The biggest problem plaguing the world of business technology – ever since businesses started using technology – is the simple fact that most enterprises blow vast fortunes on expensive tech solutions and expect them to perform wonders for their businesses without redesigning and structuring their processes and data to achieve maximum value from the technology. It was the case back in the 1960s with MRP, then decades later with ERP, and these issues are even more exacerbated with the Cloud.

Most customers of Cloud just want “easy”… that is the problem.

At least ERP gave companies a standard set of processes to force themselves to follow, but moving your existing mess into the Cloud is an expensive disaster if you avoid changing how you operate, modernizing your hodgepodge of systems and applications, and redesigning your workflows so data can flow freely around your global organization, up and down your supply chain, and across your business ecosystem of customers and partners.

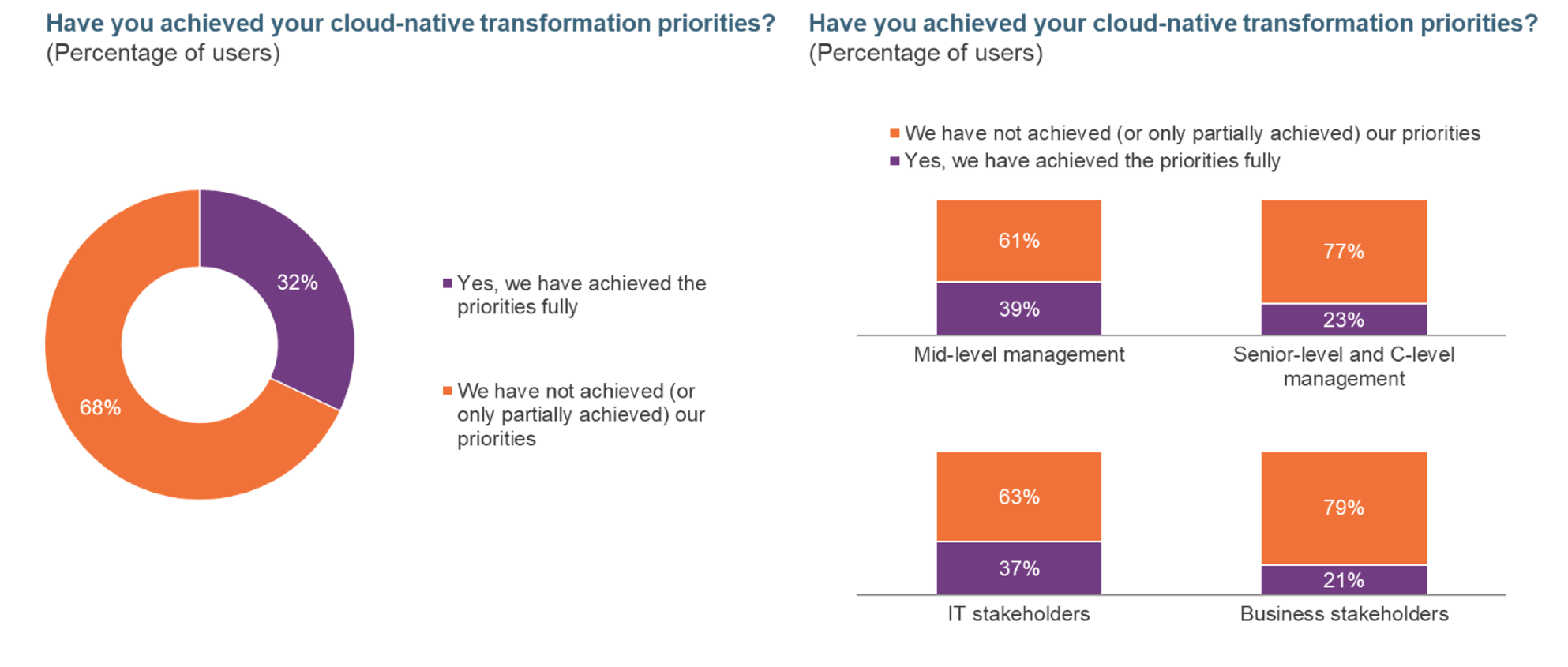

The Cloud is a whole new environment within which to operate your business, and you can’t shoehorn your legacy way of operating into this environment without addressing these (often painful) changes. “Clients just want easy; that is the real problem,” stated the leader of a major transformation practice. This is why our recent research of over 500 Cloud decision-makers from major enterprises (Global 2000) reveals that Two-thirds of organizations don’t fully achieve their strategic objectives for transformation enabled by the cloud (see Exhibit 1 below). Sadly many of those transformations clearly fail miserably if your Cloud transformation will fail if it is not grounded in business objectives. Yet, to keep the cloud bandwagon and spending going, hyperscalers and service providers are now peddling “Industry Cloud.” So let’s probe deeper into what “Industry Cloud” really means…

Many service providers are merely repackaging and rebadging existing IP and calling it “Industry Cloud.”

To accelerate and achieve transformation, creating industry-oriented solution wrappers is not enough. These capabilities can help for some more tactical initiatives, but they won’t move the needle for transformation. Just as with the broader conversations around Cloud-native transformation, we need to reset the discussions on Industry Cloud. Otherwise, we fear Industry Cloud will be just another marketing buzzword with no real definition or value.

Exhibit 1: Only a third of enterprises are realizing their Cloud ambitions

Source: HFS Research, 2023 / Sample: 508 cloud decision makers across the Global 2000

To drive more meaningful discussions, HFS is outlining its fundamental beliefs of what constitutes Industry Cloud, the state of the market, and how we can advance the discourse on the topic. We are building on our horizontal frameworks for Cloud-native transformation (CNT) and on the insights of our industry research leads. To understand the context, you might want to read our deeper dive into Industry Cloud in healthcare first. Our goal is to facilitate more meaningful discussions, thus, do get in touch with us.

Industry Cloud should be about value creation through new business models and value chain disruption.

To cut through the market noise and hype, the discussions on Cloud need to pivot from technology and capabilities to creating and capturing value and enabling new engagement models. The value from Cloud transformation can range from optimization and efficiency gains to new business models to networking effects of the platform economy, ecosystem growth, and data monetization. This is why it is so important to have clarity as to what Industry Cloud entails.

Industry Cloud should be predominantly about value creation through new business models and value chain disruption. It shouldn’t be just about leveraging industry solutions on the Cloud, as these result in efficiency gains at best. Yet, these gains are not sustainable in the long run. Therefore, organizations need to be clear as to whether they want to spend money on industry solutions with a short-term focus on efficiency gains or rather invest long-term into transformational outcomes with Industry Cloud. Confining the discussions to industry solutions is akin to throwing good money at moderate outcomes. Investing in largely horizontal Cloud capabilities is not enough to drive organizational change. Organizations might achieve decentralized working and efficiency gains, but they will continue to struggle to accelerate their transformation journeys. Therefore, how can Industry Cloud help organizations to finally capture business value from their often steep investments?

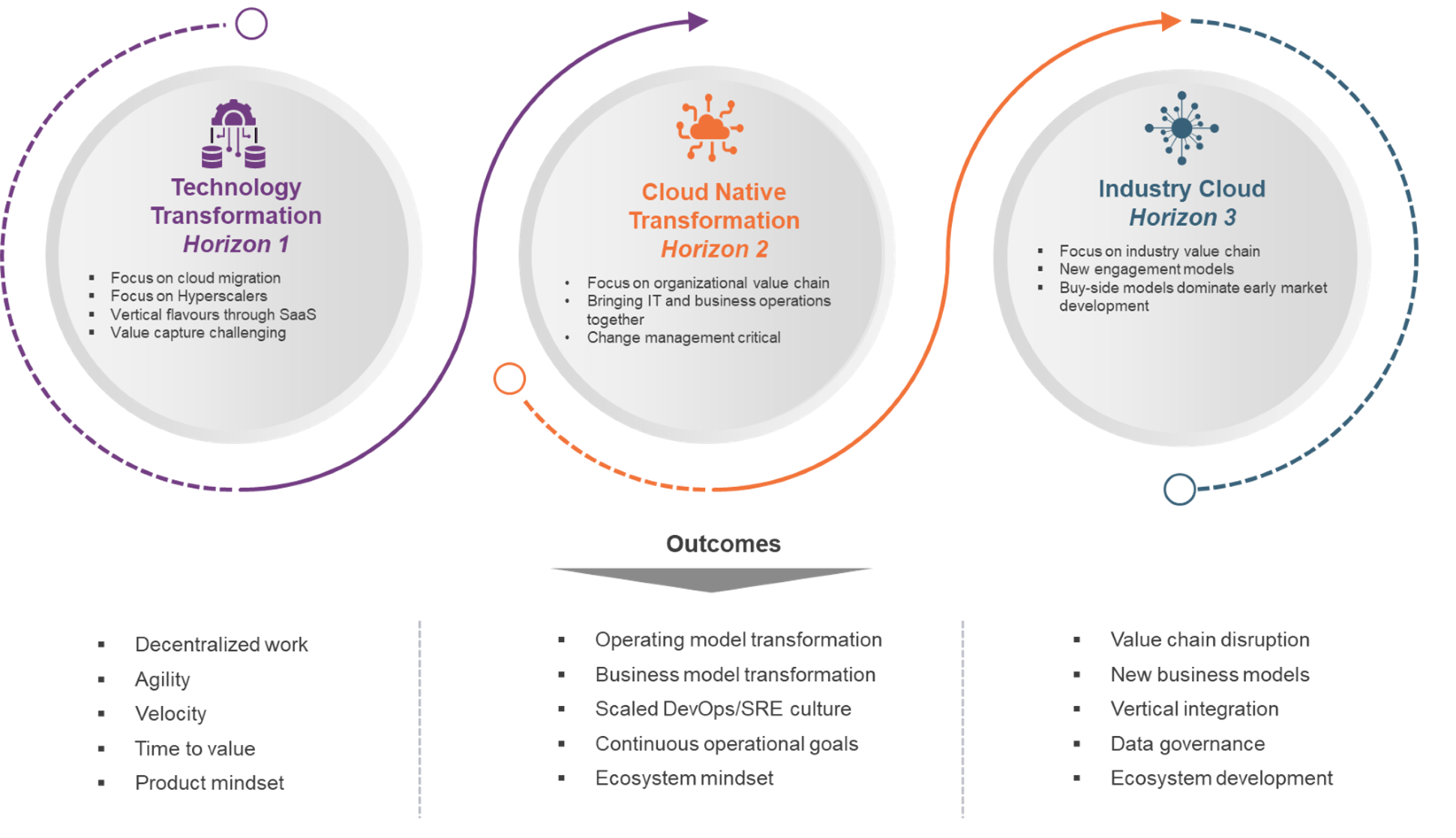

The Three Horizons of Cloud Transformation: The HFS Industry Cloud Continuum

The two key reasons why Cloud-enabled transformations fail are misalignment of technology and business objectives and a lack of understanding of the cloud target operating model. Thus, it is not about a lack of leadership or investing in more capabilities. To achieve business objectives such as moving to a data-centric strategy, and achieving higher velocity, in essence, an acceleration of business processes, decision-making, and technology deployment, organizations have to facilitate cultural and organizational change. Ultimately, CNT is about how we create and deliver, not where. Within this context Industry Clouds can facilitate new engagement models that enable capturing business value – provided they are not just old wine in new bottles.

Therefore, in our view, Industry Cloud must be aimed at overcoming those challenges. Consequently, it is not enough to have just pre-configured IP and some data assets that bring more of an industry context. The ultimate goal of Industry Cloud must be enabling value creation by offering new engagement models as well as business models. Exhibit 2 outlines how Industry Cloud fits into this evolution in the Cloud market.

Exhibit 2: The HFS Industry Cloud Continuum is about progressing toward the disintermediation of industry value chains

Source: HFS Research, 2023

The HFS Industry Cloud Continuum emphasizes that the boundaries between the various horizons are blurry. Equally, there is no pre-defined sequence as to where organizations start. It is not about envisioning transformational outcomes and then designing the Cloud target operating model to drive the transformation journey along those defined strategic objectives. Rather the reality is that organizations have many vantage points when it comes to transformation. Yet, we must shy away from simplistic suggestions of organizational change. No two Cloud native transformations are the same; each is unique. Hence regardless of where organizations are on their Cloud journey, they need clarity on their data-driven strategy and the desired outcomes. Fundamentally, Industry Cloud needs to be aligned to those outcomes.

Let’s walk through the respective Horizons and what they entail.

- Horizon 1: Technology Transformation. Organizations on Horizon 1 are focused on procuring hyperscaler capabilities and moving selective workloads to the Cloud. They might implement vertically focussed SaaS solutions. But ultimately, the focus is on technology transformation. Here offerings such as Microsoft Dynamics for Finance and Operations or the Salesforce Health Cloud add industry-specific capabilities to enhance the effectiveness of processes.

- Horizon 2: Cloud Native Transformation (CNT). In contrast, to reach Horizon 2, organizations must strive to align technology with business objectives. To succeed, they need clarity on the Cloud target operating model and move to bring IT and business operations together. To accelerate the transformation journey, deep cultural change is a necessity. Examples come predominantly from the buy side, such as the Volkswagen Automotive Cloud or Goldman’s Banking-as-a-Service. The focus here is on the value chain of one organization.

- Horizon 3: Industry Cloud. In our view Industry Cloud as Horizon 3 is not the logical evolution of CNT, rather, it is overlapping with Horizon 2, and it is offering a different approach to help capture business value from transformations. The difference between Horizon 2 and 3 is that Industry Cloud must be focused on the industry value chain, ultimately having the ambition to disrupt those value chains and provide new streams of revenue. Perhaps the most compelling example is IBM’s Financial Services Cloud, as it brings together a set of leading banks as well as FinTech companies. Similarly, new engagement models, such as Cargomatic, are a marketplace disrupting the freight market.

Simply put, the evolution of the cloud-enabled transformation is about progressing from efficiency gains and agility through industry-specific capabilities to value creation and even disruption of industry value chains through new engagement models and expansive ecosystems.

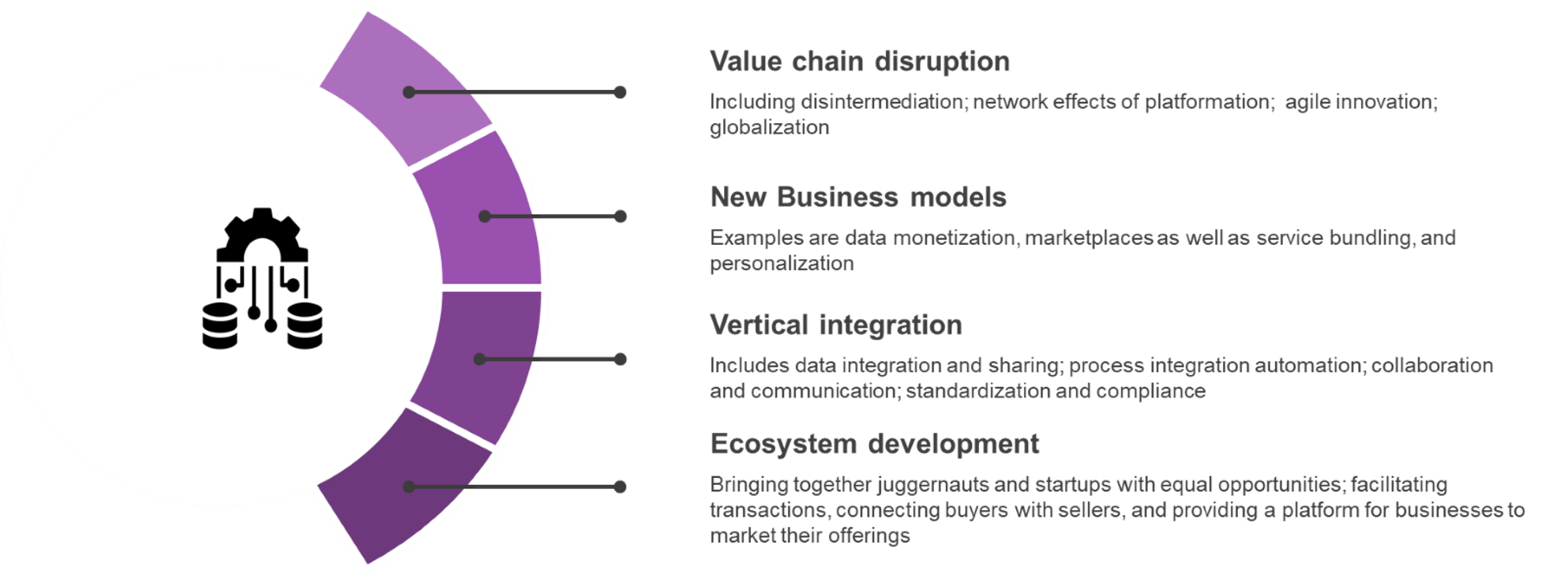

The Four Strategic goals for Industry Cloud: Value Chain Disruption, Vertical Integration, New Business Model, and Ecosystem Development

To help organizations overcome their operational challenges, Industry Cloud should be tied to clear transformational outcomes, and this requires a Cloud–native foundation. Therefore, organizations should focus on accretive value creation when assessing Industry Cloud. Deploying horizontal Cloud capabilities can foster operational efficiency and scalability. Yet, achieving more ambitious strategic and transformational goals requires different engagement models. The strategic goals can include the disruption of a traditional industry value chain and the creation of new business models. The other main levers are all intertwined. Industry Clouds can facilitate vertical integration by providing a centralized platform that connects various stakeholders within an industry ecosystem. By providing data integration and sharing Industry Clouds can serve as a hub for collecting, integrating, and sharing data across internal and external stakeholders impacting the entire industry ecosystem. Thus, potentially creating bridges with adjacencies. Such integration enhances collaboration, improves supply chain visibility, and enables data-driven decision-making across the industry. This is particularly relevant for highly regulated industries such as BFSI and healthcare. Let’s look at these levers for value creation in more detail.

Operation leaders must double-click on the value levers for Industry Cloud

When assessing the options for their strategic objectives, operations leaders need clarity on what they want to achieve. If they want to achieve more efficiency whilst getting the industry context for a specific set of use cases, industry solutions are an effective option. However, if the goal is to facilitate the development, deployment, and scaling of applications in a Cloud environment, value creation, or even the enablement of transformation, they need different approaches. It is here where we need more clarity as to what Industry Cloud entails. Exhibit 3 outlines the levers for value creation through Industry Cloud that can provide more clarity:

Exhibit 3: The 4 levers for value creation through Industry Cloud

Source: HFS Research, 2023

- Value chain disruption: As with CNT Industry Cloud is about value chain disruption, but with the difference that they are focused on industry value chains. Thus, they can eliminate or reduce the need for intermediaries within the value chain. For instance, by providing a direct platform for collaboration, communication, and transactions between various stakeholders, industry Clouds can bypass traditional intermediaries and enable direct interactions between suppliers, manufacturers, distributors, retailers, and customers. An example is Cargomatic’s automated marketplace for local freight platform that connects shippers directly with truckers, bypassing traditional logistics brokers and streamlining the transportation booking process.

- New business models: Together with value chain disruption, it is here where the biggest opportunity for value creation lies. Data monetization is top of mind where Businesses can leverage data to develop insights, trends, and predictions whilst providing personalized offerings. But it is highly likely that we will also see an acceleration of outcome-based models. For instance, healthcare providers may charge based on the number of successful patient outcomes or reduction in readmission rates. Lastly, with the rise of ecosystems, we are equally likely to see marketplaces where collaboration and transactions across the ecosystem will be fostered.

- Vertical integration: This goes to the heart of how we should assess the capabilities of an Industry Cloud. Data integration and sharing, as well as a deeper collaboration through shared workspaces, real-time messaging, and document-sharing capabilities. At the same time, such an integration can enable more effective standardization and compliance. Softer benefits include increased efficiency, reduced costs, improved transparency, and visibility across the supply chain.

- Collaborative Ecosystems: Industry Clouds foster a collaborative environment where different stakeholders can come together to share ideas, insights, and expertise. This collaboration can drive innovation and disruption within the industry. Startups, technology providers, and other participants can leverage the industry Cloud platform to develop and showcase their innovative solutions, challenging established players and traditional value chain models. Take the example of a large European chemical company that wanted to develop digital farming solutions that integrate with multiple systems and provide accurate yield prediction and disease forecasting, recommend products to improve farmers’ yield, and reduce growers’ risk. No single digital platform existed to address the needs of the entire farming ecosystem. Progressing toward an ecosystem meant overcoming silos that were outside the company boundaries.

In our view, the clearest demarcation between an industry solution and Industry Cloud is an ecosystem mindset. Industry Clouds can foster the development of an ecosystem by attracting and onboarding various players, including startups, technology providers, consultants, and industry experts. The ease of use of on- and offboarding as well as data portability, will be key success factors for such ecosystems. Ultimately an ecosystem-driven integration strengthens the industry as a whole. The example we are watching most closely is IBM’s Financial Services Cloud, as it brought together major banks such as Bank of America and BNP Paribas, as well as a broad set of startups across payments, pricing, and risk modeling.

If Industry Cloud gets confined to efficiency gains and industry-specific customization, then just call them industry solutions.

Perhaps not surprisingly, given the market noise, most definitions and descriptions of Industry Cloud focus on technology and capabilities. Callouts often include combining software, platform, and infrastructure as service capabilities to support industry-specific requirements as a near turn-key solution. Modularity and composability are meant to provide robustness and scalability. However, in our view, just like CNT, Industry Cloud needs to be grounded in business objectives. If Industry Cloud gets confined to efficiency gains and industry-specific customization, we should just call them industry solutions.

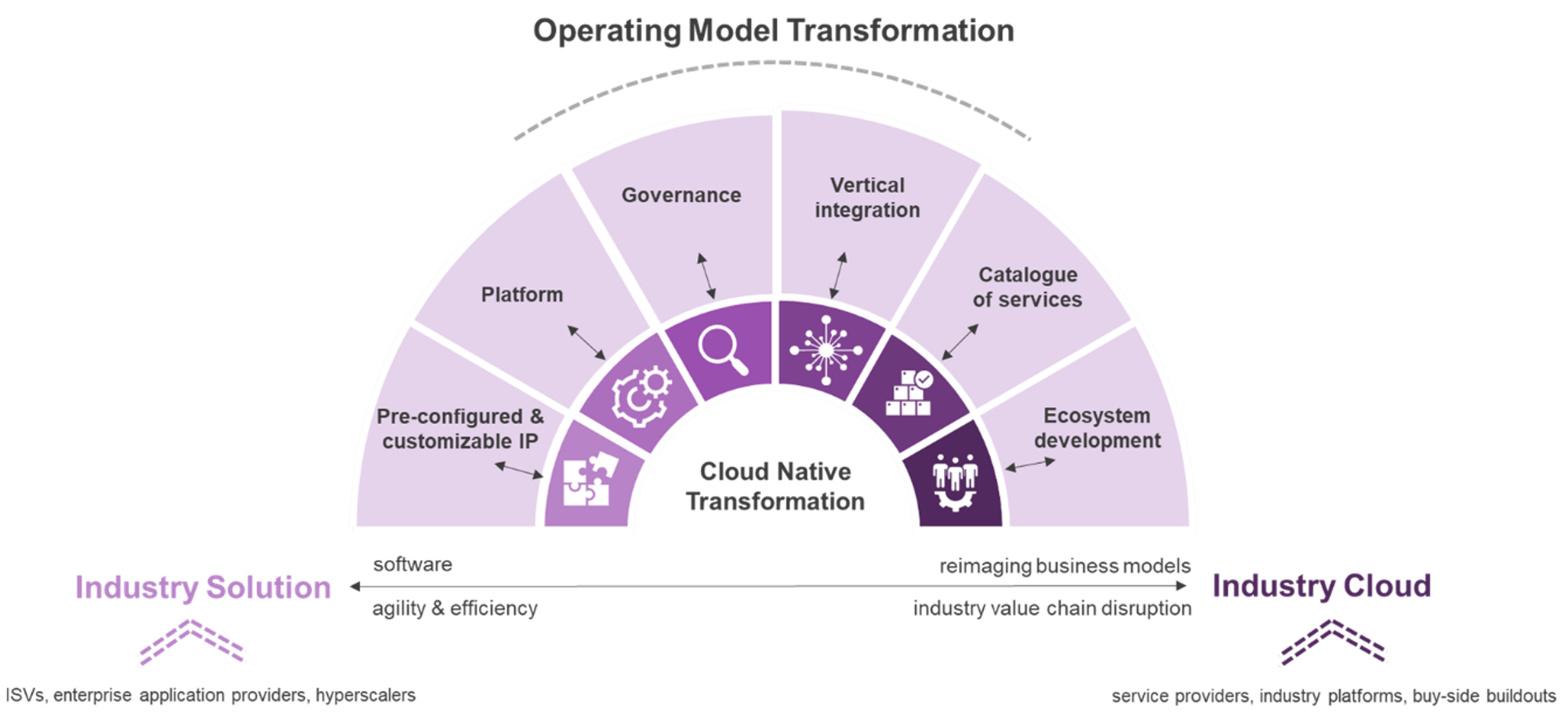

In Exhibit 4, we have highlighted both the differences between industry solutions and Industry Cloud as well as the gamut of capabilities linking the two concepts. If operations leaders are looking for agility and efficiency gains while building out data assets and workflows, industry solutions are ticking all those boxes. Put another way, these solutions can help organizations accelerate development for their top strategic use cases. However, without a Cloud target operating model, these solutions won’t accelerate transformation. Such an operating model requires a deep cultural change where engineering pods are aligned to business product owners. This change typically requires services rather than software. Simply put, Cloud-native operations must support a product-centric mindset where IT and business operate and deliver as one.

Exhibit 4: To select Industry Cloud offerings, operation leaders must align technology and business objectives

Source: HFS Research, 2023

What is lipstick on the pig, what is an industry solution, and what is proper industry cloud?

Having assessed the strategic implications of Industry Cloud, what can we learn from the early deployments? And how can we structure the various offerings to get a clearer view of their value propositions?

Looking at the competitive landscape, there is a bifurcation in the Cloud market. On the danger of painting with a broad brush, hyperscalers are predominantly interested in increasing consumption, whilst enterprise application providers are trying to make their complex platforms work in a vertical context. Therefore, here we see mostly industry solutions. As an executive at a large system integrator put it, much of this reminds him of the early days of ERP when blueprints were meant to provide industry context to monolithic SAP platforms. Looking at the other side of the Industry Cloud Continuum, industry platforms like Veeva or IBM’s Financial Services Cloud are coming closest to providing value creation through the levers we have described in Exhibit 3. Here we are seeing the intent of progressing toward an ecosystem whilst demonstrating deep vertical integration.

Deconstructing the competitive landscape

Yet, as we have argued throughout this analysis, the bulk of approaches are about efficiency and Cloud migration, not transformation. The majority of offerings are modular and composable solutions that are meant to sit on top of Cloud-native reference architectures. Take the Infosys CPG Industry Cloud, where a set of industry-specific solutions sit on top of foundation and orchestration layers. Interestingly Infosys divides these industry solutions into three groupings modernize, enhance/upgrade, and transform. Within “transform,” which is closest to our understanding of Industry Cloud, there are two offerings: Autonomous Supply Chain and Hyper-personalization. Aimed at white spaces, they stand out because they cut across the whole industry value chain. Conversely, TCS is taking a markedly different approach with its Crystallus offering. It positions the offering as a set of pre-configured accelerators and business solutions that painting with a broad brush, enable industrializing horizontal Cloud offerings.

A similar approach can be found across ISVs, Enterprise Applications providers, and hyperscalers. Take Microsoft’s Cloud for Industry. The offerings are not separate Cloud platforms but enable customers to build verticalized data, connectors, and workflows. However, for hyperscalers, the key motivation is not necessarily supporting broader transformation initiatives but, first and foremost, encouraging more consumption of Cloud capabilities. That can be seen in AWS’ for Industries approach. The thrust is about partners building industry solutions on AWS.

Perhaps unsurprisingly, Accenture and the Big 4 as leaders on CNT are also at the forefront of Industry Cloud. Unsurprising because their shared characteristics include blending a compelling vision of CNT with deep technology transformation capabilities. The wheat gets separated from the chaff when providers demonstrate how business objectives get translated into a Cloud target operating model that allows clients to capture value. Without defining and articulating business objectives and then applying technology transformation to get those outcomes, more transformation journeys will fail. Industry Cloud can be a conduit can be a conduit for accelerating that business transformation.

The most intriguing deployments of Industry Cloud are not by the supply side but by the buy side. Top of mind is, for instance, Volkswagen Industrial Cloud, which drives an expansive ecosystem mindset that will see, over time, large parts of its supply chain joining the project. Ecosystem partners ranging from ABB to AWS to Siemens Mindsphere. Talking of the latter, while focused primarily on IoT and manufacturing, both Siemens Mindsphere and GE Predix are compelling examples of platform economy as well as ecosystem mindset.

Operation leaders need transparency as to what they want to achieve. If it is about enabling business transformation and value creation, then we urgently need new and differentiated approaches. Otherwise, we end up with more failures of transformations and the challenge of justifying the often high costs for Cloud migration. Therefore, just as with CNT, we need to reset the discussion around Industry Cloud.

Bottom line: Industry Cloud can become the Holy Grail for Cloud-native transformation, but only if the focus is on new business models and value chain disruption

Industry Cloud has the opportunity to alleviate the many challenges for organizations on their transformation journeys. Yet, to be more successful with that endeavor Industry Cloud must be tied to business objectives and transformational outcomes. Incremental improvements such as agility and efficiency gains through industry solutions are always welcome, but they won’t help to overcome those fundamental challenges.

Operations leaders should focus on ecosystem engagements that have a clear roadmap for value creation. Data portability and robust governance frameworks should be critical elements on the due diligence checklist. While Industry Cloud engagements can mitigate the talent crunch, organizations have to invest proactively in having the right skill sets to manage the transformation journey.

Yet, in this early phase of the market development, we need more clarity as to what Industry Cloud is. To gain more clarity, we should call pre-configured IP and data assets what they are: Industry solutions. Conversely, what we need to highlight much stronger are the transformational outcomes delivered by Industry Cloud. Therefore, we would love to hear from organizations on the experiences of their respective journeys.

Posted in : Cloud Computing, Digital Transformation, Industry Cloud, Uncategorized