Is it possible to make it through a single day with the word “robotic” being uttered somewhere?

Indeed it is not, ever since HfS Research first began covering the emergence of the new technologies in Robotic Process Automation (RPA) back in 2012. Since then, we have seen RPA take off and become one of the dominant topics in the BPO and IT services market (read more here). RPA is now on the strategic agenda of every service provider, third party advisor and increasingly on the minds of enterprise buyers as well.

But, until now, there wasn’t a way to contrast how different service providers in particular were both thinking about and acting on the opportunity created by the emergence of these new RPA tools. Instead, every activity by a service provider seemed unique and it was hard to get a picture in anyone place as to how mature this capability was and how central it might be to the future operating model of the BPO service providers.

So, after dozens of interviews with service providers over the last several months, we have created the HfS RPA Maturity Model based around 10 Elements and 3 Levels that define what it means to have a mature strategy and delivery capability for RPA in today’s marketplace. The HfS RPA Maturity Model is a useful way for enterprise buyers, third party advisors and service providers to guide conversations within the BPO and IT services ecosystem about RPA and to assess where an individual service provider sits with regards to the maturity of its RPA strategy and program.

The 10 Elements of the HfS RPA Maturity Model include:

- Primary Goal of RPA. What does the service provider want to achieve through their RPA program, is it skills augmentation or labor cost reduction for example?

- RPA Program Owner. Who owns the RPA program within the service provider’s organization?

- Vision of Deployed RPA. How sophisticated a vision does a service provider have for how the “robots” in RPA can be deployed and the utilization model that comes with that?

- RPA Tech Vision. Is the service provider looking to deploy RPA in a relatively simplistic technology vision going forward with remote access to a client’s applications or are they building RPA into the heart of a more ambitious business platform program?

- RPA Expertise Owned By. Where is RPA knowledge being captured and maintained within the service provider’s organization?

- RPA Program Funding. Is there substantive funding behind the RPA strategy or is this being done of the back of individual client contract P&Ls?

- Vision for Processes Addressed by RPA. Does a service provider see a way to use RPA to transform existing business processes or is it a vehicle to look things in place as they are now for a few more years?

- Approach to Client-Service Provider RPA Partnership. Has the service provider learned through experience about the interdependence of RPA and a client’s business applications and if so have they built a strategy to manage that interdependence?

- Vision of RPA Data for Analytics. Has the still under-appreciated benefit from RPA of the increased availability of data on the performance of the software robot agents been identified and how has that been used in the broader analytics approach of the service provider?

- Current Long Term Vision for RPA. How does the service provider think about RPA technology itself and where it is likely to go over the next several years?

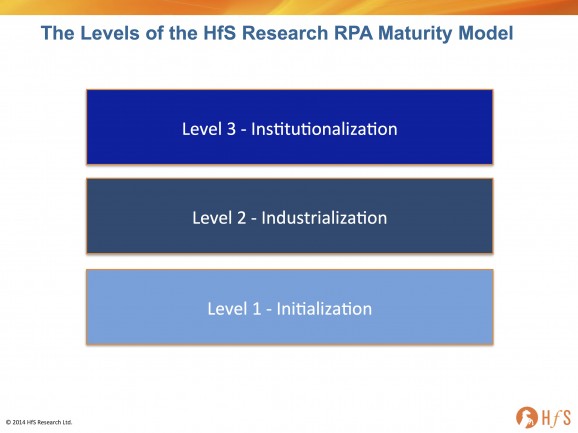

What we realized is that there were currently three different answers that came out from our interviews with regard to each of these Elements, which we then clustered into 3 Levels:

Overall, most of the service providers are consistently operating at either Level 1 – Initialization or Level 2 – Industrialization. Perhaps that shouldn’t be surprising given how relatively young RPA is in the overall scheme of BPO.

However we have seen that a few service providers are actively shaping their strategy around Level 3 – Institutionalization. Which is a broad strategic commitment by a BPO service provider to the transformational potential of RPA on their business and operations. A service provider characterized by this Level is making a sizeable, executive led investment in RPA with a view to creating a fundamental change in the commercial and delivery operations of the business.

We believe RPA will be integral to BPO delivery over the next few years as we shift away from an excessive dependence on labor arbitrage and towards the emerging “as-a-service economy” where technology will be at the core of value creation. It isn’t necessary for a service provider to be at Level 3 to create value today for an enterprise client but we do need some service providers there to set the broadest possible vision for how RPA can change the delivery of business processes.

It so happens that there may also come to be a Level 4 to this RPA Maturity Model, a Level that might come to be called “Innateness”. In this additional Level 4, it may be that the lines between RPA as deployed by BPO service providers on behalf of their enterprise clients and the RPA capabilities that may be adopted inside the client’s internal operations will come together and a new hybrid model of coordination and delivery will emerge.

We will be looking for signs that Level 4 maturity is appearing as we continue our daily discussions with service providers, software developers, advisors and enterprise buyers on the value and evolving maturity of Robotic Process Automation.

Please find the full HfS RPA Maturity Model for download on the Automation Anywhere website.

Posted in : Business Process Outsourcing (BPO), HfSResearch.com Homepage, IT Outsourcing / IT Services, kpo-analytics, Outsourcing Advisors, Robotic Process Automation, SaaS, PaaS, IaaS and BPaaS, smac-and-big-data, Sourcing Best Practises, The As-a-Service Economy

Robotic maturity model.. very good

This is a fairly good way to start evaluating this journey. I would suggest a more conventional level hierarchy perhaps – Basic, Established, Industrialized, Instutionalized and Best in Class?

Did not get the full context for Innateness; perhaps that indicates a level of adoption typical of when the automation journey sort of reaches a plateau and commoditized.

[…] (Cross-posted @ Horses for Sources) […]

[…] Read Blog Post […]

Since we switched to RPA it has sped up customer deliverers & staff productivity by a huge amount. Definitely worth it – Let the robots do the hard work!