In 2023, HFS Research released a seminal study on the state of innovation in the financial services market’s asset and wealth management (AWM) segment. In it, we spotlighted the poor digital hygiene lurking behind years of M&A and expansion efforts. More is definitely not the same as better.

We continued the AWM deep dive with the industry’s first study focused on assessing the best service providers for asset and wealth management firms across IT and business process services: HFS Horizons: The Best Service Providers for Asset and Wealth Management, 2024.

It’s time for asset and wealth management (AWM) firms to get serious about transformation. The buy-side has been flush with profit and largely loyal customers for decades, propping up poor digital hygiene. Serial merger and acquisition activity has been passed off as modernization for far too long. Changing customer needs, new business models, and expanding offerings in the quest for alpha require modernization investments to enable the future of this sector. AWM firms will get there with the help of their service provider partners.

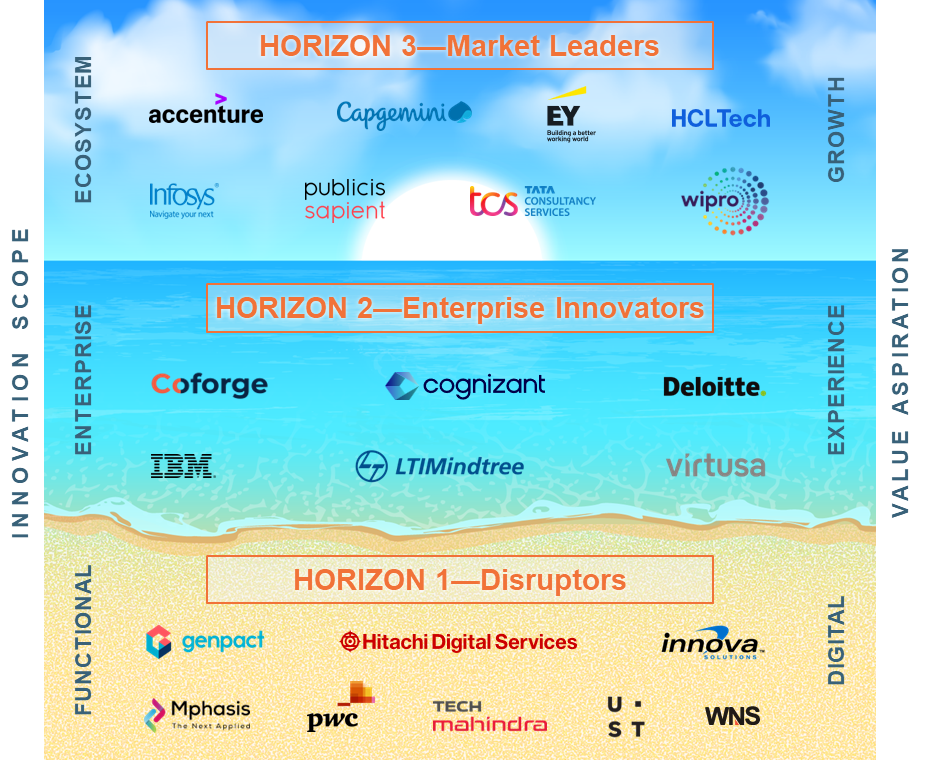

The HFS Horizons: The Best Service Providers for Asset and Wealth Management, 2024 report evaluates the capabilities of 22 service providers across the HFS asset and wealth management value chain based on a range of dimensions to understand the why, what, how, and so what of their service offerings. It assesses how well service providers are helping their asset and wealth management clients worldwide embrace innovation and realize value across three distinct Horizons: Horizon 1, optimization through functional digital change; Horizon 2, experience through end-to-end enterprise transformation; and Horizon 3, growth through ecosystem transformation.

Exhibit 1: AWM enterprises leverage the HFS Horizon model to pick their optimal service provider partners based on needed outcomes

Note: All service providers within a Horizon are listed alphabetically.

Source: HFS Research, 2024

The AWM market is amid massive change across client, business model, and offering facets; end-to-end enterprise transformation is required for progress

The enterprises and service providers interviewed for this study painted a clear picture of a market in transition. HFS notes three big buckets of change:

- Client change: Who clients are and what they want is in massive flux, impacted by a huge generational transfer of wealth and the democratization of investing for retail and mass affluent clients and underpinned by changing demographics and a growing expectation for digital interactions, regardless of whether the client is an individual or institutional investor.

- Business model change. A decade of M&A in the AWM domain has blurred once-accepted front-, middle-, and back-office roles and market participants. Who offers what to whom is changing day by day. New market participants complement market consolidation, and fee pressure drives the potential for new models.

- Offering change. There is a massive push to expand asset class and new fund offerings in the quest for alpha. This push is yielding new offerings in the ESG and sustainability domain, and an embrace of alternative assets like real estate, private equity, and digital assets is on the rise. Investors want a much more robust mix of investments to drive improved returns. Performance matters.

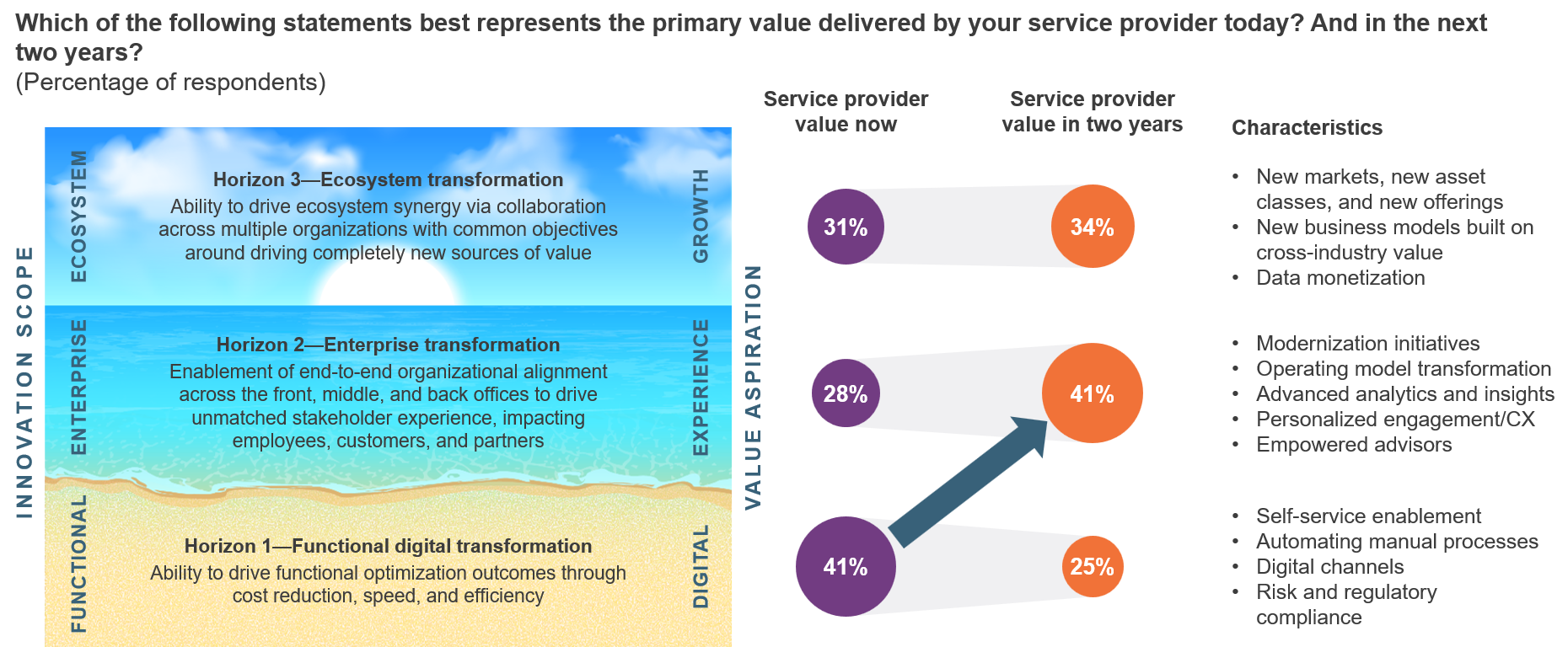

The HFS Horizons model aligns closely with enterprise maturity. We asked the AWM leaders we interviewed as references for this study to comment on the primary value their IT and business service provider partners deliver today and are expected to deliver in two years. Respondents indicated that the value realized today is largely Horizon 1—functional digital transformation focused on digital and optimization outcomes (41%). Two years from now, the story changes, with an enhanced focus on using service providers to help achieve enterprise transformation (41%) and a heavy emphasis on driving growth and new value creation through ecosystem transformation (34%). AWM firms should select their partners based on the value they seek. Incumbents may be the easy choice, but ensure they deliver updated and relevant value.

Exhibit 2: AWM firms seek enterprise transformation enablement from their service provider partners in the coming years

Sample: N = 33 AWM enterprise respondents

Source: HFS Research, 2024

Service providers are decently well aligned to AWM enterprise transformation needs

As AWM firms evolve and mature across the Horizons, service providers are on point to support these ever-changing needs. In our study, we found strong alignment between AWM firms’ push to Horizon 2—enterprise transformation—and the fastest-growing service offerings from providers. Providers are prioritizing modernization and transformation enabled by the latest digital technologies. Modernization is a necessary pathway to meet changing customer needs, develop new business models, and create alpha-generating returns. CX elevation is ongoing and increasingly enabled by modernization, especially data initiatives. Risk and regulatory compliance are perpetual, and there is still work to do to optimize these functions.

The AWM domain is where ESG has moved from a compliance and reporting focus to a growth driver through enabling green investing. IT services leads for spending, underpinning the need for tech-enabled transformation. The jury is still out on whether tech can deliver better returns for investors.

The Bottom Line: AWM enterprises need to get serious about end-to-end transformation to capitalize on the massive changes afoot in clients, business models, and offerings. They’ll get there with the help of their service provider partners.

Post-pandemic, amid a balancing act of challenging macroeconomic factors and exciting innovation potential, asset and wealth management (AWM) firms are looking beyond building capability via M&A to securing growth through a trifecta approach of developing new assets and offerings, enhancing the experiences of customers and advisors, and monetizing data with the help of analytics and applied AI to drive real-time insights, modeling, and decisioning.

The imperative for success is no longer just offerings and services across asset classes; it is increasingly digital differentiation enabled by extensible technology offering front-to-back integration. Service providers have a critical role in enabling the future of the AWM market. AWM firms should select their partners based on the value they seek. Incumbents may be the easy choice, but ensure they deliver updated and relevant value.

HFS subscribers can download the report here.

Posted in : Digital Transformation, HFS Horizons