Month: March 2017

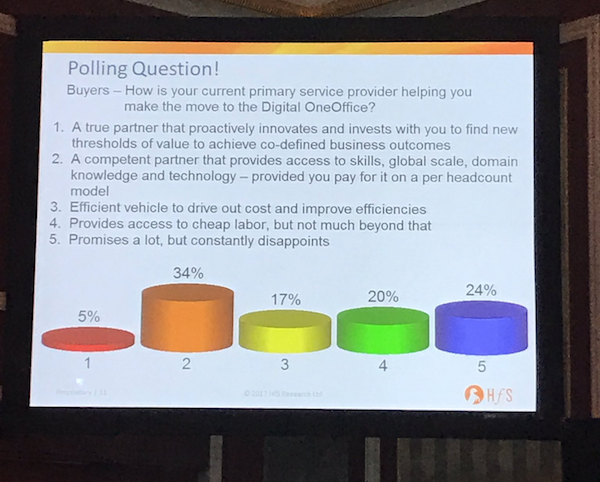

The spreading outsourcing disease: barely a third of buyers see real value in their current provider relationships

Private poll of 60 enterprise buyers at the NY HfS Summit yields a depressing state of affairs for current outsourcing relationshipsRead More

RPA is finally growing up, though custody is not settled yet

Despite a lot of noise in the industry, RPA and Intelligent Automation are still a very nascent market. Thus, we continue to have a blurred perception around RPA that gets aggravated by the amount of smoke and mirrors spawned out by some providers.Read More

Placing HCM Stewardship Where it Belongs: Outside of HR

HR adds the most value, by far, when it enables line managers to be effective stewards of HCMRead More

Digital Means Customers Don’t Need to Like You….

Digital is not about being nice or building an emotional attachment to customers – it’s about speed, efficacy, and awarenessRead More

Genpact earns its CFO Consulting stripes as it seeks to pioneer disruptive F&A services in the digital era

At the top of the finance and accounting function, today’s CFOs are more ambitious than ever to become more involved in driving future growth for their organizations, beyond oversight on controllership and bookkeeping.Read More

WNS and Its HealthHelp Acquisition “Will Not Deny” Health Care

The company that WNS just acquired is building out a patient- and healthcare provider-centric approach to utilization management designed to match procedure and treatment to the patient’s needs and network.Read More

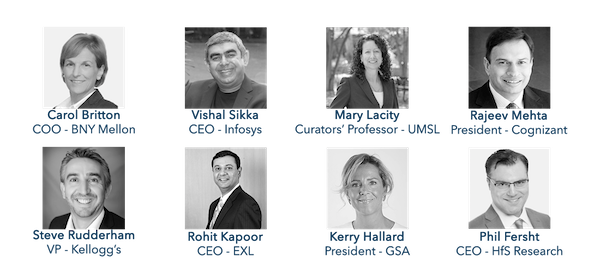

Welcome to Judgement Day, where the real future of Outsourcing and the Digital OneOffice will be decided in NY this week!

Can we really “unlearn” the last two decades and change how we buy, sell, behave and operate? Come to NYC . this week to find out...Read More

Ariba And Everledger Want Blockchain To Help Supply Chains Become More Ethical And Make The World Better

When people source ethically they can reduce a lot of bad in the world – child labor, human trafficking, working conditions that harm and kill people, and a host of other problems.Read More

#Traveldiaries2017 – Are you creating memorable service experiences for your travel customers?

All the things T&H service buyers and service providers could be doing better to think of ME, the traveler, at the core of their operationsRead More

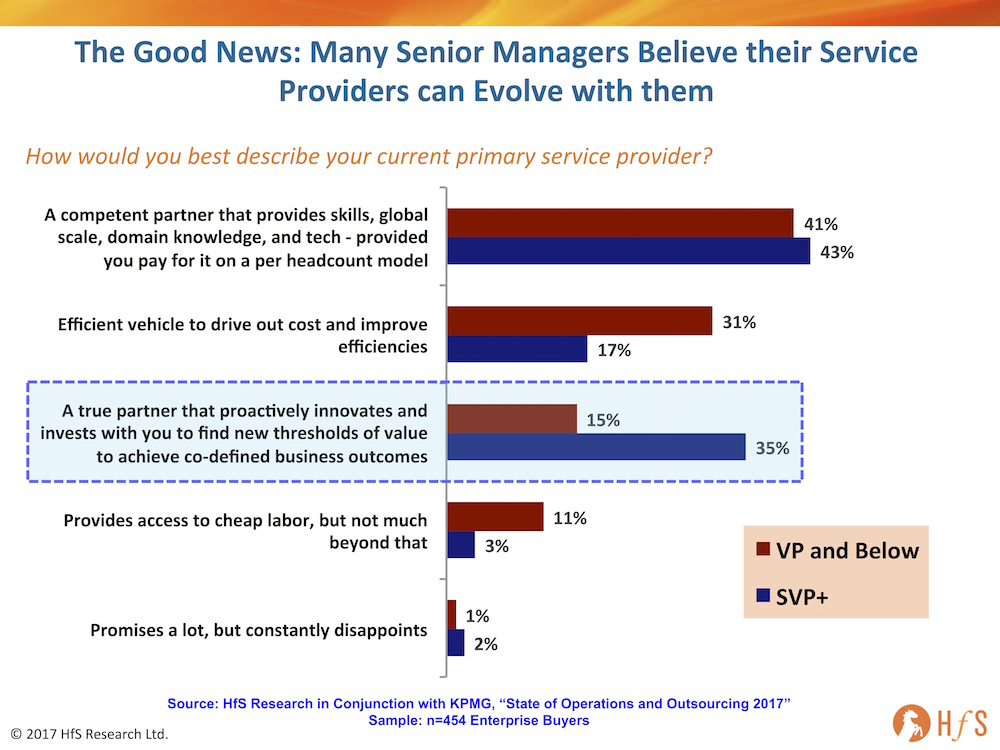

The traditional outsourcing model is officially out of value, but the future is bright for co-innovation partnerships

The door is wide open for ambitious providers willing to invest in developing their talent, but closing firmly shut for those perpetuating what worked in the pastRead More