Month: July 2020

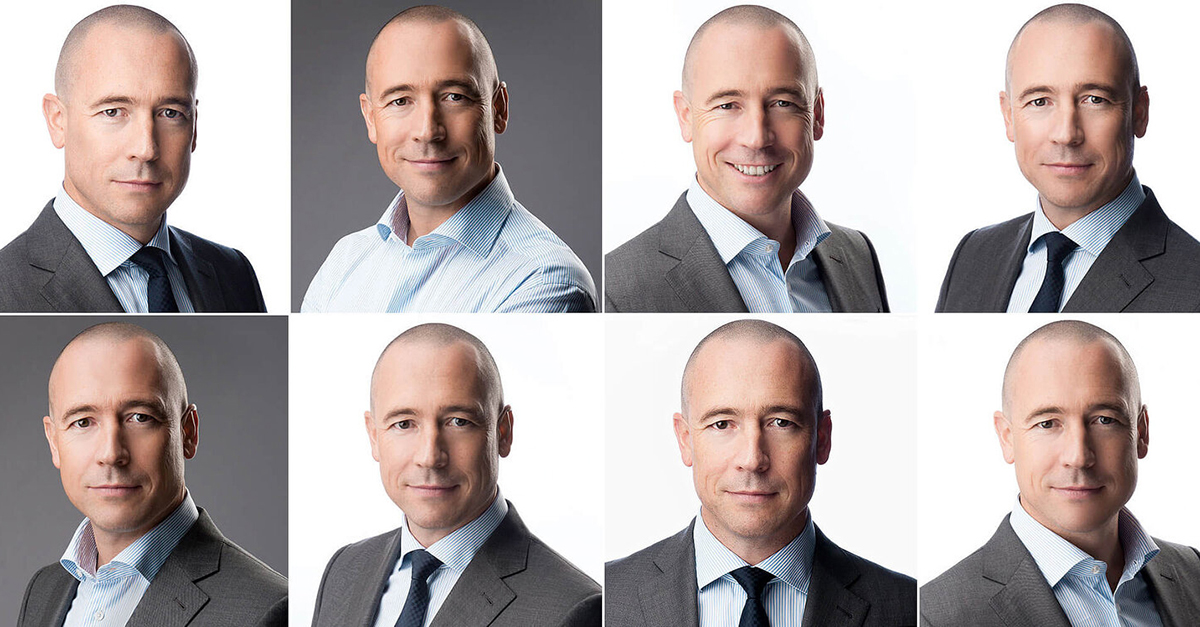

The Umph behind Humph: after 15 months in the Cognizant hotseat, Brian Humphries dives deep on the pace of change, the lessons learned… and much more

Cognizant CEO Brian Humphries moves beyond the business talk and straight to the deep end – the personal, the humble, the lessons learned – and the stakes set firmly in the ground.Read More

There’s no settling with Mike Ettling… he wants to win it all!

It’s time to check in on faceless ERP and discover the draw to Unit4’s “sizzle” and its people-centric paradigm.Read More

IBM just changed the automation game. Hello Extreme Automation

The automation game just changed – and most of you barely noticed.Read More

Nagendra’s agenda: His bullish outlook for the IT and business services industry

We recently caught up Nagendra P. Bandaru to discuss the resilient nature of the IT services industry, his bullish outlook for Wipro, and his sage advice for enterprises to adapt to this pandemic shockRead More