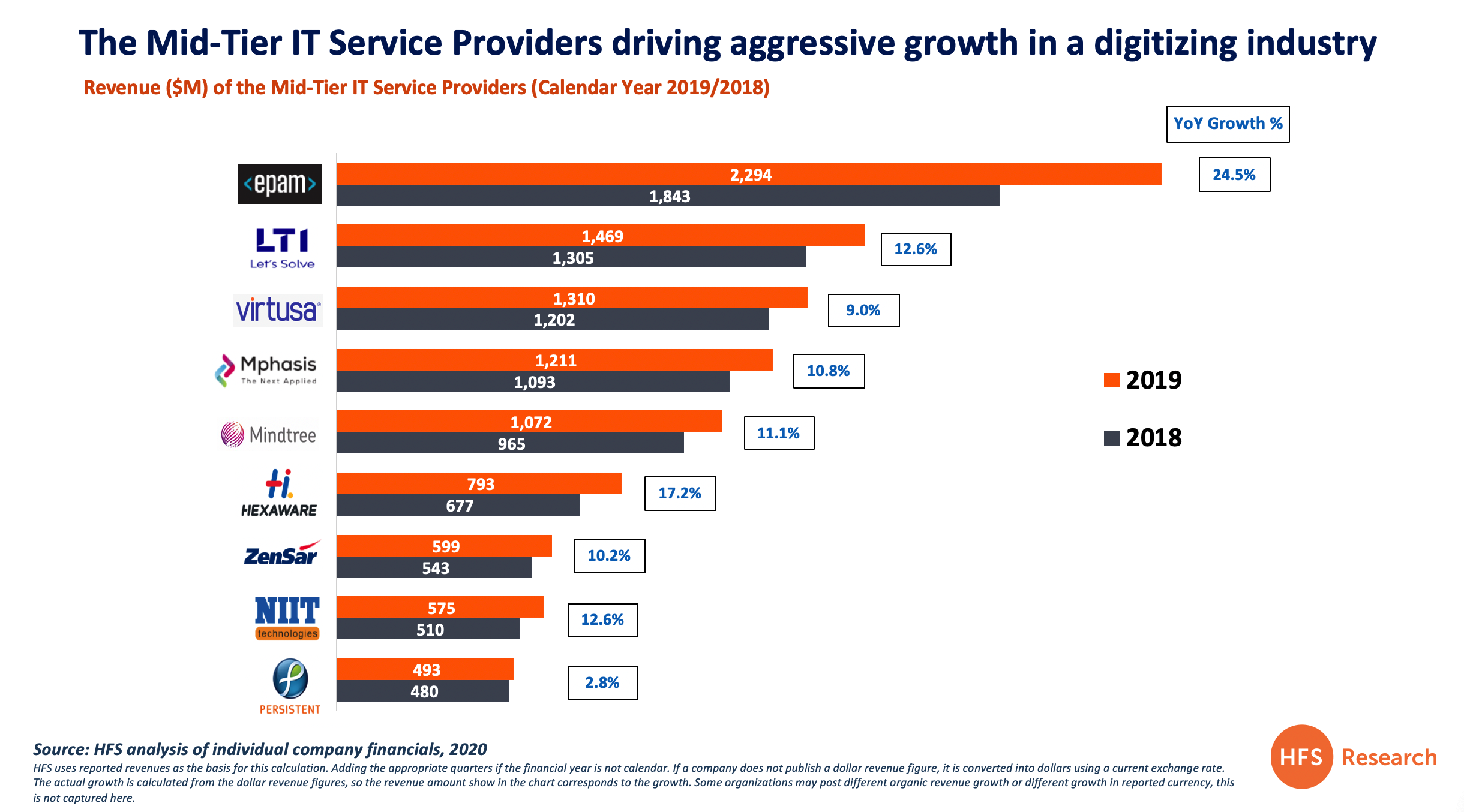

Just a few short years ago, the world of the mid-tier service providers ($500m-$3bn revenues) was a pretty depressing place – many clients were wary of using lesser brands with smaller scale and high attrition and preferred to stay loyal to the Tier 1 brands and beat them up on price. Growth was pretty stagnant and most of them just wanted a lucrative exit, such as IGATE selling to Capgemini, Syntel to Atos, Luxoft to DXC etc. Fast-forward to the last 2-3 years and suddenly the smaller service providers are in vogue, being seen by many clients as more agile, more capable of client intimacy, more flexible and eager to take on complex projects and avoid the exhausting turgid RFP bake-offs which squeeze the value out of engagements before they have even started:

EPAM ensures not all roads lead to India. While we have been overly-focused watching the success of the Indian-heritage IT service providers, the biggest standout performer is the predominantly Eastern-European provider EPAM Systems, which has quietly built out its app development capabilities over the years with its powerful access to tech talent in places such as Minsk, Moscow, St Petersburg, Katowice, Budapest etc. The firm’s focus on complex app development, software engineering, IT security and a recent investment in Blockchain is positioning the company well for strong growth in the foreseeable future. It’s also taken advantage of DXC’s acquisition of Luxoft’s to become Eastern Europe’s standout IT service provider.

Hexaware, Mindtree, Mphasis, LTI, and NIIT lead the Indian-heritage Mid-tier growth spurt. With an IT services market barely growing at 5% annually, for the five Indian-heritage Mid-Tier firms to grow at rates between 13% and 17% is quite remarkable. Clearly, the bias over brands is reducing dramatically as clients seek greater intimacy, focus, and dedication to their needs. We can dive into all these firms to call out where each iswinning, but the main factor in common is the fact that client needs are changing – they increasingly demand shorter projects as opposed to these clunky frustrating multi-year relationships that take many months to set up. I cannot tell you how many executives from these firms have said to me that more and more of their clients simply want work done – and fast – and do not want to jump through all the hoops of the legacy outsourcing world. With the need for systems modernization, digital app development, data management, and automation at an all-time high, clients are more willing than ever to trust those IT services partners where they can still get the CEO on the phone, who understand them, and are willing to move mountains to succeed for them.

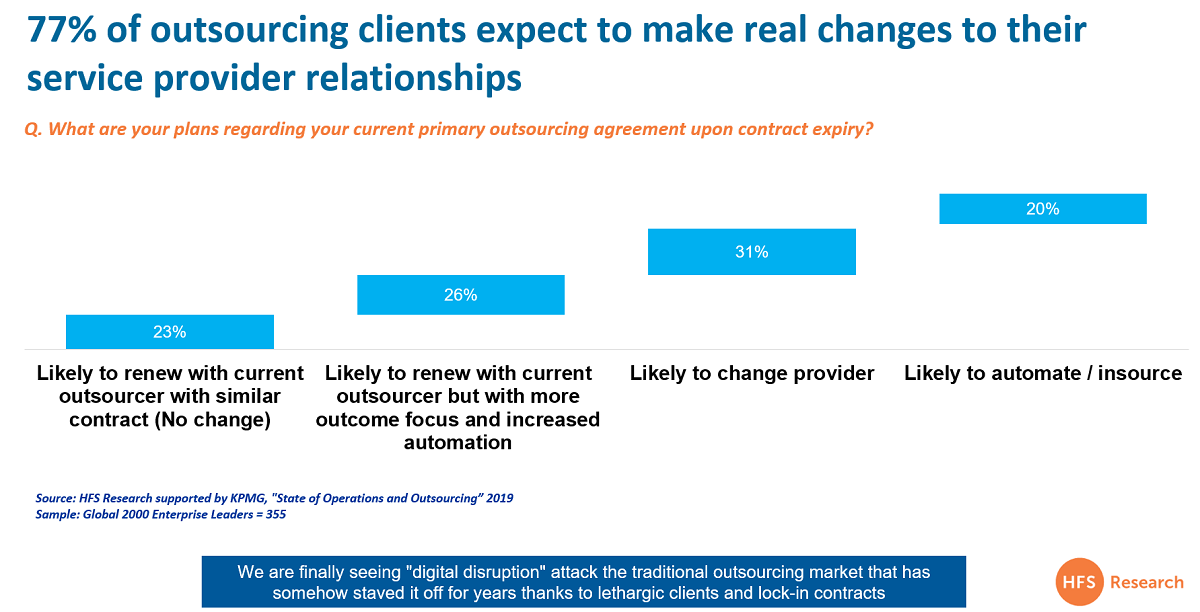

Let’s take a deeper look at what is going on at enterprise intentions when their current primary outsourcing contract expires:

Only 23% of clients are prepared to settle with their current partnership. The traditional model is only working for a minority of outsourcing clients today. If you’re a service provider leader and you haven’t identified who these clients are (and who are not), then you are in serious trouble. Smart Mid-Tiers avoid these clients – no point wasting valuable resources on lethargic clients who really only care about keeping the lights on.

Another quarter (26%) wants to move the needle but may opt for a hybrid model. Meanwhile, 27% are getting itchy to kick their service provider up the rear end and get them embedding some real automation and outcome-focus into their delivery if they are to renew with them. This means they want to see real commitment to reduce the dependence on the staff army and see real investments in process automation to digitize their delivery. These are relationships where Mid-Tiers are frequently being brought in to snaffle pieces of the pie to create competitive tension.

A third is more decisive and likely to make the switch. 31% have clearly got to know their current outsourcing provider only too well over the years and have zero hope they can get any real co-investment out of them. As we have discovered over the last couple of years, some providers have made real investments in competencies like automation and AI, while others have merely added a little sugar-frosting and persist with selling the same old model with some cost shaved off the package, and some added incentives for performance (i.e “outcomes”). Moreover, ambitious outsourcers and Mid-Tiers are heavily targeting their competitors’ disaffected clients and are willing to offer eye-catching deals to win their custom. This can include attractive pricing tied to aggressive delivery staff reduction over a 3-5 year amortization plan that is offset by efficiency savings due to automation and digitization. In other instances, clients are breaking up the provider mix and opting for multi-source relationships with shorter engagements to drive more value and innovation.

In some cases, it may also prove more attractive for the legacy provider to shed the business than fight to keep a client that will quickly become unprofitable (and the industry is littered with those engagements). In several services markets, we are seeing emerging offerings from providers where they are offering fully digital offerings (with vastly cheaper support), such as TaskUs in the customer call center market, or nDivision in managed IT operations, which can undercut traditional outsourcers so aggressively, there is no feasible way the traditional providers can compete. In addition, we are seeing several India-centric service providers offer $-per-chat support models for some transactional services that are essentially chatbots offering basic-level support services at costs as cheap as 15 cents a chat… we are finally seeing “digital disruption” attack the traditional outsourcing market that has somehow staved it off for years thanks to lethargic clients and lock-in contracts.

20% have given up and will just look at something very different. Maybe the cost of changing the model is just so abhorrent it’s time for clients to pull the work back and fix it themselves. Some are so fed up with the lack of innovation in changing anything they’ve realized they have smarter people on staff who are better deployed to take the work back, staff up to execute it while they explore all their digital and automation options. Maybe they will invest in an integrated automation platform, and use the funds saved by backsourcing the work to invest in a digital backbone that enables them to perform work in a touchless, smarter manner? Again, there are ample opportunities here for smart Mid-Tiers to pick up new client work and prove themselves to shrink legacy IT systems, develop new digital backbones and help their clients achieve real business outcomes.

The Bottom-Line: In this current climate, the time is riper than ever for these Mid-Tier service providers to grab more market share

The IT services industry really needs this healthy competition as it gives clients more choice and forces the Tier 1 juggernauts to change their delivery model and entire approach to engagements. And during a time when there is worrying economic uncertainty, global panic about some nasty flu virus, clients will need more support than ever to work with smart partners which can support them remotely, jump in to help critical situations are a moment’s notice, and show the ability to really listen to their needs.

Posted in : IT Outsourcing / IT Services, service-provider-analysis

My view – For many reasons, including being early to market, tier I brands established some beach heads (especially in the threshold to access enterprises and in their perceived capability, safety etc.). Thereafter ofcourse it was a game of execution and grabbing share (ex. A CTS sold it’s story better – over others essentially offering the same goods – which lifted it’s sales velocity).

Now, however, consumerism of offshore services capability has lead to a more open field, pricing pressure, margins squeeze etc. Growth is a challenge for everyone in the times now.

Tap into it, in any which way that you may find appropriate, that seems to be the mantra now for buyers…use a cottage provider, a tier II mid sized player, a tier I brand, build your own in-sourced centre or just crowd source it. It’s all more acceptable now to do so. Switching cost or fragmentation vs consolidation, does not seem to be a big issue.

It’s never really been about disruption or innovation by your outsourcing provider, more so in the recent times (despite the noise to the contrary). Obviously there are situations where someone maybe looking for a narrow capacity/capability (ex. Transformational Automation or AI) but generally speaking commoditised markets may show up a more level playing field?

Digital, reduction in deal size and inability of the big players to serve the leading edge skill needs of born for the cloud companies have helped Tier 2’s thrive. You should look at Tier3 & Tier4 companies who have delivered much better YoY numbers.