HFS launches its first-ever cards and payments Horizons report. Payments demonstrate the fastest innovation cycles in BFS and are in a constant state of disruption as digital models decimate the cost and data intelligence capabilities of legacy systems.

Payments were once perceived by the world as largely tangential to the banking and financial service industry (BFS), but today they have morphed into a melting pot of innovation and one of the most compelling areas of activity and investment in new capabilities within financial services.

The effects of developments in payments are far-reaching, with a broad impact across consumers and businesses. Payments-industry shifts are forcing incumbents to work harder to capture growth, pick up the pace of digitization, gain economies of scale, and manage risk—all while contributing to innovation. These demands can be overwhelming, but the potential for growth and innovation in the payments space is real. Therefore, attracting new players in great numbers, crowding the market, and raising the competitive stakes.

The payments ecosystem is more dynamic than ever with multiple forces at play, and smart service providers are seizing the opportunities

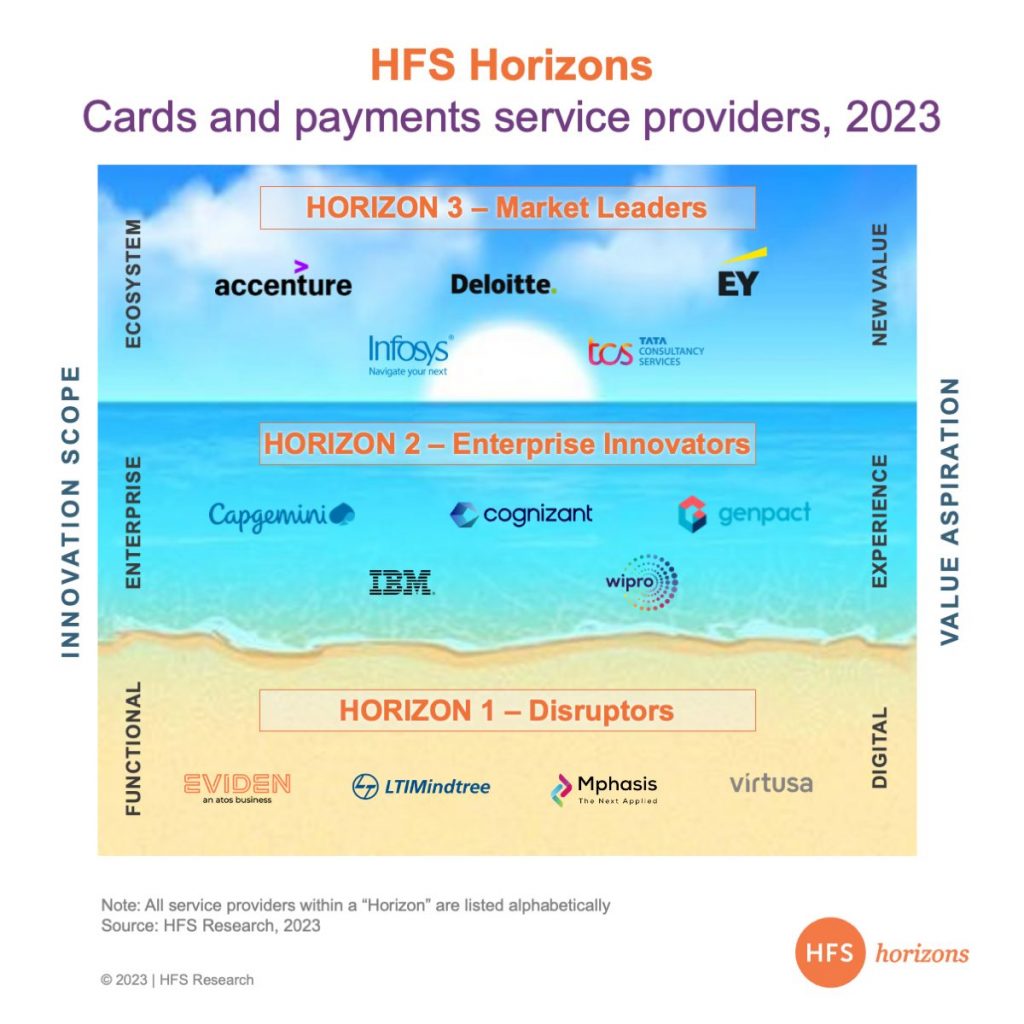

We took an all-hands-on-deck approach to understanding the changing landscape and role of service providers for our 2023 Horizons report on cards and payments, where we evaluated 14 service providers (Exhibit 1) and interacted with 40 enterprises that contract with them. Here are the top payment marketplace takeaways.

Exhibit 1: Seeing the opportunities emerging from payment evolution is not the same as being able to seize them, need the help of service provider partners to seize the opportunity

Note: Service providers within each Horizon are listed alphabetically.

The many manifestations of digital payments

Digital payments take many forms; high-profile payment vehicles include digital wallets, real-time payments, buy-now-pay-later, blockchain, super apps, and crypto payments. The most recent incarnation is mobility payments. Here, one size doesn’t fit all; different markets and regions have had success developing payment business models for specific demographics with strategies embodying the elements defining them. Common elements of a winning model include a connected infrastructure, a forward-looking regulatory view, customer intuitiveness, leveraging emerging technology, and a compelling value proposition rather than just cool technology. All digital payments have exhibited a promising future; however, players that can monetize services and data are poised to capture a larger share of revenue pools.

The promise of multiple monetizable opportunities

Nontraditional players are jostling with banks and payment service providers to become issuers, providers, processors, or partners of choice, causing a proliferation of payment providers. The promise of monetizing across various touchpoints of consumer and commercial customer journeys has everyone excited. And we can’t leave out the payments-adjacent revenue pools, such as unlocking data to capture personalization and marketing opportunities, the ancillary prospects of open banking and embedded finance, and software, platforms, and services surrounding the payment. The payments space is becoming crowded, so market participants must work hard to create differentiated value positions to win in the marketplace.

Modernize or risk disintermediation by customers

It’s time to retire legacy monolithic payments architecture in favor of more flexible systems to accommodate digital payments, integrated services, and related new payment technologies. The archetypes of modern payments architecture include cloud or hybrid models using a modern microservice-based framework, scalable data platforms to access data through standardized APIs, a nimble and adaptive ecosystem, and decoupling legacy workflows and augmenting them with new workflows powered by emerging technologies while supporting seamless integrations with external software and platforms.

The Bottom Line: There is no silver bullet that solves all payment challenges; however, there are clear action steps that participants can take to improve their positions and gain or maintain competitive advantage

The HFS Horizons: Cards and payments service providers, 2023 report includes detailed profiles of each service provider supporting the cards and payments ecosystem, outlining the service provider’s capabilities, strengths, provider facts, and development opportunities.

HFS subscribers can download the report here .

Posted in : Analytics and Big Data, Automation, BFSI, Business Data Services, HFS Horizons