Month: August 2021

Don’t let digital burn-out kill your career

We are in serious danger of our careers becoming subdued and deemphasized in the current climateRead More

Cyber Ralph serving up some sparkle for HFS

Ralph Aboujaoude Diaz joins HFS to lead CybersecurityRead More

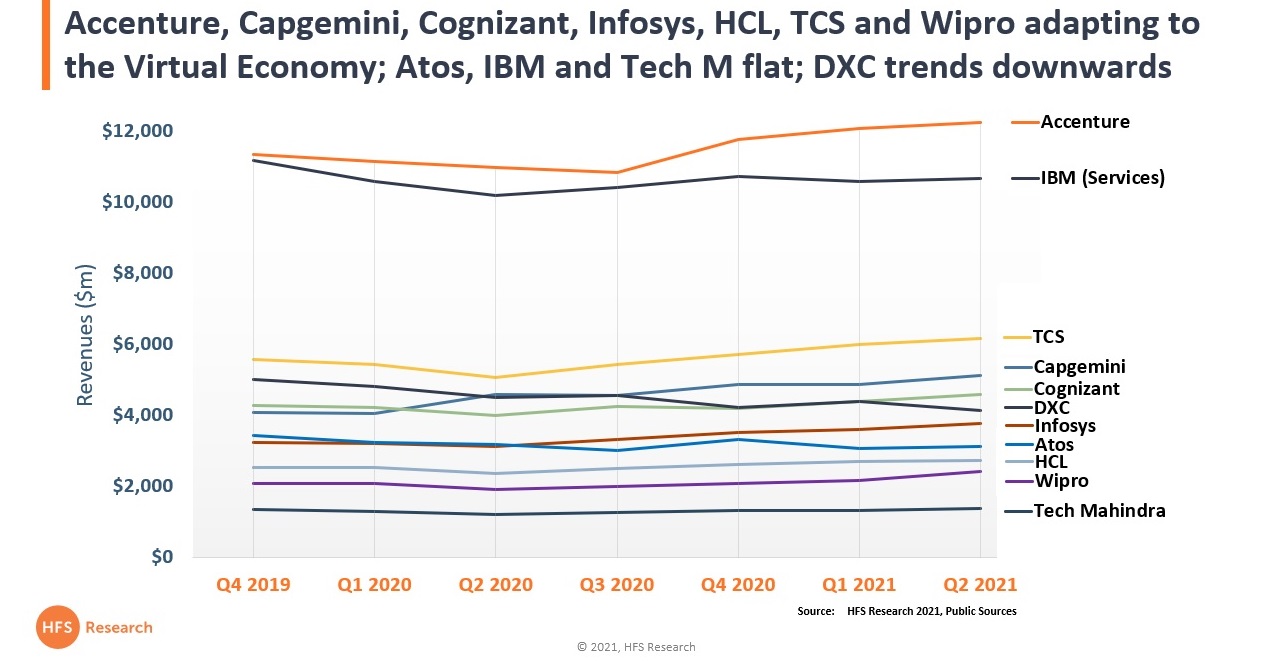

Accenture, Capgemini, Cognizant, Infosys, HCL, TCS and Wipro adapting to the Virtual Economy; Atos, IBM and Tech M flat; DXC trends downwards

The services market for the virtual economy is only just ramping up, this is merely the hors d-oeuvre before the real feasting starts!Read More

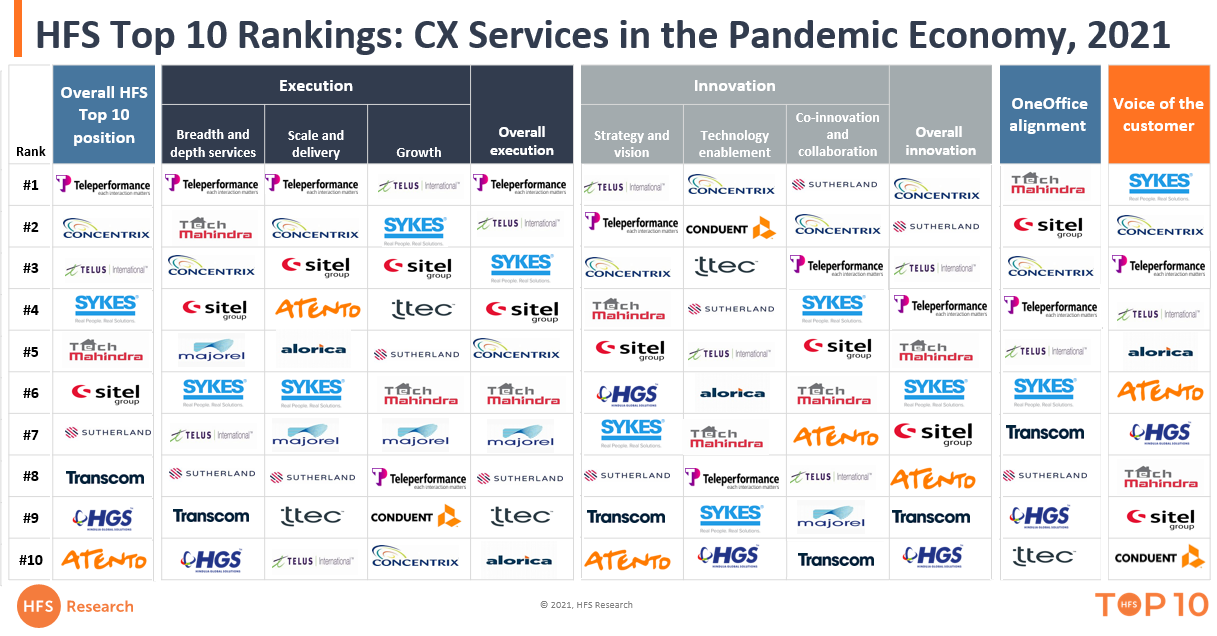

Teleperformance, Concentrix, Telus, Sitel/Sykes and Tech Mahindra kept the CX lights on during the Pandemic

The Pandemic has driven the imperative to manage the intersection between traditional BPO delivery and digital capabilityRead More

Meet the billion-dollar baby process miner who steered clear of buying an RPA product

HFS CEO and Chief Analyst Phil Fersht thought it about time he caught up with Celonis Co-Founder and Co-CEO Alex Rinke.Read More