While the world still known as “outsourcing” was quaking in fear at being renamed “augmentation” (hehe), we received some interesting notes from people with alternative suggestions for their beloved industry.

Unfortunately, some of these people had failed to read the full posting to figure out it was an April 1st wind-up, but, what the hell, it inspired some pretty good debate!

We liked this suggestion, from outsourcing evangelist, Bobby Varanasi:

Very interesting indeed. Wondering if the marketplace will accept the replacement term “augmentation”. Personally I think the term “augmentation” indicates – restrictively – that service providers only do that, augment and nothing else. However the marketplace has grown significantly on the back of “new” capabilities providers have brought to the table of buyers, not by augmenting but by “installing” or “instituting” practices, solutions etc and made the buyer organizations look smarter!!!

Good point Bobby. Let’s be realistic here:

a) “Augmentation of existing operations”. When a provider is “augmenting” a process (or cluster of processes), they’re improving it, they’re removing some unnecessary sub-tasks, or even tweaking it to work with a new software application. Whatever they’re doing, they’re trying to make it function more effectively in an externalized environment that likely involves staff on both client and provider teams.

b) “Instituting new practices and capabilities”. The nirvana, to which most ambitious providers aspire, is to have their clients move onto “shared” solutions they bring to the table that have pre-configured quality process flows and technology underpinnings that they can implement across their multiple clients, resulting in more profitable engagements for them, increased price-competitiveness in the market and – hopefully – new capabilities and improvements to delight the end-customer and win even more customers.

The outsourcing industry is caught in a “chicken and egg” situation

Hence, we would class augmentation efforts as process improvement (i.e. labor arbitrage with a few tweaks), and what Bobby is suggesting – instituting new practices – as something akin to “innovation”, as this involves new, and often unique, methods and capabilities to make buyers be more successful. There’s no doubt the industry wants to shift outsourcing engagements away from mere augmentation to the actual institution of new capabilities, however, the missing link is clearly whether the service providers can be incentivized to invest in their clients, with clients similarly being incentivized to make more radical overhauls of what they have. Clearly, we have a “chicken and egg” situation going on in today’s outsourcing business.

Whatever we call “outsourcing”, one thing is clear: providers’ capabilities are the key to the future success for finance

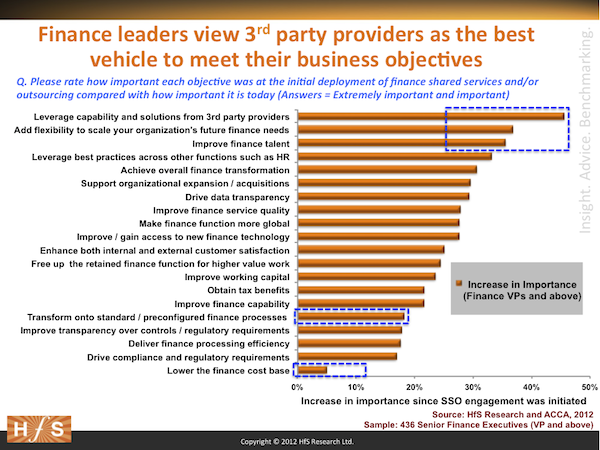

Enough of this theoretical buffoonery; let’s go ask 436 senior finance leaders from organizations with current shared services and outsourcing (SSO) models about their current business objectives – and how those have changed since they originally embarked on their SSO adventure:

This brand new data, a sneak preview of what’s to come from the recent HfS Research/ACCA study, compares the importance of business objectives made by finance leaders when they initiated their SSO engagements with how those same objectives have changed today. Let’s summarize the significant points:

Finance leaders really want to increase their access to capability and solutions from 3rd party service providers. Finance leaders have viewed this criteria as increasing by 46% in importance since they embarked on their SSO. This clearly implies they have seen what providers can/are bringing to the table up-close and have realized these attributes are what they need to reach new levels of success. This is a significant cultural shift from years-gone-by, when they over-relied on inhouse staff development and heavy ERP investments to improve finance with limited help from the outside. Most finance organizations today are tired of constantly fighting ERP dysfunction and poor process quality and are more focused on third parties to bring new ideas/best-practices/technologies to the table. Moreover, as we have been seeing repeatedly at HfS, clients are increasingly recognizing the cultures and internal capabilities of their service providers and want to nurture these skills and learning environments into their own finance organizations.

Improving talent and flexibility to scale the finance organization is paramount. While leveraging provider capability is the most significantly growing objective, improving finance talent and scaling finance are close behind. We see the desire from function heads to globalize processes and have their internal managers get a better handle on scaling finance to service the needs of the business, as critical goals of finance leaders today. Clearly service providers, in addition to management consultants, are in increasing demand to help their clients develop smarter global delivery models that encompass their available talent across shared services, outsourcing and inhouse teams. It’s no longer about clients managing each delivery model in silos – it’s about bringing them all together as one cohesive framework.

Standardizing process is desirable, but not a lot of companies are really doing it. This objective only grew by 20%, which will disappoint some providers which are banking on pushing their clients into more radical overhauls of some of their internal processes to adopt their own workflows and best practices. In many ways, this really is telling us finance leaders are more focused on augmenting what they have, than completely overhauling processes with better ones. Everyone says they want access to best-in-class processes, they say they want to blow up non-core / not critical processes and have them standardized and made more efficient – so why, pay tell, do they not do it. We use the payroll example a lot, the most commonly outsourced finance/HR process, whereby many CFOs / CHROs long gave up the ghost that there was any real strategic advantage keeping payroll inhouse, but even that case, barely a third of mid-large organizations have actually outsourced it?

The Bottom-line: Service providers are in pole position to provide the value clients need, however, there needs to be some give-and-take on both sides to move beyond mere “augmentation”

The augmenting versus instituting argument really sums up where we all are as an industry at present; providers want to institute offerings that they can scale (standardize) and execute well, whereas buyers want the execution without the standardization. They want providers to bring them all the goodies at competitive prices to make them look really good, but are yet to really embrace the internal change they have to go through in order to get the outcomes that they want.

The key is for the chickens and the eggs is to figure out together which ones came first. OK – that makes no sense! The key is for the buyers and providers to figure out the right ways to engage, so that both are incentivized to invest in the relationship and the outcomes together. There has to be a bit of give-and-take – i.e. buyers need to understand that providers want scale and utility and would like to leverage their capabilities with other clients and not just them. Similarly, providers need to understand that buyers’ needs are often complex and it’s not always “clear cut outsourcing”. As our research will reveal shortly, far more buyers rely predominantly on shared services delivery models, and outsourcing engagements still tend to be treated as discreet, augmented support services. In these cases, providers need to (at least at first) accept they need to work within the confines of their clients’ global delivery models that many not always suit them.

Both sides need to look at the bigger picture to work out how to really find future value from each other. Providers need to stop managing each client like a P&L and clients need to be prepared to understand what will encourage providers to share more of their delights.

Stay tuned for Part II where we’ll take a deeper dive into the potential for Global Business Services across finance operations

Posted in : Business Process Outsourcing (BPO), Captives and Shared Services Strategies, HR Strategy, kpo-analytics, Outsourcing Advisors, SaaS, PaaS, IaaS and BPaaS, Sourcing Best Practises, sourcing-change, the-industry-speaks

Right on point, Phil!

1) lawyers get in the way – contracting for services, risk mitigation strategies, etc…all impede providers from transferring value (providers lawyers) and from buyers recognizing value (buyers lawyers)…in short, the transactions costs (lawyers, advisors, sales people frankly) all impede the transition of value. Incentives on providers side need to change, buyers need to open up — technology, customer preference is evolving too quickly for companies to keep on top of it all…

2) financial models/contracting math – equity sharing (linked to #1) also needs to evolve…FTE spreadsheets need to die out we should be talking about ownership and risk sharing…otherwise we are stuck at the O word and the perversities of low cost labor will dominate the conversation…

Still waiting for a brave buyer and provider to step and show the rest of the industry the light!

Phil,

The best article I have read in a long while that outlines where outsourcing is stuck and what needs to change. What is surprising is how much CFOs are recognizing the value providers can/are bringing to the table. That is encouraging,

Kieran.

[…] here to read the rest: April truths about outsourcing, Part 1: Finance leaders are looking to … Comments […]

‘Augmentation’ vs. ‘Instituting’. Good way to frame the path that the outsourcing industry needs to take. It’s about who learns from whom. If the provider learns from the buyer, then it’s Augmentation. If the buyer learns from the provider, then it’s Instituting. Given that educators make more money than students, providers are well advised to continue climbing the value chain.

Phil,

Some really insightful points here. We’re definitely caught in a viscous cycle where buyers and providers want similar outcomes, it’s how these relationships are contracted and structured which is causing the disconnect. I agree with George that the lawyers and intermediaries are not helping matters at the start of these engagements. I am hopeful that will change in time as buyers mature and learn how these relationships need to develop in the future,

Rahul

[…] organizations, and they can leverage the capabilities of their providers to help them (read our earlier piece on this […]

[…] their operations – and how the majority are turning to their service partners to help deliver these delights to their clients. […]

[…] improve their operations – and how the majority are turning to their service partners to help deliver these delights to their clients. […]

[…] world of outsourcing and shared services. In fact, HfS Research has found that companies now place twice as much importance on having the right talent, compared to when they began their outsourcing and shared services […]

[…] • April truths about outsourcing, Part 1: Finance leaders are looking to providers’ capabilities mor… […]

[…] • April truths about outsourcing, Part 1: Finance leaders are looking to providers’ capabilities mor… […]

click here to find out more…

…