Month: October 2021

IBM rebrands its GBS division to emphasize what it actually does: Consulting

Almost two decades after its landmark acquisition of PwC Consulting, IBM Global Business Services (GBS) is now IBM Consulting. What may seem like semantics in the short term should bear fruit in the long.Read More

Corporations and individuals must combine forces on this last mile to defeat COVID-19… let us protect each other to return to the lives we cherish

We must balance vaccine mandates: If those who are providing services are vaccinated, then those receiving those services must also be vaccinatedRead More

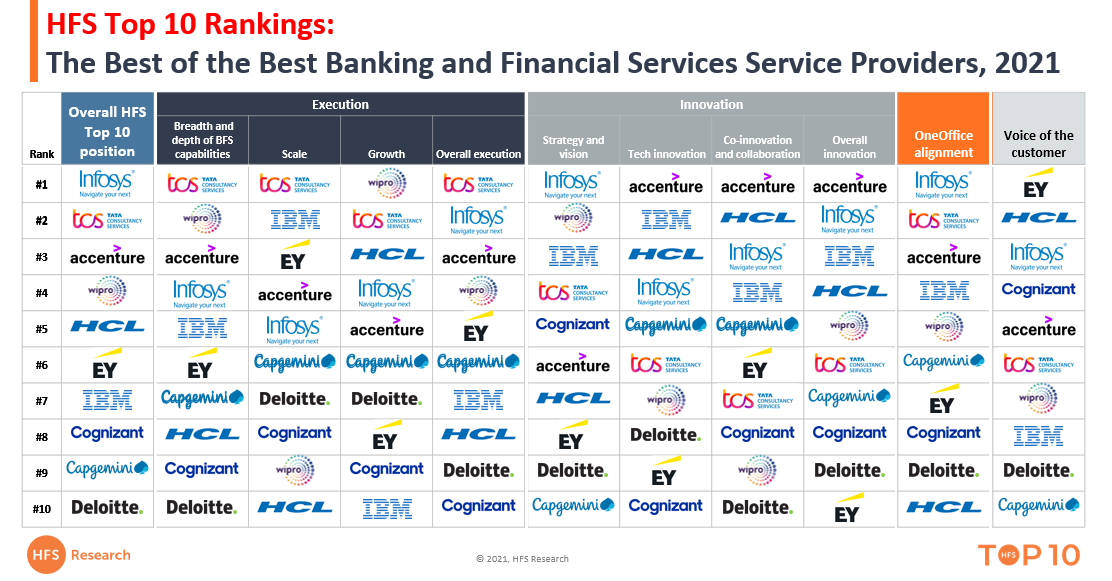

Infosys, TCS, Accenture, Wipro, and HCL helped BFS firms go from digital façade to OneOffice during the pandemic

HFS BFS practice lead, Elena Christopher, weighs in to share the results of our 2021 Banking and Financial Services research on the leading service providers specialized in support BFS clients.Read More

ServiceNow and Celonis just threw down the Workflow Platform gauntlet. The darlings of IT and process workflow execution make their joint move…

The new Celonis – ServiceNow partnership blends operationalizing data science with the capability to design workflows in the cloud. Read More

Pounding though a Pandemic… LTI and Mphasis show why enteprise customers want the personal touch

LTI and Mphasis entered the pandmic on a long growth curve, quickly readjusted and carried on regardless...Read More