It took a while, but we’ve finally seen the cards being played from Infosys’ new CEO Salil Parekh – and it’s a concerted digital play to offer clients an alternative to Accenture. Make no bones about it, the intentions are crystal clear to reverse the course Vishal Sikka set with a software-centric “product” approach, and follow the Accenture model of creative digital services supported by technology-agnostic execution. The firm, once affectionately dubbed the “Indian Accenture”, has gone full circle to reclaim its mantle and revitalize itself as one of the key services alternatives to enterprise clients seeking high-value digital capabilities enabled by industrial-scale technology execution. Infosys has never been one to go about its business quietly – the firm likes to make big bold statements and attack the industry with a swagger – and, after a full year of navel-gazing as Sikka’s reign fizzled out, amid a very public media obsessed with scrutinizing every private jet excursion and every former SAP executive’s departure package, Salil has made his play in typical Infosys style.

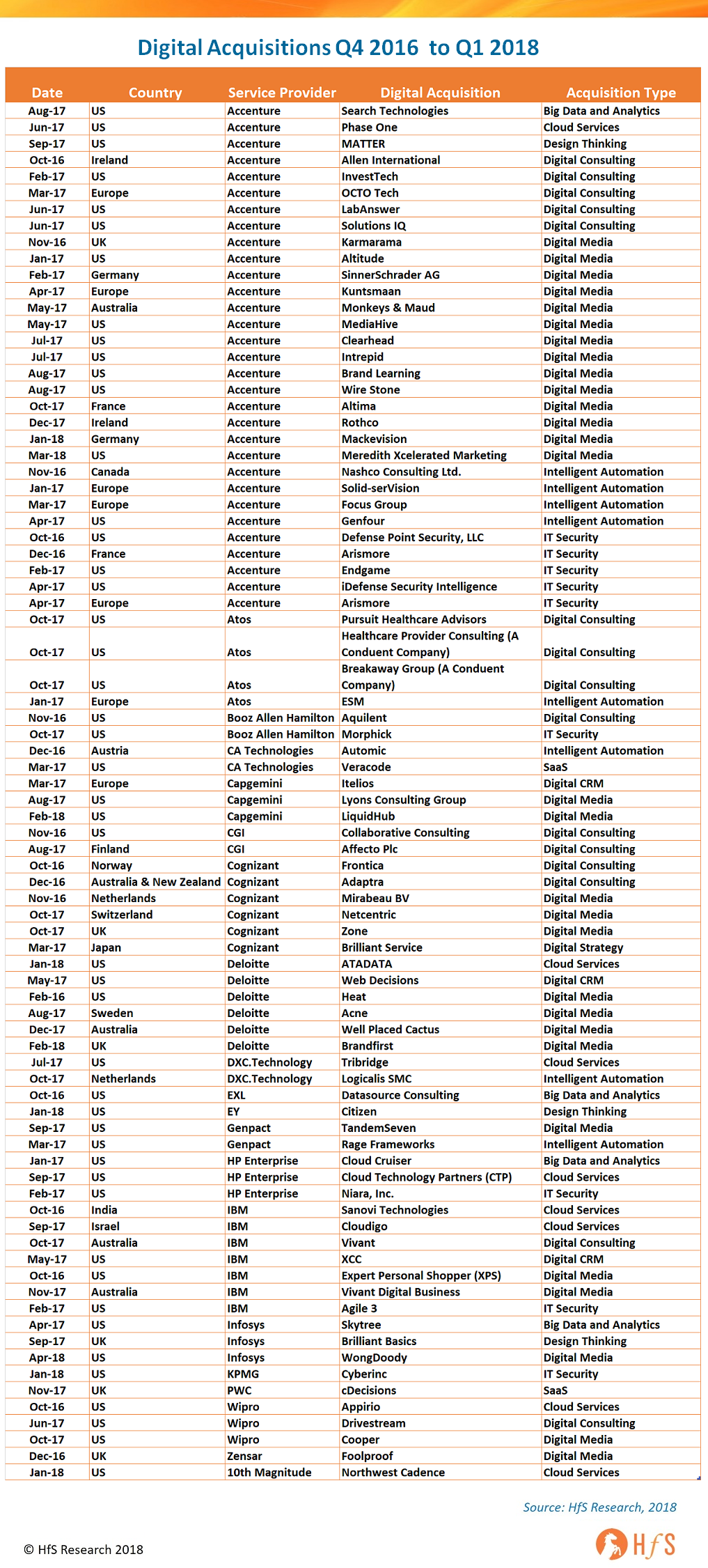

With the chest-beating battle cries coming out of the firm’s Q1 results, Salil and his new founder friends believe they have the credibility, brand and global presence to slip in front of its rivals, notably Cognizant, TCS and Wipro, and to make up for lost ground and quickly assert their presence in this digital race for client supremacy. The (surprisingly open) stated effort to sell off their product acquisitions Panaya and Skava (and likely more), the recent acquisition of creative agency WONGDOODY, famous for its Superbowl ads, and its 2017 addition of London-based product design agency, Brilliant Basics, gives Infosys a creative digital footing in both US and Europe.

So can Infosys break out of the pack to challenge? Let’s take a look at the Digital Services market…

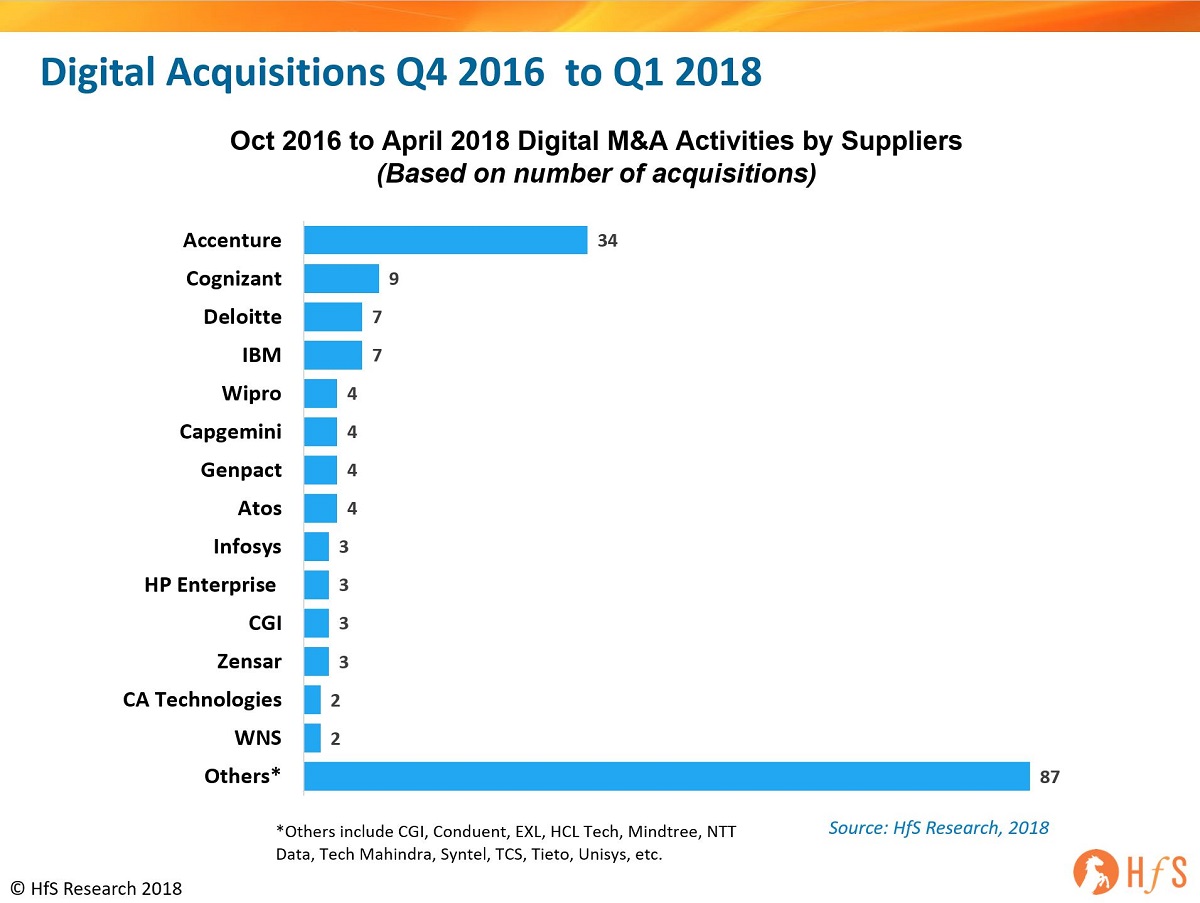

There’s been enough noise and confusion regarding what constitutes digital and which providers are truly breaking ground here, but the stark reality is that Accenture has made a relentless concerted acquisition strategy to dominate this market from the onset, and the current race is on from the rest of the service provider community to challenge them:

Digital services provide the natural evolution of traditional IT and business services firms, while products-plus-services is a struggle

For all Vishal’s intelligence and vision, the reality became very clear towards the later stages of his tenure as Infosys CEO: traditional IT services firms will always struggle to become products-plus-services firms as they simply do not have the channel to market, the sales structure or the culture to sell these offering at a one-to-many scale. “SAP has 45,000 clients while we only have 1,200” was his realization. Services juggernauts like Infosys are never going to scale effectively down to the lower middle market, hence need to deepen their footprints with large clients which are profitable to manage in their global delivery model. And remember Accenture’s aborted attempts to make a mid-market play?

A one-to-few model may work in very specific areas such as procurement (Accenture and Procurian) or healthcare (Cognizant and TriZetto), but these investments are substantial and require a significant amount of time, focus, and investment to make viable. This is why Salil made the aggressive decision to abort Panaya and Skava – these require a massive effort to deepen sales and delivery capability to make these investments truly worthwhile and pivot Infosys into a much more specialized direction. The realistic growth for a firm like Infosys is in winning big-ticket enterprise services accounts on long-term deals that require significant scale and transformation. There is a reason TCS is leading the services industry in valuation – it has its tentacles firmly wrapped around large, multi-year client relationships and is not bogged down in discreet product acquisitions.

Digital services represent the high-value end of the services business where firms like Infosys can embed themselves for many years if they get this right – the ability to design, manage and deliver the customer engaging front office, supported by a digital underbelly, support organization and predictive analytics (as we at HfS term the “Digital OneOffice“). It is that ability to enable clients to respond to the needs of their customers in real-time: Digital is the wow factor that is setting apart today’s services firms. The reality is most of these providers are competent at delivering IT services at scale to meet whatever KPIs were agreed at the onset of a contract. So the differentiation is that ability to help enterprise clients delivery the digital experience for their own clients – and you can only really do this if you have absorbed sufficient design and consulting talent at scale. Digital is much more about a services experience than a specific product experience – there are many apps and tools clients can use, but it’s how they are aligned with the business strategy that really matters. This is why Accenture’s technology agnostic strategy of the last two decades is the one so many services firms are now following.

The Bottom-line: Accenture created the digital services market and there is no clear contender to take them on from an end-to-end services standpoint. Infy has as good a shot as any of its key rivals

Three small-scale acquisitions are merely a statement of intent, but the hard work starts now – and it is a serious about of hard work! While WONGDOODY and Brilliant Basics are very credible firms and get Infy on the map for digital design and media services, Salil and his cohorts need to savage the market with some further significant investments if it wants a place firmly at the big boys’ table. Cognizant has done an excellent job taking its SMAC stack into a very meaningful effective digital offering, and currently is pushing Accenture the most aggressively, with focused offerings and marketing. Wipro has made some admirable efforts with Designit and Appirio to win some notable deals and has been very focused on this space, vastly improving its communication and positioning with clients. The reality is, no one has come anywhere close to rivaling Accenture’s scale with digital and we need to see a lot more than some small agency investments if any of these firms want to make a realistic play at Accenture’s dominance. Firms like Infosys now have to bet big if they want to do more than pay lip service to the new wave of technology-focused offerings. A major consulting acquisition, such as a Booz or AT Kearney, could make the difference, but will likely be a one-shot deal to make or break their strategy, and we all know how messy these services-plus-consultant acquisitions can get.

The bolder play is to go after one of the large creative media/advertising agencies that offers clients and scale that get Infosys immediately to the table. Firms like AKQA, BBH, M&C Saatchi, Ogilvy & Mather, Sid Lee and the Miller Group (to name a few) would deliver immediate credibility and digital design capability to a firm as ambitious as Infosys. Infosys has the swagger to pull something like this off, but has never faced such a test of focus as it does right now – it has picked its path, now the firm needs to pace some serious, eye-catching investments to stay true to its word. Most importantly, the Founders needs to stay true to Saili and not have him experience the wheels come off like they did for Vishal – that is not a road Infosys can afford to go down again, as next time there won’t be a forgiveness factor from its clients or the industry at large.

Posted in : Digital Transformation, OneOffice

Good blog Phil – you outline the industry very well. Is this market all about acquisitions, or are there firms doing this organically?

Andy

Apart from affecting the bottom line, one should also consider the actual realisable benefits these M&A ventures have brought for the parent org. along break even predictions. Perception & double entry book keeping can be only visible benefits thus far.

@Dipayan – a very pertinent point. Accenture has taken a while to get their M&A on track in this space, but agree reusing these assets is a big challenge, and explains why most these current acquisitions are relatively small and low risk.

PF

Interesting view of investment by the market leaders. Cognizant has quietly established great capability in this area and I suspect their corporate culture leads to more rapid integration of capabilities.

@Jim – Cognizant really gets the digital value proposition and makes the traditional firms like Accenture and Deloitte uncomfortable. In my view, Infosys needs to get to Cognizant’s level first before it can seriously consider giving Accenture a serious run… and we could see Cognizant make some aggressive moves in the near future also – just look at its recent acquisitions,

PF

Excellent work Phil. Infosys needed some direction and this seems like a good start, not only picking up some digital capablity but publicly stating they are selling off assets that are not key to where they want to go.

Let’s hope we don’t get another leadership drama like last time!

Phil,

Great insights and thank you for sharing all the M&A data. I agree this product approach is challenging for these providers who are not well set up to sell them on a wide enterprise scale – digital is the way to go for companies like Infosys, Cognizant etc

Carlos

@Anildeep – most of these acquisitions are centered on adding talent with the creative, technical and business acumen to design solutions with clients and help implement them. It’s a costly exercise to grow piecemeal like this and very easy to execute the M&A poorly and lose what you bought quickly. Accenture, as an example, made the mistake of trying to “Accenturize” acquisitions too quickly and ended up losing much of the talent, culture and clients that came with it. They course-corrected with Fjord and now do a much better job maintaining the DNA of what they bought and building it into a less “forced” model where creativity is widely encouraged and continuing the business ethos as before, but with the Accenture resources behind it. Cognizant and IBM are also going through similar experiences with their acquisitions.

There are many regional plays to be made here to go after local markets – digital is all about infiltrating local – as well as global – business environments which is why it’s so important to spread the talent globally. Infosys is doing a good job putting more feet on the street in the US which is helping its push to drive more intimate solutions, but as mentioned, it would benefit from some larger acquisitions to make up for lost ground,

PF

Wonder if there is a more of regional client acquisition play ( + localisation spread ) to this than just plain digital offerings to the acquisition strategy . Cognizant seems to have a focus on European markets + ANZ , Japan and none in US . No players except for IBM has acquired Indian companies .

Phil,

A lot of focus here on M&A for digital – what about growing organically?

Andy

Hi Phil,

Your two paragraphs in reply to AnilDeep pretty much capture the gist of this predicament succinctly. Agree with all of it though the absolute last bit has far reaching consequences (….benefit from large acquisition).

I think strategy (in your actions) in such a space must stem from clarity on goals, competition moves and your timing. Then execution and course corrections along the way.

Are you intending to build capability through small acquisitions and then evolve organically to compete forward and create your marketspace/share? (OR) Are you intending to build capability AND revenue volume at scale, to then establish a leadership beachhead quickly to defend?

And what is your timing?

I guess some firms have realized so very late that the revenue volume is at the first level of digital (the digital marketing, consumer/employee/partners focussed agencies, the last mile digital etc.), than at the layers above (AI/ML/Automation and Industry 4.0 and beyond) albeit fragmented and local. They are grappling with this however because everyone is rushing in, so the ones doing it consistently with a strategy and over time (Accenture) may do better over the occasional digibuys so late in the game.

If the intent is to build the (creative + technical + business consulting) talent pool to useful scale, would it not serve them better if they marry these small local acquisitions in a SFO or a Sydney or a Toronto to similar acquisitions in India and elsewhere in Asia, build a network that operates locally and globally? Without a really well thought/planned strategy on this they will “……lose what you bought quickly” and go nowhere.

And would it not be a good thing to build+buy a 30M digital agency in India and work locally, if you are an Indian HQ tech firm then expand the network? Do they have comparable experience and record in their own backyard first?

To the point about having to buy something at scale quickly (whence already behind) and so the need to take more risk and therefore a bigger “agency network” acquisition, the challenge is in managing the outcome if the big decision goes south especially after a few recent bold moves have been so embarrassing. Also notice how poorly these firms fared in even building consulting to scale (neither organically nor the big bang acq. there) in the good years that went past.

Maybe a Cognizant could do this (a big bang acq.?), than an Infosys. They are somewhere in the middle (of Accenture and the rest) on their strategy. Plus they have shown the ability to do acquisition at scale, consulting at some scale.

@Andy – if the goal is to design digital business models for clients, then the IT services firms simply have to buy in the skills to get a start in this space. These services firms have been built up over decades to deliver and manage technology implementations – at scale – *not* to design new revenue models through digital channels. In short, today’s IT services firms are engineers, technologists and transactional processors steeped in Six Sigma and LEAN, and this shift to digital solutions is forcing them to develop creative and entrepreneurial skills to be true co-innovation business partners with their clients, where digital technology is core to those business models (see the talent needs from clients in an [earlier post](https://www.horsesforsources.com/skills-most-in-demand_041618).

Once these providers have brought in enough talent which is located geographically close to its clients, they can start to develop more inhouse training to add depth and scale – and I would argue only Accenture is really at the point where it has sufficient scale to push organic growth through is substantial portfolio of agencies.

I would also make the point that a lot of this organic digital growth can only be effective if there is a significant cultural shift towards more of the right-brain design thinking skills – and this is something that will take these firms years to cultivate.

Hence, acquiring agencies and other digital people assets has to be through multiple geographic acquisitions, mergers or carve-outs in the initial phases to get enough depth to drown organically. There is a possibility of a firm like Infosys, TCS, HCL, Cognizant etc moving faster by acquiring a larger digital media asset, but this increases the risk significantly if that acquisition fails. We also need to be mindful that adding the “digital right brain” to the “services left brain” is a major cultural change that will take years to make truly effective. Remember all the telecoms firms which went bust after Y2K because they failed to diversify their services beyond networking… it’s not so different from today’s IT services firms looking t add the digital business acumen.

PF