The last decade-plus has seen the ascendancy of platform businesses like Uber, Netflix, Amazon, Facebook, Google, and Spotify… and today, six of the top 10 global businesses by market capitalization are platform businesses.

These businesses have changed how consumers and producers interact, companies compete (customer acquisition becoming more important than profits), and value is created in the economy. These platform companies with new rules of engagement, reimagined value chains, and non-conventional business models constitute the platform economy.

These companies rule the roost in market share and technological advancements. For the past few years, many leading platform companies, including Amazon.com and Meta, have been working on and incorporating recently introduced technologies such as LLM and Generative AI.

The opportunities for service provider partners continue to proliferate

The platform companies, especially start-ups and next-generation platform businesses, are constantly looking for providers that can respond to their platform’s network effects, understand the multi-sided nature of clients (providers and consumers), play the role of an orchestrator in ecosystem building, show preparedness to handle rapid scaling, and help in geographic expansion. Correspondingly, the platform economy has become an irresistible customer segment for IT and business process services (BPS) providers. However, few providers have been able to crack the code required to work with platform businesses.

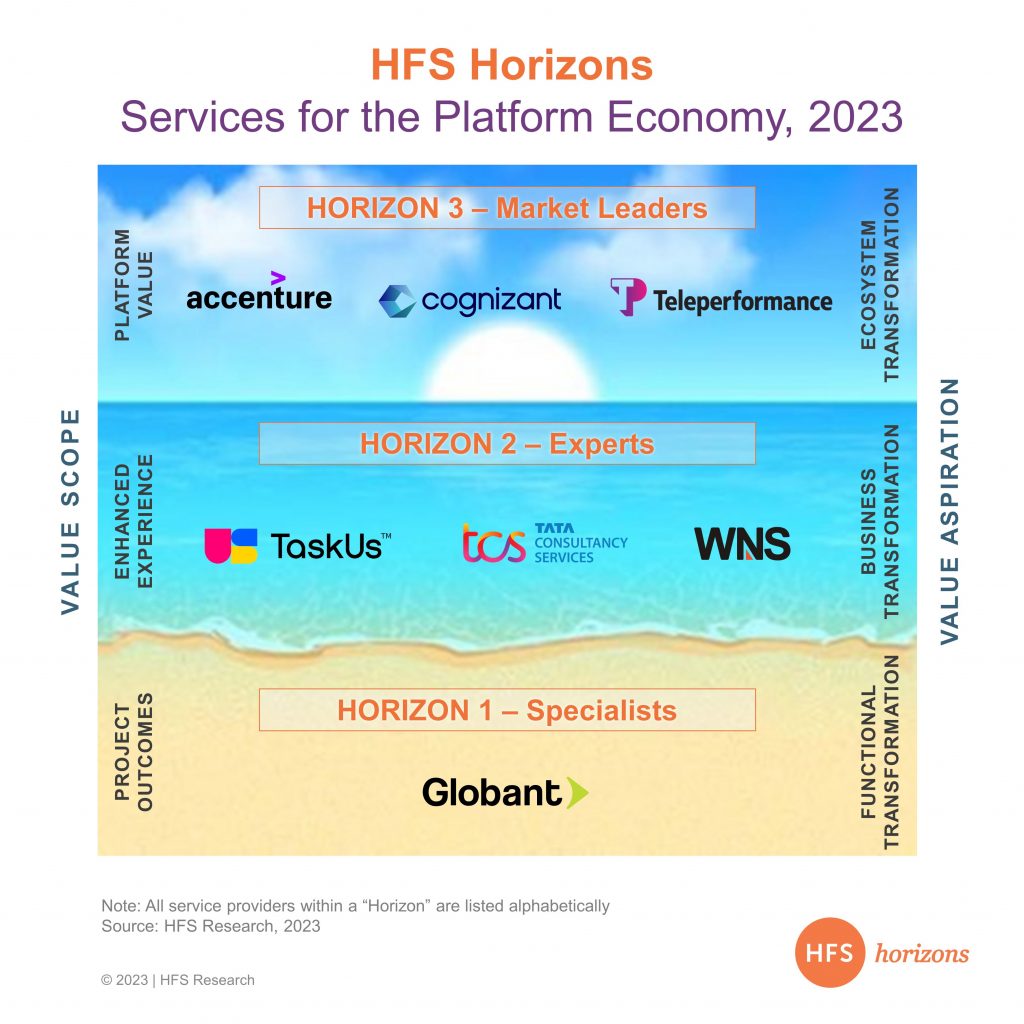

The Services for the Platform Economy, 2023 Horizons report covers seven notable providers helping their platform clients efficiently run operations, expand business, and realize value. Horizon 1 constitutes niche and specialized services catering to specific aspects of a platform business, such as digital engineering or digital marketing. Horizon 2 retains the values of Horizon 1 plus looks at a diverse portfolio of services and core competence in working with platform clients with varying business models. At the pinnacle is Horizon 3, encapsulating all values of the previous Horizons plus a focus on an innovative portfolio of tailored services and instances of co-innovation, driving completely new sources of value with the HFS OneEcosystem™ approach.

Exhibit 1 summarizes the Horizons philosophy and key underlying dynamics, showcasing the providers across the three Horizons.

Exhibit 1: Accenture, Cognizant, and Teleperformance are driving value with the HFS OneEcosystem™ approach

Note: All the service providers within a Horizon are listed alphabetically.

According to the report’s lead author, Ashish Chaturvedi, “The ascendancy of the platform economy ushers in a transformative era in the enterprise world—six of the world’s top 10 companies by market capitalization are now platform businesses. This dynamic shift redefines traditional business boundaries, compelling the market to embrace eco-system-driven opportunities, multi-sided customer lifecycles, and manage hypergrowth phases. Service providers are pivotal in fostering this growth and innovation by sharing and managing their platform clients’ critical business and IT activities.”

Report highlights include:

- Providers are still finding their footing. Providers, barring Accenture, don’t have a dedicated business unit or practice for the platform businesses. In most provider organizations, the platform clients are segregated based on industry verticals. For example, if it’s Uber, the travel, transportation, and leisure vertical in the provider organization would be handling that account. Similarly, if it’s Amazon.com, then the retail and CPG practice would manage it.

- The typical deal size is sub-$50 million. As platform businesses are born digital firms, providers don’t win large legacy modernization and transformation projects. For instance, the probability of Walmart outsourcing $500 million is much higher than Amazon.com because of the underlying business model, legacy infrastructure, and physical footprint.

- Platform players are inward. Platform companies like keeping services in-house, both business and tech functions, to stay competitive. Many platform companies in the hyper-growth phase grow at a phenomenal rate, experiencing 10X to 100X growth, but that doesn’t translate to similar growth on the provider side. Regardless, all seven providers evaluated in this study have witnessed high double-digit growth from platform clients for the past few years.

- Platform players are selective in provider selection. The seven players evaluated for the study generated more than $13 billion in annual revenue from about 979 platform clients (with overlaps). Interestingly, many other tier-1 and tier-2 vendors initially considered for the study don’t even generate 5% of their overall revenue from the platform economy or have fewer than 12 platform clients. It points to the fact that platform companies selectively choose their partners.

- HFS assessed seven leading service providers catering to the platform economy. Of these seven providers, three are positioned in Horizon 3 as leaders, three in Horizon 2 as experts, and one in Horizon 1 as a specialist. The services firms leading the market and ecosystem-level change in Horizon 3 are Accenture, Cognizant, and Teleperformance. The services providers with rich client experience and a wide array of offerings in Horizon 2 are TaskUs, TCS, and WNS. The services firm providing specialized and niche services in Horizon 1 is Globant.

- The report includes detailed profiles of each service provider, outlining their capabilities, strengths, provider facts, and development opportunities.

HFS subscribers can download the report here

Posted in : Business Data Services, Business Process Outsourcing (BPO), GenAI, HFS Horizons, IT Outsourcing / IT Services, OneEcosystem, OneOffice, The Generative Enterprise