A geopolitical cyber emergency is escalating—and we’re all deer in the headlights

As global tensions escalate—from Ukraine and Israel to rising flashpoints in South Asia—cyberwarfare has emerged as the new frontline. It targets not just military infrastructure, but also cloud platforms, supply chains, tech ecosystems, social media feeds, and the smartphones of your employees. Today's CIO not only has to manage significant pressures from their boards and leadership peers to deliver an AI agenda, but they also have to balance this with a proactive, holistic cybersecurity approach that business leaders can comprehend. Mess up your cybersecurity, and you’re not only fired, but your entire firm may just sink with you. Read More

AI agents are redefining commerce by eliminating legacy B2B SaaS

Visa and Mastercard just escalated the war for the future of commerce—not with another app, but with autonomous AI agents that buy on your behalf. These aren't lab experiments. Visa’s Intelligent Commerce and Mastercard’s Agent Pay are foundational shifts designed to embed payments into AI platforms that consumers already trust. The implications for enterprise commerce are nothing short of seismic. Read More

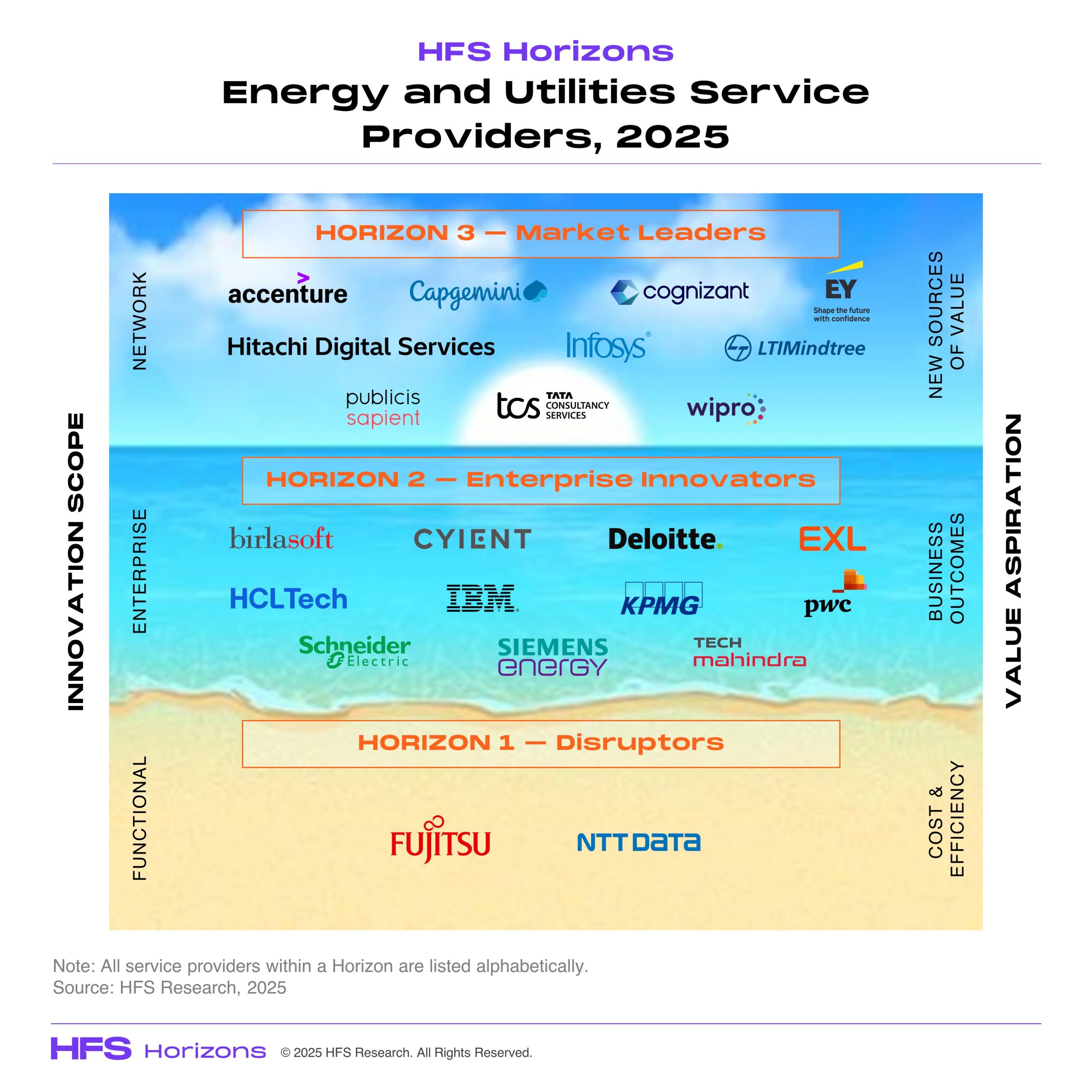

Individuals, teams, and firms can all still lead energy and utilities systems change

Prepare for a breakthrough year in the Generative Enterprise—powered by the potential of agentic AI to deliver end-to-end, self-improving, cross-silo processes to achieve business outcomes, the promise of deregulation, and greater access to infrastructure of the Stargate program, and a new wave of LLM innovation exemplified by China’s DeepSeek. Our Generative Enterprise Services Horizons report 2025 identified several trends: how service providers are meeting enterprise needs, effectively training people, what enterprises need more of from their service partners, and what customers and partners have to say about their service experiences. Read More

Meet Babak, one of agentic’s original inventors

If you’re an enterprise leader staring down ballooning tech debt, rising pressure for AI transformation, and daily new product drops that all scream “innovate now or be left behind,” stop. Take a breath—and read this wide-ranging Q&A between Cognizant CTO Babak Hodjat and HFS Executive Research Leader David Cushman. Read More

The US and India are joining forces to manage 1.4 billion iPhone users. Wow.

Think about it: we're witnessing the strategic decoupling of one of the world’s largest tech titans from its longstanding reliance on China, driven by geopolitical tensions, tariffs, and a desire to insulate against future disruptions. This isn’t just supply chain optimization; this is Apple's full-throated acknowledgment that geopolitical risk is now the primary disruptor of the global technology industry.Apple’s pivot to shift its US iPhone manufacturing from China to India by 2026 isn’t just significant—it’s monumental, and it's happening at warp speed for such a huge manufacturing shift. This also signifies the deepening links between the US and India as these global trade wars gather pace. Read More

Services-as-Software threatens to kill off BPO specialists as WNS eyes Capgemini as a strategic exit partner

As speculation of a Capgemini takeover of WNS hots up, you have to question the future of BPO specialist firms as the worlds of services and software continue to blend together in a rapidly emerging $1.5 trillion market, which HFS last year termed "Services-as-Software". Read More

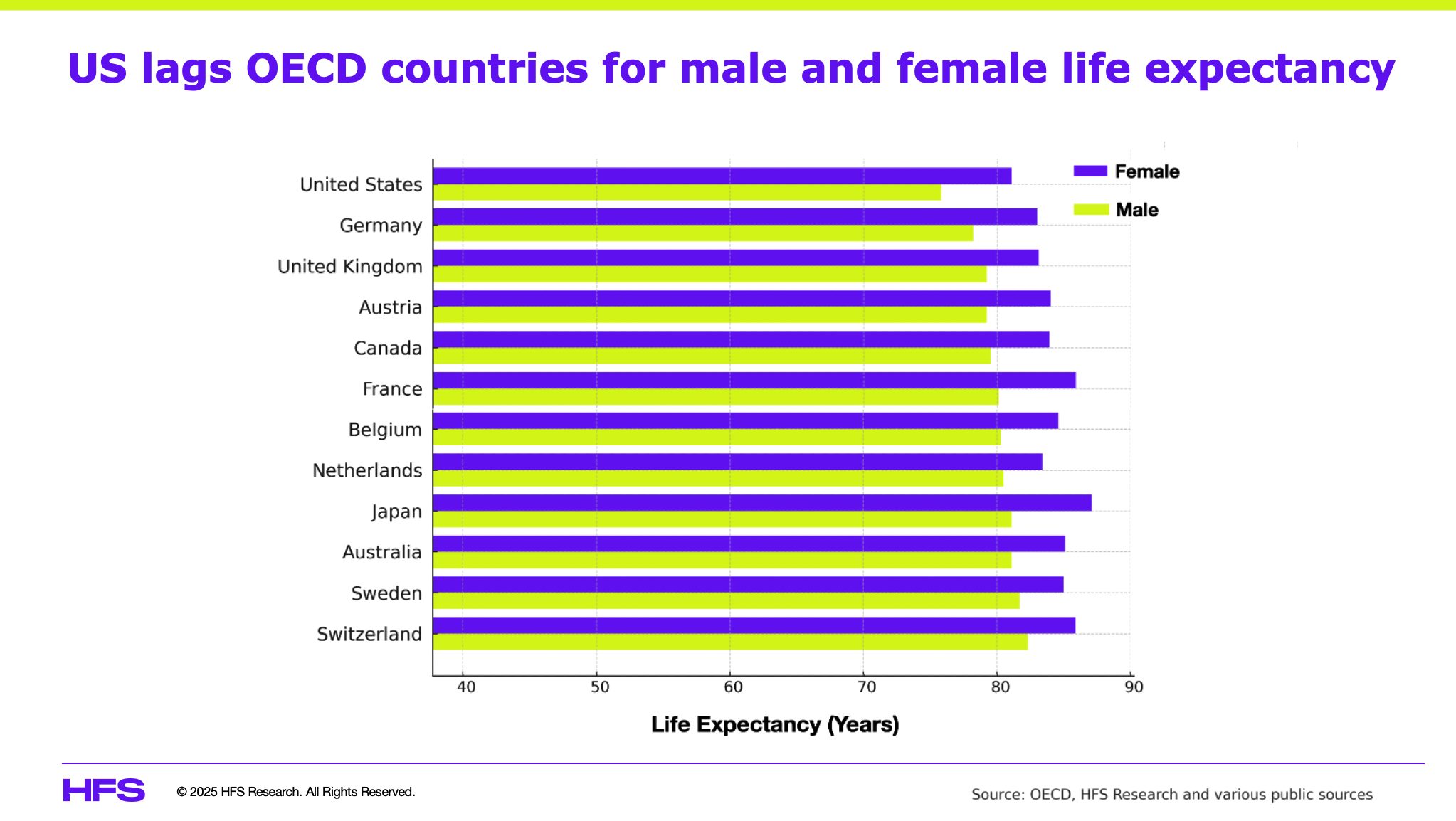

DOGE would find trillions in savings and value if it zeroes in on US healthcare

While the US administration obsesses with pointing DOGE at relatively small levels of governmental expenditure in areas such as USAID and the Department of Education, when it comes to US healthcare, there are levels of cost inefficiencies and improved outcomes that could reach trillions of dollars if managed effectively.In fact, if US healthcare were its own country, its annual spending of $5.2 trillion would make it the world’s third-largest country by GDP. Yet, the US has amongst the worst health outcomes among OECD countries, with the lowest life expectancies for both men and women, and has not been able to address obesity and mental health epidemics. Read More

Trump’s tariffs will rattle the foundations of the global IT services industry to its core

The focus of a lot of US business is going to be squarely on cost reduction, and this will have a direct impact on the global IT services industry. This will result in a double whammy hit for the India-dependent service providers and consultancies as US firms will be incentivized to reshore services work back to the US, and also to invest more heavily in AI to reduce reliance on support staff in areas like application development and business services. Read More

Tariffs won’t save American industry — They’ll strangle it

Let’s be clear. Tariffs aren't inherently evil. In limited, strategic use, they can buy time for critical industries. But when wielded as a broad, blunt policy — as a primary economic lever — they don’t deliver results. They create a cascade of consequences that hurt far more than they help. Sure, there can always be a few modifications here and a consensus agreement there, but when they are designed to choke the life out of a trading relationship and load costs onto the consumer, the ramifications rarely read to achieving lofty political goals. Read More

Joe Biden to keynote at the HFS Summit

HFS Research, the analyst firm which coined the term “Services-as-Software” has added former president Joe Biden to its stellar line up of speakers, which include CNN’s Fareed Zakaria and Wharton School Professor Ethan Mollick. He will address the impact of AI on the United States under the theme “The Agentic President”. Read More