Who's feeling disruptive today?

Why do so many service providers still hover feverishly around outsourcing advisors begging and willing them to invite them into huge contracts… when the reality is that most maturing enterprises are today less reliant on the advice of traditional consulting than they ever were? And when will advisors wake up and realize that the old method of billing their clients millions for effort-based grunt work is just no longer doing it for them?

As one advisor confided the other day… “we can tell in a quick phone call if we can bill them $500K plus… if we can’t, we just don’t bother pursuing them”. There was little thought regarding how to develop a long-term outcome based relationship, the onus simply being to park the MBA bus at the client’s visitor’s parking spot and sell the same old dog n’ pony show of cranking out operational data to effect the sort of operational result that the client really should do itself. Bottom-line, clients need a helluva lot more than the obligatory 200-slides appendix that quietly gets dropped into the recycling bin after gathering dust on some executive’s desk for a few weeks.

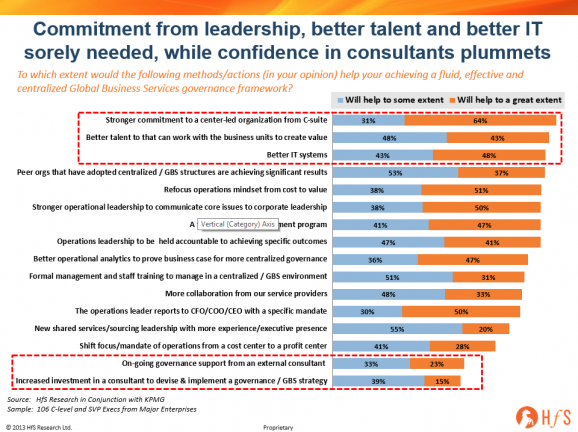

And when the world’s number 1 management thinker, Clayton Christensen, writes about Consulting on the Cusp of Disruption, you know it’s officially game-over for the way consultants have traditionally delivered effort-based high-cost projects for wizening clients. And when it comes to helping clients with Global Business Services and Outsourcing, the credibility of consultants is at an all time low – according to 106 C-levels and SVPs of major enterprises responding to our new GBS study:

Why do only half of enterprise leaders see increased investments in consultants as the way forward to achieving effective global business services?

Yes – just look at the data – increasing investments in consulting scores drop-dead last when it comes to achieving fluid and effective governance. 46% actually sees no benefit whatsoever, and only 15% sees any real help coming from outside.

Compare this to the fact that over nine-tenths of enterprise leaders look to stronger C-Suite commitment, better talent and better IT to achieve their governance outcomes. Clearly, if consultants could help ensure their clients could begin to achieve these three objectives, they would find themselves sitting near the top of the priority pile, instead of at the bottom.

How has consulting reached this low-point and what can be done to turn the corner?

Let’s refer to Clayton Christensen first:

We have come to the conclusion that the same forces that disrupted so many businesses, from steel to publishing, are starting to reshape the world of consulting. The implications for firms and their clients are significant. The pattern of industry disruption is familiar: New competitors with new business models arrive; incumbents choose to ignore the new players or to flee to higher-margin activities; a disrupter whose product was once barely good enough achieves a level of quality acceptable to the broad middle of the market, undermining the position of longtime leaders and often causing the “flip” to a new basis of competition.

And the world of outsourcing advisory fits right into this trend, where, in years gone by, the likes of TPI (now ISG) would park teams of former EDS executives into enteprises to number-crunch outsourcing contracts and FTE cost-data for millions of dollars. Other advisory boutiques sprang up to take advantage of this model, such as EquaTerra (now part of KPMG), Alsbridge, Everest, W Group and Pace-Harmon. We then saw traditional consultants, namely Deloitte, PwC, KPMG, Ernst and Young and even McKinsey, form “outsourcing advisory practices” to grab their own share of the pie, as clients queued up for help with their global sourcing needs. However, as all of them quickly discovered, all the easy money was centered in the act of brokering a deal, crunching the numbers, vetting provider long/shortlists and working with lawyers to finalize the contracts. Most were quickly ejected after the contract was signed, as they simply didn’t have the right consulting skillset – or data – to support the client with its operational and strategic needs to transition the operating model and develop a fluid, effective governance capability.

Some of these firms have flourished to evolve their models to provide platform-based solutions which enable client to access process benchmarking data, dynamic pricing information, on-tap support when needed, but most have persisted in hawking the same-old model that half the clients – as the data points out – are not really looking for anymore.

As brokering outsourcing contracts has become operational – and commodotized – these consultants have been faced with three stark choices:

1) Just do deals cheaper. Today, we see deals that used to involve teams of six (or more) consultants, now being brokered by one solo advisor. Go figure. We are also seeing outcome-based models from non-traditional consultants, such as UpperEdge, that do not rely on the onsite hourly-bill-fest consultant model to broker a transaction and can radically undercut their higher-priced competition with its strong data and pricing capability. Alsbridge has been one of the few smaller advisory boutiques to survive in recent years, developing a strong competency in IT infrastructure and networking data benchmarks that enable it to take the lead in a commodity market and service clients with low-cost support, in addition to traditional outsourcing advisory, based on its client needs.

2) Persist in finding clients naïve enough to pay 2005 prices. Sadly, there are still some enterprises which still get convinced they need the MBA bus dispatched to number crunch an ADM bake-off between HCL, Cognizant and TCS. Yes – seriously – this still happens! Traditional consultants, such as Deloitte, PwC and Ernst and Young have stayed in business doing it the old-fashioned way, and do a good job leveraging their long-established auditing relationships to get to the table with clients, still happy to pay top-whack for the peace-of-mind of using a reputable brand. ISG (formerly TPI) is the traditional 800 lb gorilla of the complex and clunky outsourcing transaction, and has made efforts in recent years to position itself as more than a transaction shop dependent on the $550/hour gray-haired former EDS executive-cum-consultant rolling up to camp in a cube somewhere at the back of a mid-west shared service center for the next three years model. While it has made some interesting efforts to change its business, such as its recent multi-year contract with Marriott to manage its outsourcing governance program, the firm still makes the bulk of its business from the old world of traditional advisory. Whether it can eventually transform itself into a research / benchmarking firm after its acquisition of Compass three years’ ago, remains to be seen.

3) Develop platform-based capability that decouples the requirement for onsite consultants, while providing clients with the data and capability they need. We are starting to see pockets of this happening, such as the work KPMG has done developing its Governance Workplace tool that provides clients with ongoing process benchmarking, industry insights and pricing data to manage its service provider and shared services portfolios, supported by a dedicated onshore delivery team in Grand Rapids, Michigan. The firm has done an impressive job developing the IP and technology acquired from EquaTerra and coupling its governance consulting talent to its clients, as and when they need it, under its Managed Governance Services offering. While it’s still early days to gauge the long-term potential of KPMG’s model, it’s clearly a front runner in terms of balancing clients’ needs for traditional consulting with the disrupter product that is acceptable to the broad middle of the market which Christensen talks about.

The Bottom-line: Consultants are not immune in today’s disruptive world – it’s “change the model, or prepare to fizzle-out” time

I’ve never known a more disruptive time for business than today – entire industries can be decimated before they know it – just look at the impact social media and the proliferation of information and communication has had on PR, research, media, technology and content-provision. Many once-great great brands have faded (or become extinct) because they failed to keep up with the changing needs of their markets, preferring to stand still and hope their brands carried them through… well, if Clayton is correct, the same is about to happen right at the front door of outsourcing advisory.

Smart clients are losing their appetite to invest in expensive consulting models that only deliver effort-based inputs. So much of the information they had to pay millions for in the old days can be found in LinkedIn groups, or served up for free by eager BPO firms seeking to develop client relationships. The onus is shifting to arming clients with ongoing data, analysis, insight, support and knowledge to help them empower themselves to be more effective. Clients want to improve their own talent, not just hire it in for a piecemeal project, which goes away when the money runs out. The issue is that traditional consultants are only schooled one way – to price based on bodies and effort, as opposed to outcomes and sustainable longevity. They will obviously claim they provide their clients with those outcomes, but when those clients can start to achieve the outcomes they need from less costly and more flexible, relevant models, then the game is up – and the old world has to change.

Like any other industry, change only comes about then the actual fundamentals are shaken and the “old way” of getting paid changes. As the data clearly indicates, traditional advisory, as we knew it, is on that very cusp in the global services world. Those consultants who fail to change their ways, bring in leaders with new ideas and new models for IP delivery, or hire innovative consultants who are not always from the other traditional consulting shops, are surely about to go the way of the Woolly Mammoth…

Posted in : Business Process Outsourcing (BPO), Global Business Services, HfSResearch.com Homepage, IT Outsourcing / IT Services, kpo-analytics, Outsourcing Advisors, SaaS, PaaS, IaaS and BPaaS, Social Networking, Sourcing Best Practises, sourcing-change, Talent in Sourcing, the-industry-speaks

Superb article. So many truths. Couldn’t agree more on the the “TPI clunkiness” !!! Having said that, being ahead of the pack with the “future” consulting offering, life has not been easy for Maturity Sourcing.

NB Based in France, Blog post mainly in French but on exactly same wavelength !

On the money, Phil. Data is shocking – I never knew perception of consultants had dipped so low.

The consulting industry is definitely approaching its “come to jesus” time.

Phil,

This article rings so true for us. Consultants have failed to provide services that help us with process benchmarking, real transformation, change management etc. There is so much more we have to learn ourselves,

Amanda Hare

Phil,

Brilliant post – kudos for calling it. The current mammoths are mainly body shops where they look to milk clients running prolonged contract negotiation processes. They have no competency to do any strategic work with transition / governance. All the money is in the transaction – and that is a shrinking pool. We’ll see some of these firms exit this market soon.

John

Spot on, this trend really started several years ago. The MBA bus model as you so aptly described rarely impacts many of the issues that companies face in trying to transform their business. These issues, many of which, center around “cultural shields” compromise the impact that a consulting model brings to the table. Invariably what has happened in the past is that failing to reach their goals the C-Suite will say that what they tried to do could not be done because they brought the best consultants in and they failed, or they will try to make a “silk purse out of a sow’s ear” and spin a success story although the original results were never achieved. In the end the operational performance metrics never lie. Thanks again.

It’s vital for these sourcing consultants to work with clients post-transaction to be credible. We have too many of these advisory firms focused purely on making money from the deal process, with very little visibility or experience how outsourcing or shared services genuinely work in practice. This is why so many engagements are set up to fail from the outset. The firms need to change their approach to long-term support for clients that does not always involve vastly expensive hourly-billing projects. As both you and Clayton Christensen discusses – creating tools and platforms that provide ongoing analytics, with “live support” when required on an adhoc basis, if one way forward. It’s a major shift for some of these firms, and many will fail.

Dang, there goes my early retirement, part time consulting gig. Blogging here I come….

The bigger story, IMHO, is the general failure of the outsourcing industry to fulfill its promise. Is this because of the Outsourcing Advisors, or despite them?

Arbitrage is not Service. Capability is not Service. That’s what today’s Outsourcing Industry commonly delivers. As Outsourcing fades in relevance, so do the consultants who enable that strategy.

Consultants serve a vital role to enable the unimagined. If a company COULD change itself without the frameworks and analytics of the noble consulting profession, they would. One hires a consultant to do that which cannot be done solo.

So, perhaps the question isn’t whether outsourcing advisory consultants are irrelevant, but rather better asked as “Has the form of enterprise services contracting and integration changed such that a new breed of consultant is required to imagine, design, and deploy business models for the “as a service” economy?”

Peter

@Mike – it’s much easier to write about it than actually do it 🙂

@Peter – you raise an excellent point – when monolithic enterprises want to engage in prehistoric practices of arbitrage with limited future value, what more can they expect beyond more woolly mammoth-like services?

I would go further than your suggestion and stake the claim that the consultant skillset is dated for many of today’s advisors. I know for a fact that some of the “Big 4” are only interested in hiring consultants who have “Big 4” experience. They really do not want to bring in fresh thinking or new blood that has been on the buy-side or in an innovative provider where the focus in on the unimagined, as opposed to the blindingly obvious…

PF

Peter,

I think the answer to you last question is yes. To deploy new business models there are 4 levers; People, Process, Technology, and Policy. You just can’t outsource to a partner and think that your problems are solved. Consider the debacle at Lenovo who out sourced their service parts operation to a single partner without considering the need to manage the relationship. The roll out was never completed and Lenovo was losing millions of dollars every month until they abandoned the relationship. Compare that to Dell Managed Services who created a major revenue stream for Dell by intelligently managing a ‘disaggregated value chain’, or Cisco who has been very successful in understanding how to manage outsourced relationships. Compare both of those to Palm who paid significant penalties to carriers such as Verizon when they tried to manage their reverse logistics and repair operations with outsourced capabilities. In the end it was one of the factors that ended Palm as a company. Today, companies need help in managing all 4 levers of change. You need a holistic viewpoint. The potential for the outsourcer is to move beyond the arbitrage model and look at how they can enable transformation for their clients.

John Thomann

While I agree with the analysis and conclusion that traditional outsourcing advisory is dead. I believe that there is more to the story than advisors and providers changing their engagement practices. Buyers must also take responsibility to ensure that the changing models and disruptive forces lead to measurable and fundamental improvements in the engagement methods, negotiations, pricing, and delivery.

Buyers have longed complained about being victims of the bad deals, now the table are changing, as buyers unite, and communicate in industry forums and events our demands will be heard. Buyers are insisting that if advisors and providers want to be at the table, they must make fundamental and significant changes to support buyer’s objectives, business challenges. Advisors and providers must remove the barriers that they have created and used to profit between their sales, delivery and the financial teams that has led to so much confusion and conflicting priorities.

Those advisors and providers that recognize and adjust to the demanding and disruptive changes will profit, not from hourly changes involved with quick one off engagements, but with delivering real value and long-term relationships utilizing outcomes based deliverables and business benefits.

Looking forward, Sourcing Advisory should be all about being able to ‘walk-the-talk’.

Can you advise/draft a sourcing model/arrangement for your client which, subsequently, you can confidently execute and then govern? Or are you here just to bill for big bucks/hr and then walk away for someone else to ‘deal-with-the-mess’?

And yes. Clients. All of ‘em. Should honestly ask themselves. Can I manage this in-house? Do I have the skills, temperament and most importantly guts to run this all on my own? To take both credit and the ‘curses’ for a deal well-handled/messed up.

Or

Do I just want to hire an external expert who will make my wins look smart (Look he was so smart that he knew right up front that he had to hire the best guys externally) and my losses less pathetic (He tried his best…he even had the best help from outside…this deal was meant to fail anyways).

Some much needed introspection is needed.

[…] Traditional Outsourcing Advisory is Dead We don’t give Horses for Sources the visibility it deserves. There is a constant flow of quality material over at ‘Horses’. This article takes Clay Christensen’s notion and starts to apply it in the HR industry. Effectively, consulting is a means of communicating data. Self-service and automation work oerfectly well in data delivery. […]

Perhaps the sub-title to this piece should have been ‘Outsourcing Advisory is dead, Long Live Outsourcing Advisory’. It is very true that the traditional consulting model is becoming less and less relevant as clients become more informed and the consultancies keep their head in the sand. However, speaking as an Outsourcing Advisor myself, there are new models and new ways of doing things, but it’s coming from the ground up. When Source was founded three years ago, it was for exactly the reasons stated in the article and in the comments: outsourcing has a bad brand and the traditional advisory model isn’t working. Only when advisors start to do work that benefits the outsourcing business as a whole will you see the new consulting model really kick in.

@Andrew – maybe “dying a slow death” would be more appropriate… sorry you didn’t like the title, but we really need to draw a line where the old way of doing outsourcing deals is put to rest and clients are engaged in advisory services that can take them beyond a contract into the long-term governance of their engagement. While it’s encouraging that boutiques like your firm are trying to change the model, most of the old guard are still living in the past, relying on legacy consultants to service legacy clients. When we asked 42 buyers are our last council meeting if they relied/received value on advisors post transaction, not a single one said they did, or saw the need for advisory, based on the advisors they were familiar with. They’re living in a world where they are simply figuring t all out for themselves.

PF

@Phil – I think that’s spot on: the points where sourcing advisors can add the most value are at the strategy stage (long-term view) and during the post-contract stage (long-term action). It’s really about building meaningful and productive relationships between clients and service providers which, as you say, goes beyond a mere contract. Understanding the positive outcomes that will benefit everyone involved in the deal, and then helping ensure that these are delivered right the way through its life, are probably the two most valuable things that an advisor can do. Everything else follows on from that.

@Andrew – I would add that advisory firms also need to employ consultants with the battle-scars to prove to clients they can do more than deliver nice PowerPoint. It’s easy to pitch a great “capability”, but this is really about rolling up your sleeves and working with buyers and providers to make these relationships function better. Moreover, it’s about creating relationship dynamics where the expectations are set correctly – if clients really do want “innovation”, then they need a provider that can genuinely work with them to achieve it. If clients only really want low-cost standard services that are delivered on-time and on-budget, then find them a provider that is happy to do exactly that. We need to see more mixing of skills across buyers, providers and consultants, in general: more provider execs going to the buyside, more buyer execs going to the consultant and provider side. That will really help the dynamics on both sides of the fence,

PF

@Phil – Absolutely! Nobody ever built great relationships through PowerPoint. Advisors need to build real relationships with our clients that engender trust and bring those long-term benefits. If you can do that then success will naturally follow.

And the more mixing of skills and personalities the better. Far more interesting (and fun) to have unique individuals with the right experience than a load of ‘suits’ advising and working with you.

As a former buyer, then Service Provider, who has now just started an interim assignment to advise a C-Level executive (and his leadership team) on outsourcing, my client represents a jaded bunch about the traditional outsourcing advisory role. They want to be challenged about how to best use sourcing to support the business. Perhaps my personal relationship and trust with the C-level is allowing me to ask the tough questions. [I don’t have the slick Powerpoint or templates anyway to leverage and “wow them”.] Is that not what advisors should be doing anyway?

Phil —

Flashback: September 2011. In a published study, HFS asked clients where they got outsourcing information and insights. The results ranked Boutique Advisory Firms dead last. Two years later and the trend has accelerated — so, evolve or perish; but this has been coming for at least 2 years (and longer if y’all were looking).

@mark – I had forgotten about that study. Great to find out we’re consistent:)

[…] of the future aren’t necessarily going to be the analysts of today – the smart consultants are desperately looking at more “one-to-many” models to service their clients who want more of an ongoing relationship, […]

[…] asked advisors how their clients’ demands of them were changing. And for the gray-haired old woolly mammoths, this isn’t great news… their clients are now more interested in advisory services that […]

The article is quite interesting and provides lots of good input to think about new trends it IT Sourcing Advisory.

Coming from a service providers perspective, we did found a software startup with the aim to industrialise the governance application development with global (offshore, nearshore) teams. The tool “Outsourcing Director” is up and running (http://www.plixos.com/en/products).

In addition to that and more directed by our customers or friendly outsourcing consultants this offering was extended to Software as a Service (SaaS) tools automating parts of the sourcing strategy (tool Outsourcing Advisor, which was developped with and pyed by customers).

This was further extended by a partner to Sourcing Advisory as a Service (SAaaS): http://www.plixos.com/en/it-outsourcing-services/saaas-sourcing-advisory-as-a-service

We think, this to be a good solutions due to the higher value for costs ratio for customers. I am keen to get your views. Joerg Stimmer

[…] Traditional outsourcing advisory is dead. – There was little thought regarding how to develop a long-term outcome based relationship, the onus simply being to park the MBA bus at the client’s visitor’s parking spot and sell the same old dog n’ pony show of cranking out operational data to … […]

[…] Traditional outsourcing advisory is dead. – There was little thought regarding how to develop a long-term outcome based relationship, the onus simply being to park the MBA bus at the client’s visitor’s parking spot and sell the same old dog n’ pony show of cranking out operational data to … […]

[…] Traditional outsourcing advisory is dead. – There was little thought regarding how to develop a long-term outcome based relationship, the onus simply being to park the MBA bus at the client’s visitor’s parking spot and sell the same old dog n’ pony show of cranking out operational data to … […]

[…] Traditional outsourcing advisory is dead. – There was little thought regarding how to develop a long-term outcome based relationship, the onus simply being to park the MBA bus at the client’s visitor … or served up for free by eager BPO firms seeking to develop client relationships. […]