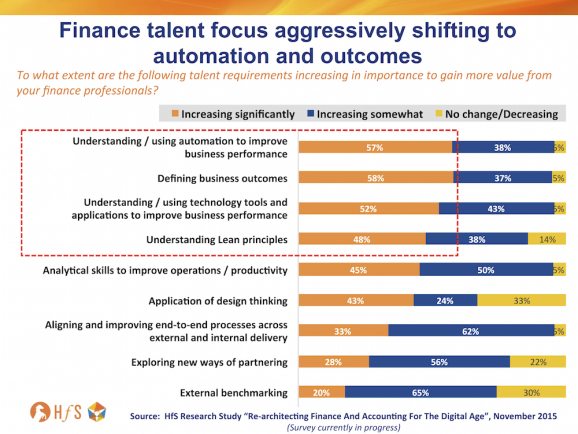

Our current in-the-field study looking at Re-architecting the Finance Function for the Digital Age (click here if you are yet to complete it) is confirming some major changes in the capabilities organizations need from their finance staff:

What’s eye-opening, here, is the softening focus on analytics skills and the huge increase in the need to understand automation and better define business outcomes. I’ve long preached that you can’t really get the data your organization needs real-time, if you don’t have well automated processes to generate it in the first place.

Enterprises are settling for what they have, and are now focused on making it function more productively

It’s becoming clear that staff have to be less focused on creating data, overseeing operational processes and performing routine tasks, and much more adept at figuring out how to make better sense out of what they are doing to achieve more measurable, value-add results (outcomes) for their organizations.

In many cases, enterprise operations leaders are realizing they can’t create armies of world class data scientists out of their current crew, and it’s simply too expensive to hire top-notch MBAs to sit around all day trying to correlate data points. Yes, you need to have some of those people on staff, and yes, you can pay your service provider or consultant to add data talent, but the more immediate and tangible need to shifting to automating finance processes more effectively, and the influx of robotic process automation tools and platforms is changing the conversation.

The fat fluffy middle is running out of excuses

When you talk to customers today, there is a clear growing lack of tolerance and impatience to run operations more efficiently and more digitally… and you simply can’t do that when you rely on messy processes, poorly integrated systems, on-premise software and over-reliance on constant manual intervention to just to keep the lights on. The excuses around security fears of the public cloud, the offshore outsourcing horror stories have run dry and it’s time to act.

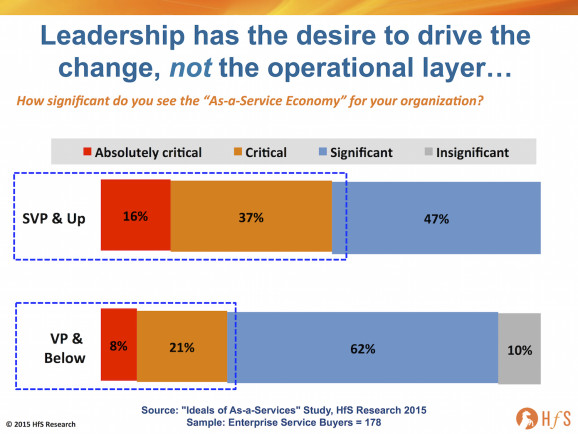

Our recent As-a-Service Study clearly outline the growing bifurcation between leadership vision and middle-management inertia:

Let’s be honest, most people are comfortable with their daily grind – they stare at metrics on spreadsheets, ensure exceptions are handled and the corporate engine keeps running. They turn up at meetings and say all the right things, avoid challenging the status quo (while acknowledging there can always be improvement), but deep down have settled for adequacy and a steady treadmill of efficiency without too many fireworks or drama.

The Bottom-line: It’s time to get with the program, or get out of the way

Why would they want to learn how to access and interpret data more intelligently? Why would they want to find problems, as opposed to reactively solving them when they crop up? Why would they want to mimic manual processes into scripts to have them run robotically, when they can patch over these inefficiencies with cheap offshore labor? Why would they want to explore the potential of artificial intelligence and self-learning computing capability when they can just do these things themselves (or at least pretend to do them). Answer – they have no burning platform to change the way their do their jobs.

But there is one significant burning platform that will burn them, if they are not willing to adapt to the As-a-Service world: they will be irrelevent in tomorrow’s enterprise. Yes, they may be lucky and survive in legacy organizations that can get away without changing, or they may be in their late 50’s and only care about lasting a few more years until retirement, but – for most – if they cannot adapt to As-a-Service, their bosses will shift them on and either replace them with a service provider staffer, or just simply phase out their legacy job, as it was not really needed anymore.

Stay tuned as we drip this study out to market in the next few weeks. The world changed at lot in 2015, and we need to get back to basics in 2016 to understand actions customers are taking to change with it…

Posted in : Business Process Outsourcing (BPO), Design Thinking, Digital Transformation, Finance and Accounting, HfSResearch.com Homepage, HR Strategy, kpo-analytics, Robotic Process Automation, SaaS, PaaS, IaaS and BPaaS, smac-and-big-data, Sourcing Best Practises, sourcing-change, Survey: Re-architecting Finance for the Digital Age, Talent in Sourcing, The As-a-Service Economy, the-industry-speaks

Phil – nice piece and good observations.

Clients are focusing more on automating and standardizing their back office processes. You’re exactly right – the excuses are running dry and companies want to drive out the inefficiency and cost.

What do you think will be the catalyst for RPA? Clearly there’s a lot of talk, but will there really be significant adoption?

Paul

Phil – nothing like calling it how it is! Great piece.

Let’s be honest here, finance is not strategic anymore. Buyers want to drive out the cost and automation is the flavor of the month to do it.

@Paul – most of today’s RPA tools are not rocket-science, but need to form part of a broader automation strategy. In most cases, it’s figuring out what not to automate which is the way forward as firms can drive themselves crazy trying to automate all their moving parts.

So two things need to happen to spark adoption:

1) Awareness and understanding. Until recently, most clients have been fact-finding to figure out what’s possible and why they need to do anything. Many now have at least a rudimentary understanding of where they can take this, if pushed (especially those with sophisticated shared services / BPO operations looking for the next value play). Current data show only ~12% of enterprises have definitive RPA strategies, but well over half expect a major impact from RPA in the next two years.

2) Proof points with hard data. This is what will ultimately force buyers to make the shift – once the stories of RPA impact on cost start to filter into the market, we’ll see a wave of concerted pressure on CFOs to drive automation strategies. While I would love the conversation to be more about the added value of augmenting people’s jobs with better tools and tech, the sad reality is it’s the hard numbers that will force decision-makers to take notice.

However which way we look at it, RPA is now part of business operations. Now’s it more about the pace of change, and macro-economics that will dictate behaviour.

PF

@John – not so sure automation is just a “flavor of the month” – it’s highly infectious. Maybe “disease of the decade” is more apt =)

PF