Month: January 2017

Salesforce Services Blueprint 2017: Leaders demonstrate commitment, dedication, and investment

What has changed since our 2015 analysis of Salesforce Services providers? Quite a lot..Read More

Why the Time is Right to Evaluate Predictive Capabilities in HCM Systems

Predict all employee-related outcomes that materially impact business performance, understand why the outcome is likely, communicate why this insight matters, and determine and pursue the key actions neededRead More

Harman, Accenture and Atos are bossing emerging IoT Services, but we need real IoT algorithms and security standards

Harman, Accenture and Atos are bossing IoT Services as the Digital OneOffice emergesRead More

Make Sure Your Managed Security Services Provider Keeps Current With Your Changing Security Posture

A company’s security posture changes often. The change can be company-created, for example, by opening an office in a new geography or entering a business with different regulatory requirements for data protection.Read More

VCU Health tests telehealth for shortening time to treatment for stroke patients (#telestrokecare)

At the heart of the effort is empathy – making an effort to “get inside” the experience of each person involved, understand their needs, and how to address those needs both simply and effectively.Read More

HR Best Practice? Yeah, Right

HR practices truly are “best” when they directly support both a company’s target culture and their workforce strategies aimed at creating a great customer experience.Read More

Why Customer Delight is Overrated

Bad customer experiences have a much greater potential to do business damage than great experiences do to have a positive impactRead More

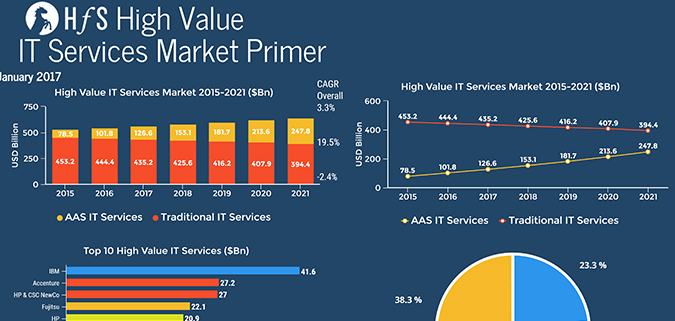

The year of the HfS Infographic begins… in earnest

The IT Services Market Primer 2017Read More

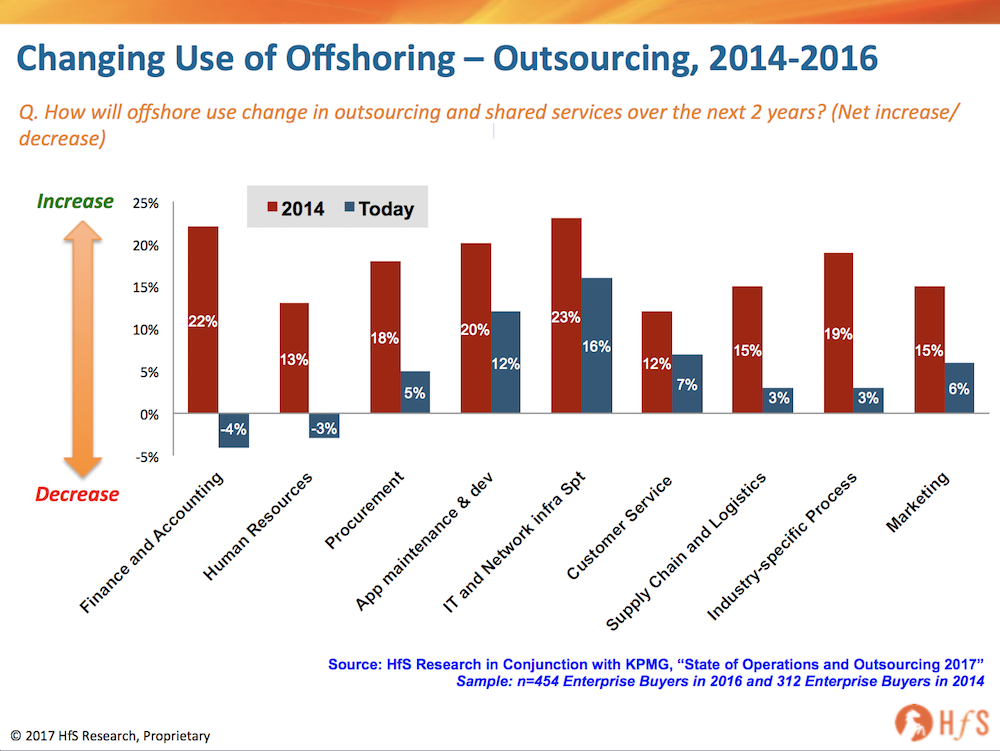

Offshore has become Walmart…as Outsourcing becomes more like Amazon

No one cares much about “offshore” as a strategy anymore - it has become part of the fabric of managing a global operating modelRead More

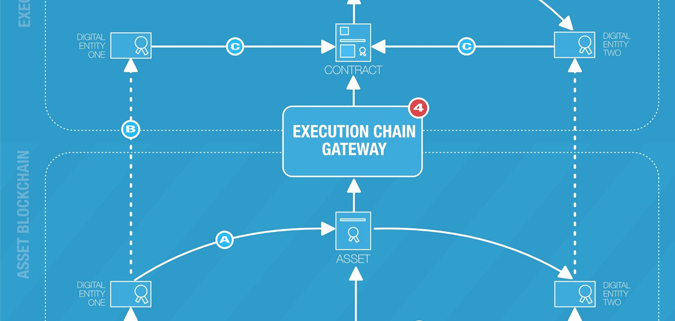

Talking Blockchain Business Models and Network Ownership With HCL

HCL sees a lot happening in security and privacy, as well as regulatory agencies stepping up to help businesses form some governance policies around blockchain.Read More