As we famously declared in 2019, standalone RPA is dead, and the only way to derive real value from process automation and data is to adopt an integrated approach that breaks down silos and produces the data executives need to make rapid decisions. Our autonomous enterprise principles clearly outline the steps needed to define the data needed, the transformation to collect and access it, and the governance capabilities to arrive at the decision points along the way.

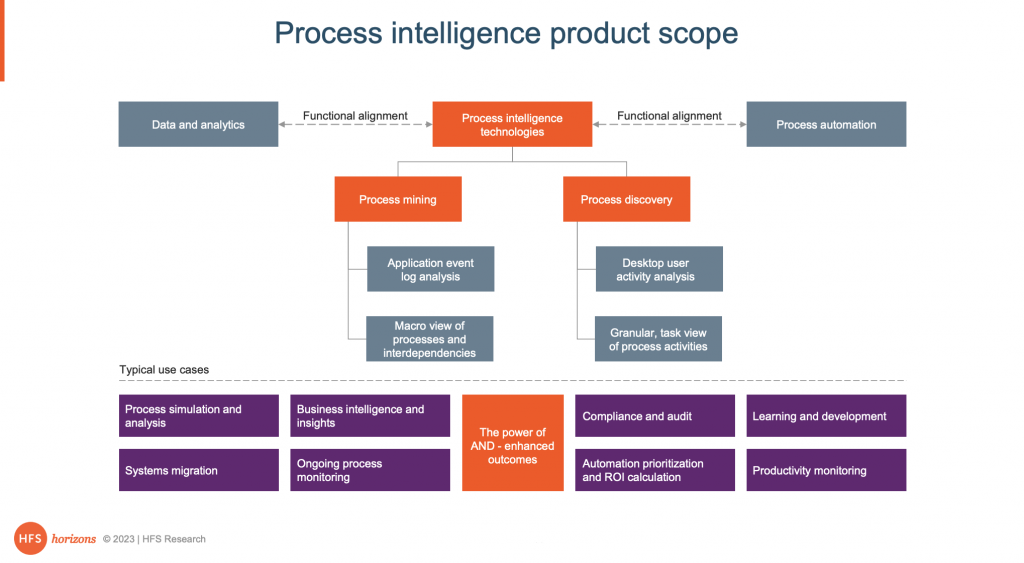

Enterprises can either use a multitude of specific software tools to support their needs or opt for a single platform approach that encompasses the functionality they need. We categorize software platforms that support this integrated approach as “Process Intelligence”:

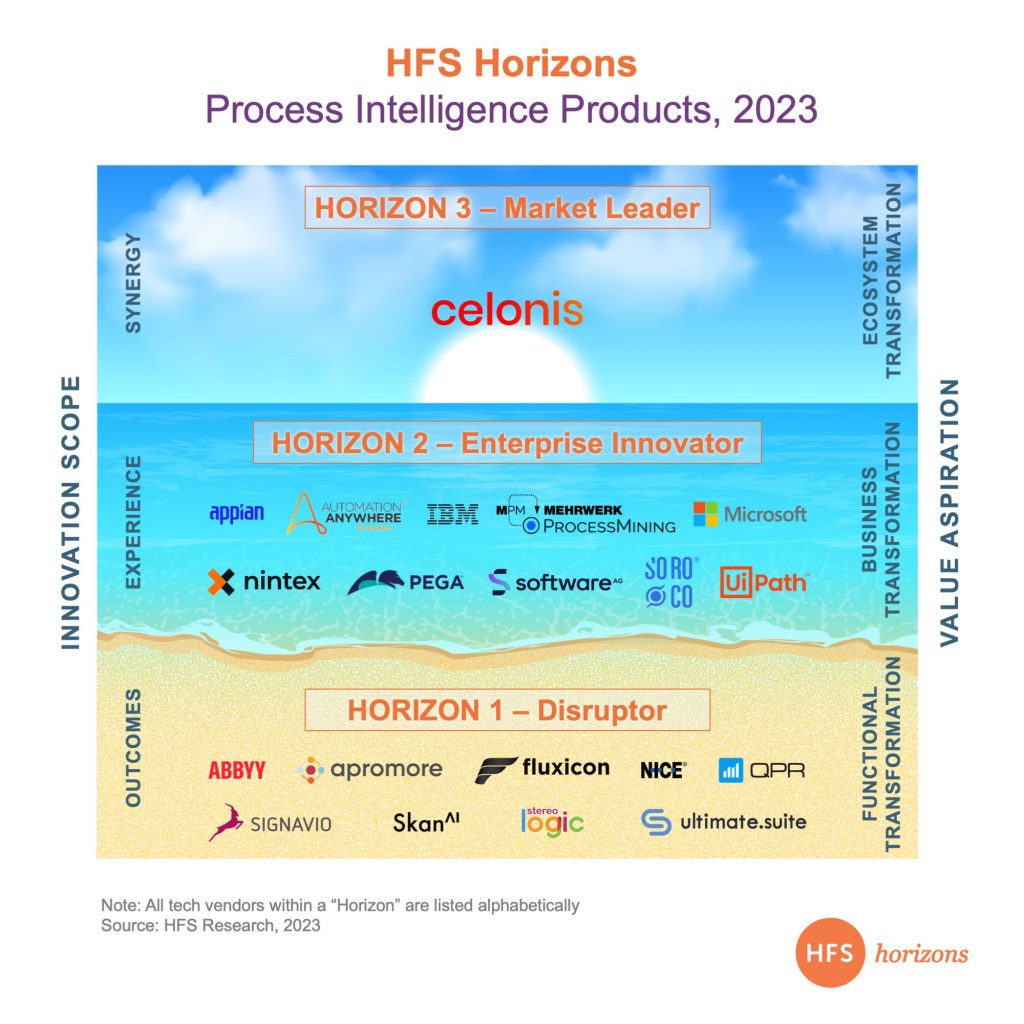

To this end, HFS published its latest HFS Horizons report delving into the world of Process Intelligence Products. Rather than being a ranked Top 10 list, the assessment methodology provides a Horizon view comprising a full market landscape of vendors bringing different sets of technologies and focus to help enterprises understand how their work gets done.

Much like our previous assessments, we grouped process and task-mining vendors in this analysis for several reasons:

- HFS focuses on the use cases and business values being derived from this set of technologies rather than the specifics of data capture and analysis techniques. In fact, our research proves that enterprise clients are applying a combination of process and task-mining tools toward similar and distinct use cases.

- There’s a significant amount of convergence in this space. The market is full of acquisitions, investments, partnerships, and inhouse development to offer integrated solutions to combine both process and task data to deliver combined value – and it’s a trend we expect to see grow in the coming years.

The process intelligence market continues to grow exponentially and transform equally as fast.

Organizations are battling decades of technical and process debt, and as we immerse ourselves further into the digital economy, it will be enterprises with efficient operations that will succeed. To that end, we expect to see the impressive growth of process intelligence to continue – and the data in this HFS Horizons report confirms it, as we report that the majority of enterprises are predicting a ‘significant increase’ in spend on the technology over the next 12-18 months.

On the vendor side, we’ve witnessed the process intelligence market transform radically in recent years. A handful of vendors have been acquired by large enterprise technology platforms, automation, and workflow vendors. Meanwhile, new entrants are coming to the market armed with fresh approaches to gathering information and analyzing how people work. For enterprises, this makes it even more difficult than ever to select their preferred process intelligence partner – but they are also spoiled for choice.

HFS evaluated 20 technology vendors

We assessed 20 technology vendors across four key dimensions: Why, What, How, and So What, allowing us to categorize vendors into three horizons: delivering cost and efficiency transformation (Horizon 1), driving enterprise business transformation at scale (Horizon 2), and creating new sources of value and creating an ecosystem impact (Horizon 3).

Note: All service providers within a “Horizon” are listed alphabetically

We identified one clear Horizon 3 market leader – Celonis

Celonis emerged as the only clear Horizon 3 market leader thanks to its ability to deliver ecosystem-based, data-driven transformation today. Horizon 2 hosts 10 fast-growing vendors whose clients are seeking enterprise-wide, data-driven initiatives – and it includes a combination of pureplay and acquired process intelligence vendors.

Horizon 2 plays host to 10 innovative vendors who are driving real business outcomes and improved stakeholder experiences. These vendors are putting an increasing amount of pressure on the likes of Celonis and are beginning to assemble a compelling end-to-end proposition, which we expect to see come to fruition in the next 1-2 years.

In Horizon 1, we identified 9 disruptive vendors helping enterprises make focused investments in the space. In particular, Horizon 1 disruptors excel when helping organizations with limited process intelligence experience and those focused on project-based functional transformation.

This report included detailed profiles of each service provider, outlining their placement, provider facts, as well as detailed strengths and opportunities.

HFS subscribers can download the report here

(available free for a limited time).

Posted in : Artificial Intelligence, Automation, Autonomous Enterprise, HFS Horizons, Process Discovery, Process Mining, Robotic Process Automation