Month: June 2010

Event Alert: Capgemini differentiates its BPO services on global delivery, but can it compete on price?

Capgemini is one of the largest and most well-known European IT/BPO service providers and consulting firms, with revenues of $10 billion, but has struggled in the past become a household name in the US. However, its recent aggression in the BPO market, resulting in notable client wins such as Bunge and Coca-Cola Enterprises, has helped elevate Cepgemini as a serious contender for global enterprise BPO engagements.Read More

Preaching Process with Pramod, Part III: What if you can build a true back-office-in-the-box, based on the Cloud and ERP platforms, which costs a fraction of what it used to?

At long last, we come to the final part of our interview with Genpact's President and CEO, Pramod Bhasin. Phil Fersht and Pramod discuss the future of process consulting, where labor arbitrage is heading, more about the Cloud, and a some advice for today's budding sourcing executives.Read More

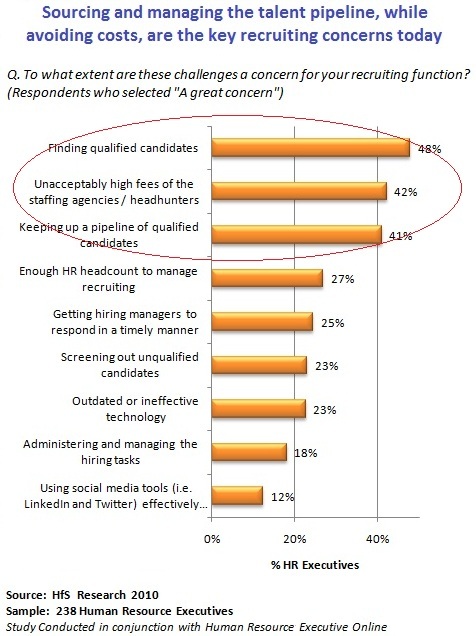

Surprise, surprise… HR still hates outsourcing. Is its next victim RPO, or will it get trumped this time?

HfS Research's latest study, conducted in conjunction with Human Resources Executive Online, gleaned the views and dynamics of 238 HR executives towards RPO. And the first factor that was apparent, was that RPO was low down the list of recruiting services HR executives are going to take a look at this year.Read More

Innovation discovered!

The key to achieving innovation, is to nurture today's young talent, teaching new and creative methodsRead More

Today’s Asia/Pacific: why smart enterprises no longer view it as one region

With much of the US and Europe's economic leaders coming to terms with paying for their years of spending excesses, their financial bail-outs and tethering themseves to basket-case economies, the next decade represents a real shift in the balance of economic power. No longer can enterprise leaders afford to view Asia/Pacific myopically as a single region, requiring a single go-to-market strategy for a "region" that houses 60% of the world's population.Read More

A US onshore view of Schumer’s offshore-tax proposals: “A no-win approach for tapping the strength of the US-based outsourcing industry”

The majority of the viewpoints convey concern and confusion regarding the implications of Senator Schumer's proposals. However, one opinion does standout, coming from a gentleman called Skip Womack, who heads up the US onshore IT outsourcing provider, Advantage Outsourcing, based in Wichita, in the Midwest. Read More

Innovation in BPO purgatory, Part III: the escape route

When it comes to achieving innovation when outsourcing, buyers need to identify where real innovation is possible, and where they only really need operational efficiency. Both buyers and providers need to be honest with themselves to determine whether they are truly prepared to invest in either achieving or delivering innovation. If not, stick to being operationally efficicient and stop talking about an innovation game-plan that will never happen.Read More

Event Alert: Mahindra Satyam faces the global services industry – the bleeding has stopped, but can it regain its Tier 1 India provider status?

Mahindra Satyam recently staged it first analyst conference as a new entity, to announce to industry that its new structure was complete, and was a serious IT/BPO services competitor. Resurrecting itself from the biggest scandal in Indian outsourcing history, a renamed Mahindra Satyam has quietly been going about its business to rebuild trust and confidence in the firm. Read More

Event Alert: Genpact looks to a new era beyond “General Electric’s provider”

In its first industry analyst conference, business process outsourcing (BPO) provider Genpact emphasized its business, today, is much broader than supporting General Electric’s back office and primarily delivering finance and accounting (F&A) services. Read More

Why aren’t I happy with my outsourcer?

How many times have you heard someone say that all our service metrics are green, but the relationship is red? This sort of non-specific concern about an outsourcer seems to be as old as outsourcing itself.Read More