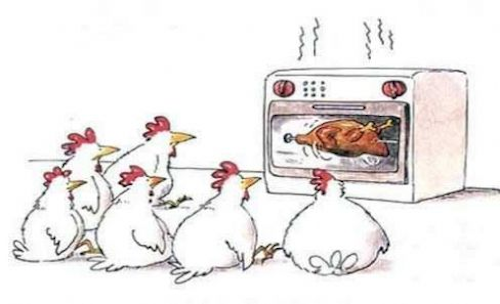

Most British people around my age will be familiar with Not The Nine a Clock News – a satirical sketch show on the BBC in the early eighties, which was one of the first vehicles for Rowan Atkinson. I remember a sketch where a customer was visiting an electrical retailer and asked a series of questions to one of the staff members about a Stereo’s features, like “does it have Dolby?” With the member of staff just parroting back affirmatives to every question, “yes it has Dolby.” The customer, with increasing disbelief asks if it could microwave chickens – with the “expert” answering with disinterest “yes it microwaves chickens.”

Most British people around my age will be familiar with Not The Nine a Clock News – a satirical sketch show on the BBC in the early eighties, which was one of the first vehicles for Rowan Atkinson. I remember a sketch where a customer was visiting an electrical retailer and asked a series of questions to one of the staff members about a Stereo’s features, like “does it have Dolby?” With the member of staff just parroting back affirmatives to every question, “yes it has Dolby.” The customer, with increasing disbelief asks if it could microwave chickens – with the “expert” answering with disinterest “yes it microwaves chickens.”

This is the type of response you get when you ask an “expert” about blockchain. What does blockchain do? Everything. Or so it seems.

I have the fortune (or misfortune depending on your perspective) to hang out a lot with IT and sourcing industry analysts – working in the industry they make up my colleagues and many of my friends. This means that, over the last couple of months, I have had to endure a whole spate of blockchain theses testing the boundaries of sanity. The issue with a topic like blockchain is it’s hard to understand what is real and what is not. Because blockchain is a difficult concept to understand, many of the people I have encountered talking about the benefits do not seem to understand what it actually is. Except that it will revolutionize lots of things – by making electronic voting a reality, electronic financial transactions perfectly secure, IoT actually happen and work, helping to enforce digital rights and combatting physical counterfeits. Which are all laudable aims, but I tend to lose confidence in people’s predictions about a subject, when they do not understand how it works. Just saying “well you know, it’s blockchain, of course it can (microwave chickens),” just doesn’t inspire.

What is more, this overblown confidence in blockchain’s ability to change the world is not shared by business leaders at the moment. Our recent research on achieving Intelligent Operations, which canvassed 371 major buy-side enterprises, showed interest in blockchain at a similar level to using drones.

Posted in : Blockchain, Financial Services Sourcing Strategies, Security and Risk

Izabella Kaminska (@izakaminska) of @FTAlphaville, a bitcoin skeptic, wrote a piece in the Financial Times on the recent Bitfinex hack in Hong Kong. ‘We probably won’t know what really happened at Bitfinex for a while. But what is clear is that thus far the technology which was supposed to be revolutionising finance and making it more secure (oddly, by skirting regulations) is looking awfully like the old technology which ran the system into the ground.’

Credit Suisse have just released a report ‘Blockchain:The Trust Disrupter’ which takes a look at three UK BPO service providers and blockchains implications for share registration, payments and the public sector. Like cloud computing before it, blockchain is causing a considerable amount of hand wringing and argument. This is set to continue but this story has a long way to go, whether blockchain will follow the cloud phenomena or be the 21st Century version of Y2K is still to be determined.

From the report:

Share registration: The application of blockchain technology to the UK share registration market is at least five years away, in our view. It is likely that full dematerialisation (the eradication of physical share certificates) needs to happen before full adoption can happen, and the timing of this is deeply uncertain. In the event of a shift to blockchain, we believe there will still be a critical permissioned ‘gatekeeping’ function for the incumbent registrars to ensure that all entries onto the chain and reconciliations of data being pulled from the chain are accurate and to act as the ultimate ‘source of truth’ as regards legal title. We see the threat of disintermediation as a relatively low probability risk.

Payments: Capita and Equiniti are the two largest pensions payments administrators in the UK, handling billions of pounds worth of transactions each year. The potential for blockchain to remove significant layers of cost from the current ‘byzantine’ UK payments architecture could deliver significant cost savings for Business Process Outsourcing (BPO) operators. We believe the timing of this potential opportunity is likely to precede the timing of any disintermediation threat in share registration.

Public sector opportunity: The UK government has already identified significant and wide-ranging benefits of distributed ledger technology to public sector administration. This could create a multi-decade opportunity for blockchain transition and integration specialists. Capita and Equiniti are likely to have to partner and acquire to build the skills to meet the demand. Once any such grand project has been achieved it is unclear what the size and shape of the UK public sector BPO will look like over the very long term, but this is likely offset by a significant opportunity to export such skills internationally.

https://doc.research-and-analytics.csfb.com/docView?source_id=eqgl&document_id=1063851711&format=PDF&language=ENG&serialid=ntOlA/vHDxjr9/D1u31yRiRRfwcdGRX1L/4f/qtEHNo%3D&serialid=fzjfThkB3Ghzc0HXZ8F4wYsIlHtCVLxCrsbZ32SR5io%3D

‘