No living member of the human species knows more about healthcare payor BPO than Tony Filippone (this also extends to other species such as consultants, lawyers etc).

Tony "The Governator" Filippone (pictured left) launches his first major report on the state of the healthcare payor industry and the current and future role of BPO services

Prior to his reincarnation as an analyst with HfS Research, Tony spent the last nine years of his existence tackling everything from print and document management, to call center ops and real estate management, through to procurement and strategic sourcing, for $60 billion healthcare payor giant WellPoint. And now the fella gets to elaborate on his experiences and help sustain the issue of healthcare costs beyond a level even more riveting than which young lady Justin Bieber was spotted with last week (no kidding – actually a true fact).

So without further ado, here’s the Governator himself with some snippets of what to expect from his new blockbuster…

The Healthcare Payor BPO Landscape in 2011: Will Reform Shatter a Complacent Industry?

You’ve probably heard the news: health care costs are rising.

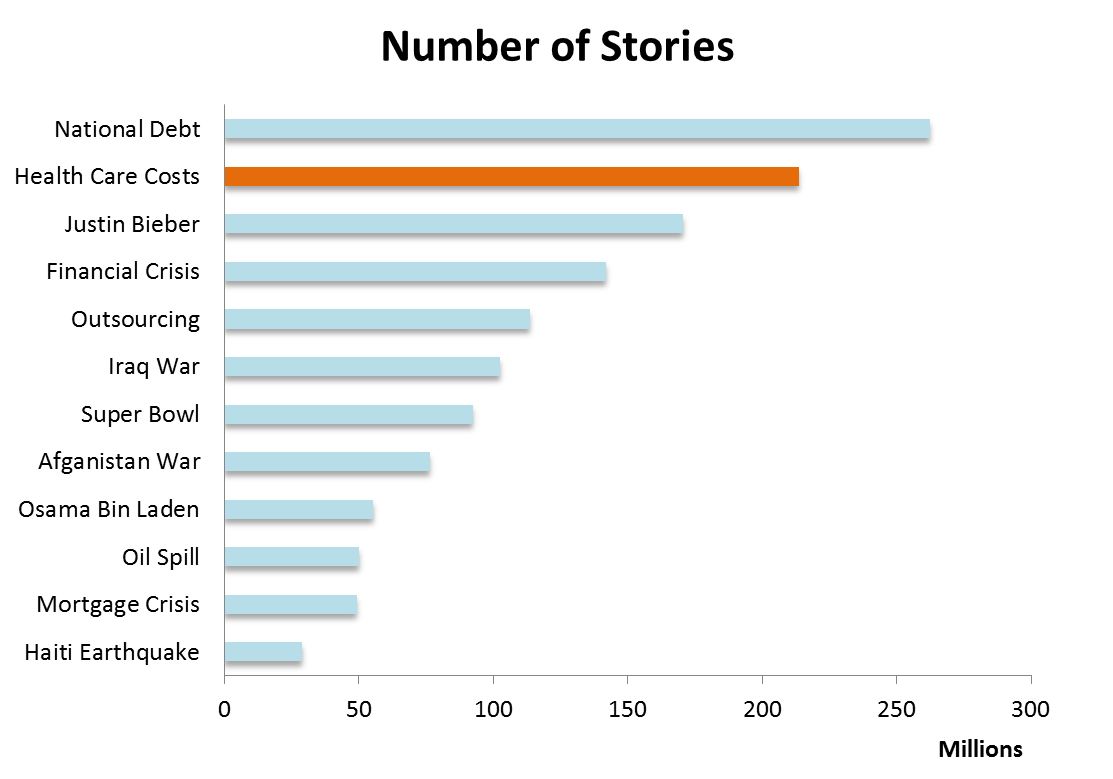

Since 2002, U.S. health care expenditures have doubled. This major increase has dwarfed almost all the major world news stories over the last six years, as shown in Exhibit 1.

Only the U.S. national debt has received more news coverage than health care costs.

Thank goodness it edged out news stories on Justin Bieber.

Exhibit 1: Health Care Costs Dominates News Coverage, 2005-2010

Source: HfS Research/Google, 2011

Health insurance has long been the vehicle most consumers use to access affordable care, whether through employers, federal government programs (Medicare), state government programs (Medicaid and CHIPs), or individually purchased coverage. And, despite the value health care payors provide their customers, payors’ processes are complex, manually intensive, and prone to error. One consumer’s visit to the hospital generates substantial legal paperwork, complex approval processes, coordination of benefits with other insurers, and a blizzard of bills, notices, and follow-up calls that require months to resolve. The processes are so poor that a “mini-industry” of service providers thrives on collecting overpayments and underpayments resulting in several pending lawsuits. The American Medical Association believes payment inaccuracy alone costs the industry $17 billion annually.

To be fair, payors are just one stakeholder in the health care process. Payors, physicians, hospitals, clinics, outpatient treatment facilities, labs, pharmacies, regulators, and medical product companies have conspired to create the greatest dysfunctional customer experience in the modern world (excluding government dysfunctions). No, they have not colluded together with this intention. Rather, by failing to collaboratively find solutions, they have created a politicized, inefficient system. While America’s Health Insurance Plans (AHIP), American Medical Association (AMA), American Hospital Association, Pharmaceutical Research and Manufacturers of America (PhRMA), the Medical Device Manufacturers Association (MDMA), and state and federal regulators have all contributed to substantial improvements in the quality of care, their inability to collaboratively drive out administrative costs is downright shameful. The lack of administrative standards and automation is inexplicable in an industry that represents 16% of the U.S. gross domestic product. Why can’t a consumer go online to evaluate the best care provider options, visit the care provider, swipe a smartcard to reveal electronic health records and benefit eligibility, review a posted price list, receive covered services without additional validation or approval, have prescribed medications automatically shipped to her home, automatically pay for all the above, and get an electronic month end summary of benefits? Instead, many consumers have no idea how much a particular procedure costs until months later when the eligibility and billing issues are resolved.

As unfair as it may seem, health care payors have absorbed the brunt of recent U.S. regulation. The regulation will increase market competitiveness (with health insurance exchanges), intensify administrative cost management (with medical loss ratio maximums), strengthen consumer rights and access (with guaranteed issue, mandates on covered services, elimination of lifetime maximums, and strengthened state insurance regulator powers), and dramatically expand the individual retail market (with individual mandates and financial incentives that may cause groups to drop coverage). Pharmaceutical and medical device manufacturers were hit with higher taxes, but these taxes will likely be passed on to consumers. Physicians and hospitals quietly escaped the blood bath and were left to deploy undefined electronic health records over underdeveloped health information exchanges.

A Sampling of Report Findings

It is in this context of industry upheaval, regulatory changes, and administrative inefficiency that we researched the state of business process outsourcing services provided to the health care payor industry. These services include claims and enrollment processing, customer service, analytics, medical management, finance and accounting, procurement, and print management. Here are some findings are regular readers may find interesting:

- HfS Research estimates that health care payor BPO industry to be a $1.2 billion market, which we forecast to grow to $1.9B by 2014. 90% of this market services payors with more than $5 billion in revenues. Primary growth will be driven by increased transaction volumes and new administrative cost reduction initiatives.

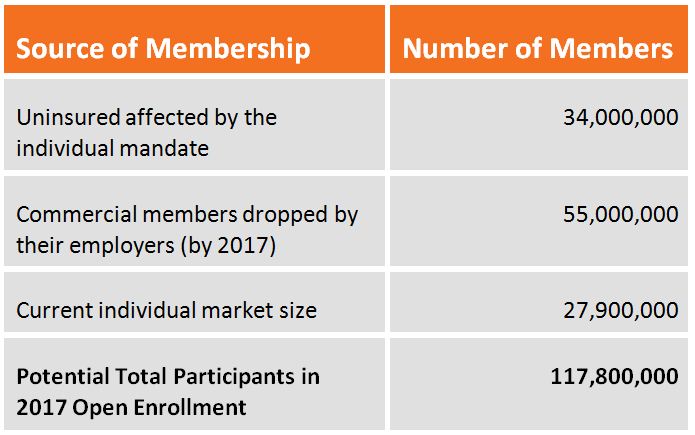

- Payors bracing for a radically new and substantially larger individual market. Based on our research, payors are still in the midst of strategy development. However, it is clear that payors will need substantial investments to support the individual market, which may quadruple in size. Especially open enrollment periods in 2014 and 2017.

Exhibit 2: One-Third of Americans Will Participate in Open Enrollment 2017

Source: HfS Research 2011

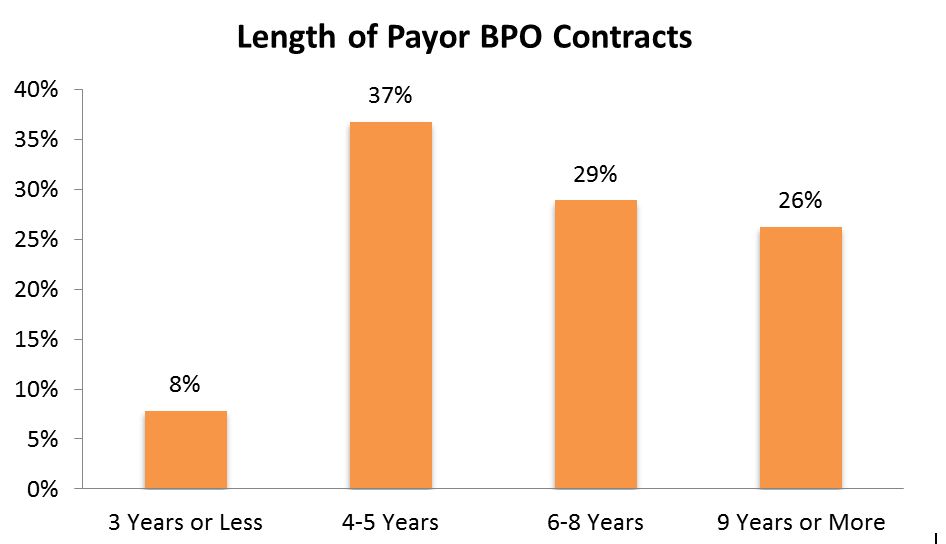

- Payors are really conservative. In an industry where average BPO contract terms lasts less than five years, 55% of payors’ contracts have terms of six years or more.

Exhibit 3: Payors Rarely Switch Service Providers

Source: HfS Research 2011

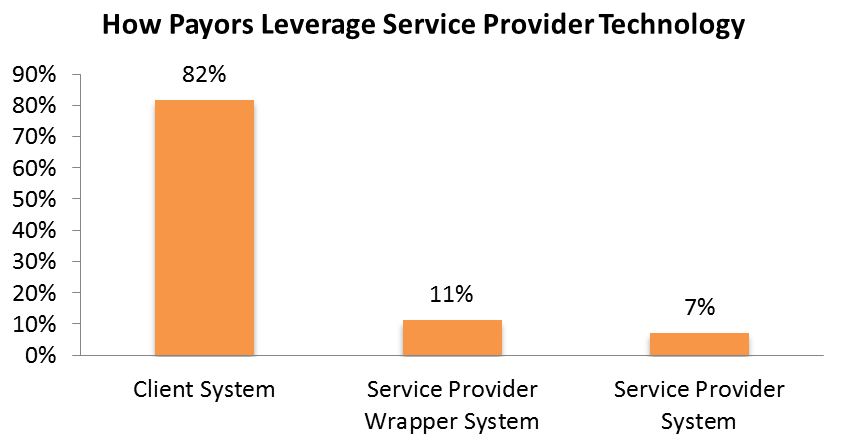

- Payors rarely leverage service provider technology. Only 7% of contracts used service provider platforms and 11% of contracts required service providers to provide improved reporting.

Exhibit 4: Payors Expect Little Technology from their Service Providers

Source: HfS Research 2011

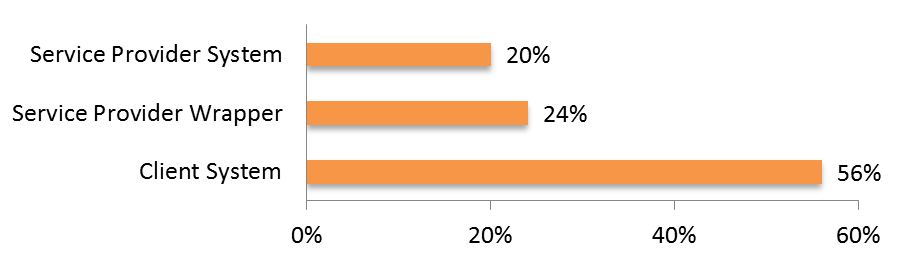

A key example of this is in data entry “front-end” processes where paper claims and enrollment forms are entered. Service providers are asked only 20% of the time to provide their own technology solutions.

Exhibit 5: Front-End Processes: Use of Technology

Source: HfS Research 2011

- Payors are extremely tactical with their outsourcing initiatives. 48% of all contracts are FTE-based and 32% are based on transaction fees. 40% of contracts had no gainsharing incentive. Those that did focused on sharing process efficiencies, not transformational value.

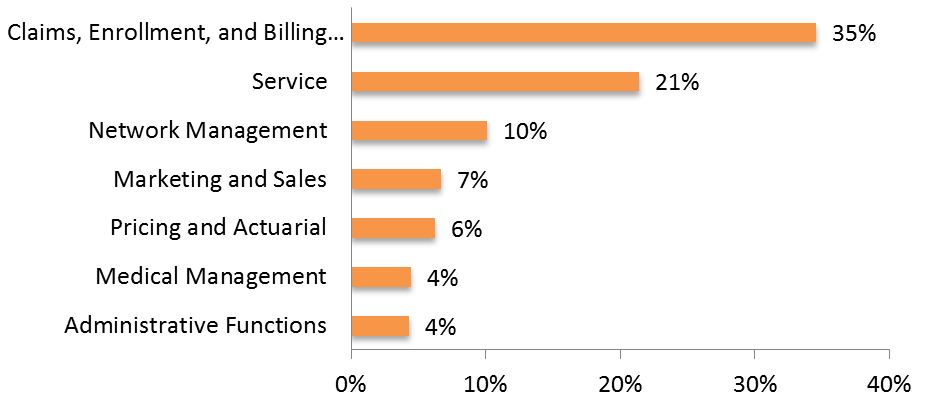

- Payors have outsourced little of their value chain. Not surprisingly, payors focus on outsourcing manual processing of claims, enrollment, and billing (35%), while service falls far behind (21%).

Exhibit 6: Healthcare Payor Value Chain Outsourcing Focus

Source: HfS Research 2011

Our report drills into more than 20 sub processes of these major processes in more detail, including use of technology, observations gleamed from data and interviews, identification of outsourcing opportunities, and a short list of service providers to consider.

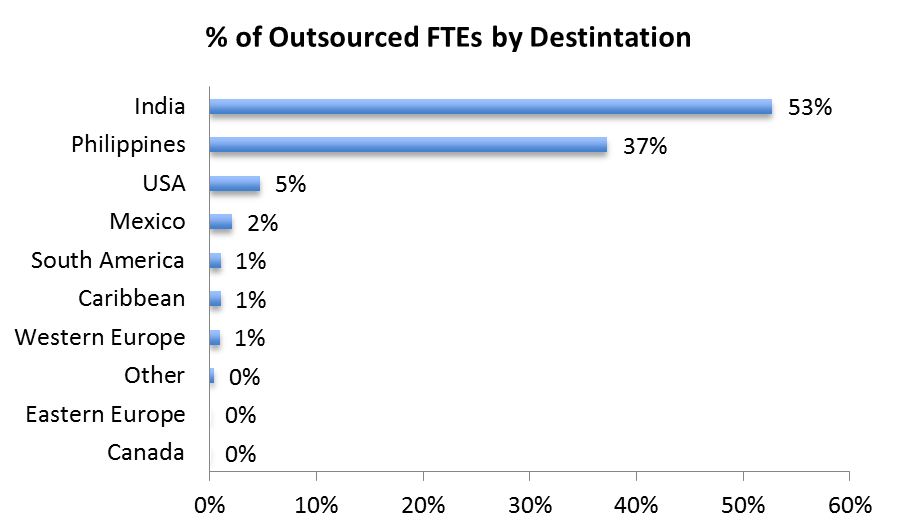

- The Philippines plays a major role in payor outsourcing. Unlike financial services and property, casualty, and life insurance, payors have a strong interest in the Philippines (37%).

Exhibit 7: Healthcare Payor Outsourcing Destinations where work is Delivered

Source: HfS Research 2011

- Payors tackle outsourcing alone. Only 5% of contracts were negotiated with the assistance of outsourcing advisors or consultants. HfS Research also found that 0% of payors used advisors to stand-up governance teams. On one hand, this indicates advisors’ lack of experience in health care outsourcing compared to in-house staff. On the other hand, maybe payors are too new to outsourcing to know when to ask for help?

Where Does This Leave the Industry?

Obviously, we need to share the juicy details with our subscription members. However, here are a few nuggets worth your consideration:

- Payors Cannot Thrive using a Labor Arbitrage Model; Bundled End-to-End ITO/BPO Solutions Pick up the Pace – Leading payors need service providers to leverage best-in-class platforms to drive process efficiencies. Service providers without platforms will fall behind. Platform and system interoperability and integration is key. Using data entry solutions for claims as an example, service providers must leverage a data entry platform that replaces their clients’ platforms, but integrates into existing client provider databases and claims processing platforms. Service providers with platforms that can comprehensively extend the workflow outside of payor systems will lead. Further, given the complexity of the payor processes and heightened regulatory attention, payors will consolidate their provider portfolios in favor of of those that provide end-to-end services.

- 2014 Open Enrollment Madness – The frenetic Medicare Part D open enrollment period in late 2005 will be dwarfed by the preparations for the 2014 open enrollment period. With Medicare Part D’s winners and losers fresh in mind, almost all the energy of the payors over the next few years will be spent building efficient marketing, sales, broker management and enrollment processes. Scalability and flexibility will be a significant concern.

- Offshore Service Providers will Increase Onshore Staff – Due to the combination of conservative decision makers and regulatory restrictions in the payor segment, offshore-only service providers will be at a distinct disadvantage. To overcome this, they will rely increasingly on onshore operations.

HfS research clients can download this new report here.

Posted in : Absolutely Meaningless Comedy, Business Process Outsourcing (BPO), Financial Services Sourcing Strategies, Healthcare and Outsourcing, HR Outsourcing, kpo-analytics, Procurement and Supply Chain, Sourcing Best Practises, sourcing-change

definitely interesting times!