Month: April 2018

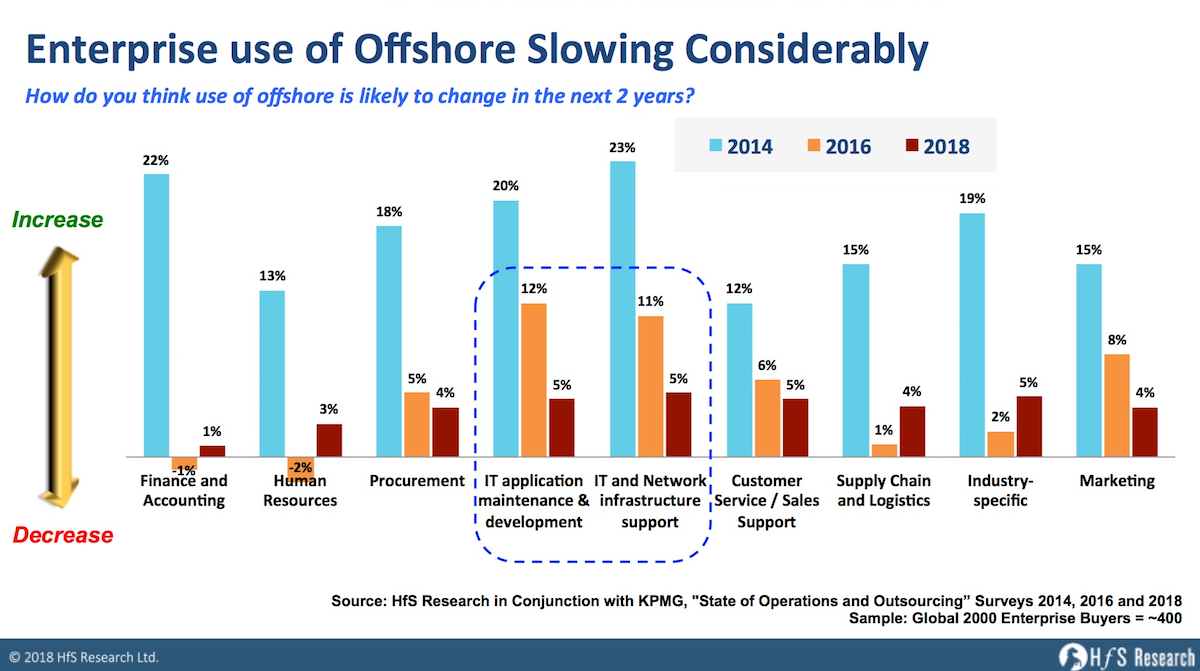

Offshore outsourcing died with Trump. Now value-based partnerships are rising from the ashes…

New data from the HfS/KPMG State of Industry study shows IT offshoring slipping from 20% to 5% growth over just the past four yearsRead More

Japan: The Land of Rising Automation

Japan’s skills crisis is driving automation at a breakneck paceRead More

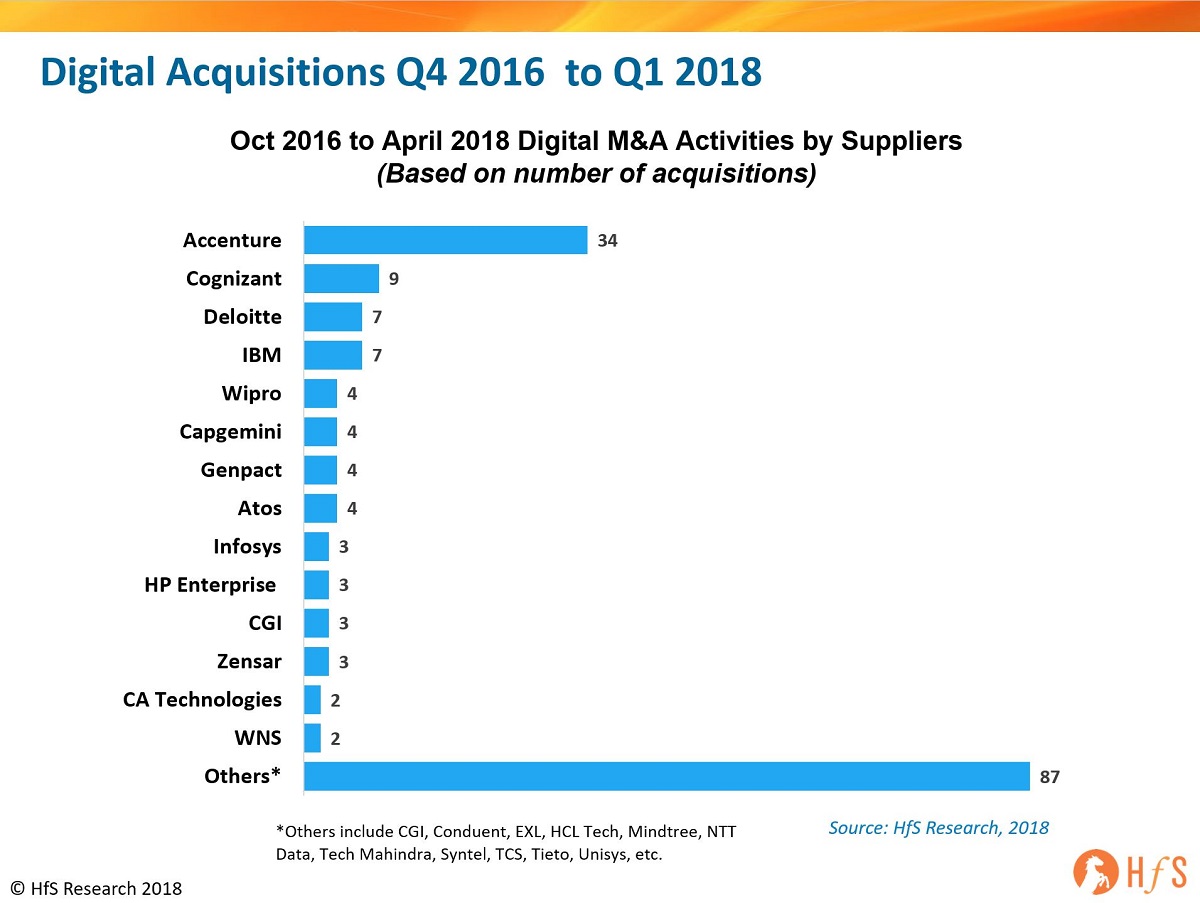

Can Infosys be the one to challenge Accenture’s digital services dominance?

The cards have being played from Infosys' new CEO Salil Parekh - and it's a concerted digital play to offer clients an alternative to AccentureRead More

We’re becoming obsessive social networkers with a huge appetite to learn from each other

New data shows the ability to partner, be intellectually curious and creative are the most in-demand skillsRead More

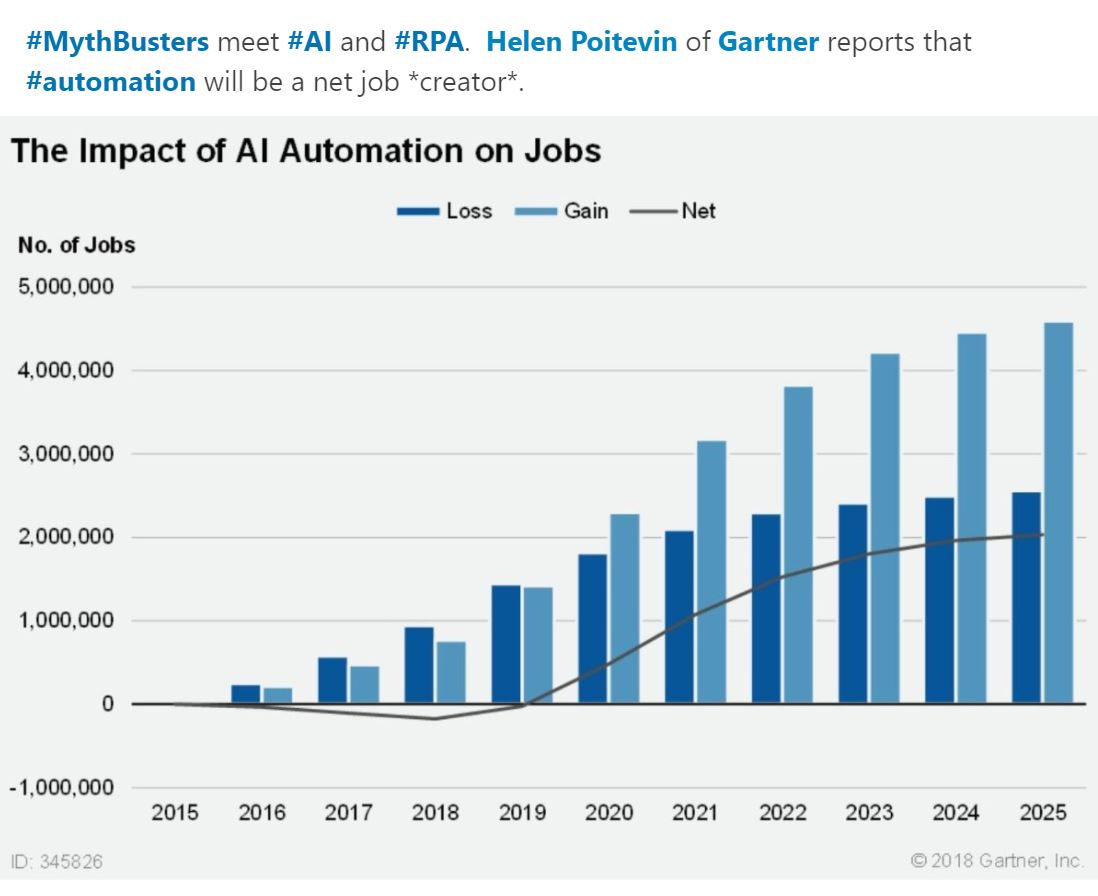

Gartner fails spectacularly with its 180 degree flip on the impact of AI Automation on jobs

While many people love to keep spinning new headlines everyday, in the hope #fakenews is now the #realnews, some of us still have memory banks that last longer than one week, especially when CIOs spend billions of dollars for this type of councilRead More

Fed up with the AI nonsense? Well here’s your reality check…

An unvarnished, unsponsored, unpuffed view of the AI enterprise world from HfSRead More

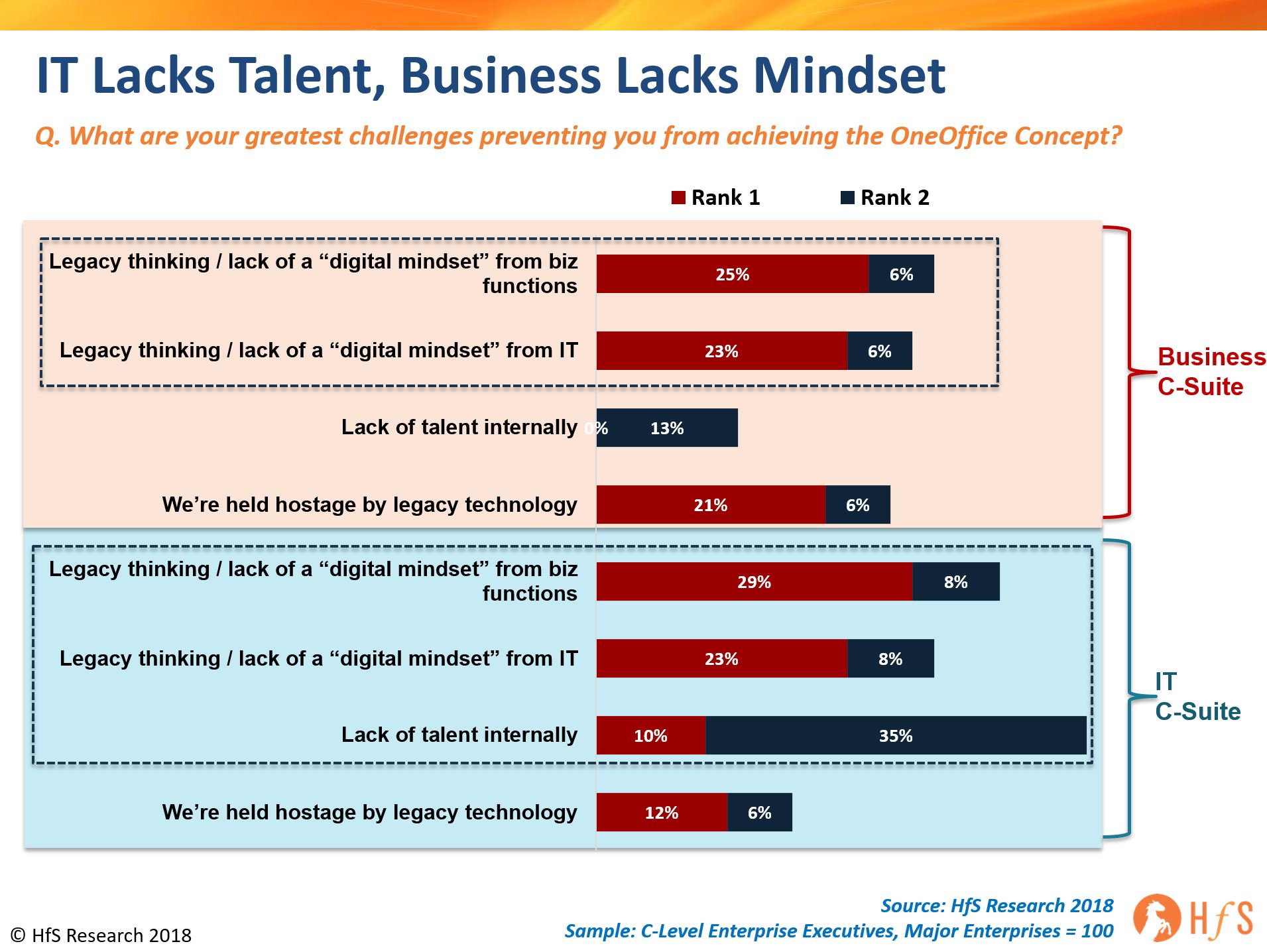

It’s not all about mindset: The lack of IT talent is the biggest roadblock to reaching the Digital OneOffice promised land

It's not just about software packages and APIs, it's about both business and IT staff learning to understand each other's strengths and challenges betterRead More

How blockchain will change the world in many more ways than you realize. It’s cataclysmic

New research from HfS is demonstrating Blockchain's value could go even further than merely digital assetsRead More