbook is changing radically and all the leading providers have no choice but to practice what they preach and take themselves through painful bottom-up change, where they need to focus on repaying their legacy debts of the last two decades to reinvent their own cultures, break down their silos and create distinct value for their clients. Being a true services-as-software provider necessitates a completely integrated company operating under one mission, one culture, one brand and one united leadership team energized by working together. But if anyone can pull this off, Manish can... Read More

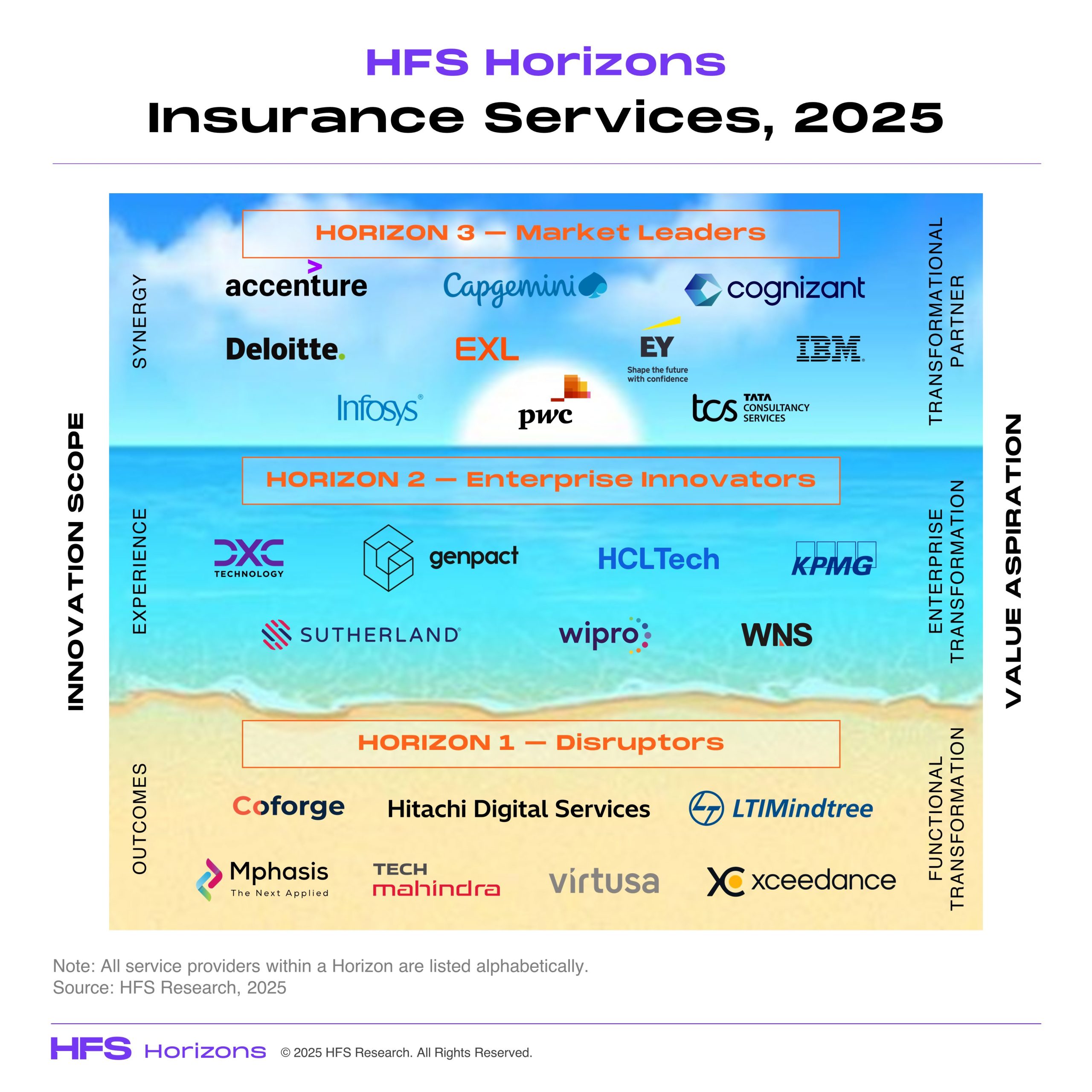

Modernizing insurance was the mandate—now it’s about monetizing what’s next

Prepare for a breakthrough year in the Generative Enterprise—powered by the potential of agentic AI to deliver end-to-end, self-improving, cross-silo processes to achieve business outcomes, the promise of deregulation, and greater access to infrastructure of the Stargate program, and a new wave of LLM innovation exemplified by China’s DeepSeek. Our Generative Enterprise Services Horizons report 2025 identified several trends: how service providers are meeting enterprise needs, effectively training people, what enterprises need more of from their service partners, and what customers and partners have to say about their service experiences. Read More

Stop pontificating about other people losing their jobs to AI and worry about your own job

Here's the cold, hard truth about employment today—we're judged by one ruthless metric: how much you cost versus how much value we deliver. With AI reshaping expectations, the tipping point where our value fails to justify our price tag is frighteningly closer than most of us will admit. Read More

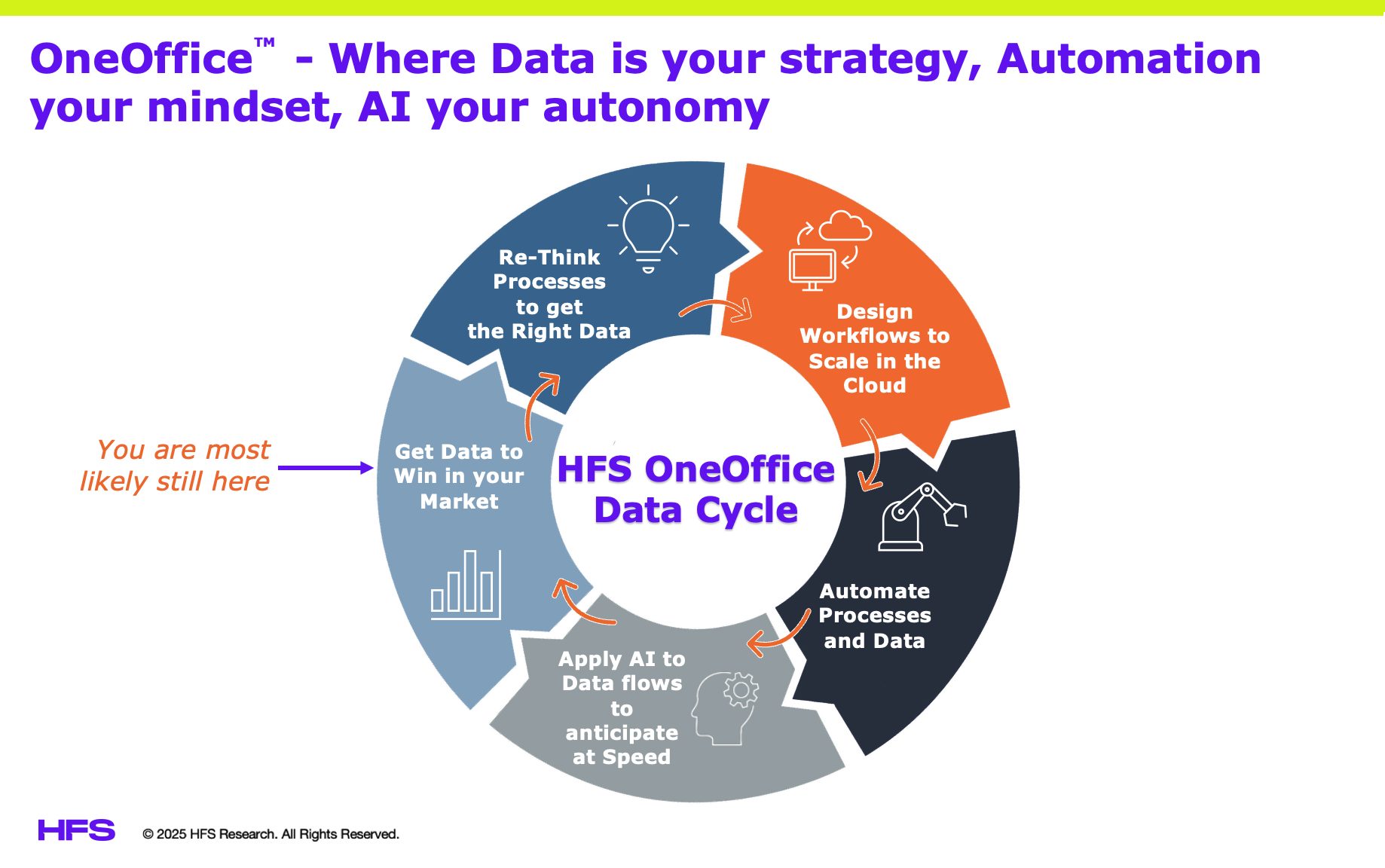

How Generative and Agentic AI are Supercharging the OneOffice Data Cycle

We finally have an injection of rocket fuel from Generative and Agentic AI to create intelligent agents that can sense, decide, and act with autonomy... as long as we have our data strategy right. To be a truly autonomous organization, the principles of OneOffice hold truer than ever: workflows executed in real-time between customers and employees that engage partners right across our business ecosystems. Read More

A geopolitical cyber emergency is escalating—and we’re all deer in the headlights

As global tensions escalate—from Ukraine and Israel to rising flashpoints in South Asia—cyberwarfare has emerged as the new frontline. It targets not just military infrastructure, but also cloud platforms, supply chains, tech ecosystems, social media feeds, and the smartphones of your employees. Today's CIO not only has to manage significant pressures from their boards and leadership peers to deliver an AI agenda, but they also have to balance this with a proactive, holistic cybersecurity approach that business leaders can comprehend. Mess up your cybersecurity, and you’re not only fired, but your entire firm may just sink with you. Read More

AI agents are redefining commerce by eliminating legacy B2B SaaS

Visa and Mastercard just escalated the war for the future of commerce—not with another app, but with autonomous AI agents that buy on your behalf. These aren't lab experiments. Visa’s Intelligent Commerce and Mastercard’s Agent Pay are foundational shifts designed to embed payments into AI platforms that consumers already trust. The implications for enterprise commerce are nothing short of seismic. Read More

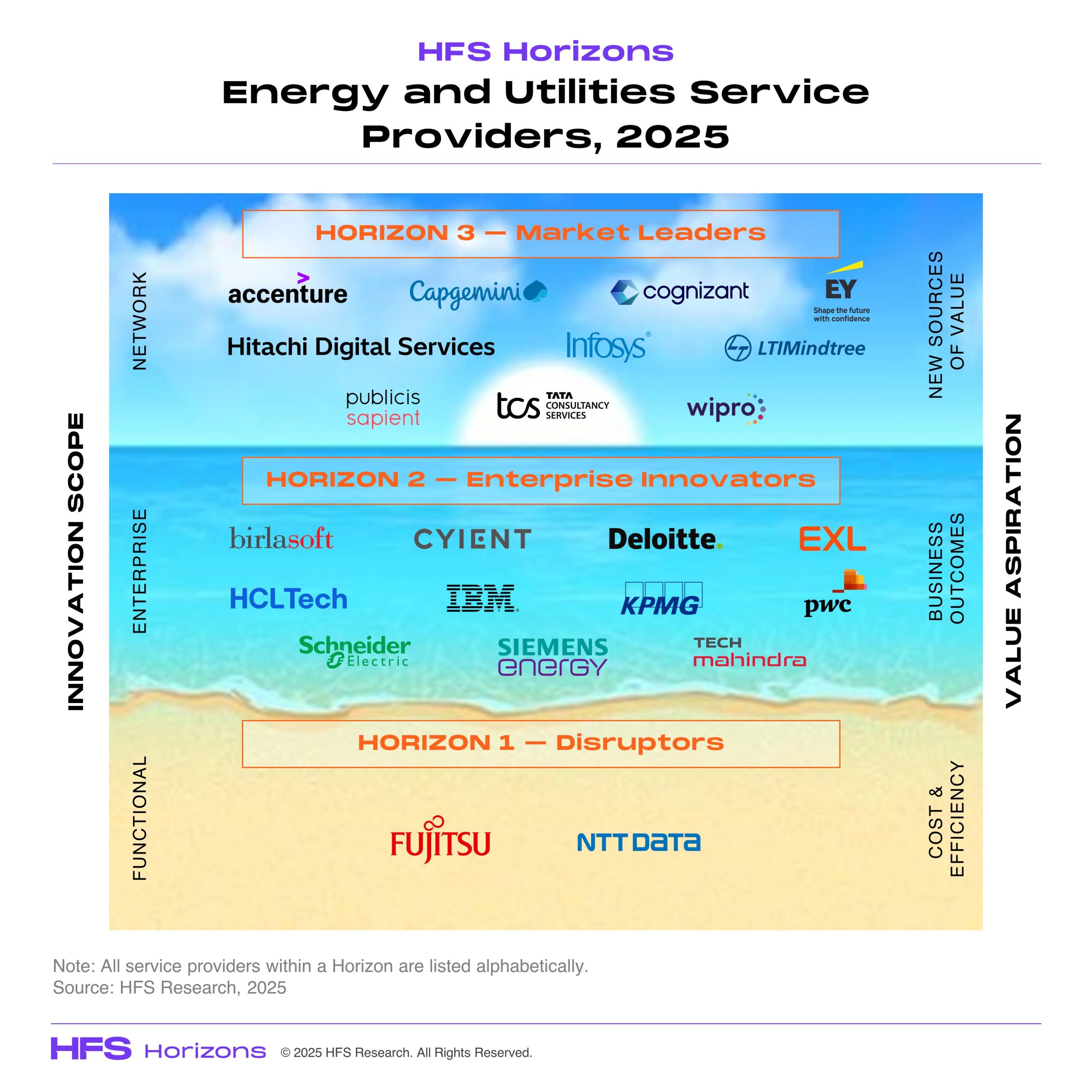

Individuals, teams, and firms can all still lead energy and utilities systems change

Prepare for a breakthrough year in the Generative Enterprise—powered by the potential of agentic AI to deliver end-to-end, self-improving, cross-silo processes to achieve business outcomes, the promise of deregulation, and greater access to infrastructure of the Stargate program, and a new wave of LLM innovation exemplified by China’s DeepSeek. Our Generative Enterprise Services Horizons report 2025 identified several trends: how service providers are meeting enterprise needs, effectively training people, what enterprises need more of from their service partners, and what customers and partners have to say about their service experiences. Read More

Meet Babak, one of agentic’s original inventors

If you’re an enterprise leader staring down ballooning tech debt, rising pressure for AI transformation, and daily new product drops that all scream “innovate now or be left behind,” stop. Take a breath—and read this wide-ranging Q&A between Cognizant CTO Babak Hodjat and HFS Executive Research Leader David Cushman. Read More