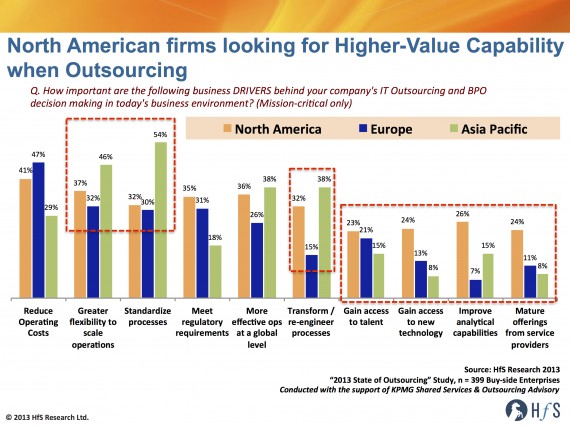

Why is it always the Americans at the head of the queue when it comes to increasing quarterly profit margins? But, even more intriguingly, why are they also leading the way when it comes to attempting to improve their capabilities when they outsource? Our recent State of Outsourcing Study 2013, conducted with the support of KPMG, clearly shows the differing mission-critical business motivations across the main three global regions, when it comes to ITO/BPO:

So, in our true style of insulting everyone from every continent with sweeping generalizations, let’s take a closer look:

North American Enterprises:

Simply put, these firms are a lot more experienced with outsourcing IT and business processes, and a good proportion of them are today showing a good deal of maturity as a result. Much of this is because outsourcing has traditionally been a game for the large corporates to play… and most of the large corporates are based Stateside. Moreover, the biggest “lever” of attractiveness over the last 10+ years has been wage arbitrage to India, hence it is those English-speaking enterprises with the most to save, who are the prime candidates to benefit financially in the short-medium term. This also explains why the UK, then Australia are the second and third most mature countries, respectively, for ITO/BPO.

What’s most interesting here, is the fact that cost-reduction is no longer the main dominant factor behind outsourcing for American firms – effectiveness measures, such as process standardization and re-engineering, are nearly as important, but, most encouragingly, high-value capabilities, such as improving analytics, accessing new technology and talent – and proven provider offerings, are mentioned as mission critical business drivers by a quarter of North American firms.

Simply put, many organizational leaders are waking up to the realization they are running out of wiggle-room in terms of finding massive cost savings simply from labor arbitrage, and the only long-term measures to find new thresholds of productivity is through smarter process redesign (and standardization in areas where there is limited competitive advantage to be had), a more analytical workforce that can help the firm make faster and smarter decisions, and a more flexible operations infrastructure that can scale to the needs of the business. What’s more, our research shows many of the larger enterprises viewing outsourcing a part of a broader framework for achieving business objectives, alongside internal business functions, shared services and offshore captives. It’s being viewed less and less as a siloed strategy for cost reduction, and more as one lever of many for achieving better productivity, tighter operational control and access to external resources and acumen.

Moreover, an encouraging economic period traditionally drives North American firms to evaluate more radical opportunities, and outsourcing frequently rises to the surface as a genuine change-agent during times of economic stability.

European Enterprises:

Cost-reduction and standard delivery requirements still dominate most European firms, with the exception of a handful of enterprises in the UK. Simply put, many of the large-scale European enterprises are far less experienced when it comes to outsourcing and offshoring as their North American counterparts, and many offer a less mature, “just get it done” attitude. The majority do not really want to change, and do not feel the need to transform processes or improve their analytical capabilities – or even if they did, they certainly do not view an outsourcing relationship as an opportunity to do a lot more than drive down some costs, standardize some processes and get some better flex into their operating model.

Interestingly, there does seem to be a notable increase of Euro firms viewing outsourcing as an opportunity to access some quality talent (21% state this as a mission critical driver), which is surely a result of the shortfall of affordable quality IT talent available on the European continent and the proven success of the ITO model for many global organizations today.

Couple all of this with a horribly nervous European economic outlook and you quickly get the picture why outsourcing just isn’t everyone’s cup of tea these days. Why rock the boat even more, when everyone’s already seasick?

Asia/Pac Enterprises:

It’s difficult not to sweepingly-generalize when you have the likes of Japan lumped in with Malaysia, India, China and New Zealand, but the underlying trend here, is that many firms view outsourcing as a real chance to improve their processes, and globalize their operations. They are less enticed by cost-reduction – and this is often because low cost labor is already available locally, in addition to the fact many AP firms are scattered across the region without massive repositories of centralized staff do to a cost-slashing “lift and shift”.

It’s clear many AP firms see outsourcing as a quick route to get from “A to C” with some areas of the business that could really benefit from a more standard solution, such as payroll, procure-to-pay or ERP maintenance. However, what’s also clear is these organizations are miles away from recognizing real strategic value from outsourcing, with only one-in-every-seven organizations viewing outsourcing as a key driver for improving access to new talent and analytical capabilities.

So these immature adopters are viewing the tactical benefits first and foremost. Perhaps that will change in a few short years as uptake of global sourcing models picks up… but it’s still very early days for this region.

The Bottom-line: Tactical measures continue to dominate, but ambitious North American buyers are starting to lead the way with a more progressive approach to outsourcing

We can bemoan the old “outsourcing is all about cost and meeting green lights” adage, but there are some genuine positive signs that our weary operational warriors are beginning to take a more progressive approach to outsourcing these days.

The fact a quarter of North American buyers now view analytics, talent, improved technology and provider maturity as mission critical shows that a portion of this industry is finally beginning to move the needle to achieving more than the basics. Smart governance leads realize they need to build careers from managing outsourcing engagements, and if they simply sit back and check boxes on spreadsheets, their own employability with soon come into question.

What’s more, shared services has struggled similarly to achieve higher level value – and over a longer period than outsourcing – and there is a genuine coming-together of operational governance models, with the likes of Global Business Services being tested as the future operating model. Are we at an inflection point? Yes, I believe so… albeit very “gradual” one!

Disclaimer: before you non-Americans go piling in, the author of this article, Phil Fersht, is actually a British subject currently living Stateside

Posted in : Business Process Outsourcing (BPO), Captives and Shared Services Strategies, HfS Surveys: State of the Outsourcing 2013, HfSResearch.com Homepage, IT Outsourcing / IT Services, Sourcing Best Practises, Sourcing Locations, Talent in Sourcing, the-industry-speaks

Phil,

Excellent analysis and jives with what I am seeing. European firms struggle with changing their operating model and have done so for many years. I do agree with your comments about shared services also struggling with many firms and outsourcing being increasingly viewed as a complimentary model,

Gaurav

Phil,

Good data and a very well thought out piece. This is definitive proof that outsourcing is quickly moving beyond cost containment as its primary strategy for many firms. Am not surprised the US companies are leading the way – they have always been the first movers with the outsourcing model,

Paul McDonough

This article struck a chord with me. I don’t believe American organizations are more sophisticated with their operations, they are simply more aggressive with making changes that improve their profit margins.

I miss a bit the factor of languages and support for Europe withing your article but definitely enjoy your “true style of insulting everyone from every continent”. Well said!

Thanks, Carola – this is a very valid factor. I believe made the point here:

biggest “lever” of attractiveness over the last 10+ years has been wage arbitrage to India, hence it is those English-speaking enterprises with the most to save, who are the prime candidates to benefit financially in the short-medium term. This also explains why the UK, then Australia are the second and third most mature countries, respectively, for ITO/BPO.

US firms are definitely leading the way on looking at other factors beyond labour arbitrage to inform the next wave of second, third and even fourth generation deals, but in terms of public sector outsourcing and shared services models, the UK may be further along the maturity curve in recognising that flexibility in delivery has a major role to play alongside cost savings. We have recently published an article on Guardian online about this, if you’re interested? http://www.guardian.co.uk/local-government-network-serco-partner-zone/public-sector-contingency-customer-demand

[…] Source: http://www.horsesforsources.com/us_eu_apac_041713 […]

@Serco: this is a fair point. UK public sector has come a long way since the EDS court cases 😉 While I wouldn’t describe some of the DWP/NHS/HMRC engagements as “progressive”, the focus on BPO is much further along than many of the US states. ITO is similar on both sides, but I view this more as many public sector bodies raising the white flag and asking providers to bail them out…

PF

Good analysis, Phil.

Sweeping-generalisations aside, you have to agree with the differing attitudes across the regions. US businesses are generally looking for more than wage savings and are quicker to look for the “what next”, whereas Europeans tend to be much more tentative when it comes to outsourcing. The issue is mainly cultural – Europeans, in general, are used to living with a safety net and prefer to keep the status quo, while American businesses are more capitalist with their attitude and more willing to sacrifice their own staff to further their productivity.

Amanda Hare

Phil, the data says more than thousand words!! Having been associated with all the markets in the recent past, the data quite accurately, reflects my first-hand experience. So, great work in collecting the data to substantiate the knowledge.

Couple of additional input from my side:

– Evolution Time: Quite a few North American enterprises started their journey in 90s thereby, providing them years of experience in fine tuning and extracting new/improved ways of creating and managing the structure. Compared to that Asia Pacific, has seen more movement in the last 5-7 years than in the past.

– Cultural similarities and differences: Experience says it tends to be a lot more difficult to outsource (or move work to captive) in similar cultures than otherwise. While India and Philippines are the world centers of BPO, very limited number of outsourcing takes place within the country. Obviously, cost aspects and an arms-length controllership help the issue either.

– Legal complexity: European countries tend to be a lot more convoluted (largely due to presence of socialist structures) and thereby, providing limited incentive to take advantage of the outsourcing structure. Which is why, apart from the language component, the ratio of organizations in Europe who have outsourced to Eastern Europe (vs India) is a lot higher than American organizations who outsourced to near-shore (Mexico, Puerto Rico, etc.) vs India.

– Heterogeneity in Europe: While overall consolidated Europe numbers look big but due to linguistic and geographical limitations, these numbers are fractured at a country level. And therefore, little incentive is avaibable.

– Market maturity in Asia: Organization models in Asia tend to be a lot more conventional than their western counterparts. Organizations tend to hierarchical and limited existence of new-wave roles exist like organization process improvement roles at C-level. Grey hair and conventional wisdom is often given more importance than availability of data.

Anyway, there are several other points that I could add…but will leave it at this.

Meanwhile, I would be curious to know how do the graphs look like if UK and Australia were separately displayed.

I agree to Carola that linguistic challenge could be one of the factor which make O/S a less preferable model in European countries. Cost reduction & process improvement are predominantly the main reason why companies opt to O/S. But how many times do we see that professional’s from IT, medical, construction or legal are also equally good in speaking languages like German, French, Italian or Spanish etc.

[…] via Why American firms are more progressive with outsourcing than the Europeans and Asians. […]

[…] (repost)Workshop on Global Sourcing6 steps on How to Achieve Innovation in OutsourcingPublicationsWhy American firms are more progressive with outsourcing than the Europeans and Asians .recentcomments a{display:inline !important;padding:0 !important;margin:0 […]

Thanks for breaking them down by continent. I must agree on your bottom-line. I keep on seeing companies who are more enthusiastic about outsourcing in the North America. It’s actually amazing for me, but I also think that countries among the other continents must keep it up with them. There’s a lot of competition going on these days.

Phil,

My personnel experience differs from the facts in the Article. I have found the UK Sourcing Teams to be higher quality than the American teams (I am an American) and when trained, the contential Europeans to be also proactive and aggressive in strategic sourcing along with the American Counterparts.

I have found my observations noted to be true in 3 large companies. When trained, the Asians have also shown very active outsourcing skills for categories purchased. The bigger concern was to coordinate activities globally among the continents to capture the outsourcing benefits of acting as a larger company versus seperate regional companies. As a global company, interestingly it was the Americans that performed better at leading global outsourcing categories.

Thank you for the article. Dave

[…] article was originally published at Horses for Sources blog and contributed by Phil […]