Outsourcing is like ripping off a Band-Aid. Do it slowly, it’s a slow and painful experience. Do it quickly, and the pain is gone before you know it…

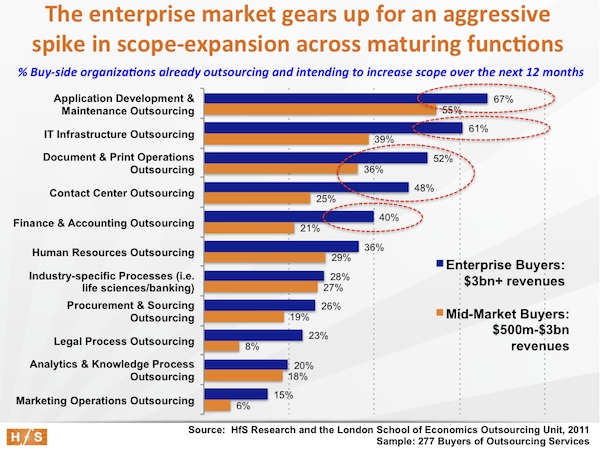

Outsourcing of IT and business process has always been a game for large enterprises, where well-executed large-scale employee transitions have resulted in profitable endeavors for both providers and buyers. But while the large buyers like saving the money (see Part 1), it’s actually the mid-market sector ($1bn-$3bn revenues) which is getting a lot more out of the experience:

This graphic shows where outsourcing has been very effective for organizations. And the mid-market buyers have been enjoying considerably more success in every area – from cost reduction through to global effectiveness, through to getting better business process improvement and technology.

HfS believes much of the reason for this is that mid-market buyers are forced to jump into outsourcing more aggressively to attract a quality provider, which, in turn, is forcing them to transform their operations much more rapidly to incorporate the provider’s global delivery infrastructure. Let’s examine this further…

Why mid-market buyers are enjoying more successful business outcomes when they outsource

Mid-market firms appreciate the global scale, expertise and process acumen providers bring to the table

In the mid-market, organizations are less well-resourced – they often have legacy IT and can’t often afford to have well-paid top-notch finance, procurement, HR and operations talent. Hence, having skilled service providers take on their stuff has been – by and large – a positive experience for them. Their bigger counterparts tend to have more sophisticated ERP and empires of IT, finance, procurement and HR. When the large firms outsource, they don’t really want to change the way they do things – they simply want to run them the same way at a lower operating cost. While a mid-market organization may not wield the same level of aggressive cost reduction through large-scale labor arbitrage as larger enterprises, they clearly enjoy the benefits of accessing improved technology and process expertise.

Mid-market buyers initially outsource a greater proportion of their staff and processes to make the economics work, which is leading to more positive business outcomes

Enterprises usually have a lot more staff supporting business functions, and many of them are today outsourcing in increments, perhaps starting, for example, with accounts payable, before extending to receivables, reporting, procurement and analytics. They are large enough to be able to dictate to suppliers their preferred pace of outsourcing. Many mid-market firms may only have, for example, 150 people in finance and 25 in procurement. They’re pretty much going to have to bundle as many staff into the first deal to attract a top tier provider and don’t have the “luxury” of outsourcing step-by-step.

Moreover, the fact that most of the mid-market buyers have to outsource more processes and staff faster correlates with the increased satisfaction ratings – a more rapid transition to an end-state clearly helps drive transformation and improvements in process.

Many enterprise buyers are outsourcing in an incremental fashion, which doesn’t encourage business transformation

Large enterprises continue to dominate the lion’s share of current outsourcing activity – because they are tending to outsource in smaller increments which, in turn, is inhibiting change and encouraging them to muddle through with their existing processes, which are often inefficient and not very effective in a global outsourcing delivery model.

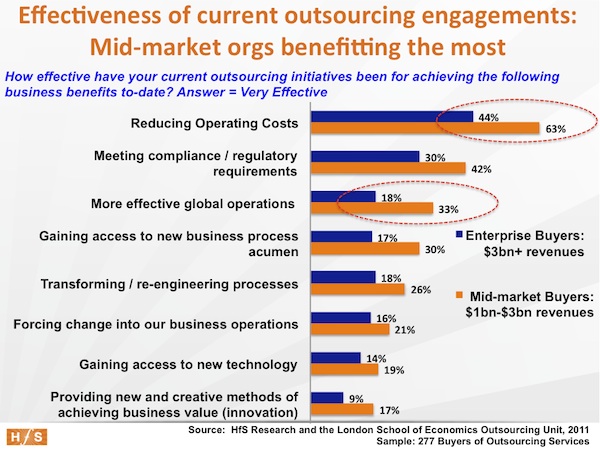

The following graphic illustrates the fact the enterprise buyers are far more active increasing the scope of their existing engagements:

As this data plainly illustrates, large buyers are not holding back when it comes to expanding their outsourcing engagements in established areas where they have eager suppliers swarming all over them to take on more work. For example, 40% of large buyers already outsource parts of their finance and accounting and are looking to grow their engagements, half of them are doing likewise with document and print management, and two-thirds in application development and maintenance.

It really does beg the question: why continually look to increase scope, when you could have outsourced a load of these processes years ago? What were you waiting for?

The bottom-line

Let’s be realistic here – organizations outsource processes that probably aren’t very well run in the first place. Why persist is continuing to run them poorly and take 5 years to reach a point where you finally admit you have to change?

Let’s be realistic here – organizations outsource processes that probably aren’t very well run in the first place. Why persist is continuing to run them poorly and take 5 years to reach a point where you finally admit you have to change?

HfS believes the whole “softly, softly” approach to outsourcing that we are seeing from many enterprises, is prolonging the disruptive change a buyer needs to go through to reach its desired global operations end-state. Enterprises clearly struggle to achieve the business benefits of smaller organizations which are forced to bite the bullet and take on new ways of running processes when they outsource.

Moreover, the mid-market is clearly becoming the testing ground to develop more standardized outsourcing models that can be implemented quickly and incorporate quality process workflows. Moreover, the opportunity is clearly there to bring together much more “industrialized” outsourcing solutions that incorporate software IP, analytical outcomes and BPO. HfS strongly believes that providers need to attack the middle market, in addition to the “easy dollars” at the enterprise level, in order to develop a balanced portfolio of clients: enterprise engagements will serve up profit and delivery scale that can be invested in middle-market clients which are road-testing these industrialized solutions of the future.

Posted in : Business Process Outsourcing (BPO), Captives and Shared Services Strategies, Finance and Accounting, Financial Services Sourcing Strategies, Healthcare and Outsourcing, HR Outsourcing, IT Outsourcing / IT Services, kpo-analytics, Procurement and Supply Chain, SaaS, PaaS, IaaS and BPaaS, Sourcing Best Practises, sourcing-change, state-of-outsourcing-2011-study, the-industry-speaks

[…] here: The undisputed facts about outsourcing, Part 4: Mid-market buyers … Comments […]

Phil,

Finally some evidence to back up what we have been suspecting for a long time. Great analysis and data,

Gareth Johnson

There are 2 really strong points here:

The more you retain, the worse your outcomes. This has been intuitively true to all of us for a while, but now we have data to prove it! Acute, short-term pain is better than dull, long-term pain.

Mid-market actually appreciates and is willing to take advantage of provider’s full capabilities. Large companies due to ego, politics, and maybe even a few legit requirements legislate the value down.

I want the SPs to prove that they can continue to evolve the processes after they’ve received them.

In other words:

Buyer owns an old car.

Buyer trades in the old car to SP and asks SP for a new car lease.

Seven years later, is the once new car old? Can the buyer lease a new car? What are the lease conditions?

If the SP can continue to evolve their processes, they’ll make very happy buyers,

Terry Fuller

Excellent analysis, HfS team – you have built an amazing research engine which is finally revealing some real truths about the outsourcing industry, that many have suspected for a long time, but never had the data to back it up.

Buyers need to be bolder when they outsource, if they truly want to change processes and do more than labour arbitrage. When they say they want “transformation” but are only willing to let go parts of a process, or only a very transactional area, how can the provider do much beyond an operational service?

A willingness to take a great initial risk can – as this data signifies – lead to a greater and faster reward.

However, I would concur with Terry that the providers really need to demonstrate their ability to do this,

Stephen

[…] Source: http://www.horsesforsources.com/the-undisputed-facts-part-iv_061611 […]

Interesting data. Have you considered that many of the smaller firms are using smaller providers, which may be going the extra mile to help there clients?

James Doherty

Very nice analysis. The other big advantage be it mid sized firms or large enterprises is the transformation that happens within the outsourcers organisation.The data provided adds more value to the topic.

@Ravi – to Terry’s point: “providers must continue to evolve the processes after they’ve received them”. I can’t emphasize enough how critical this aspect is. Quality providers will only make money out of this is they can run the processes effectively and replicate best practices and quality workflow across clients. That is why I see the middle market as such an important “testing-ground” for developing more robust, standardized solutions that incorporate analytical capabilities and better technology. I suggest talk to buyers 5+ years into an engagement and ask them whether they still fee they are getting “additional value” beyond the standard operations. That, in my opinion, is the true test of a providers’ capabilities – whether it can really evolve with the client over the long-term, as opposed to a single contract,

PF

Phil, absolutely agree with the HfS article on the 2 key points; pace of outsourcing, benefits to mid-market enterprises.

My experience has been that taking the deep plunge (ripping the band-aid) has led to an overall shorter period over disruption and higher levels of benefit. While there are no doubt some benefits in trialing or piloting, a long, staggered approach prolongs the pain and provides organisations more opportunities to check out of the outsourcing process; reducing benefits, increasing uncertainty and prolonging disruption. In contrast a shorter timeframe, deeper approach moves the organisation forward quickly and shifts focus ‘are we doing the right thing’ to ‘lets get this working and drive the benefits’ – a much more preferable state of mind.

I agree with your points on the mid-markets, while they have arguably fewer heads and hence lower absolute arbitrage opportunities by tapping into the scale, efficiencies and capabilities of SP’s they can rapidly move up the capability curve for the outsourced functions. The flow on benefit is more executive and managerial focus on the core business.

Be interested to see correlation of overall business performance to outsourcing to see how the benefits the article highlights flows through to the bottom line.

Good research !

Russell Ives

[…] The undisputed facts about outsourcing, Part 4: Mid-market buyers are enjoying better outsourcing ou… […]

[…] because they have to offer-up broader process-scope and need to reach an end-state quicker (click here to view our insights about the “Band-Aid” effect). We believe the success of […]

[…] wanted “bigger-bang” deals that the top providers can comfortably cater. Our recent State of Outsourcing industry study shows the increasing relevance of the middle-market to BPO services areas such as […]

Right on. I’m sorry it took me so many months to find this. It told me what I’ve known for years. Mid-market companies do better at outsourcing than large companies — at least proportionately. When we cut a couple of hundred grand from someone’s expenses and upgrade their technology platform at the same time — it makes a big difference.