Our new study of 1350 outsourcing industry stakeholders, conducted with our friends at the Outsourcing Unit at the London School of Economics, continues to reveal home-truths about what’s really going on in the business. Quite alarmingly, we can also reveal that many providers are not entirely in synch with what their customers actually want from them.

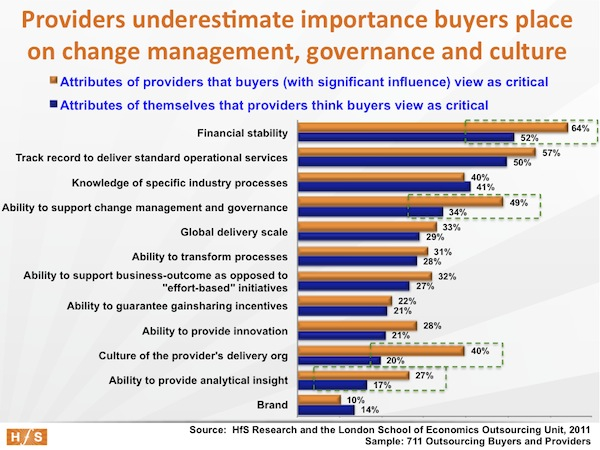

We asked a cross-section of buyers with significant influence over outsourcing decisions, to reveal the critical attributes they seek in a provider. At the same time, we asked providers what attributes they believe their clients deem critical. And – guess what – their are significant gaps between what clients want and what providers think they want:

Providers are underestimating the importance buyers (34% compared to 49%) are placing on their ability to help address their change management and governance challenges. This indicates a significant communication problem is going on in industry – buyers are clearly realizing they need a ton of help and are actually looking to providers to deliver it. We believe some providers are simply unaware of the extent to which buyers are concerned about these issues, and are over-focused on being price-competitive, demonstrating operational delivery capability and risk mitigation.

Moreover, to prove further this communication gap between buyers and providers, 40% of buyers see the culture of a provider’s delivery organization as a critical attribute, compared to only 20% of providers. This begs the question whether many providers ever stop to examine seriously their delivery culture and how it gels with their clients. How can so many miss the importance their culture has on their clients’ decision-making? Again, the answer has to be a lack of good ol’ communication.

Analytical insight is also becoming increasingly important to buyers (27%), with many providers – again – underestimating the extent to which those decision-makers want to learn more about their capabilities. Are providers simply convinced their clients and prospects are only interested in the basic table-stakes of outsourcing?

The bottom-line: understanding and communicating service-culture is the critical component of successful outsourcing

HfS believes that the knowledge and intentions of providers’ clientele is quickly maturing, and they need to find smarter ways to communicate with them, understand what’s really important and invest in their services to respond to their needs. Currently, the outsourcing industry has a problem – providers either aren’t listening to their clients, or simply aren’t being given the environment to listen.

Let’s face facts here – outsourcing has historically been far too reliant on contractual terms, to the detriment of the softer elements that are needed to foster better provider/buyer relationships. And it still is. However, what’s transpiring is that buyers are increasingly looking for more from their provider to help them better manage their outsourcing engagements. They don’t want continually to spend millions each year on consulting support to improve their governance capabilities, their processes, their analytics, their innovation roadmaps etc.; they want this stuff embedded in the day-to-day service-culture of their partner.

HfS ultimately sees three root causes inhibiting this development:

- Buyers need to try harder to get the message to providers about what’s really important to them;

- Advisors, consultants and intermediaries need to help facilitate (not restrict) more communicative environments for buyers and providers (pre and post contract);

- Providers need to spend more time demonstrating how their service-culture is the right fit with prospective buyers, and how they can help them with all the painful change and governance issues they are going to face over the long-haul.

Posted in : Business Process Outsourcing (BPO), IT Outsourcing / IT Services, Sourcing Best Practises, sourcing-change, state-of-outsourcing-2011-study, the-industry-speaks

I have worked for Indian outsourcing firms serving American clients and Indian clients. I have also worked for European outsourcing firms who define global expansion/delivery, as anything done outside 30 miles from their HQ 🙂

Every observation is bang on. I was just thinking of the adverse selection bias that we all know exists in many outsourcing evaluations, but was wondering how many different reasons contribute to the information asymmetry in the first place. You’ve put them all here. Really from the horses’ mouth this time.

– Ashwin

http://blog.ContractIQ.com

Interesting insights here. It seems that the provider-side is still too focused on the “nuts and bolts” of meeting the operations and metrics goals, and not focusing on the governance needs of actually helping the client transition into an outsourced environment.

However, I would add whether this is their fault, or more the manner by which they are told to behave to win business? I especially agree with your point about whether the right communications environment exists to help providers really understand their client needs. Clearly, it doesn’t in many instances, based on this data.

Great research – keep it coming!

Andrew Wagoner

This may also indicate that providers are not testing their hypotheses. It is “easy” to just keep doing what has worked in the past.

On the other hand, buyers may “value” culture fit at some level, but “price” still trumps them all. I would be interested to know how many buyers have selected one vendor over another on the basis of culture fit, even if that vendor is the more “expensive” one.

BTW, I’ve quoted “price” and “expensive” because as a matter of fact most buyers are focused on a few elements of cost and don’t really make their decisions based on the Total Cost of Engagement. If they did, they would realize how *expensive* it is to try to partner with a company that is not a fit culturally.

Great data, BTW.

Have a nice weekend.

I also feel that the providers are spending more time and money in “communicating” the value they bring on the table and very less time, money and efforts n “creating” value.

Case in point are the various white papers, case studies that the providers churn out, how many of these artifacts differentiate and substantiate the providers “value proposition”

@Matt: great to “hear” from you, old friend! In the past, providers have often relied on “flashy selling” and using complex terminology, essentially impressing the buyer with big ideas and big words. What’s been happening is the buyers has gotten smarter and seeing through a lot of the puff and bravado, and want to get to the issues that matter most to them: i.e. what are you actually like to work with, and will our people like your people.

Price is – and will always be – a very important factor, but I do not believe that it’s the ultimate consideration these days, provided all providers are within a 10% -15% band of each other. I have even seen buyers refusing to switch providers offering 25-30% cheaper rates, in instances where they are comfortable with their service, and their provider has institutional knowledge of their processes.

For LatAm providers, such as yourselves, while demonstrating the total cost of engagement is smart (but very hard to calculate), I would focus on demonstrating your prices are similar (without being overly scientific about it), with the culture of your service delivery being the key value-component for your clients,

PF

@Phil,

It’s good to hear of examples of buyers working with vendors that are aligned with them and putting “price” second.

We have pretty much followed the “culture first” issue as our differentiator and it works. The “challenge” continues to be getting past the “outsourcing” stereotypes in order to have a real conversation with prospects.

cheers — matt

Good insights.

One company that I believe that has got its model right both on culture and on governance/change management is Cognizant. And no surprise that this company is the fastest growing in the industry with high levels of client, employee and investor satisfaction.

Right from the beginning, the company adopted a hybrid model with a localized Client Partner architecture which has helped demonstrate a unique customer-first culture. Interestingly, the company’s business model (of focusing on a limited number of industries, geographies and service lines), operational model (two-in-a-box operating rhythm) and financial model (of managing margins within a narrow range and reinvesting everything above that for the cultural connect) have held the company in good stead.

On the second point on governance, it’s again pertinent to point out that Cognizant is pehaps one of very few companies to have acquired a pure-play program and change management company PIPC.

Spot on numbers and insights.

In my first major FAO implementation (transformational) I thought we were way overdoing it from the change management, knowledge transfer, governance, and other perspectives. Having since observed additional FAO implementations, I’ve seen the other end of the spectrum in questionable execution – the issues and counter-culture it can create impacts the current and future relationship, putting a fuzzy front end of negativity on client outsourcing expectations.

Much of this has been covered on HfS, yet the change has been slow to materialize. Recent coverage – e.g. “The Don” – give hope; addressing the 3 root cause issues at the end above need to be the starting point from the very first business development contact.