The traditional lines between CPG brands and retailers are blurring, with brands engaging consumers directly and retailers elevating private-label products to international rivals. The global supply chain instability is pushing them toward diversification for greater resilience. These firms are battling multiple fronts—margin pressure, shifting consumer preferences, operational complexity, and a relentless technology drumbeat. While the noise around GenAI, automation, and omnichannel disruption is deafening, executives are shooting sharper questions: What investments actually matter? Where should we double down now? What’s worth betting on for the future?

The lion’s share of tech budgets remains anchored in traditional strongholds: cloud computing (26%) and analytics (21%), which collectively command nearly half of all enterprise tech spending. But the real surprise lies in the swelling appetite for new-age AI: GenAI (10%) and agentic AI (7%), which now outpace traditional AI (6%) and underscore a dramatic pivot in enterprise AI adoption narratives. RPA and intelligent automation are still much alive (9%). Meanwhile, emerging tools such as blockchain and digital twins hover at the margins, but their moment may be approaching.

90% of IT and business services outsourcing spend maps to the eight domains of the HFS retail and CPG value chain. Over 56% is concentrated in just four areas: Data-driven product innovation, omnichannel CX, resilient operations, and immersive marketing and customer engagement.

Investments that clearly demonstrated business value and are now ready to scale include:

- Personalization, driven by AI recommendation engines and GenAI content creation, is delivering a double-digit revenue uplift per user. Retailers using tools such as Salesforce Einstein or Adobe Target are driving higher conversion rates and increased loyalty.

- Omni-fulfillment strategies—including BOPIS (buy online, pick up in store), curbside pickup, and ship-from-store—are now foundational, supported by cloud-based inventory management and AI-driven demand forecasting. Enterprises mastering this coordination enjoy 30% higher customer lifetime value.

- Micro-fulfillment centers are helping to meet the growing demand for same-day delivery in urban markets, while bonded warehouses are improving global cash flow and customs agility.

- Data-fueled product innovations, such as private-label SKUs based on trending ingredients or unmet category demands, is cutting time-to-market and improving launch success rates.

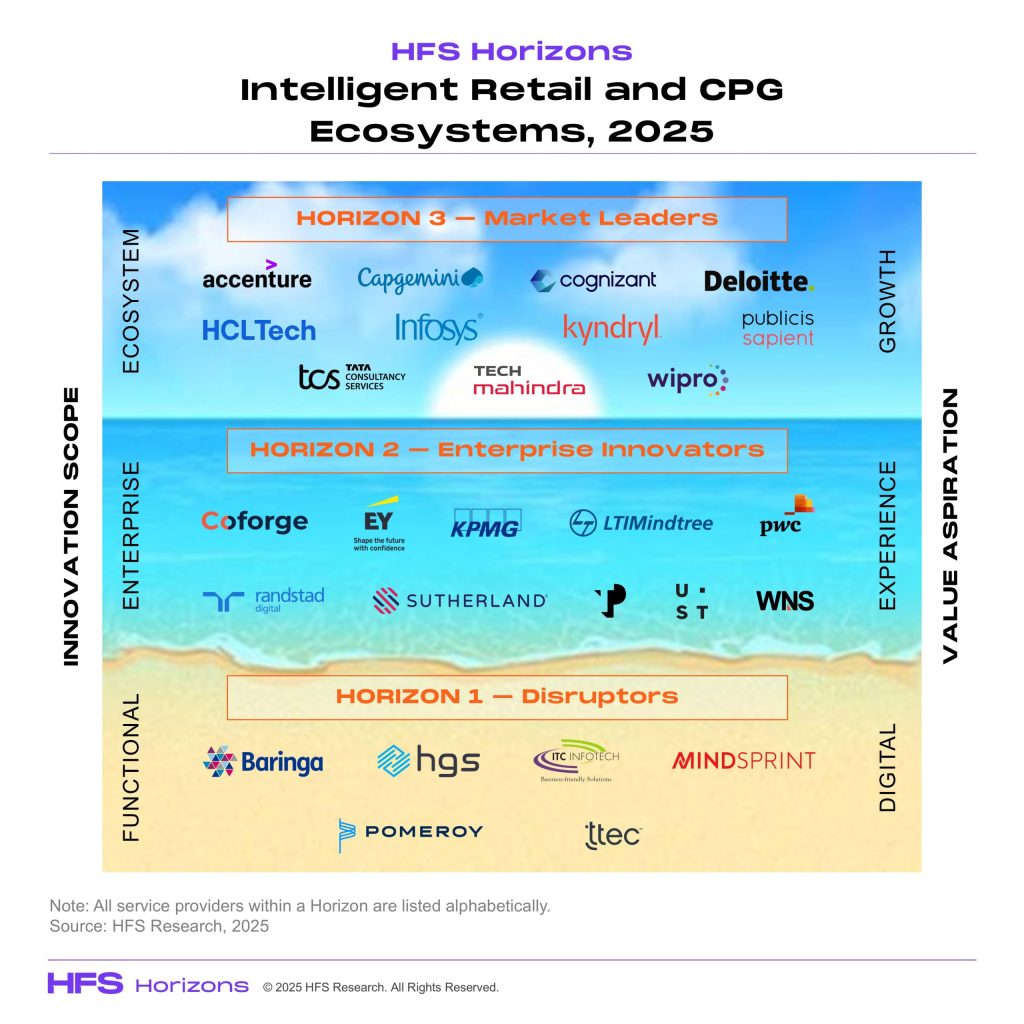

The report evaluates 27 retail and CPG service providers. Of these, 11 are classified as Horizon 3 Leaders, 10 as Horizon 2 Innovators, and 6 as Horizon 1 Disruptors. The evaluation included inputs from 44 enterprise reference clients and 36 reference technology vendors.

Exhibit 1: HFS Horizons: Intelligent Retail and Consumer Goods Ecosystems, 2025

Horizon 1 represents Disruptors laying the foundation for digital efficiency by leveraging technology to drive cost reduction, speed, and operational efficiency in specific functions across the value chain.

Horizon 2 represents Innovators delivering end-to-end experience transformation i.e., Horizon 1 + elevating the entire value chain by creating integrated, customer-centric experiences through data unification and seamless interaction across touchpoints.

Horizon 3 represents Leaders showcasing ecosystem synergy and new value creation i.e., Horizon 2 + building ecosystems that unlock new business models, foster co-innovation, and create entirely new revenue streams, with an emphasis on sustainability and collaboration.

The Bottom Line: Retail and CPG leaders should prioritize investments in data-driven product innovation and omnichannel CX with cloud as the enabler, analytics as the propeller, and AI as the value generator.

Service providers that are rising beyond traditional services and capturing value through futuristic value-capturing models such as services-as-software are best suited to cater to the business expansion demand of the retail and CPG ecosystem.

HFS subscribers can download the report here

Posted in : Artificial Intelligence, Cloud, CPG, Customer Experience, customer-experience-management, CX, GenAI, HFS Horizons, Retail, Retail and CPG