In October 2022, HFS said goodbye to the Top 10’s and welcomed HFS Horizons, a forward-looking construct to evaluate service providers. Our first industry-focused horizon report is the healthcare payer service provider report that was published in November 2022. This report helps healthcare enterprise buyers make high-confidence buying and partnering decisions in the context of the specific challenges they are attempting to address.

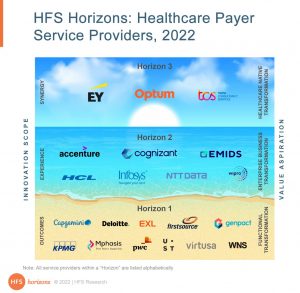

Note: All service providers within a “Horizon” are listed alphabetically

A healthy list of 21 service providers evaluated

The service providers were evaluated across four dimensions – Why, What, How and So What – to arrive at a comprehensive conclusion categorizing service providers into three horizons: supporting Functional Transformation (Horizon 1), driving Enterprise Business Transformation at scale (Horizon 2), and leveraging deep healthcare expertise to craft Domain-Specific Transformation (Horizon 3).

The HFS Horizons report is about matching service provider capabilities to enterprise buyer needs

This study aids health plans, government agencies, and self-insured employers to understand the forward-looking capabilities that service providers will bring to bear.

The Healthcare Horizon report is an effort to help healthcare enterprise buyers evaluate service providers fit for the challenges they face as the market needs evolve. It shines a light on where the puck will be for enterprise buyers and the ability of service providers to meet the puck where it will be instead of where it is.

Unlike a ranking study, each Horizon reflects a set of capabilities aligned to a set of industry challenges that require addressing. It’s a practical tool for making high-confidence buying and partnering decisions.

The Healthcare Horizons Report boldly indicates how healthcare funding is shifting and its implications for service providers

Funding for healthcare in the US has been shifting from fully funded commercial insurance to self-insured employer and government programs steadily for several years. Governments (state and federal) and large employers have become the largest underwriters of medical risk.

Consequently, traditional health insurance companies are changing from financial institutions to service providers. This fundamental shift will continue to strengthen co-opetition between health plans and service providers, requiring a different solution portfolio and go-to-market to address the evolving needs of a reconfigured market.

Healthcare provider choices are driven by health insurance. In 2020, enrollment in self-insured employers surpassed enrollment in plans underwritten by health insurers. Self-insured employers will likely seek direct-to-provider contracts both for primary and acute care to drive improved employee productivity instead of just reactive care. The shift in this market dynamic could make a positive change in aligning HCPs to health vs. just volume-driven sick care.

Vertical integrations mean new opportunities for service providers

The shifting markets are forcing healthcare enterprises (health plans and providers) and new entrants to create new business models that require a new level of vertical integration. Integrated delivery networks or IDNs, such as Kaiser Permanente and UPMC, have shown that the power of vertical integration through proliferation across the healthcare ecosystem has been limited.

However, a new wave of vertical integration is reimagining how synergies could redefine the value proposition. This will require service providers to rethink their solution portfolio and go to market.

The Healthcare Horizons report includes service providers with heritages across IT services, BPO, consultancy, and healthcare

The 21 service providers covered in the healthcare horizon report, alphabetically, are Accenture, Capgemini, Cognizant, Deloitte, EMIDS, EXL, EY, Firstsource, Genpact, HCL, Infosys, KPMG, Mphasis, NTT DATA, Optum, PWC, TCS, UST, Virtusa, Wipro, and WNS.

This report includes detailed profiles of each service provider, outlining their placement, provider facts, as well as detailed strengths and opportunities.

HFS subscribers can download the report here

(available free for a limited time).

Posted in : Business Data Services, Business Process Outsourcing (BPO), Healthcare, Healthcare and Outsourcing, HFS Horizons, IT Outsourcing / IT Services, OneEcosystem, OneOffice