Category: Healthcare and Outsourcing

The decline of commercial payers is an opportunity to address new markets

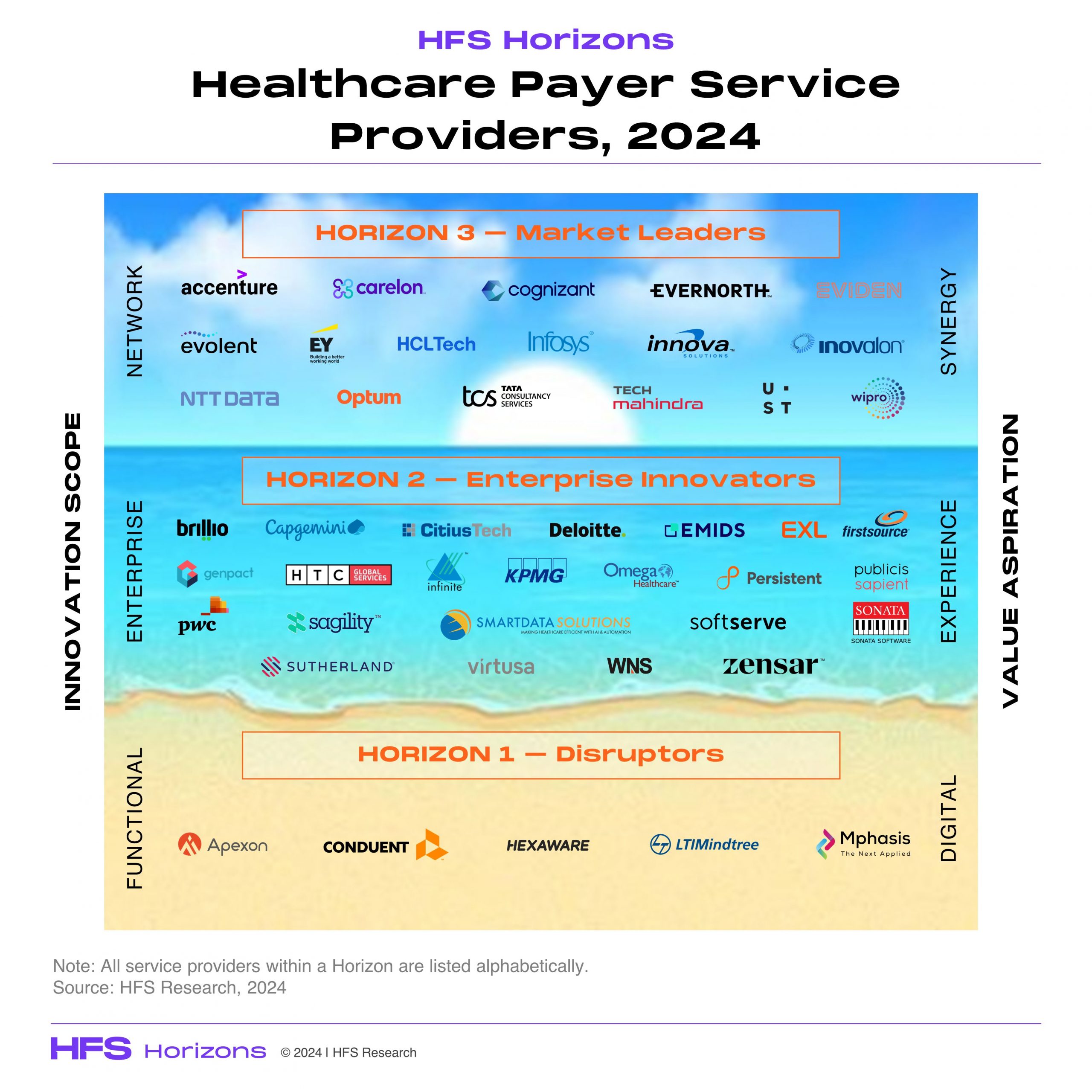

The HFS Horizon: Healthcare payer service providers 2024 study evaluated 45 service providers for their ability to address the cost and experience of care, and health outcomes for health consumers globally. This study reflects inputs from more than 300 healthcare enterprises, over 80 enterprise references, and approximately 80 supplier partners. Read More

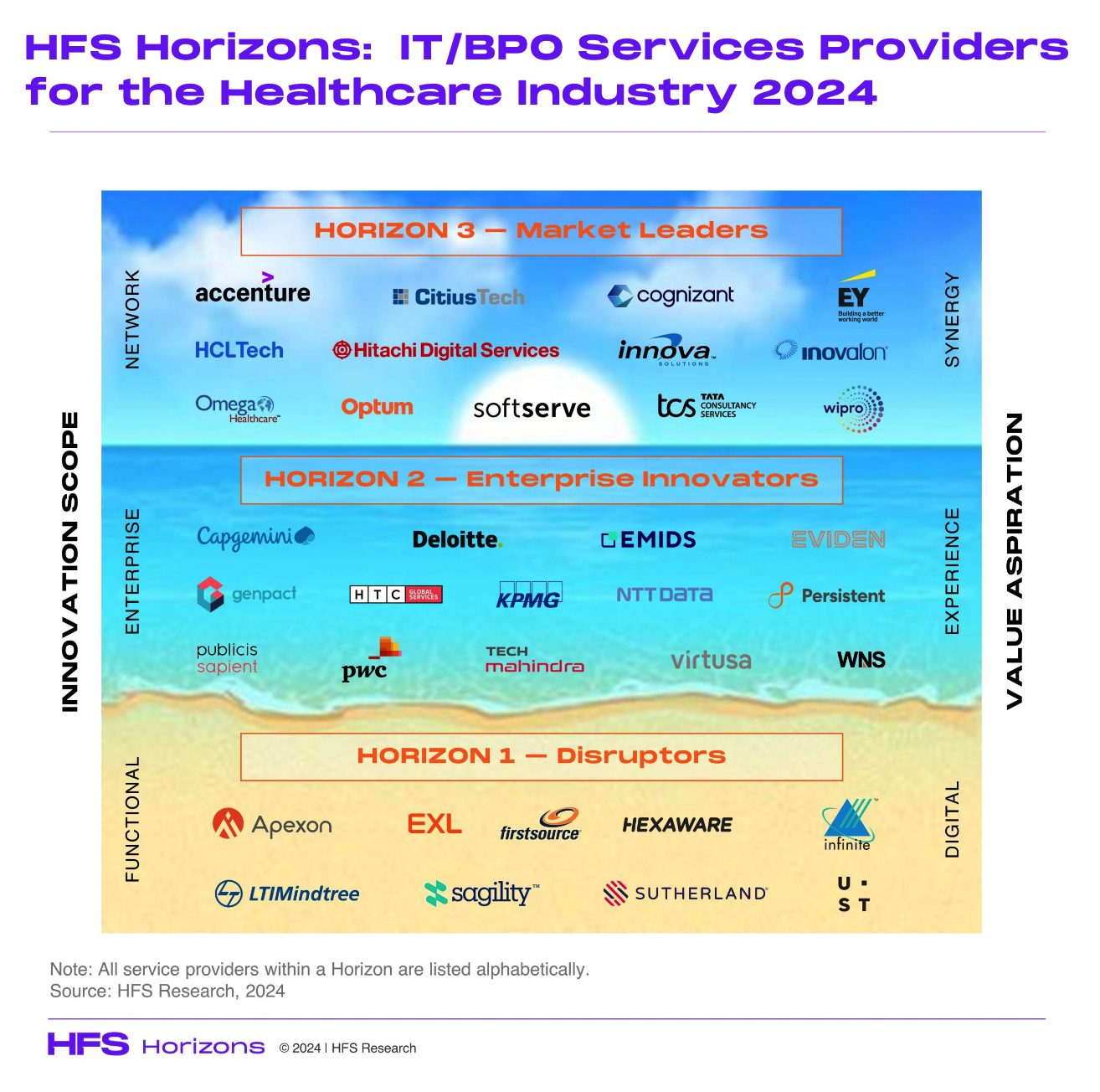

Health systems have unprecedented options to address all that ails their business

In the HFS Horizons: Healthcare Providers (HCP) Service Providers, 2024 study, we evaluated 36 service providers for their ability to address the cost (Horizon 1), experience (Horizon 2), and health outcomes (Horizon 3) for health consumers globally.Read More

Be pragmatic, excited, and responsible: how to get GenAI done

Sandeep Dadlani, Executive VP and Chief Digital and Technology Officer at UnitedHealth Group (UHG), the world’s largest healthcare enterprise with diversified businesses, has a long and deep technology experience across multiple industries on both the supply and demand side. His early days at UHG coincided with the explosion of GenAI on the global stage and has been shaping some of the thinking and doing for him.In speaking with Sandeep, it is clear about the methodical and structured approach he is driving at UHG could define how healthcare leverages the latest technology miracle.Read More

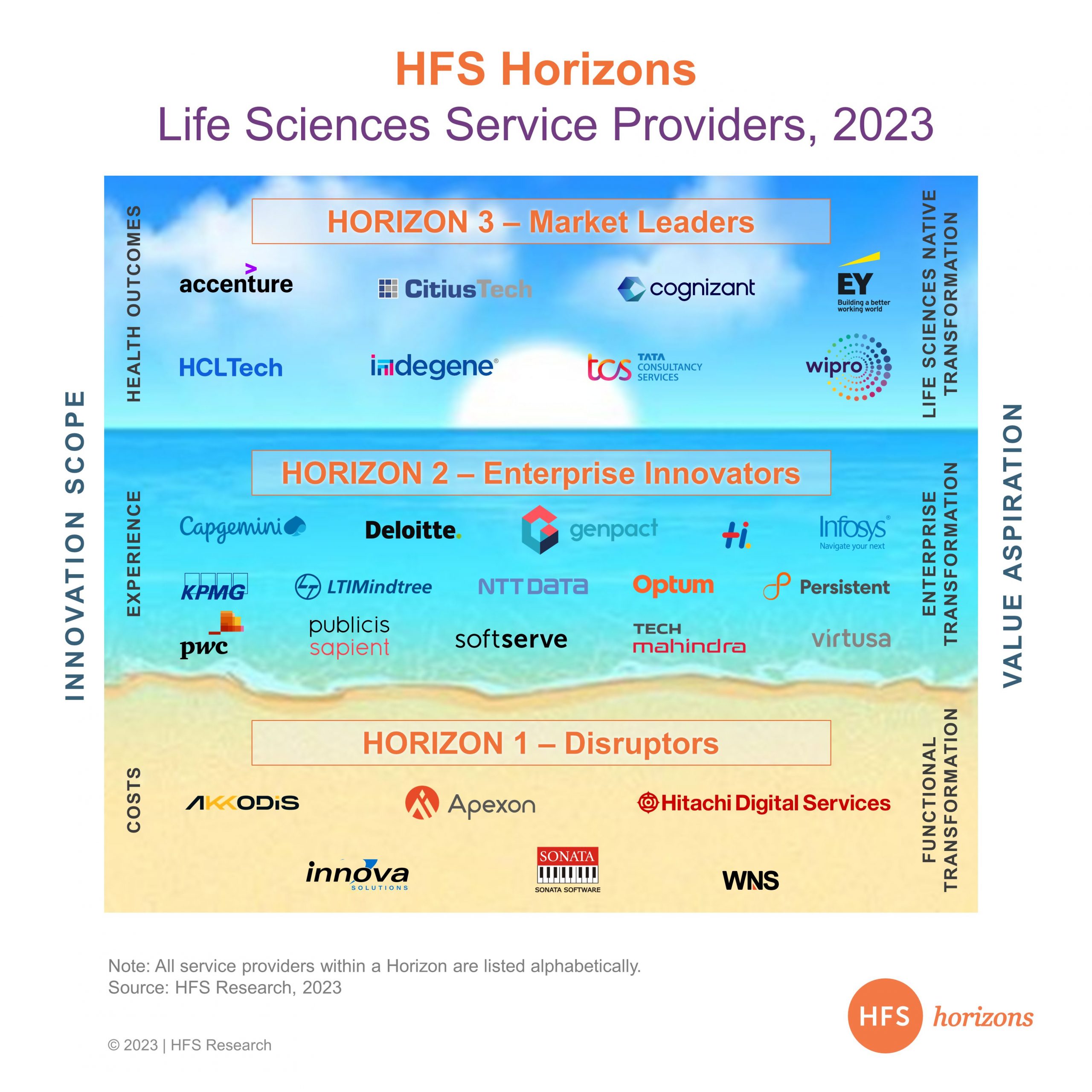

Pharmas’ desire to accelerate results is being matched by supplier sophistication…mostly

In the HFS Horizons: Life Sciences Service Providers, 2023 study, we evaluated 29 service providers for their ability to address the cost (Horizon 1), experience (Horizon 2), and health outcomes (Horizon 3) for health consumers globally. Read More

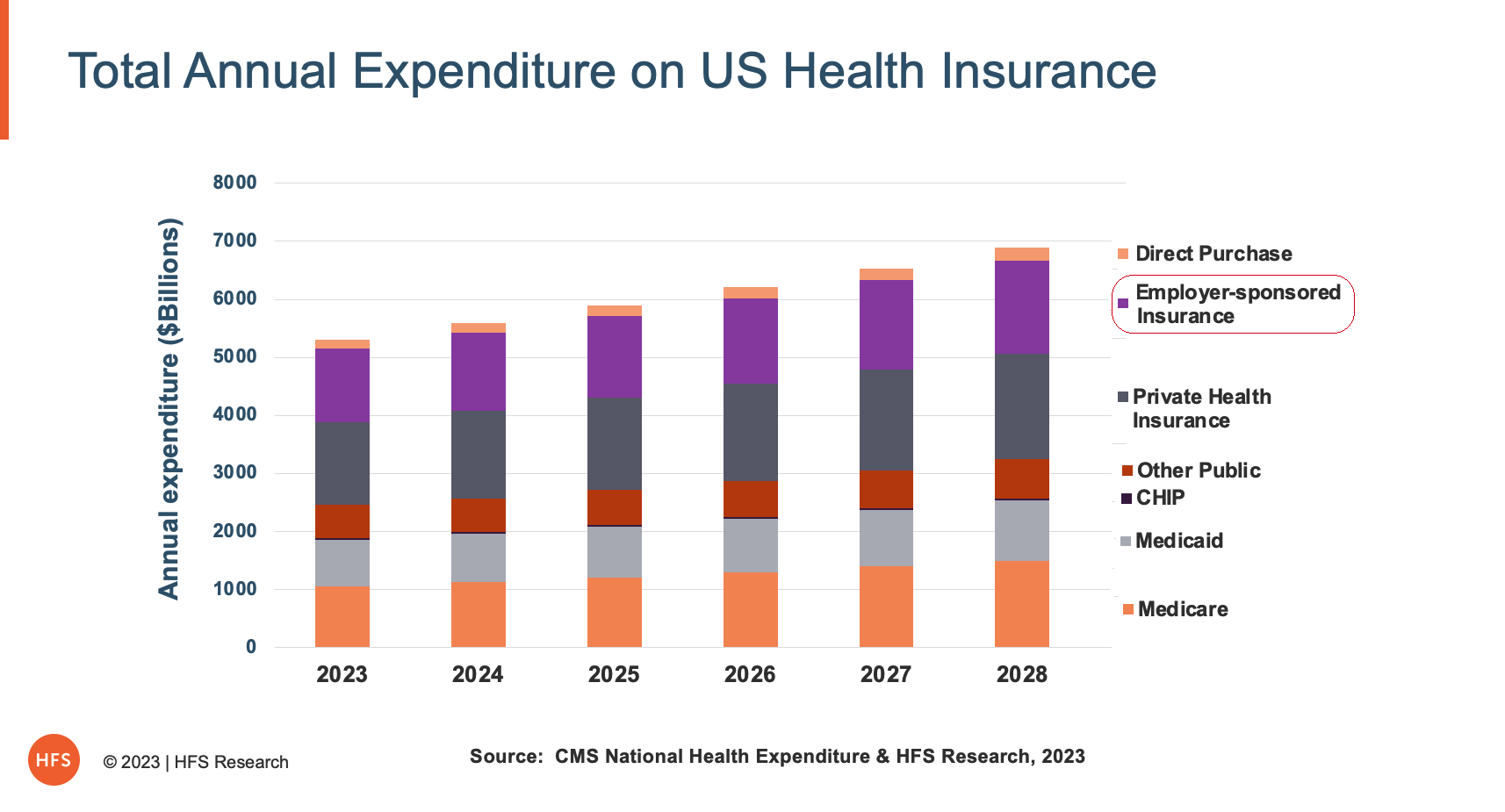

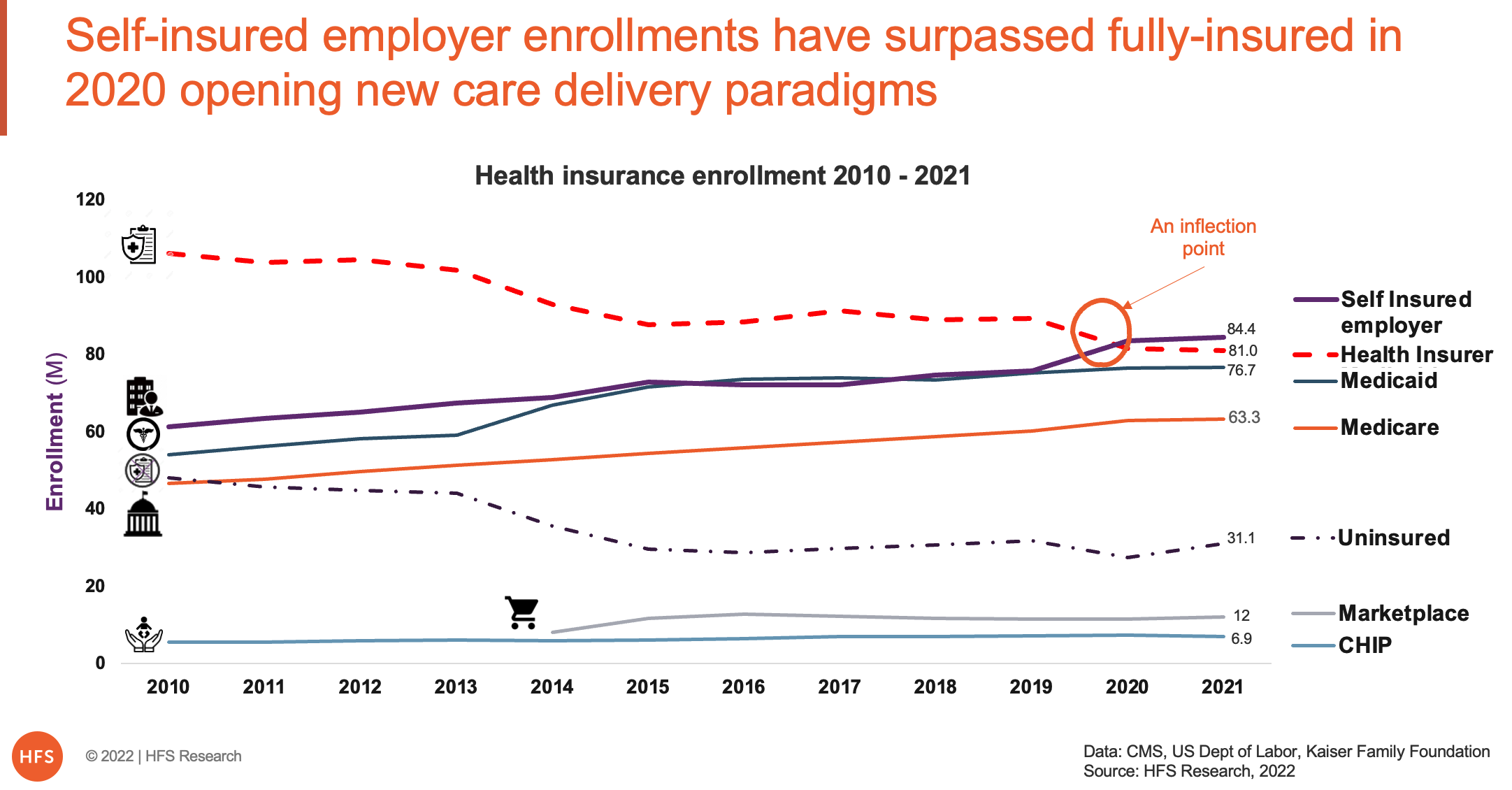

Employers can save $350 Billion a year if they shift to a self-insured healthcare model

Self-insured employers have a generational opportunity to course-correct on the health and care needs of their employees in an apolitical, sustainable, and materially cost-effective mannerRead More

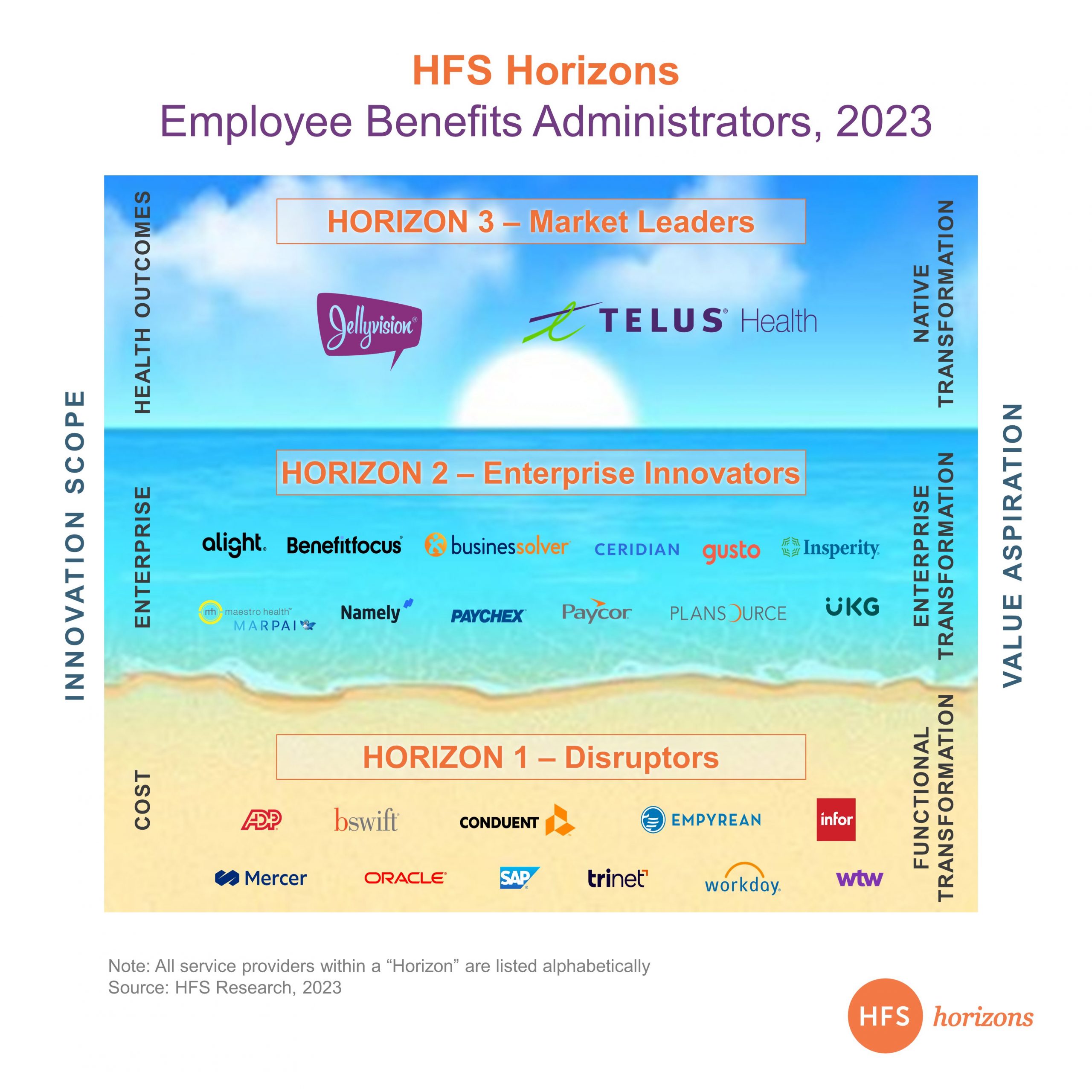

Most benefits administrators are missing the opportunity to address a multi-generational workforce

The aspirations of a post-pandemic multi-generational workforce continue to evolve, and the proliferation of technology is accelerating—yet benefits administration appears stuck in a legacy paradigm. Employers and benefits administrators are guilty of not sufficiently investing in understanding their employees’ evolving needs and not reimagining how they address their health, wealth, and professional needs beyond traditional solutions.We evaluated the 25 benefits administrators for their ability to address the cost (Horizon 1), experience (Horizon 2), and health outcomes (Horizon 3) for employees globally - the first of a kind study ever conducted for the employee benefits services industry.Read More

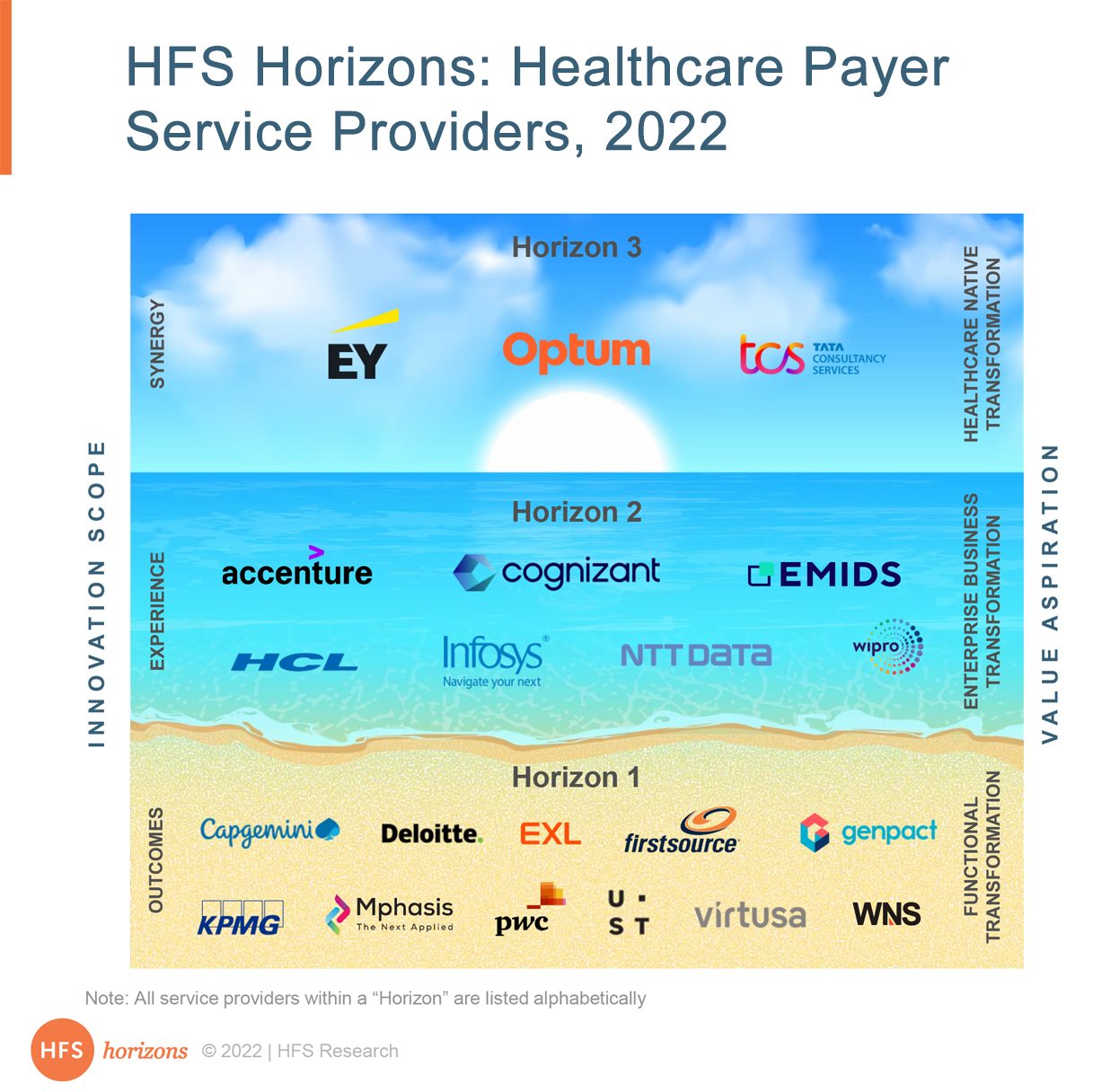

New HFS Horizons Report! Healthcare Payer Service Providers are all about the right fit

In October 2022, HFS said goodbye to the Top 10s and welcomed HFS Horizons, a forward-looking construct to evaluate service providers. Our first industry focused horizon report is the healthcare payer service provider report that was published in November 2022. This report helps healthcare enterprise buyers make high-confidence buying and partnering decisions in the context of the specific challenges they are attempting to address. Read More

A $600+ billion new services market going begging for attention

The growth of enrollment in self-insured employer plans holds the tremendous promise of systemic change in US healthcare without the drama of national politics. It opens new opportunities for service providers, technology enablers, and consumers. It will unleash new business models, better health outcomes, and potentially address the runaway train of healthcare costs.Read More

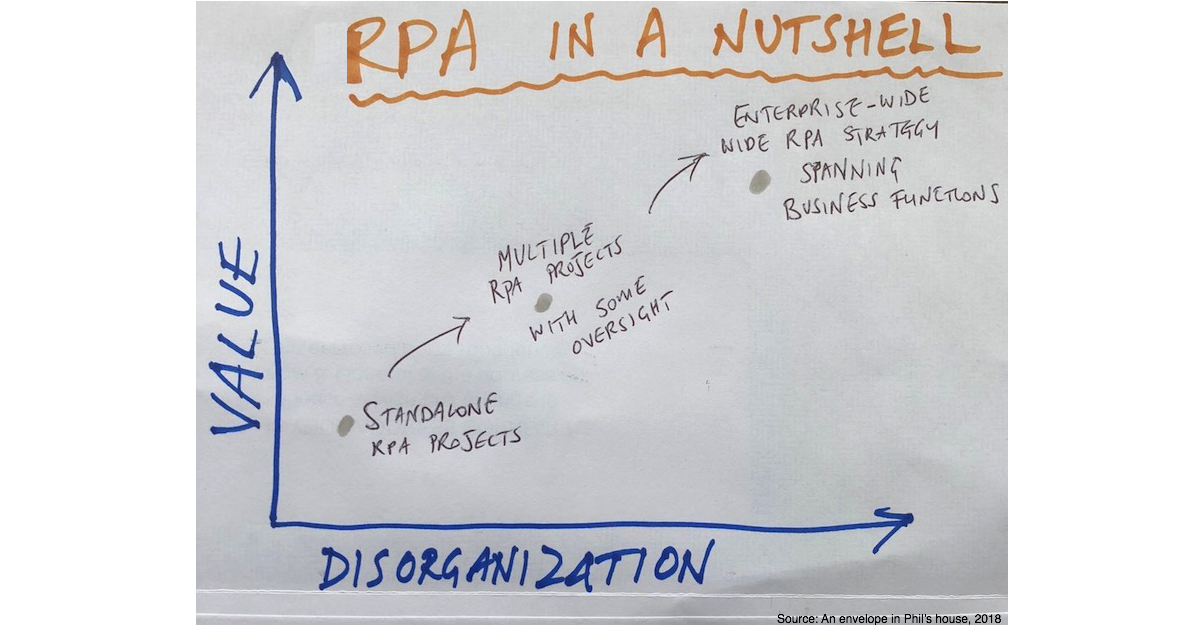

Forget Brexit, RPA could wipe $820m a year of costs from the NHS with a common model across its 207 trusts

What I love about RPA is it most often has the highest impact where there is a serious amount of IT failure, disorganization and overworked staff.Read More

How a Healthcare Insurance Company is Bringing RPA and AI into Business Operations

By defining appropriate scenarios, thinking outside the box, managing proactive communications with staff, and looking to get people excited about the positive impact on jobs, relationships between payers, providers, and patients and healthcare consumersRead More