The time for smart partnerships to drive real innovation and new thinking in Artificial Intelligence (AI) and cognitive computing is now. This means we need to see the industry’s deep-pocketed innovators become increasingly open – and eager – to working together to help the services industry make the shift to true digital, intelligent, cognitive capabilities.

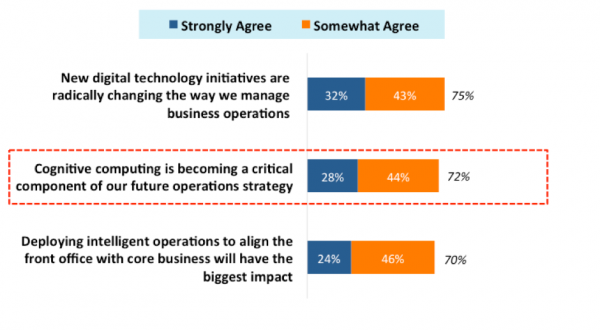

Recent HfS research shows adoption of Artificial Intelligence (AI) and cognitive computing to enhance operational analytics and Machine Learning is strongly accelerating, with 72% of senior operations executives citing cognitive as becoming a critical component of the future operations strategy:

Digital and Cognitive are Driving Enterprise Operations

Source: “Intelligent Operations” Study, HfS Research 2016; Sample: Buyers = 371

While the market perception around these topics remains refreshingly blurred, AI is a critical building block as organizations increasingly look to progress from legacy labor-driven service delivery to progress toward notions the As-a-Service Economy and the Digital OneOffice (see link). While AI is capturing the imagination of many PE investors and VCs and is being used to hype up media reporting and conference circuits, the market dynamics are far from clear.

Against this background, the fundamental question being posed is “Who will be in the driving seat scaling out the deployments? Will it be the service providers, the leading industry platforms or will startups scale out?”

Salesforce Einstein and IBM Watson Partnership: A genuine step forward in AI, or another nice Press Release?

Salesforce and IBM have announced a global partnership to integrate their respective AI platforms to provide enhanced information and services to joint clients. Clients currently have access to Salesforce Einstein, which is built into the Salesforce Intelligent Customer Success platform. Einstein provides a broader set of capabilities around operational Analytics and Machine Learning. Salesforce’s ‘Spring 17 product announcement made Einstein available across Salesforce cloud products for customers. The integration of Einstein with Watson, planned for the second half of 2017, would bring significantly deeper and broader analytics insight to customers. In addition, IBM Application Integration suite for Salesforce, which enables clients to integrate on premises and cloud data for Salesforce, will become available at the end of March 2017. IBM, for its part, will deploy Salesforce Service Cloud enterprise-wide.

So, what does this mean for the respective parties?

- Client and business growth: Both providers have broad opportunities to cross-sell into their respective customer bases through the partnership. The providers have an estimated joint client base of more than 5,000 enterprises.

- Salesforce strengthens growth area: As market awareness, if not real demand, for AI increases, Salesforce will be able to offer clients a broader orchestration of AI enabled services. The fact that it has already made Einstein available across Salesforce cloud products demonstrates the software provider’s commitment to and investment in this space.

- Potential to create leading AI offering: The partnership has the potential to drive broad AI capabilities into industry platforms. Thus, extending the reach and commoditizing of Watson capabilities. From a domain standpoint, while Einstein has focused on customer relationship management, Watson is going deeper into vertical scenarios, in particular financial services, healthcare and retail. Additionally, weather data from Weather.com will create new opportunities for both AI capabilities to test new use cases altogether. Salesforce brings its broad customer base and rich customer data to the table. IBM has had a head-start with building Watson APIs and products, which Einstein could benefit from. Clients will most likely select multiple cognitive engines in the next few years, as they embark on their journey towards increasingly intelligent operations that require less direct human interaction. These systems will need to interact with each other, built upon interoperable standards for data curation and access. A partnership like this could help that process, and possibly help clients with overall cognitive engine adoption in the long run.

- IBM wins in technology and services: As well as finding an additional, lucrative channel for its Watson technology, IBM also has an advantageous position to take the associated IT services work. IBM strengthened its Salesforce services capabilities by acquiring specialist Bluewolf in 2016 (see: IBM Culls The Pack Of Salesforce Partners By Buying Bluewolf). Salesforce has always had a close relationship with Bluewolf, and it’s no surprise that it has decided to strengthen this particular partnership now. Bluewolf, an IBM company, will establish a practice to deploy the combined functionalities for clients, called Bluewolf Dedicated Consulting Services and Expertise for Cognitive Solutions. IBM will therefore strengthen its position in this market, with potential increases in technology and services revenue. Other partners in the ecosystem with the relevant capabilities have opportunities to build out similar services, but Bluewolf has a first mover advantage.

How can this partnership truly plug Salesforce’s gaps in Analytics?

While the stage could be set for AI in the long term, Salesforce needs to address the more basic analytics piece of the equation. While access to advanced AI insights delivered by a combined Watson and Einstein platform is useful, most Salesforce services clients are simply grappling with implementing basic analytics solutions. Some Salesforce services clients who require analytics capabilities have selected alternative solutions to Salesforce because of the disappointment with the slow development of the Salesforce Wave Analytics product and the service providers’ slow ramping up of Wave capabilities.

Our research from the HfS Blueprint Report: Salesforce Services 2017 highlights that most Salesforce services clients are just starting to consider analytics services, so Salesforce needs to speed up its development of the analytics module as well as market the developments made, so as to prevent any future clients looking elsewhere. Analytics services, particularly consulting services are a massive growth opportunity for Salesforce services providers. Leading service partner, like Accenture, Deloitte, Cognizant and IBM, have invested in analytics solutions and services, anticipating the upcoming demand, but the specific solution selected by clients will not necessarily be Wave Analytics.

The bottom-line: This new partnership could genuinely accelerate the commoditization of AI capabilities

This partnership is a smart move by both Salesforce and IBM to use their strengths collaboratively – potentially winning IBM and Bluewolf more business, bringing Einstein up to speed on Watson’s expanding range of cognitive capabilities and industry depth and most importantly, unite the industry heavyweights that are most heavily marketing AI capabilities. At HfS, we increasingly view smart partnerships with real teeth as the way forward for the software and services industry makers.

The ecosystem around Watson capabilities is slowly starting to emerge. IBM is working on a more structured approach to driving the broad capabilities toward partners that often are its competitors beyond the more narrow Watson context. As with all partnerships, most will come down to the investments into the collaboration and how transparent the account management will be. For IBM the partnership could accelerate the pervasiveness but also the commoditization of its Watson capabilities. The upside could lie in establishing Watson as de facto standard for broader industry platform and thus see Watson crystalizing its position in emerging ecosystems. Conversely, Salesforce could get access to much deeper analytics capabilities that would increase the stickiness of its products.

For the broader market, this could provide the blueprint for driving Watson capabilities into other industry platforms such as ServiceNow, Workday, and others. Fundamentally though this requires significant education of clients that the combined marketing power of IBM and Salesforce could provide. And these initiatives could prove tactically helpful to contain the impact of emerging competitors to Watson. If executed effectively, the Digital Underbelly of the OneOffice could mature significantly faster.

Posted in : Cognitive Computing, intelligent-automation, saas-2, smac-and-big-data