The insurance industry has spent the last decade digitizing its core in the form of claims, policy servicing, and back-office operations. But in 2025, modernizing won’t cut it. The real challenge is shifting from functional transformation to enterprise orchestration and ecosystem-led growth.

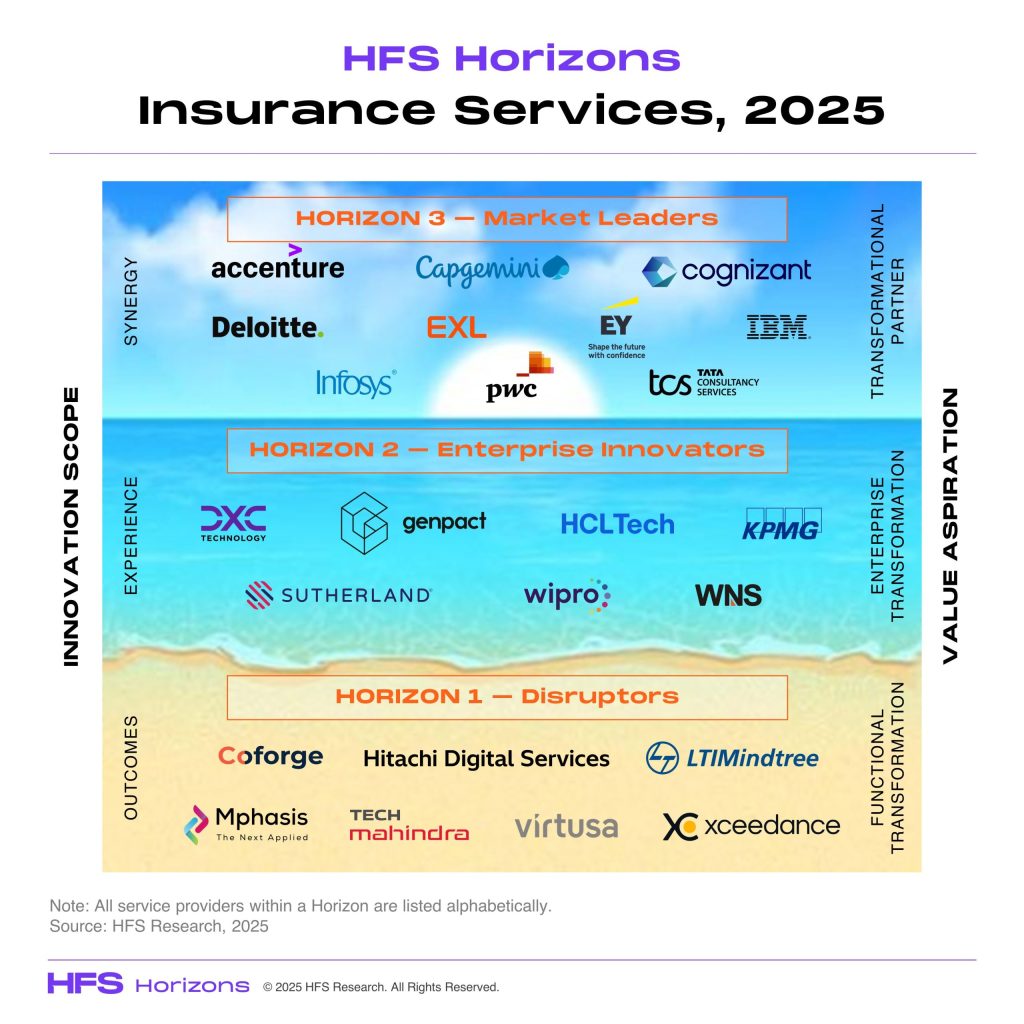

Our HFS Horizons: Insurance Services 2025 study evaluates 24 leading service providers across the insurance value chain. The verdict is that winners aren’t just automating; they’re unlocking new forms of value through GenAI, smarter underwriting, personalized CX, and ecosystem co-creation.

Exhibit 1: The Insurance Horizons framework captures the transformative shift from operational efficiency to ecosystem-driven, experience-led enterprises

Key study findings:

Functional transformation is the foundation and not the future: Many service providers have been successful in reducing expense ratios, streamlining workflows, and bringing regulatory clarity to complex insurance operations. Providers in Horizon 1 are driving measurable outcomes in speed, cost, and compliance, especially across claims, policy servicing, and legacy modernization.

But while functional execution earns providers a seat at the table, it doesn’t guarantee long-term relevance. Insurers are now expecting more flexible APIs, GenAI-powered insights, predictive risk engines, and cloud-native ecosystems that don’t just fix problems but prevent them from occurring.

Ecosystem orchestration is moving from slideware to real revenue: The most forward-looking providers (recognized as Horizon 3 Market Leaders) are co-creating with insurers, InsurTechs, data providers, and cloud platforms to reimagine entire insurance journeys. These firms are embedding intelligent agents in underwriting, activating ESG-linked product design, and orchestrating API-first platforms that connect distribution, policy, and claims into a single flow.

What separates these players isn’t just innovation but their ability to operationalize it at scale. They’re building modular offerings with clear business cases and aligning their delivery to customer, broker, and employee experience KPIs.

Underwriting is emerging as the next transformation battleground: Underwriting is the new frontier. Buyers want AI-driven triage, real-time risk scoring, and faster quote-to-bind cycles. Yet many providers still treat underwriting as off-limits. Leaders such as EY and EXL are deploying modular, data-rich solutions. Insurers should prioritize partners that bring speed, intelligence, and transparency to the front-end, not just clean up the back office.

The GenAI gap between hype and impact: Most GenAI pilots in insurance (chatbots, claims summaries, FNOL) haven’t scaled yet as they are bolted on and not embedded. Domain-specific tuning, deep API integration, and governance maturity are still lacking. Until GenAI is wired into core delivery without being stitched around it, enterprise leaders will see potential, not value.

Experience integration is the next mandate: Enterprises seek connected experiences, not point improvements. Whether it’s agents, policyholders, or employees, users are tired of jumping across portals, systems, and processes. Service providers that can’t deliver seamless journeys across underwriting, claims, and service will lose out to those that can.

The Bottom Line: Enterprises today have no shortage of service providers, but their true transformation lies in enabling a future-ready business model. Service providers that can’t make that shift will be replaced by those that can.

Insurance providers have modernized, but now they need to orchestrate. Leaders in this space aren’t just fixing workflows; they’re building modular, intelligent, and experience-aligned ecosystems that insurers can monetize. The ask has shifted from automation to alignment, tech showcases to scalable orchestration, and functional delivery to growth-anchored impact.

GenAI won’t matter unless it’s embedded. Underwriting won’t scale unless it’s intelligent. And journeys won’t stick unless they’re connected. To stay relevant in Horizon 3, insurers must move beyond just transforming operations by reinventing their business models.

HFS subscribers can download the report here

Posted in : Customer Experience, customer-experience-management, Digital Transformation, GenAI, HFS Horizons, Insurance Industry