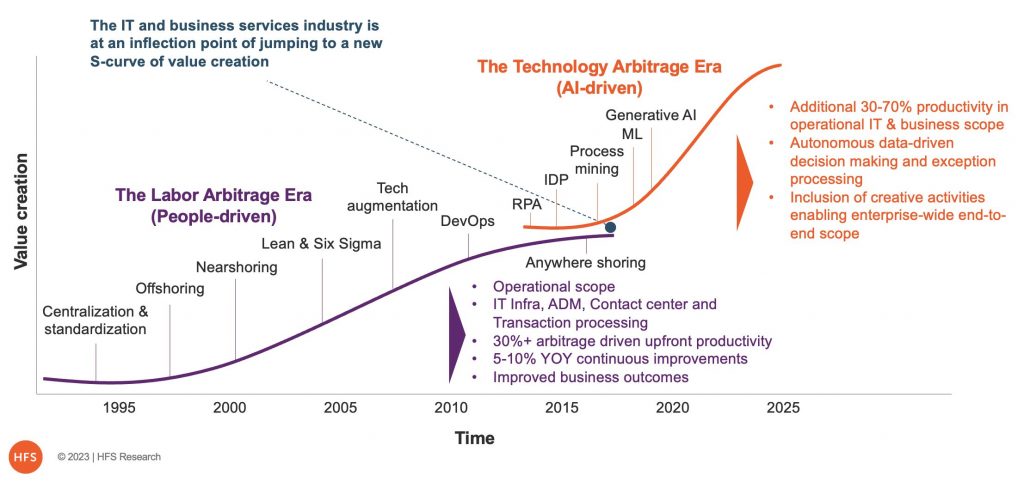

IT and BPO services have been on an incredible run for the last quarter of a century, enjoying the relentless double-digit growth of global delivery models fueled by skilled talent pools in more cost-effective regions of the globe.

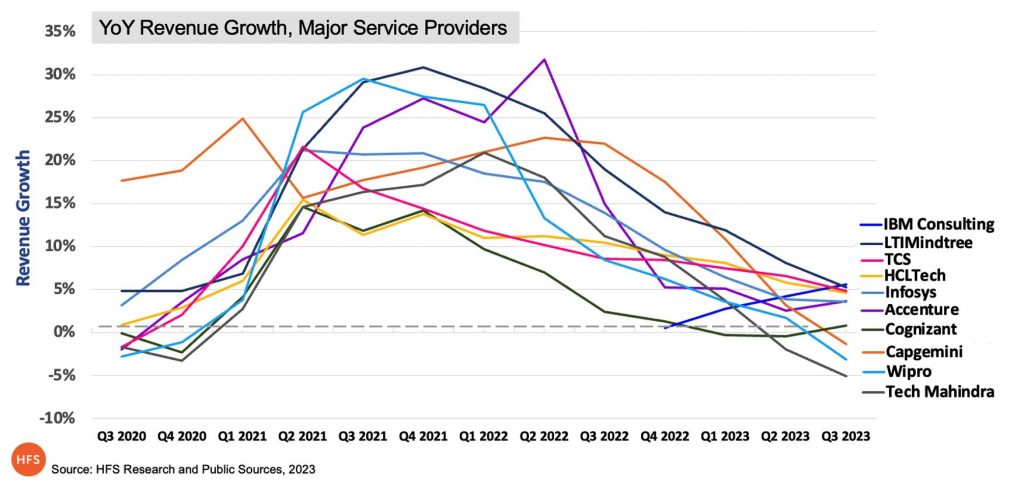

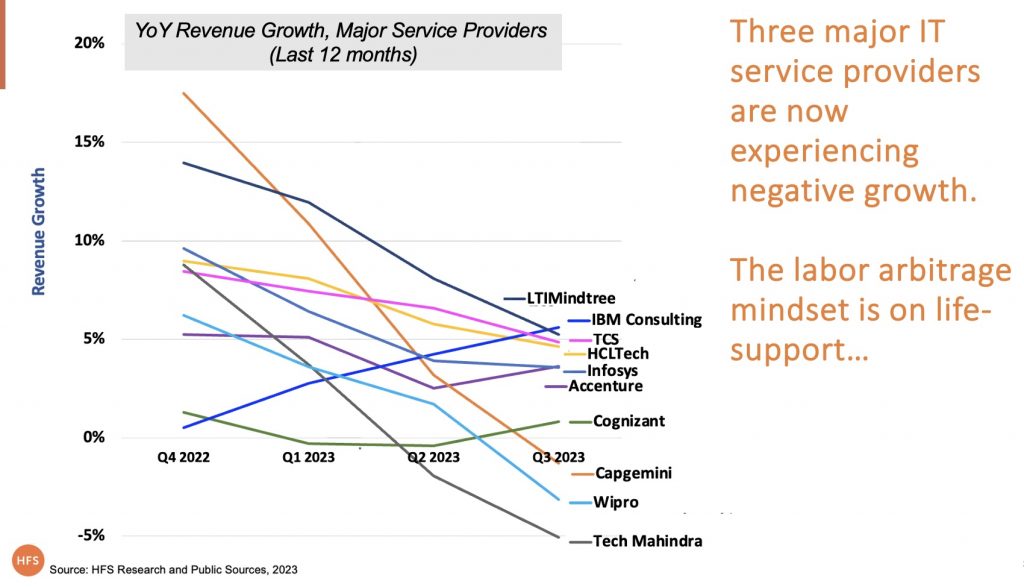

Who’d a thought the Global 2000 would keep finding more and more reasons to keep spending more and more money on global service providers? Yes, they’ve had a lot of fat to keep trimming, but many have finally cut to the bone, and 2023 has seen a nosedive in growth from most of the major service providers:

Exhibit 1. 2023 has proven to be the great Reality Check for IT / BPO Services*

One can argue that the legacy labor arbitrage model was already running out of steam before the Pandemic, but the rush to the Cloud, driven by those pandemic-driven virtual business experiences, kept that spending on labor-intensive cloud migrations artificially high until everything came crashing down to earth this year:

Exhibit 2. The pandemic fueled the dying embers of Labor Arbitrage, but growth is flattening out

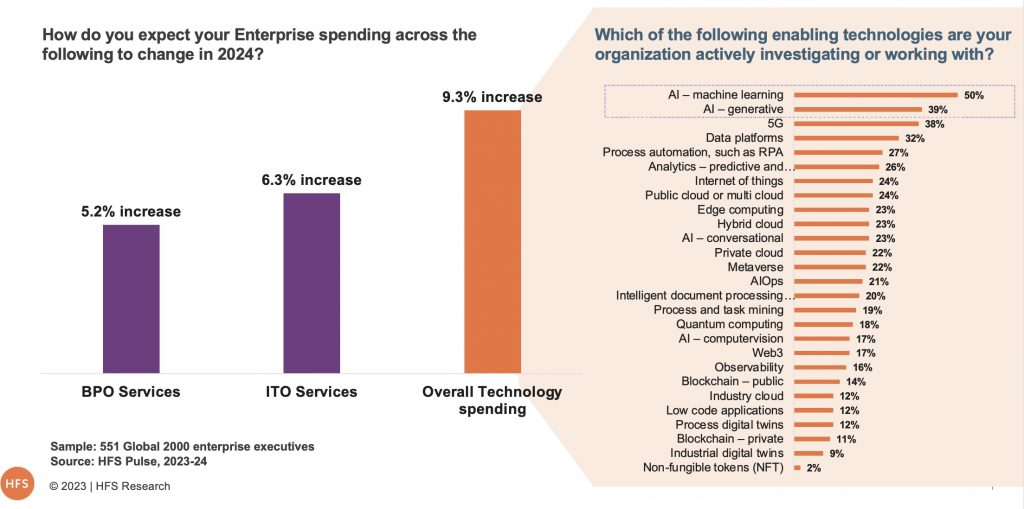

Our latest HFS Pulse data based on ongoing inputs from 600 of the global 2000 enterprises also suggests that labor-driven IT/BPO services growth is expected to be ~5% in 2024, and AI-driven technology spending is expected to increase at ~9% (See Exhibit 3):

Exhibit 3. Labor-driven IT/BPO services growth is expected to be 5%, but AI-driven technology spending is expected to increase at 10%

The industry has matured where most large enterprises (above $5B in annual revenues) have pulled the basic levers of offshoring either through in-house shared services and /or 3rd party service providers. And after playing for 3-5 years in the model, while there are incremental improvements that they can achieve, the transformational benefits start to diminish.

The reality is that costs are like hedges: they grow back after trimming, and the pruning shears are becoming blunt

Enterprises are running out of obvious places where onshore people can be replaced with offshore people, and they have no choice but to investigate new avenues of value that are less obvious. And those avenues are only to be found by exploiting technologies that can scale operations, provide rapid access to data that gives you a competitive edge, and grant you access to ecosystems to expand business opportunities. New technologies that enable you to run things faster, better, slicker, smarter, and cheaper than ever…

It’s past time for the IT and BPO Services industry to jump to a new S-curve driven by technology arbitrage if they wish to get back to another season of hockey stick growth:

Exhibit 4. The new S-curve of Value Creation will be AI-driven Technology Arbitrage

Technology Arbitrage = Ecosystem Orchestration

The “scale of technology partnerships” becomes far more important in the technology arbitrage era versus “the scale of people” in the labor arbitrage era.

The fundamental value creation lever in the legacy Labor Arbitrage era has been the centralization of people in a global delivery model. The fundamental value lever in the Technology Arbitrage era is all about architecting and orchestrating the rapidly changing technology ecosystem in line with the client’s business model.

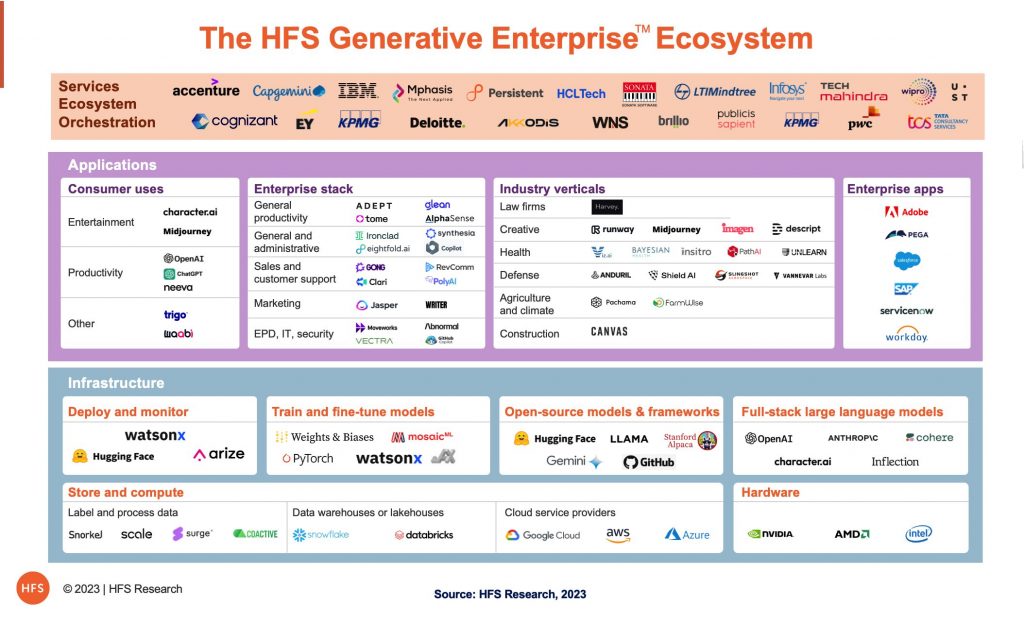

Let’s take the example of the rapidly emerging GenAI ecosystem (see exhibit 5) that an enterprise must build, manage, and keep updated on an ongoing basis as new players emerge, continually enhancing technology capabilities. This becomes too complicated and too costly very quickly, and consequently, the ROI becomes murkier.

Service providers have a significant value proposition to orchestrate this ecosystem to drive real business value for their core customers. Enterprises can’t exploit GenAI alone and need smart partners, which can really help them get ahead of the innovation curve. With GenAI, for example, there are real business pressures from the C-Suite to design AI capabilities that create genuine differentiation in the marketplace. Smart services firms that can engage at the senior level to bring their GenAI ecosystem to life will win in the emerging market, but they need to convince enterprise leaders to take a bet on partnering with them.

Exhibit 5: The technology ecosystem becomes too complicated very quickly (GenAI Ecosystem example)

With the advent of GenAI, this brand-new ecosystem is creating itself right in front of our eyes with new stakeholders that most enterprises will find difficult to engage and build relationships with. Ecosystem orchestration is a fundamental shift in the role that service providers can play in driving value for their clients.

The Technology Arbitrage era is not only about doing more with less but also generating actionable business value

At HFS, we are wrapping up a research initiative where we reached out to 100+ enterprise leaders who are actually doing something credible with Generative AI and interviewing the executives actually leading the GenAI initiatives. Contrary to the popular media narrative, improving productivity is not the #1 use case for GenAI (see Exhibit 6); AI’s predictive capabilities and ability to personalize at scale are tickling the fancy of business leaders:

- Predicting with Precision. The ‘Prediction’ theme emerges as the most popular and brings to the forefront use cases that deploy AI to anticipate, forecast, and devise estimations, playing a crucial role in strategic planning and decision-making.

- The Age of ‘Me’. Personalization also dominates. Forget one-size-fits-all; we’re in the era of AI-driven, tailor-made experiences. The eminent theme of ‘Personalization’ has emerged as a dominant application area, underlined by use cases that harness AI to tailor experiences, content, and solutions.

- Value isn’t all about Productivity. Productivity improvements must be augmented by Prediction and Personalization in the Technology Arbitrage era if they are going to drive real impact for enterprises. The legacy mindset of simply driving out cost as the core imperative has to change to a value mindset.

Exhibit 6: Prediction, Personalization, and Productivity: The 3Ps powering GenAI use cases for enterprises

Winners in the emerging Technology Arbitrage era will require strong business acumen.

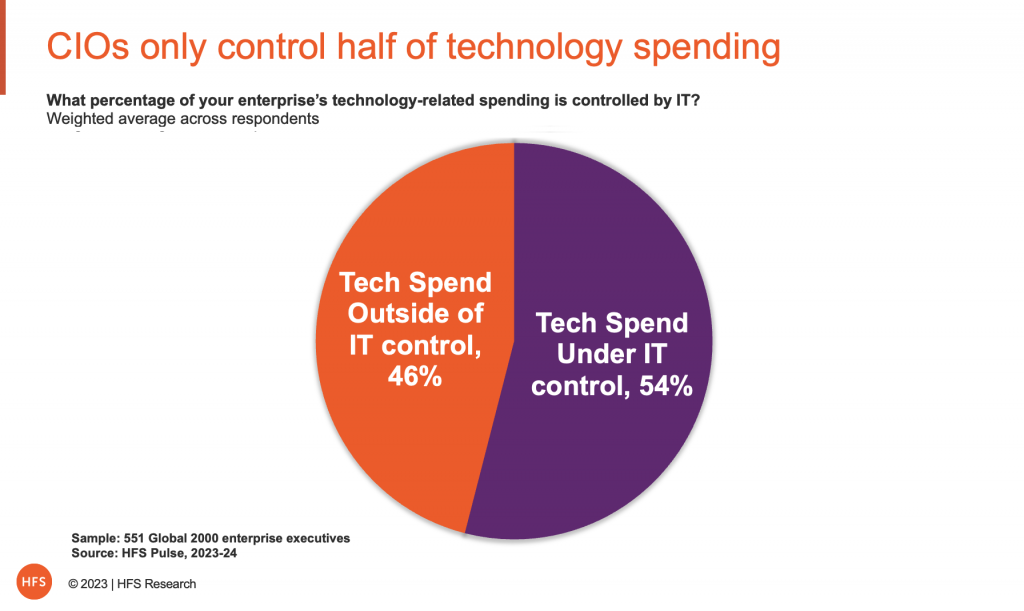

Nearly half of the new technology spending will be outside the CIO/CTO control – it’s with the business (See Exhibit 7). Past surveys before the Pandemic typically showed 70-80% of tech spending under CIO control, but the balance of tech power within major enterprises is clearly shifting.

However, our IT services industry keeps selling to the CIO/CTO. As traditional IT services growth flatlines, the IT service providers must develop a business narrative behind their technology services. For instance, every CPG company wants to go direct-to-consumer today – that is the challenge the business wants to solve. Now it’s obvious that the CPG companies will need to redesign entire business processes and integrate their data repositories in the cloud to make that intrinsic change in the business model. However, most of the current crop of IT service providers do not offer a solution to help them change their business model; they only propose how quickly and efficiently they can migrate workloads from legacy to cloud. This business acumen is exactly where Accenture outshines most other service providers, as it can redesign businesses to be effective in cloud ecosystems and manage them for its clients at scale:

Exhibit 7: CIO/CTO controls only half the technology spend

BPO service providers work with business stakeholders, so they should have more success in tapping into this tech spending. Right? WRONG! The BPO narrative has not changed for decades. Most enterprises leverage BPO for processing transactional, mundane, and frankly boring work. The tired old BPO value proposition is stuck with the labor model.

The first question when anyone discusses BPO is, “How many people?” The BPO model is so obsessed with FTEs that we’ve even converted automation initiatives to “number of digital FTEs.” Both clients and service providers just cannot get beyond this FTE model.

The Big 4 accounting firms (Deloitte, EY, KPMG, and PwC) have realized that they can give the BPO providers a run for their money with managed services offerings. They have C-level business connections in spades, but can they get out of their own way to be successful? EY’s failed Project Everest is a great reminder of how difficult it will be for the Big 4 to make fundamental GTM changes in their partner-led model.

The Bottomline: We need less “easy” and more “hard”. Bold enterprise leaders must stand up and create a new market paradigm. Service providers alone can’t do it.

“Labor arbitrage” in the 1990s was as novel an idea as “technology arbitrage” is today. Back then, it took British Petroleum to make a big bet by outsourcing its finance & accounting jobs on a large scale for the first time. Others then saw how transformational it was, and it created a whole new industry. We need a few bold enterprises to also take a risk with technology arbitrage. Unfortunately, we see most enterprises taking a very risk-averse approach to 3rd party services and persisting with the same old ways of operating.

We fear that this blog will die its own death of time as a potentially great idea that never took shape without any pioneering enterprise leaders who were willing to take a risk and take our industry to a new S-curve of value creation.

To conclude, the blame isn’t solely on the service providers for pushing the same old tired model. It’s also with the buyers of services who are too afraid to make complex changes to take full advantage of Cloud, AI, and automation technologies. Enterprises like easy – they really don’t like hard – but if they were to partner with ambitious service providers to share the risk, they would end up sharing significant rewards. As BP did with Andersen Consulting and PwC in the 90s to create the labor arbitrage model at scale, we need to see a similar risk being taken today by our major enterprises and their service provider partners if we are truly going to prosper in the Technology Arbitrage era.

*The service provider results reported above are taken from the earnings releases, where some are in constant and others in current currencies. For this article, we merely want to show the general trend in the industry, not zone in on individual performances

Posted in : Artificial Intelligence, Automation, Business Process Outsourcing (BPO), Buyers' Sourcing Best Practices, Cloud Computing, Design Thinking, Digital OneOffice, Digital Transformation, Financial Services Sourcing Strategies, GenAI, Generative Enterprise, Global Business Services, Industry Cloud, IT Outsourcing / IT Services, OneEcosystem, Robotic Process Automation, Sourcing Best Practises, Sourcing Change Management