These are unique times for IT services – at the big-ticket end of the spectrum you have the mega-scale and competitive-cost propositions of the tier 1s vying for greater wallet share within their enterprise clients, while at the other, we have specific technical needs that warrant a lot of close attention that grabs the focus of the “mid-caps”, which are much more flexible and can operate at smaller scale, while turning an attractive profit.

The mid-caps are catering to the “build” needs of enterprises where the Tier 1s often struggle to deliver top talent

I recall just a couple of years ago how many of the big boys arrogantly called time on the smaller providers, but the exact opposite is transpiring; many clients are less brand obsessed as they once were and are more focused on accessing the skills they need with the attention they deserve. Why settle for a B- team, when you can get a B+ team that’s going to go the extra mile and work with you to figure out how to deliver complex requirements? And the numbers, simply, do not lie:

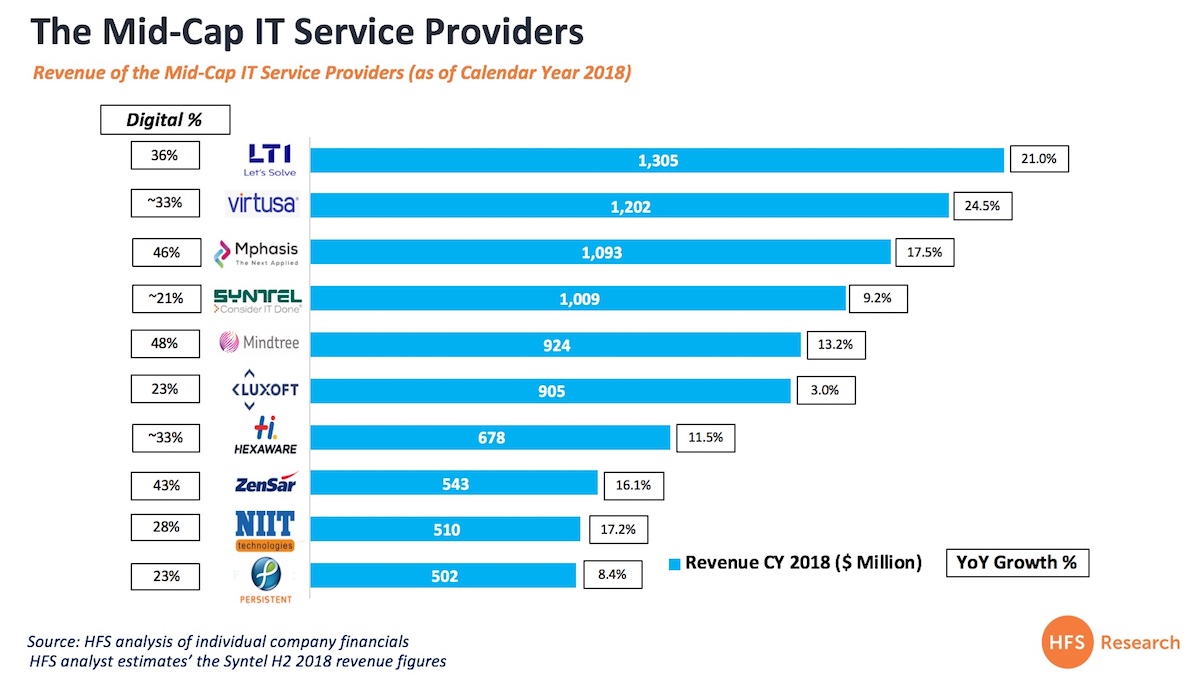

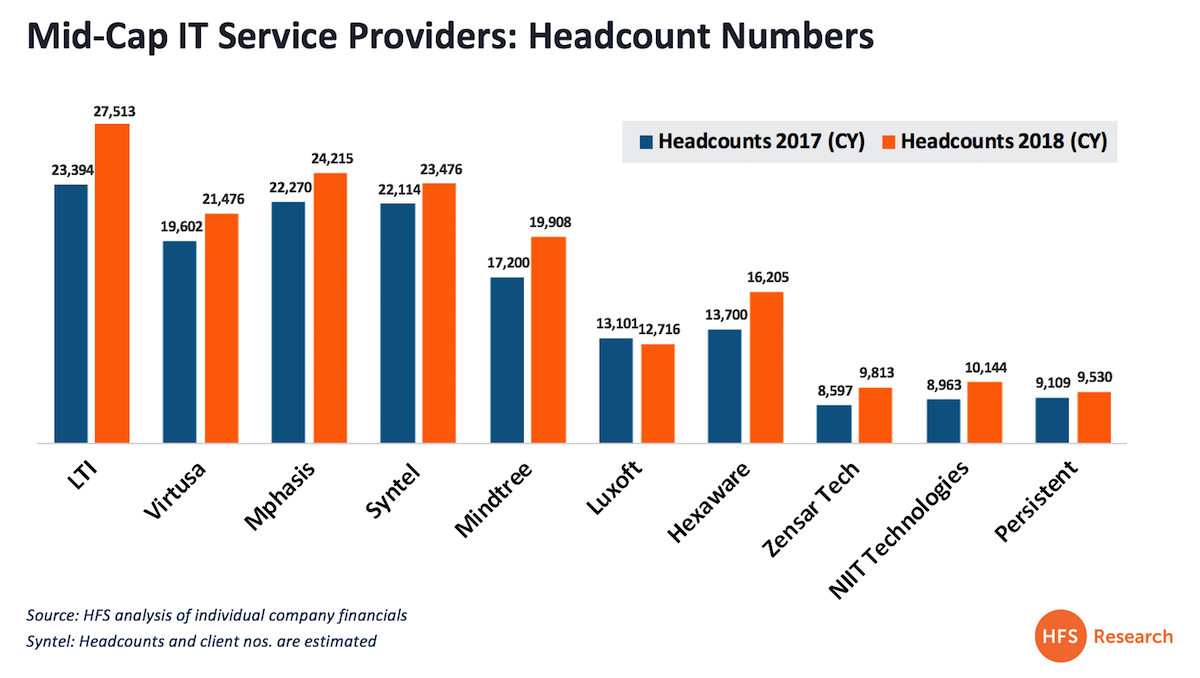

All these providers, with the exception of Luxoft, grew their employee base and 7 out of the leading 10 grew revenues by double-digits 2017-2018:

The mid-caps can rely on dynamic personalities to win deals

Remember the good ol’ hyper-growth days of IT services where the likes of Chandra (TCS), Frank (Cognizant), Nandan (Infosys) and Shiv (HCL) would fly around the world to close deals? Well, those days are long-gone as the top tier providers are simply too large and clients know they can’t just pick up the phone to scream at the CEO anymore.

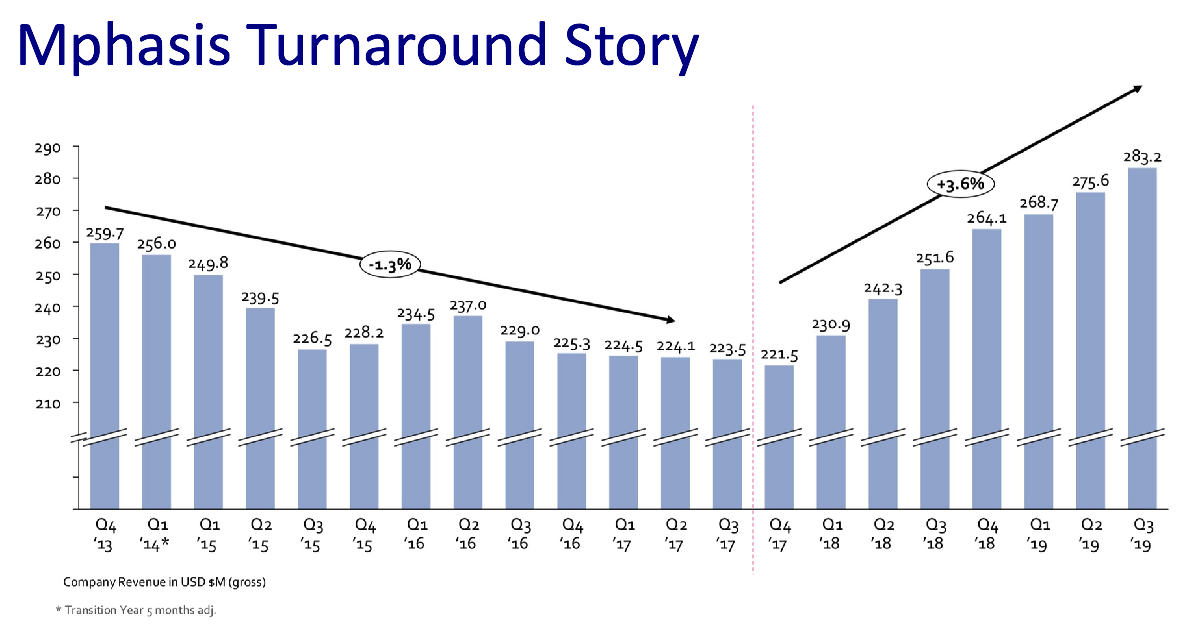

However, they can still do that with most of these mid-caps. We conveniently forget that services is still largely about people and that personal touch from the top is still what most clients really want. One such eye-catching success story has been that of Mphasis, where the impact of CEO Nitin Rakesh (read the interview here) has been nothing short of remarkable:

Bottom-Line: The success of the mid-caps was not in the script… new rules of services are being written

In the last few years, Capgemini acquired IGATE and Atos acquired Syntel. In both cases, the company being acquired was the leading mid-cap on the market, and both provided some crucial resources for European-centric service providers lacking strong Indian delivery capability. However, what transpired since has been the door opening for the next tranche to step up up – notably LTI, Virtusa and Mphasis – all of whom have blown past $1billion. While LTI and Mindtree are embroiled in a less-than-friendly merger and Luxoft has already been bolted into the DXC empire, it would be of little surprise if any of the successful ones in this list are snapped up in the coming months as enterprises grapple with their needs for close attention to their creaking IT infrastructures and the dire need to develop agile capabilities, take better advantage of automation and AI tools… and find more sophisticated help to sort out their cloud messes. And as the latest ones are picked off, it’s simply the time for the next wave to step into the void… firms like Zensar, NIIT and Hexaware are routinely discussed these days as strong providers in their own right, and are also potentially attractive acquisition targets, provided the fit is right(despite decades of heritage).

These are the new rules of the services game… because the simple fact is that there are no rules and we’re all writing new ones as the need for rapid, personalized IT salvation becomes more and more a critical part of the C-Suite agenda.

Posted in : IT Outsourcing / IT Services, it-infrastructure, ma

Err…you mean the PE industry is killing it?

Hi Phil,

Interesting perspective as always. NIIT has already found a new financial buyer over the last week end:). As you rightly put it , the increased attention ( and the associated hungryness from the senior management at a few Tier II techs), smaller sizes of contracts and the clients willingness to look beyond the scale and the brand of the vendor have all helped drive better traction for the Tier II’s. Key question to answer is how the Tier II techs compete against the Tier I vendors as the ‘Digital at scale’ catches significant offshore momentum.

Look forward to your thoughts here.

Good points Phil though my prediction is that every firm which succeeds by 2020 will be either billion dollar plus in revenue or a small niche digital platform provider !