Outcomes, outcomes, analytics, analytics, innovation, innovation… Outcomes, outcomes, analytics, analytics, innovation, innovation… Outcomes, outcomes, analytics, analytics, innovation, innovation… Hurry while stocks last folks!

Buyers wants to shift from the basics first…

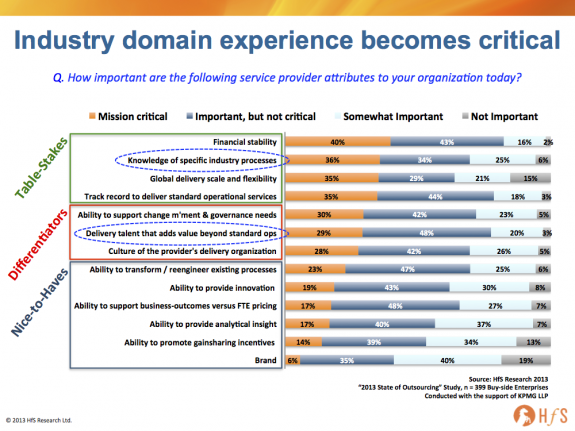

Well, we have some shocking news for you all… these things are only making the “nice to haves” category when it comes to provider selection, as buyers look at more immediate, tangible benefits from providers.

Our seminal State of Outsourcing Study, conducted with the support of KPMG, where we delved into the views and dynamics of 399 enterprises, has revealed that today’s wizening outsourcing buyer is looking at industry experience and the provision of talent that can do more than just the basics, when it comes to choosing between their providers:

The answer’s simple – most providers are tooled up to deliver what was contracted, not what the client really needs. Most large outsourcing deals today were (and many still are) initially negotiated and brokered by different teams, on both the provider and buyer sides, than the teams which ended up running the engagements. Too many enterprise outsourcing relationships, today, were (and many still are) brokered to solve yesterday’s challenges – namely, driving out labor costs, mitigating risks, and achieving a basic level of operational performance.

These are now “table-stakes” – or should be – for any serious enterprise buyer or provider. However, if your talent pool was hired and developed only to perform against those objectives, and you contracted with a provider to deliver precisely what was agreed five years’ ago, then how, exactly, do you expect to rise to an improved level of performance? Until enterprise buyers make these attributes critical during negotiation and selection, providers will continue to push their table-stakes capabilities, and throw in all the “nice to haves” as marketing frosting – because they know they can never likely to be held accountable to them. How many times have you heard the cry “we were promised innovation, better analytics and all these wonderful new capabilities, but haven’t seen anything“? Well, that’s because they didn’t actually buy those things…

Then why are we so obsessed with the act of sourcing, as opposed to the management and success of a long term relationship?

The problem we have – as an industry – is that we’re obsessed by the act of sourcing, as opposed to the practice of managing it effectively over the long haul. However, as the data insinuates, as buyers become more experienced, and governance executives get more involved in future decisions, the approach from many providers has to change. We’re already seeing this with several contracts coming up for renewal, where the buyers are inviting others to the party, seriously looking to see if they can get more value from another provider (and many forlornly wishing it wasn’t so damned hard to kick out their incumbent).

Their problem has, simply, been that they opted to go with a provider to achieve the basic table stakes, and they now feel that said provider cannot deliver anything much beyond the current performance, due the constraints of their current contract – and, in several cases, because their provider simply does not have the acumen or talent availability to help them attain improved new levels of performance.

Until governance executives, with real working experience of outsourcing in their organization, get involved in the brokering of contracts and provider selection discussions, we’re going to be plagued with many outsourcing engagements where the provider is never really delivering much value beyond cost.

Most enterprises are looking for help getting from “mediocre” to “better-than-average” – they’re not yet ready for “world-class”

The other issue we are dealing with here, is that providers are obsessed with positioning themselves as having solutions that are, simply, far beyond the immediate realities of their clients – many are simply looking for better mileage form their Chevy before considering a Cadillac. Achieving incredible “business outcomes” is a journey both a provider and buyer can work on over the years of getting to know each other. It is not something that can be bought and sold on day one. Moreover, the same can be said for reaping great value from analytics, or developing a realistic innovation roadmap – these are delights that take years to achieve – and competent providers will provide the right teams to create the environments in which their clients can progress along their journeys.

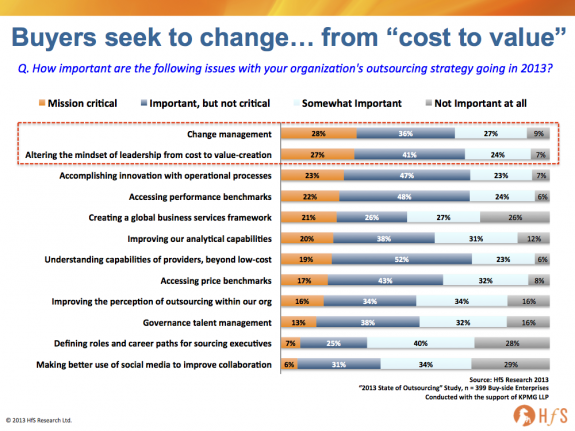

It’s clear, when you examine the key topics on the minds of enterprise executives, that it’s baby steps for most of them, as they look for more value from outsourcing:

Two items dominate: how to change, and how to move leadership away from the legacy “cost reduction” mindset. It’s clear that enterprises need to tackle these two areas before they can really get stuck into the longer term benefits that can be achieved.

The Bottom-line: Providers are being judged by clients expecting more… and many need to up their game

You don’t need to spend hours cutting up survey data to fully realize what is happening in outsourcing today – you just need to talk to a few clients to get the fuller picture: essentially, many are trying to fight their way out of the corners in which they unwittingly found themselves, where they were signed up to receive low-cost, adequate operations.. and expected to be “content” with that. At the same time, it’s nigh-on impossible to attain better performance and efficiencies from your operations if you have the provider’s C-team delivering your processes from some far-flung location.

And there lies the Catch-22; Your firm bought “cheap and adequate” and if you can’t turn around in 3 years and show where that next 10-20% of productivity is coming from, your job may well be next on the line. There’s a scary attrition rate of buyers who got pushed out of their firms after a couple of years of grappling with the mediocrity, where settling for the status quo clearly wasn’t an option.

The only solution is for the majority of enterprises to change their whole approach to selecting – and working with – providers, and most of them are only now in the process of asking some very tough questions… and trying to figure out how to change their whole approach to managing engagements.

Click here to view our full array of blogs that discuss our “State of Outsourcing” study findings, conducted in partnership with KPMG LLP

Posted in : Business Process Outsourcing (BPO), Global Business Services, HfS Surveys: State of the Outsourcing 2013, HfSResearch.com Homepage, HR Strategy, IT Outsourcing / IT Services, kpo-analytics, smac-and-big-data, Social Networking, Sourcing Best Practises, sourcing-change, Talent in Sourcing, the-industry-speaks

Phil,

Happy labor day! Very well written and insightful. I agree that most outsourcing clients have set up their deals to deliver very functional results – and many have become disappointed that functional results are all they are getting. The real change that needs to happen is with the leadership on the client side that must refocus on higher value outcomes when they sign these contracts, if they want to keep seeing value from their operations. Otherwise, these clients will get stuck with a sub-standard operational model that will eventually lead to a competitive disadvantage,

Thomas Grayson

Phil,

Providers can only sell what their clients want/are advised to buy from them. I blame sourcing advisors and lawyers for squeezing providers on these deals, which result in very “standard” delivery. They are the ones who only care about the act of sourcing.

I think, as you rightly point out, that more experienced buyers are wizening up to what they really need and we’re seeing that in some of these re-bid situations,

Eric

Interesting data. From what I am seeing, analytics is increasing in importance massively, but my read here is that with outsourcing, those benefits are only really possible once the relationship is working well. At the same time, the client has to invest in higher caliber resources – both internally and with its vendor.

Hi Phil – enjoyed this piece and agree with your conclusions. Ultimately, when cost reduction is the main factor, quality always suffers. Once buyers make this cost-to-value shift we’ll see more focus on innovation from outsourcing deals,

Gaurav

Phil,

People normally only deliver to the minimum acceptable standard – to get higher performance, you need to pay for it. Companies are outsourcing to get work performed to a pre-agreed cost at pre-agreed delivery units. Expecting providers to deliver value beyond what was paid is a pipe dream.

What is clear from the data is that the provider having industry knowledge is clearly an expected table-stake of delivery. The provider having motivated staff that can go the extra mile is what the clients would like to see above all else,

Heather

[…] Our seminal State of Outsourcing Study, conducted with the support of KPMG, has revealed that today's wizening outsourcing buyer is looking at industry experience and the provision of talent that can do more than just the basics, when it comes to … […]

Phil,

Hope you enjoyed the labour day. The article explains what I felt often as a client and operations head – the client contracts for the cheapest, and a year later starts looking for an upgrade.

Nothing surprising as most consumers up their expectations over time. What is surprising is how many clients ignore this in contracting, and continue to ignore requests for re-doing the contract. This often put me, locked into a scrape-the-bottom contract with static KPI’s, into a bind as I could clearly see us failing to provide adequate level of service to consumers, while the client continues to hang on to the contract. An unsatisfactory situation as attrition rises, costs rise, making it even more difficult to upgrade.

Of late, some clients, mainly Europeans, have started sending us RFP’s with the time element and evolving service standards in mind, which should result in more satisfactory outcomes for all 3 parties – consumers, clients and providers.

Yet the clients and their advisors base their their agreements on the GM model (KPI’s, penalties et al), which is an excellent way to buy products. To my mind, sourcing contracts are more akin to Public Private Partnership contracts, and would help factor in evolving consumer needs better.

Or the client can enter into a 1 year contract, with service provider being reimbursed for start up costs, should the client pull out, and a longer term (2/3 years) contract when both sides have a better understanding of how the customers’ needs are evolving.

Your views?

@Manoj: Initial 1 year contracts – bingo – very solid idea, as long as the exit clauses and severance penalties are well defined. I would advocate initial 2 year contracts – as 1 year is rarely enough time for both parties to do much more than initial transition activities.

Cutting the chase, I see the biggest issue here is about making it possible for clients to exit their agreements, if they fail to deliver value beyond very basic service provisioning. On the flip side, customers need to be smarter about investing in a provider which has the incentive and funding to provide higher caliber resources – plus the customer also need to ensure it also has the governance skill and talent to partner with the provider effectively.

As we may have said here before – it takes two to tango 🙂

PF

[…] the entire post: http://www.horsesforsources.com/beyond_adequate_090113 This entry was posted in Uncategorized on September 12, 2013 by […]

[…] the entire post: http://www.horsesforsources.com/beyond_adequate_090113 Share page:EmailPrintLinkedInTwitterFacebookGoogle […]