Since we published our first report on blockchain, we continue to talk to players in the industry about how this fast-moving market is changing and growing. Compared to last year, there’s more discussion about security and privacy (evolving from the “blockchain is unhackable” talking point that was popular last summer,) there’s more talk about non-financial examples like using blockchain to help with supply chain compliance issues, and a hunger to get beyond POCs into valuable operational execution.

Recently we spoke to Santosh Kumar, Rob Ellis, and Mani Nagasundaram from HCL about blockchain trends. HCL shares many characteristics with the players we included in the report, such as:

- Basing its blockchain expertise within its financial services practice

- Building expertise in some key industry hot buttons like international money transfer, asset tracking, and trade operations

- Creating POCs with global banks like one HCL did on cross-border money transfers across subsidiaries

- Exploring partnerships with several key blockchain technology vendors like Ethereum and ERIS Industries

Regarding trends, HCL sees a lot happening in security and privacy, as well as regulatory agencies stepping up to help businesses form some governance policies around blockchain. We’ve seen in the past few months that while maybe the blocks in the chain aren’t hackable per se, there have been identity thefts, fraudulence, and further concerns about public blockchain networks.

The HCL team notes that transactions are well executed in blockchain, but identity validation and asset validation are less mature. And valuation of assets still needs to happen in the real world, so they caution over-optimism in moving quickly to broad blockchain adoption.

Also, adoption may be slowed down until we can answer the key question, “who owns the network?” HCL’s current thinking is that there’s likely to be one or two per industry and that moving or crossing networks will be difficult (HfS agrees that network interoperability is a big problem. See my prior blog on network interoperability issues here.)

They also believe that maturity in blockchain comes in three phases and that blockchain mirrors the Internet itself in this maturity curve:

- Operating business processes better with blockchain

- Changing operations using blockchain

- Using blockchain to create new business models, processes, and activities

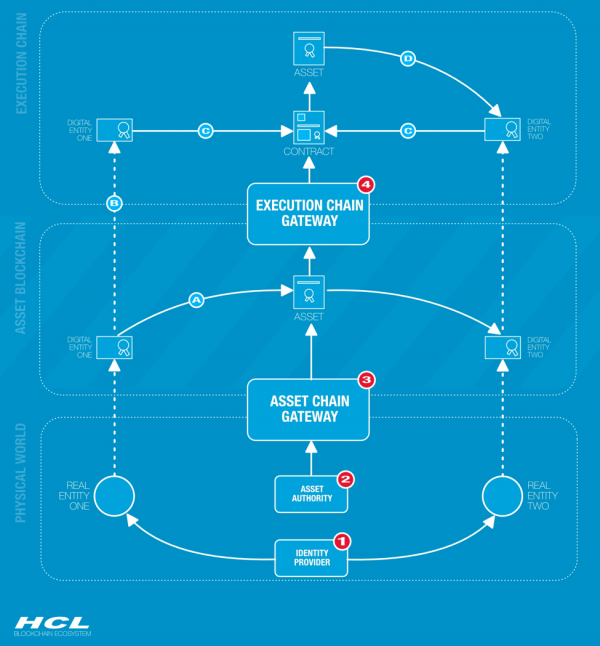

When you get to the discussion of new business models, HCL has a few scenarios that they share (see Exhibit 1 for an example.) We like HCL’s ability to not just explain the technology in-and-outs, but blockchain’s impact on business. In the blueprint guide on blockchain, we scored providers highly on innovation when they have strong business stories and the ability to demonstrate blockchain’s potential to prospective clients.

Exhibit 1: HCL’s Blockchain Ecosystem Example

Click to enlarge. Source: HCL, copyright HCL

Bottom Line: 2017 will be an important validation year for blockchain

As HfS continues to research HCL and its competitors, we’re looking for the following in 2017:

- Movement beyond POCs into live implementations

- An example of inter-company blockchain work (remember, most POCs right now are intra-company, which is why the network question didn’t come up much this year)

- Some hardening lines in the partnership area as the winners and losers on the technology side become clearer and providers get pickier about which vendors they bring into client engagements

Posted in : Blockchain, Procurement and Supply Chain, The As-a-Service Economy