Month: April 2008

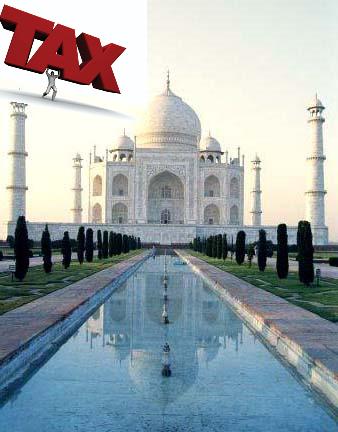

Bada Din comes late this year for Indian outsourcers: the Indian STPI tax holiday is extended

Unexpected extension of the Indian STPI tax holiday Read More

HROWorld 2008: An industry re-inventing itself

Braving the annual industry HRO schmooze fest this year, I realized I was emulating Roger Federer’s extraordinary Wimbledon run by making it to my fifth-consecutive show. Read More

Hewlett-Packard warms to bundled BPO/ITO

I firmly believe the future of outsourcing lies in outsourcing vendors' abilities to deliver hybrid business process and IT solutions in a managed services model - either under a single vendor, or under a well-governed combination of best-of-breed players. Read More