Everyone we talk to these days has become a data governance obsessive, regardless of their role. Whether it’s ensuring data flows are effective across front to back office to align customer engagement with employee effectiveness, or accessing external data up and down our supply chains to stay ahead of our competitors and cement strategic partnerships.

In short, we need to make our data ubiquitously available, accessible, and mineable – embedding a mindset into our leadership to inspire our people to work together to create an organization that can flip our business models to exploit these seismic market changes. But we can’t get the data we need if our critical data is not in the cloud and we don’t have the people, partners, processes, technology – and desire to change – to make this possible.

At HFS, we describe data and decisions services as an array of services designed to help customers create a culture of data that drives new opportunities through interactions, insights, and predictive capabilities, giving clients the ability to access data at a speed that drives critical decisions for their business.

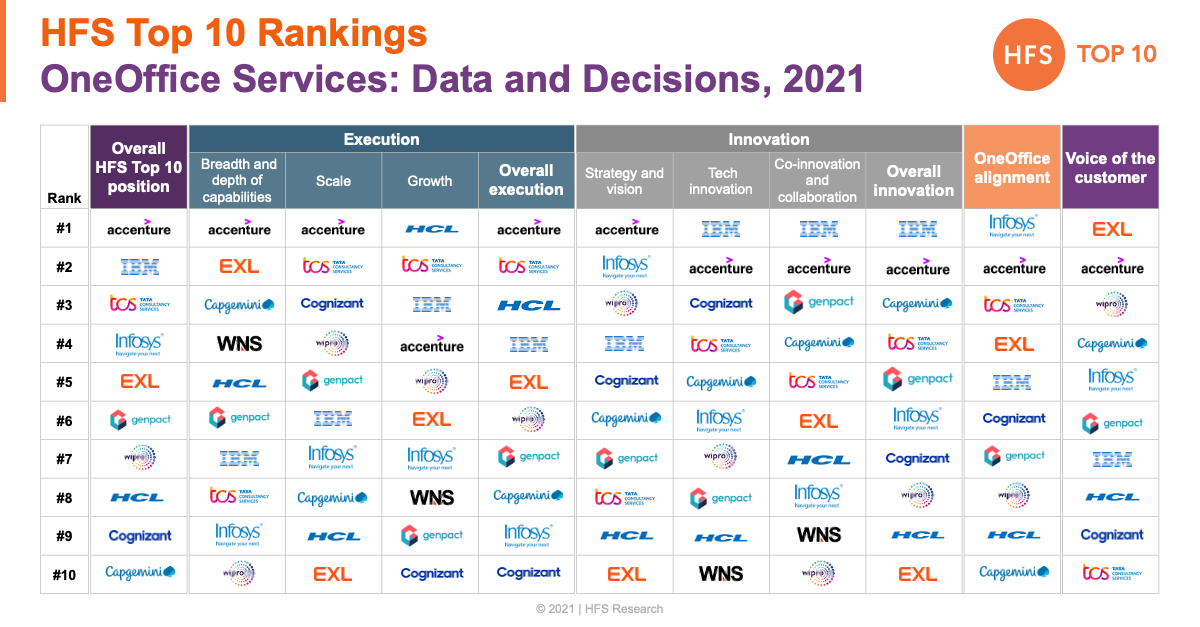

This month, we unveiled the 2021 rankings on Data and Decisions (download report here) which clearly show which providers have been able to maximize the value of their data investments during the pandemic:

To learn more, I sat down with Reetika Fleming, Research Leader and David Cushman, Practice Leader at HFS to talk about their reflections and perspectives in working on one of our most exciting and topically relevant research publications, 2021 HFS Top 10 Rankings on Data and Decisions.

Phil Fersht, CEO and Chief Analyst, HFS Research: So Reetika, What did you learn from doing this interesting and topically relevant Top 10?

Reetika Fleming, Research Leader, HFS Research: Well an obvious one was that organizations turned to their data investments to help them survive through the pandemic, and there’s more to come down the line. We realized the need for a strong underlying data foundation to develop business agility. And agility is key to tackle planning and budgeting through market volatility, cope with supply chain challenges, or redesign operational processes to function virtually. The data and decisions service partners to the Global 2000 that we evaluated for this Top 10 all shared examples along these lines.

Phil: Anything that surprised you from this Top 10, Reetika?

Reetika: One thing that didn’t surprise me, was the level of demand for data and decisions services across the value chain of consulting, data management, data visualization, and analytical modeling. Across the participating service providers, we observed 41% average growth in the number of clients in data and decisions between 2018 and 2020.

I was surprised – in a good way – by the number of business leaders taking ownership and driving enterprise-wide data and analytics initiatives, in collaboration with CDOs and CIOs. Traditionally, the IT organization has driven data governance and infrastructure-related mandates that has inhibited the strategic use of data in business. This is starting to change, and we’re finding business leaders more and more wanting to come out of their “pockets of expertise” in data and analytics and wanting to collaborate with their peers across departments and drive global standards of data sharing and trust.

Phil: So, Reetika which Service providers are Top on the list? Why?

Reetika: For the Top 10, we assessed 11 service providers across execution, innovation, OneOffice alignment, and voice of the customer criteria. The top 5 leaders are, in order, Accenture, IBM, TCS, Infosys, and EXL. Their secrets to success are not all the same, interestingly:

- #1 overall – Accenture – Accenture’s Applied Intelligence practice continues to grow rapidly, bolstered by C-suite and board-level attention and investments – resulting in its #1 spot for Execution and the overall study. Accenture’s vision on “intelligent operations” holds strong, and a simplified “OneAccenture” go-to-market strategy makes it easier to anchor around. The internal transformation story is very much tied to data, where it is ‘making AI everyone’s business at Accenture’ giving it a #2 in OneOffice Alignment.

- #2 – IBM – IBM is having tremendous success collaborating with its clients on data and decisions – its Garage methodology is paying off, earning it a #1 on Co-innovation and collaboration. IBM also has a rich history of investing in technology innovation, including data, analytics, and AI patents that helped it earn the #1 spot in innovation this year.

- #3 – TCS – TCS has always done really well in our data and analytics studies for its highly scaled talent pool of specialized talent that clients need to make large engagements successful. While TCS did do well in Scale (#2), it did equally well with Growth (#2), as it has one of the fastest-growing D&D practices – even at its size.

- #4 – Infosys – Infosys came out as #1 in OneOffice alignment, owing in large part to its internal transformation efforts to better serve D&D clients. . Its focus on creating net new talent is commendable, with internal investments such as Lex/Wingspan, external partnerships such as Udacity, and getting creative with new types of skillsets and roles in data (e.g., data hunters and AI story tellers).

- #5 – EXL – EXL has one of the highest concentrations of advanced analytics specialists, which helped it earn the #2 spot for Breadth and depth of data and decision capabilities. Where many service providers are focused on the lower end of the value chain in data management and reporting, EXL is doubling down on highly strategic engagements. Its also a customer favorite, coming in #1 for Voice of the Customer in our study.

Phil: David, my question for you is this. We always go deep on voice of the customer to round out our research. Any notable takeaways here?

David Cushman, Practice Leader, HFS Research: EXL stood out here claiming the top spot in our Voice of the Customer category, on a podium completed by Accenture and Wipro. Customers like EXL’s ability to deliver “end-to-end solutions built at pace, at cost, with high reusability.” They rate size, scale, cost, speed to delivery, and response times as EXL’s greatest strengths.

Accenture customers told us: “They have problem-solving capabilities at scale.” Customers feel Accenture can introduce big ideas in ways that aren’t scary, and that they take pains to understand their clients’ businesses. Customers praise their open and honest communications and ability to respond at speed.

And there was praise for Wipro’s communications. Their regular updates on plans as they progress were welcome in a period in which clients faced the disruption of Covid-19. Clients describe Wipro as a “true partner” and applaud them for bringing a strong mix of internal IP and external capabilities. Wipro’s data understanding, data management capabilities, and speed of development also ticked customer boxes.

But it’s not all roses. Our Voice of the Customer research found that in many cases providers need to be more proactive in mitigating the risks introduced by remote work. They want more of what Wipro has been delivering – communication, communication, communication.

Some feel they don’t always get the full power of the service provider they sign up with, either. The gap between the vision they are sold and the actual access to capabilities delivered, too often fall short.

Enterprises have noticed high rates of staff turnover and that this is having impact on their programs.

Phil: What are some of the common trends on how enterprises are working in this space David?

David: There is a growing understanding of the foundational role of data in digital success. That’s reflected in big money being laid out. The $35b of D&D revenue we estimate the 13 service providers in our report are now earning a year, represents between one quarter and 35% of the money enterprises spend with those service providers.

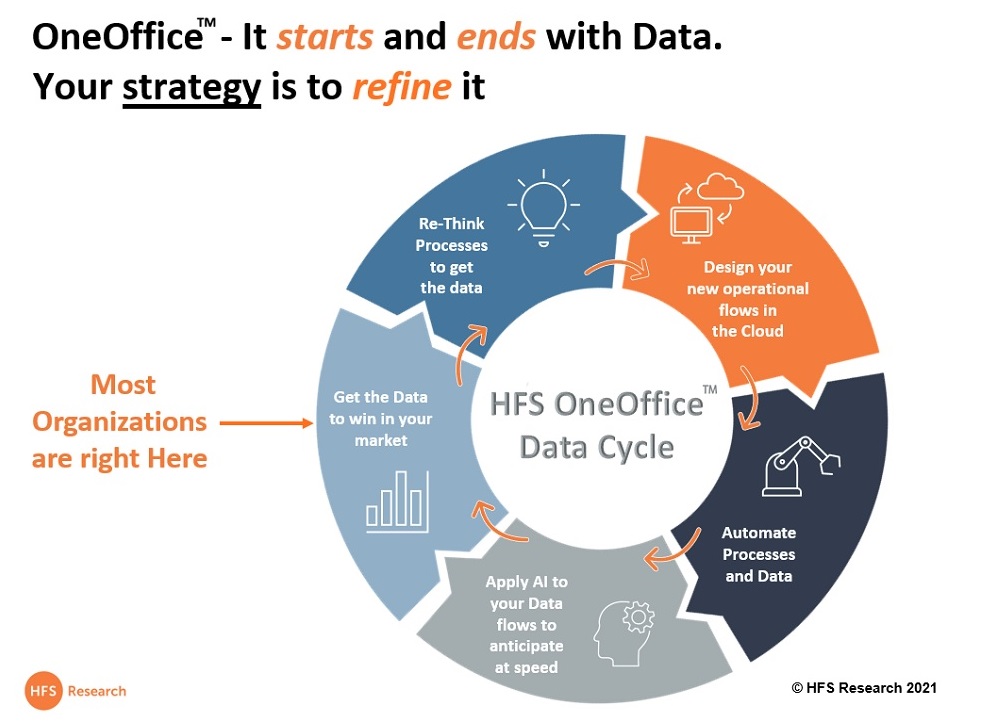

On average, that spend goes on technologies more focused on the early stages of the HFS OneOffice Data Cycle (exhibit included below). Across more than 14,000 enterprise clients, service providers indicated that the leading technology components in their data and decisions engagements are data optimization (55%) and integration (53%). The combination of integration and data optimization is foundational in the HFS OneOffice Emerging Tech Platform, and it is reflected in work in the enterprise.

After data is prepared and integrations are in place, enterprises and their partners seek to apply process intelligence (37%) and process orchestration (42%), rethinking the processes to get their data.

New clients are still arriving fresh to the D&D party in large numbers. Earlier arrivals are now moving beyond project-by-project operations and establishing closer partnerships with their service providers. How deals are getting done remains heavily dependent on traditional FTE and fixed-price agreements. That’s something we expect to change.

The HFS OneOffice Data Cycle

Phil: David, what should leaders do as they move in 2022?

David: If they aren’t already investing in D&D, then this is a wake-up call. You really must get motoring and accelerate around the HFS OneOffice Data Cycle. Those who have started on their journeys should be rapidly building on their foundations with more automation and the application of AI to use data to anticipate market, employee and customer needs.

Learning from the last 18 months, leaders need their D&D service providers to become strategic partners, working closely with them and, crucially coming to them with a stream of new and relevant innovations. So, get creative with the deals you do. Contracts that place value on innovation-beyond-the-pitch – and measure it – will pay dividends.

Our OneOffice Services Top 10 series assesses the digital transformation capabilities of services providers across a trio of core enabling capabilities:

- Native automation: Covering services that leverage a range of emerging technologies to create intelligent and automated workflows in the cloud enabling new “native” standards for consistent cross-functional enterprise operations. To read the 2021 Top 10 Report, click here

- Data and decisions: The subject of this report, these services are designed to create a culture of data, driving new opportunities through interactions, insights, and predictive capabilities and offering the ability to access data at a speed that drives critical business decisions. To read the 2021 Top 10 report, click here

- People and process change: Focusing on capabilities in developing and integrating people and process change across the services portfolio, such as design thinking, change management, skills enablement, and process innovation to drive operations excellence. Top 10 report coming soon!

HFS premium subscribers can access 2021 rankings on Data and Decisions here

Posted in : Business Process Outsourcing (BPO), IT Outsourcing / IT Services, OneOffice, smac-and-big-data