Category: state-of-outsourcing-2011-study

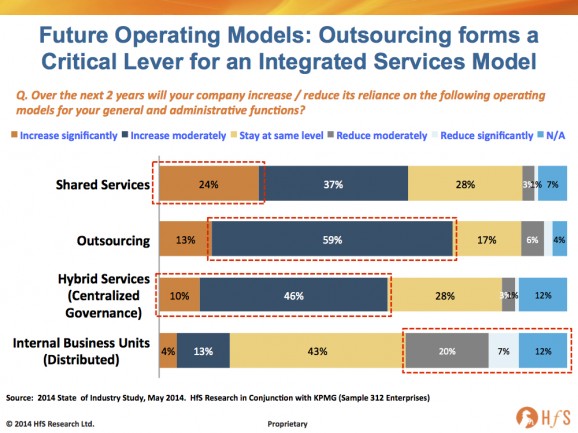

Outsourcing and shared services investment intentions at record high as the Integrated Global Services model takes center stage

Simply plastering more and more lipstick on the same old pig is eventually going to fail for many as Integrated Global Services becomes the future model of choiceRead More

Happy birthday, Dodd-Frank!

Please join us in wishing Dodd-Frank “Happy Birthday.” This is the largest financial reform act in U.S. history, amassing 884 pages when it was finally signed in 2010, designed to enforce the most significant changes to financial regulation in the United States since the regulatory reform that followed the Great Depression.Read More

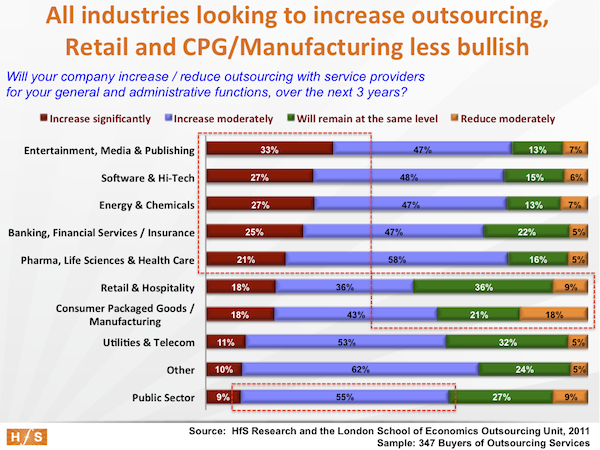

Which industries are more inclined to outsourcing versus shared services?

Secular changes to industry environments are crystallizing options for businesses and driving more radical and actionable behaviors from executives under pressure to deliver continual productivity improvements. The radical impact outsourcing can potentially have on business performance is clearly becoming more attractive to those businesses in the throes of tackling fundamental challenges and opportunities to their business environments.Read More

The undisputed facts about outsourcing, Part 8: Industries experiencing secular change have more aggressive outsourcing plans

Those organizations being impacted by radical, fundamental shifts to their very industry economics, are more prepared than ever to admit they need to look outside of their current organization boundaries to keep their business operations cost-competitive. Simply-put, secular change crystallizes options for businesses and the outsourcing planning process often becomes more clear-cut as a result.Read More

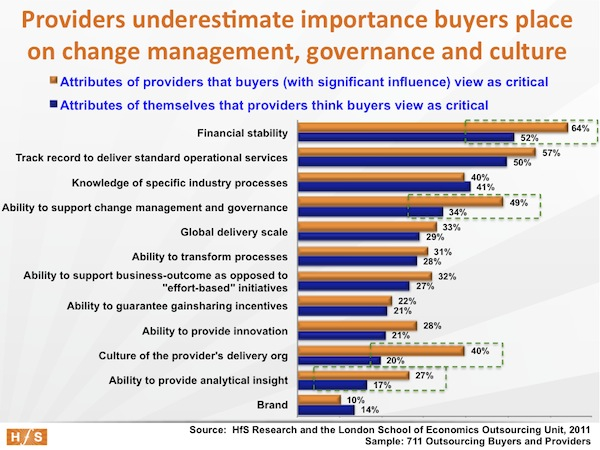

The undisputed facts about outsourcing, Part 7: Service-culture is the new differentiator

We asked a cross-section of buyers with significant influence over outsourcing decisions, to reveal the critical attributes they seek in a provider. At the same time, we asked providers what attributes they believe their clients deem critical. And - guess what - their are significant gaps between what clients want and what providers think they want.Read More

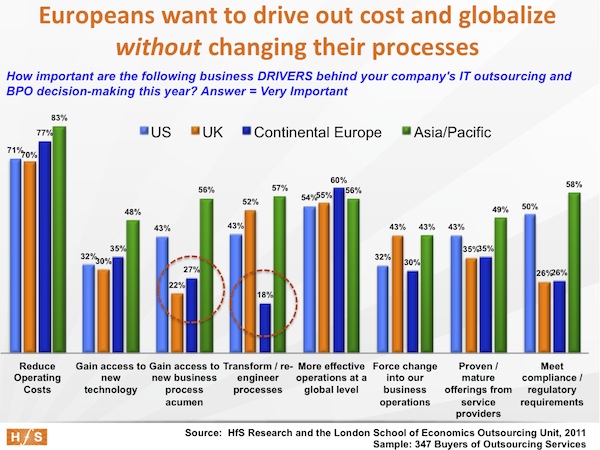

The undisputed facts about outsourcing, Part 6: Europeans love money, but hate change

What's driving outsourcing decision-making across the world? HfS Research's new study on global outsourcing adoption reveals some key regional differencesRead More

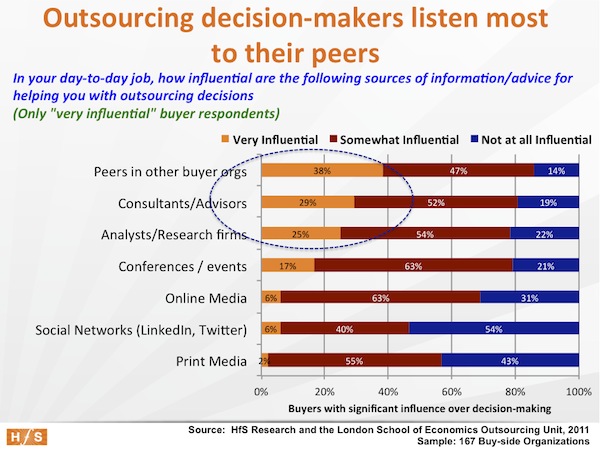

The undisputed facts about outsourcing, Part 5: Decision-makers increasingly reliant on peer-networking and research than traditional channels

In the past, outsourcing was still a unique, foreign and scary activity, and it was always easier for buy-side executives to bring in consultants to make their decisions for them - especially as there were so few trusted data-points and information sources widely available in the industry to support decision-making. Executives didn't want to get fired for making bad decisions. However, today they know they'll get fired for the wrong decision regardless of who made it - whether it was theirs' or McKinsey'sRead More

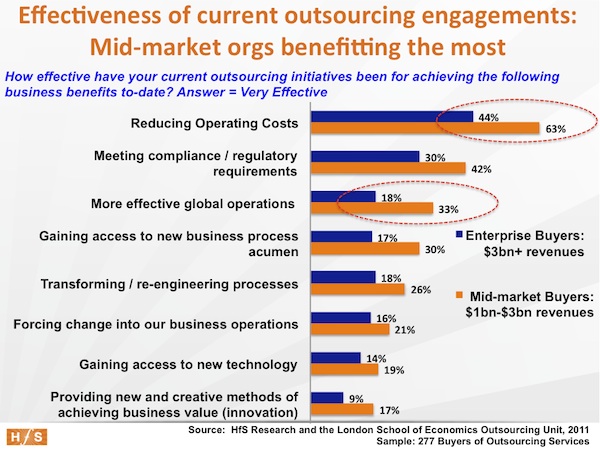

The undisputed facts about outsourcing, Part 4: Mid-market buyers are enjoying better outsourcing outcomes than enterprises

Outsourcing of IT and business process has always been a game for large enterprises, where well-executed large-scale employee transitions have resulted in profitable endeavors for both providers and buyers. But while the large buyers like saving the money, it’s actually mid-market sector ($1bn-$3bn revenues) which is getting a lot more out of the experienceRead More

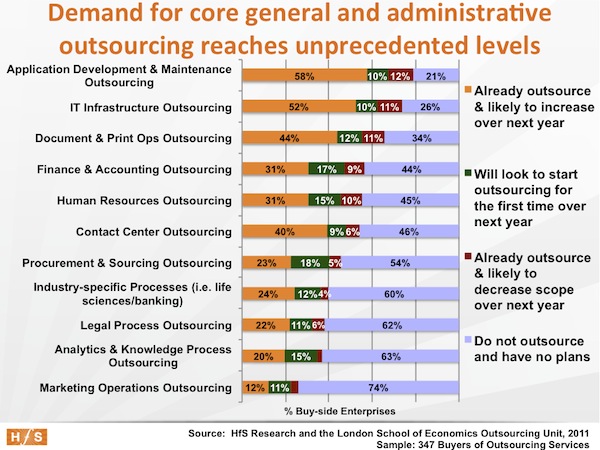

The undisputed facts about outsourcing, Part 3: With outsourcing demand at unprecedented levels, can new buyers get across the finish-line?

HfS Research's "State of Outsourcing 2011" study of 1335 industry stakeholders, conducted with the Outsourcing Unit at the London School of Economics, points to a marked turnaround in outsourcing intentions as global economies reach a period of sustained (albeit limping) recovery. For many organizations today, clearly the short-term counter-recessionary measures have been executed through to fruition, leaving business function leaders under renewed pressure to seek out new operational strategies for driving out cost and improving global effectiveness.Read More

Nobody doesn’t like Sara Lee… and everyone loves an iPad 2

If you participated in our State of Outsourcing 2011 survey, you may have been anxiously monitoring your inbox for a notification that you'd won the iPad 2. Well, the anticipation is over, and we can announce that the winner of the drawing is Stephen Kincanon, Vice President - Shared Services at Sara Lee Corporation. Congratulations, Stephen!Read More