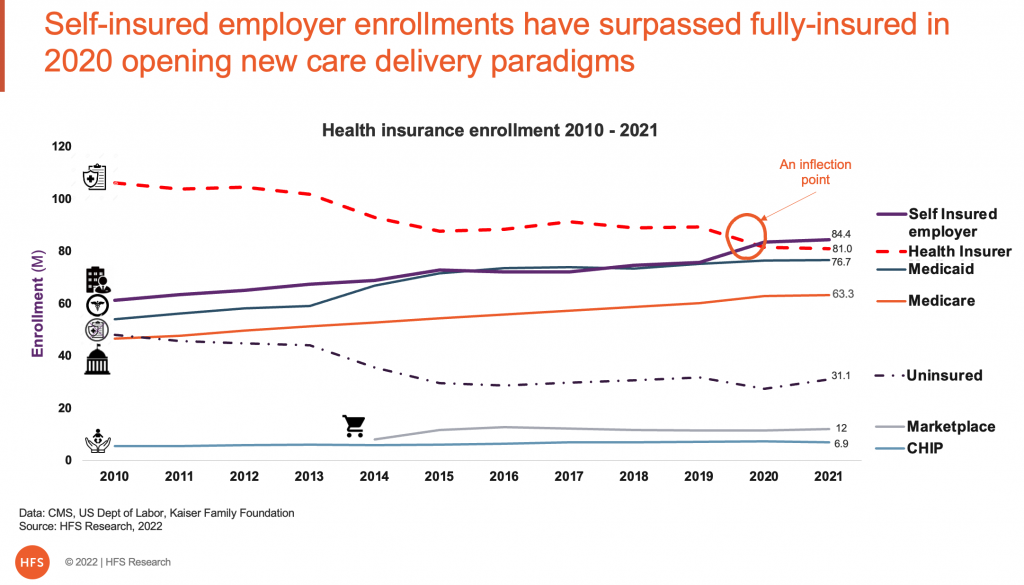

Self-insured or self-funded employers underwrite the medical risk of over 84 million of their employees and their families in the US. In 2020, self-insured enrollment by employers themselves surpassed the enrollment in health plans underwritten by health insurers, becoming the single largest market segment for healthcare. I caught up with our healthcare practice leader, Rohan Kulkarni, to learn more…

The 2020 inflection point at the start of the pandemic is a seismic event that passed off with little attention given our combined attention was on COVID-19, the economy, and yes, the 2020 US elections. Still, the growth of enrollment in self-insured employer plans holds tremendous promise of systemic change in US healthcare without the drama of national politics. It opens new opportunities for service providers, technology enablers, and consumers. It will unleash new business models, better health outcomes, and potentially address the runaway train of healthcare costs.

Health insured enrollment decline is offset by self-insured employer enrollment growth

Phil Fersht, CEO and Chief Analyst, HFS Research: Rohan, you have been researching the self-insured employer market for a while. Please explain this market and its genesis.

Rohan Kulkarni, Healthcare Practice Leader, HFS Research: That’s right Phil, I have been spending a lot of time researching this area given it is the single largest new services market.

Let us visit two events a decade or so ago to appreciate the genesis of the self-insured market.

The first is the financial crisis of 2009-2008 that despite the initial setback allowed companies to return to a growth trajectory with a ton of cash on hand. Given healthcare costs were already increasing unpredictable, large employers (over 500 employees) figured they could save on healthcare premiums by self-insuring, managing risk by stop-loss insurance which is less expensive while being able to pay healthcare costs with the cash on hand.

The second event was the passing of the monumentally impactful Affordable Care Act (ACA) in 2010 which opened the insurance market to the uninsured and expanded Medicaid among other things. The impact of ACA was the standardization of healthcare benefits, optimizing member loss ratio (administration vs. healthcare cost ratio per premium dollar), and removing pre-existing conditions as a reason to deny insurance. ACA helped employers standardize healthcare benefits for the employees.

These two events crystallized the transition of the healthcare market. It gave cause and rationale for employers to take better control over their employees’ health and wellbeing.

The market dynamics are also shaping up to form the single largest new service market in the US. At HFS, we estimate that this market that reflects almost a quarter of all US residents is approximately $600 billion and expected to grow at about 2x that of inflation.

Phil: That is interesting but is this a flash in the pan or is the market sustainable?

Rohan: That’s a fair question and deserves some analysis. The chart in exhibit 1 above shows enrollment from 2010 through 2021 for employers and other risk bearers. The health insurers (health plans) have been declining their enrollment at a compound annual growth rate (CAGR) of 3% and that has been offset by a CAGR of 3% for the self-insured employers for over 10 years across 3 different administrations. Given the overweighted impact of politics on US healthcare, it is notable to see a consistent trend irrespective of who has been in government.

There are some 120 million employed in the US with the workforce participation rate picking back up despite the great resignation. Combining that with the growing population, we should expect more people to work for companies that self-fund. Additionally given that wages are on the rise with the expectations that healthcare benefits are robust, employers have a finite budget to work both those needs. Consequently, we are likely to see more employers head the self-insured route to better control their employee benefit dollars.

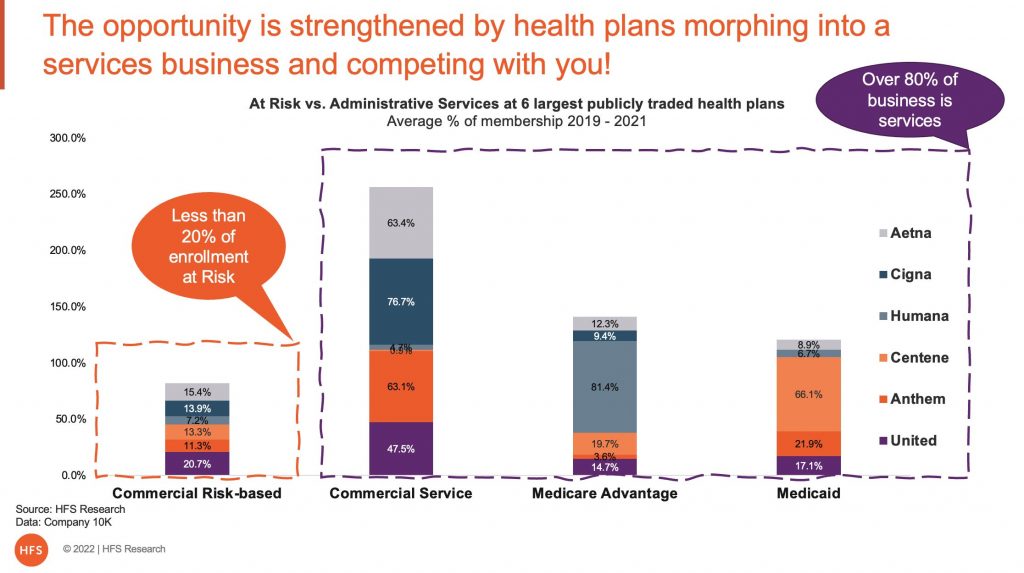

Lastly, health insurers are becoming a predominantly services business instead of a risk management business. In exhibit 2, I compared the last 3 years of revenue streams for the 6 largest publicly traded health insurers who count over 50% of America’s population as their members. Over 80% of their business is now services compared to less than 20% underwriting medical risk.

Health insurers are really health services providers

The retrospective trend combined with the contemporary market dynamics suggests to me that we are going to see further growth in self-insured enrollment over the next few years before we see the graph stabilizing.

Phil: So, are you suggesting that self-insured employers will replace health insurance companies?

Rohan: Yes and No! Let me explain, Phil.

The value proposition for a health insurer is essentially two-fold; a) underwriting medical risk and b) managing a healthcare provider network that includes negotiated rates for care.

As more employers self-insure, the reliance on health insurers will continue to decline, however, there is still a market for individuals who may not be covered by their employers or the government, such as the growing gig workforce.

Provider networks are becoming a commodity product and can be rented, again declining the value of health insurers. This will be compounded by the recent Centers of Medicare and Medicaid Services (CMS) rules to drive price transparency where healthcare prices will become more standardized over time, allowing employers to contract directly with providers instead of working through health insurers.

Consequently, health insurers will become more of a service provider and less of a risk-bearing entity. Call it a slow march to the other side.

Phil: Will self-insured employers behave like health insurers for their employees then? This does not seem like the dynamics have changed for the better.

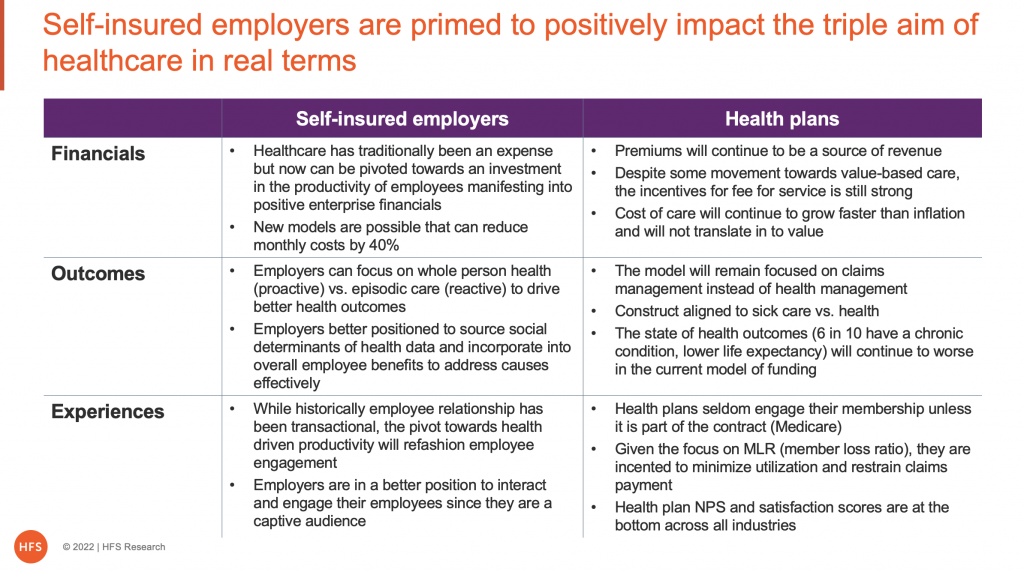

Rohan: I think there is merit in that, but I think it is less likely the case for a variety of reasons, primary in that healthcare is a cost for employers not revenue like it was for health insurers. That fundamental difference will drive a different paradigm that will focus on employee productivity vs. healthcare, same goals different pathways.

Employers are likely to focus on proactive measures to impact health and sustainable productivity that impacts revenues instead of reactive healthcare that adds to cost. One of the key reasons they will find more success in impacting health is that their employees are a captive audience. Given that, employers have enormous influence over their employees’ behaviors and lifestyle choices (nutrition, activity, etc.) determining potentially better health outcomes. I often say that I never miss a call from my HR, but I rarely ever pick up when health plans call…that is if they ever call.

Social determinants of health (SDoH) are conditions in the places where people live, learn, work, and play that affect a wide range of health and quality-of life-risks and outcomes. Employers are more likely to leverage SDoH in their efforts to influence their employees’ health and well-being, to think and do outside the box. When you think about it, we have over 50 years of data on what insurance-based healthcare has done well and has not. This is that generational opportunity for employers to learn and use.

Phil: If self-insured employers are going to reframe the paradigm towards productivity vs. reactive care, how will that manifest itself in terms of buyer behaviors?

Rohan: This is a nascent market that is evolving as we speak. While I have addressed self-insured employers in the aggregate, they can be segmented based on their tolerance for change and risk, corporate culture, industry and regulatory impacts, size of the employee population in the US, and more. Each segment will have a different set of priorities that will drive different behaviors. However we segment them, and whatever their priorities, they have taken the big first step of underwriting their employees’ medical risk, a decision that I suspect was not taken lightly. And they have stayed with as the count of self-insured employers as per Kaiser Family Foundation has now increased to 92% of all large employers (over 1000 employees) from the high 80% and 67% of all employers from low 60% pre-pandemic.

I believe that 5 archetypes are forming as in exhibit 3, where legacy aligned models for risk-averse employers are on the left side and those for risk-tolerant progressive employers are on the right. As we move from left to right, the models increase in their focus on productivity while reducing reliance on healthcare, enhancing appeal to employers really seeking change.

Service providers are likely to align to 5 archetypes

As I indicated earlier, the self-insured employer market is the biggest new services market worth some $600 billion that is begging for help, and we are seeing loads of private equity money pouring into this space.

Phil: This is fascinating! I understand the demand-side dynamics as a new market worth $600B is forming, but what will happen on the supply side?

Rohan: As you are acutely aware, Phil, we at HFS cover the service providers across the spectrum of technology and business and all points in the middle. The cadre of diversified service providers who have been serving health plans for decades has an opportunity to pivot towards self-insured employers on the backs of their existing relationships with their clients, many of whom are self-insured employers. They must begin to think of healthcare as a horizontal and begin to plan out for the next 3 to 5 years. They are primed to make the investments that will help them further diversify while de-risking their reliance on the legacy health insurance business.

Like any new market, the bold visionary will succeed while the others will fall aside. Service providers who have been serving the health insurers have deep expertise in the space and have made investments that can be pivoted smartly towards the new market. This market is attracting competition from benefit brokers (Wills Towers Watson, Mercer, etc.), third-party administrators, and health plans themselves in addition to service providers. Given the size of the disintermediation and the creation of a new market on the back of it, it will drive some very interesting moves in the market with potentially increased M&A activity, high levels of funding, and creation of new entities. Phil, it’s time to strap in!

Phil: What is the role of technologies in the self-insured market?

Rohan: I see the journey to take three paths a) healthcare service providers will attempt to pivot their platforms like Core-Admin Process System (CAPS) towards the self-insured employers b) HR aligned platforms be it Human Capital Management (HCM) or Learning Management Systems (LMS) etc., will be expanded to address some of the needs of this new market and c) new systems will be developed that will be custom-built to address specific needs of this market, perhaps along the lines of the archetypes described in exhibit 3.

I think the platform evolution will occur in parallel with the evolution in the buying models. In the initial phase, most will make do with existing software and platforms. But over the next 3 to 5 years, we are going to see the use of emerging technologies as the level and complexity of outcomes increase as does the sophistication in how SDoH is leveraged. This is going to be a particularly exciting space.

Phil: Ok so what is the time horizon for this change?

Rohan: Well, the pioneers like Boeing, Walmart, Intel, and a few others have been at it for a while, self-insuring and then directly contracting with health systems for care delivery. These companies have a decade’s experience experimenting with what suits them best.

In the conversations I have had with benefit managers at self-insured employers, I sense they are energized as they see real options to pivot. The pandemic has unleashed the power of telehealth, particularly for primary care that I wrote about, empowering employers with real-world evidence to act. They also sense that their employees are more open than ever to using telehealth and their app-based behaviors support the change.

In addition, as I mentioned earlier, CMS’s price transparency rules will commoditize healthcare costs over time allowing employers to contract directly with health systems and hospitals. So, I think the change is happening as we speak.

Phil: What do you see as the impact on US business with the likely reversal of Roe v Wade, Rohan?

Rohan: Phil, I think of health and healthcare impacts in the context of the triple aim of care, which is to reduce the cost of care, improve the health outcomes and enhance the experience of care. I think overturning Roe vs. Wade will grievously harm the triple aim of care causing higher cost of doing business.

Cost of care will increase even more. Given the overall support for Roe in the US is between 60% and 70% across the nation, it is reasonable to assume that practitioners in women’s health will likely move to states that support women’s rights causing an imbalance in supply and demand. This behavior will extend to new clinicians entering the space likely to choose to practice in states that support women’s right. Health economics has taught us that supply and demand do impact price and tends to be secular. So, while women’s primary care costs could go up in Texas, it won’t be restricted to that state, but will rather impact the median cost of care nationwide. This will negatively impact employers spend on their employees’ health. In fact, we are seeing some of it in play as Apple, Uber, Amazon are committing to paying for their employees’ non-emergency medical expenses including abortion if they travel out of state which adds to their healthcare costs.

Women and children’s health will negatively be impacted. Access to care is critical to health outcomes. Access includes the availability of resources (insurance, funds), availability of clinicians (primary care, specialists), availability of time, transportation, support, and more. If there is a supply imbalance due to limitations in practitioners, it will impact outcomes including potential unnecessary deaths. Which directly translates into increased absence, lower morale and productivity and eventual impact on the financials.

A recent editorial in the Lancet suggested that overturning Roe vs. Wade will not succeed in ending abortion but will only succeed in ending safe abortion. So, this is a function of employee safety, enterprise morale, and culture. It will test employers on their commitment to their ESG programs given that certain minorities are more impacted than not.

So, I think US businesses will see financial impacts, will see reputational impacts and will most definitely see employee productivity impacts.

Phil: Rohan, thanks for your insights and sharing the dynamics driving this huge emerging market. HFS subscribers can access your research here.

Posted in : Healthcare, Healthcare and Outsourcing