Our new “Technology in BPO” study will soon reveal (stay tuned) that this industry is on the brink of a significant, radical overhaul to its very core value proposition. Quite simply, when we look at the current performance of BPO engagements today, the results are more than depressing, but the encouraging news is that half of today’s clients are not expecting to settle for this status quo:

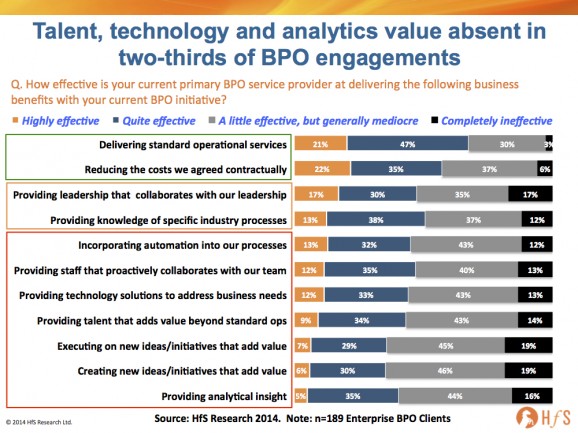

Where BPO is performing well (green). The positive news for the BPO industry is that providers are proving effective at delivering the principal two table-stakes of BPO: (1) delivering the standard basic operations, and (2) meeting the pre-agreed contractual cost reduction targets for clients on more that six out of every ten engagements.

Where BPO performance is average (amber). Encouragingly, half of BPO buyers are pleased with the efforts their providers’ leaders are making collaborating well with their own leadership, a recent trend we have observed where senior provider executives are getting more hands-on with their clients, as opposed to disappearing from sight the moment the contract ink is dry. This is positive news for buyers which need to discuss how evolve their BPO value beyond very basic service provision and gain senior buy-in. In addition, it is reassuring that more than half of buyers are pleased with the specific industry process knowledge their providers are bringing to the table – an area that has proved much more disappointing in past studies.

Where BPO is struggling (red). The areas in the red box give serious cause for concern regarding the potential of the vast majority of today’s BPO engagements. When you consider that many of the leading BPO providers today are significant IT services firms, it is staggering that over half of buyers are dissatisfied with the technology solutions and automation being incorporated into their engagements. Not only that, among the areas where providers can easily impress with a little investment is in providing talent that can be more proactive with their clients, and also deliver more than simply operational support. The picture becomes even more depressing with the fact that barely four out of ten BPO buyers can attest to some positive performance with new ideas and initiatives and some analytical insight from their providers.

Simply put, the majority of providers need to step up significantly, if they can fulfill their clients’ ambitions of moving to a broader transformational environment where they are benefitting from process and technology transformations. On the flip side, HfS research last year (see link) examined the talent issues in sourcing, revealing that many buyers simply do not have the right talent mixes on their outsourcing governance teams to work effectively with their providers to take advantage of their analytics capabilities, jointly plan and develop new initiatives, or work collaboratively on problem-solving or outcome-based gainshare initiatives.

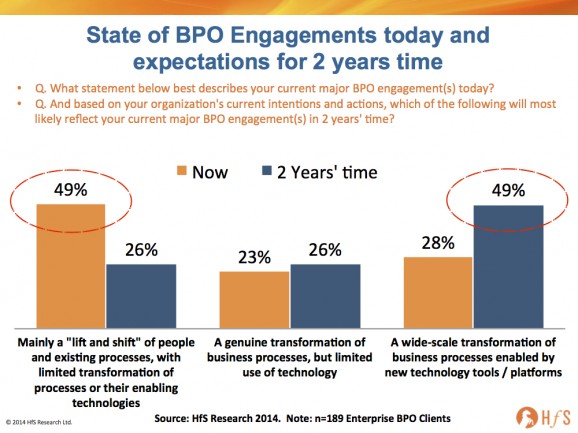

And now the good news: Half the industry expects to break out of the old world of “lift and shift”… and fast!

Some buyers and their providers will embrace what needs to be done to evolve this business beyond being a mere wage-reducing staff augmentation service, while others will persist in slogging away with a model that is now proven, beyond any doubt, that the only real benefits are from the supply and purchase of cheaper labor.

BPO creates a new normal for businesses… and the winners will be those which can break from the status quo. Sadly, once enterprises offload labor costs, they don’t ever want them back, so a new normal will quickly occur where the most enterprises’ leaderships will start to demand further efficiencies – and smart governance leaders today know they will be out of job before long if they are simply going to persist in overseeing a stagnating offshore-based operation. What’s more, expectations are moving a lot faster in today’s environment, where function leaders don’t have the luxury of ten year programs anymore – leadership expects to see tangible results in much shorter timeframes.

Smart enterprise leaders know they have to change how they add value to their firms. You only have to look at the growing number of unemployed CIOs to understand what happens when functions become overly operational and limited value and innovation is being achieved. It’s the same for CFOs, CPOs, supply chain heads and other function leaders – they are all under pressure to drive out costs, while delivering ongoing improvements to data quality and having greater alignment with front-office activities. This is why 49% of today’s BPO buyers expect to have moved to a “wide-scale transformation of business processes enabled by new technology tools/platforms” in just two years:

The Bottom-line: BPO will only fail those enterprises which settle for “mediocre”

Providers can only deliver what their clients demand of them – and pay for. Simply put, 49% of enterprise buyers have only ventured as far as doing basic labor arbitrage, and are clearly failing to find much (if any) value beyond those wage savings. Most providers are not delivering that value, but, in most circumstances, this is because their customers have not got their act together to set out a value-based agenda and work with their provider to have them help achieve it. Providers will not seek to deliver value until their clients demand it, are prepared to invest in it – and will kick them out if if they then fail to deliver it.

BPO is the start of a new phase of change for more enterprises… it’s persisting with the change agenda which dictates the pace of new value creation. These 49% of “lift and shift” engagements have been set up for short-term cost gains, not long term improvements and innovations. However, all is not lost, because moving into a “lift and shift” BPO environment isn’t necessarily leaving the buyer and provider in a bad situation. They have achieved goal number one with most outsourcing: they got the bloated costs off the books and are in a better place to effect change.

In essence, BPO isn’t failing, it’s simply milked as much as it can from the very first phase of efficiency gains… the removal of bloated costs from years of onshore staff hiring. As one major BPO enterprise adopter, now in a very mature state, declared, “We were mired in expensive shared services and politics. The situation had reached the point where we were unable to drive any changes, efficiencies or innovations. Every decision to change a process, procedure or policy would require a committee meeting of people who had no desire or incentive to do anything differently. BPO saved us – it drove the shock through the system we needed to change our ways, and created a new starting point for creating a much more effective, scalable operations infrastructure.”

So, folks, this isn’t the end, or the beginning of the end… moreover, its the start of a new beginning.. for at least half of today’s BPO buyers.

HfS will shortly release its new report, entitled “BPO on the Brink”, that analyzes, in full, the results of this groundbreaking study that covered 189 experienced buyers of BPO services and their practices with regards to achieving business outcomes, deriving value beyond cost and adopting enabling technologies to improve processes and performance.

Posted in : Business Process Outsourcing (BPO), Global Business Services, HfS Surveys: Technology in BPO 2014, kpo-analytics, smac-and-big-data, Sourcing Best Practises, sourcing-change, Talent in Sourcing, the-industry-speaks

Phil,

Really strong analysis and telling data. Do you really see buyers moving from the labour arbitrage model in under two years?

Gareth

Very insightful blog. Really puts into context how much the marketing talk is different from reality,

Ajaj Shah

@Gareth: Most of the buyers have sharpened up their game considerably in the last couple of years – they are much more aware of the issues facing them and what they should be getting from their provider. As I mentioned in the piece, the onus really is on them to drive the agenda with their provider and set out what they want to achieve. As we’re seeing already, some providers are having to up their game (mainly at renewal) to retain their clients. While two years doesn’t seem like a long time, just look at how far things have moved in the last two… things are moving a lot faster in today’s environment with the availability of information, speed of access to new cloud-based tools and the increased intensity to get things done quicker within firms. We’re living in a new time where things just move faster than they used to!

PF

Phil,

What I think happens is most buyers go into BPO without looking too far into the future – they are just thinking about getting the cost out and mitigating the risks while they do it. I think most know there are many opportunities to transform operations down the road, but that is simply a step too far in the short term. What we are seeing here is a waking up of buyers to the potential to change the model as they become more familiar with it and what their provider can (or should) bring to the party,

Amanda Hare

Phil,

Excellent analysis. I actually believe most enterprises are initially separating transformation of their processes with the act of outsourcing – in the early phases. They are not expecting the provider to bring them all these early delights, but simply get the outsourcing working effectively. It’s only when the clients become more capable with BPO that they want more, and realize they haven’t actually contracted for it – or staffed properly for it.

Hence, I don’t think labor arbitrage per se is bad thing, it’s simply the first step on a longer journey, and most buyers are in that “interim” state where they want more, and are trying to understand how to achieve it. As you rightly point out, there needs to be a complete overhaul in terms of mindset and approach for many!

Daniel

@amanda: definitely agree that buyers are getting smarter a lot quicker – any many are going into these engagements with a lot more information upfront on what they need beyond the basic provision. Also, a lot of lessons have been learned from ITO deals about ensuring they find the right partner beyond mere low cost. What’s interesting to me is the speed with which buyers are learning this business and laying our their needs. Conversely, am also seeing many buyers openly struggling internally to elevate sourcing into a value-add initiative and solid career move for operations talent, especially in areas like F&A, which are fiercely resistant to moving up the value chain, in terms of analytics and more consultative support. Interesting times – some are going to get on the train, while others just can’t get out of their own way…

PF

Phil,

the analysis is spot on. The trends are not new but seem to have accelerated with the recent market, technology and consumer behaviour changes. I agree that this will require status quo changes from the buyer and supplier communities. IT-enabled value creation requires a different breed of talent and a different commercial model:

On the one hand, BPO providers will need to hire and nurture a different type of sales, solution and transition professionals who can lead the way of change for their traditional BPO teams. Even for BPO suppliers who also deliver ITO, it is unusual to have good cross-stack solutions and professionals. They are worth their weight in gold.

On the other hand, sourcing and service owners on the buyer end will need to up their commercial game if they want true cost transformation and value beyond labour arbitrage.

Exciting times ahead!

Phil, Excellent write-up. . I agree with you that most enterprises have started to separate transformation of their processes with the act of outsourcing – in the early phases. It is unfortunate that a similar analysis is not available for the SMB Marketplace as that will encourage lot of SMB enterprise to recourse to outsourcing and understand that outsourcing is not just about costs arbitrage, but better productivity, analysis and research. They are not expecting the provider to bring them all these early delights, but simply get the outsourcing working effectively. It’s only when the clients become more capable with BPO that they want more, and realize they haven’t actually contracted for it – or staffed properly for it. I don’t think labor arbitrage per se is bad thing, it’s simply the stepping stone to a longer journey, and most buyers are in that “interim” state where they want more, and are trying to understand how to achieve it. As many of the readers have rightly mentioned, there needs to be a complete overhaul in terms of mindset and approach for many. If a similar roadmap is created for the SMB space, it will be of great service to the industry and will enable them to taste the fruits of success that the Fortune companies currently are taking advantage of.

Very insightful blog Phil. Interestingly Platform offerings are there for quite some time however only recently it is becoming point of focus in the discussions. I feel the industry has to still go thru an adoption cycle on tools/platforms. What’s your view on cloud in this context?

@Daniel: completely agree – labor arbitrage leaves most companies in a great place to transform their operations. First you need to get rid of the bloat and take out unnecessary cost. Hence, this isn’t doom or gloom, just an impasse before the next wave of improvement, for – well – 49% of today’s buyers…

PF

@Pilar – reminds me a bit of the ERP “transformation” issues in the 90s and early 2000’s. One of SAP’s biggest mistakes was losing so many of its industry experts

PF

@Taheri – we discussed the mid-market in depth here. It’s fertile ground for much faster transformative initiatives – companies have to move from A to C quickly, and much less of the slow, painful step-by-step behaviors we see at the high end.

PF

@Gurjeet – Cloud is having a huge impact in terms of helping standardize process and standards and enabling global access/delivery. However, the impact of cloud apps needs to evolve further with BPO, where there is huge potential for the likes of Workday, ServiceNow and several other platforms. I would like to see more cloud development in accounting platforms, where Workday needs more feature development and SAP hasn’t rolled out a cloud based version of its software for global accounting BPO deals (but I hear developments are in the pipe).

PF

Great analysis.

This provides a very interesting parallel to what happened to IT outsourcing. I think only thing it will differentiate it from that is the speed with which the change will manifest itself. The buyer maturity curve will be much shorter on the time-scale. Your two year prediction seems to be on point. Besides the technological advances in cloud and platform based solutions etc, the maturity in defning the contractual requirements is coming a long-way as we see on a daily basis.

[…] http://www.horsesforsources.com/bpo-fail-change_021914 Share this:TwitterFacebookGoogleLike this:Like Loading… […]

Hello phil,

I believe your predictions are spot on. I have been witness to this ever evolving buyer maturity in the bpo space. Most of the new deal discussions and renewals go through an engaged round of discussion on “what more”.

Buyers’ insistence on value and a focused governance is what takes it to next level. From doing it cheaper to eliminating work and further ensuring a business impact requires a great deal of operational maturity on service providers part. It is happening as we speak

I believe we will very soon see excellent examples of newer techniques and technology at play in bpos i.e. robotic automation. Cloud computing, mature platforms.

Warm regards.-Prashant

Phil,

Cogent and insightful analysis. Providers who can orchestrate relevant expertise and effective technology into improved performance for their clients seem best placed to benefit from this transformation. Of course having the governance in place to recognize what is on offer from providers matters significantly.

Ed Marcarelli

[…] our standpoint at HfS, it’s abundantly clear that ambitious 49% of enterprise BPO clients are shifting towards a two-pronged requirement of both […]

[…] our standpoint at HfS, it’s abundantly clear that an ambitious 49% of enterprise BPO clients are shifting towards a two-pronged requirement of […]

[…] this value. In short, the BPO industry’s ability to change is still slower than what buyers claim they want and expect, and what service providers claim they can actually […]

Hi Sachin,

Wanted to speak with you. Can you call me tomorrow on my cell

Thanks

Rajesh Shetty

[…] this value. In short, the BPO industry’s ability to change is still slower than what buyers claim they want and expect, and what service providers claim they can actually […]

[…] (Cross-posted @ Horses for Sources) […]