Month: October 2017

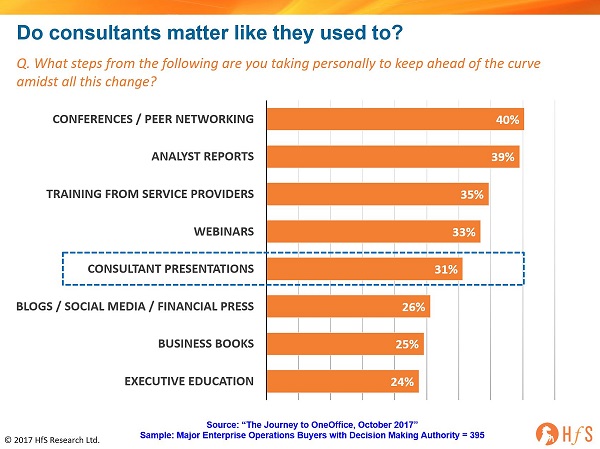

Are we poised to see a new era of digital operations advisors?

Not even a third of decision-makers are relying on consultants in this ever-confusing marketRead More

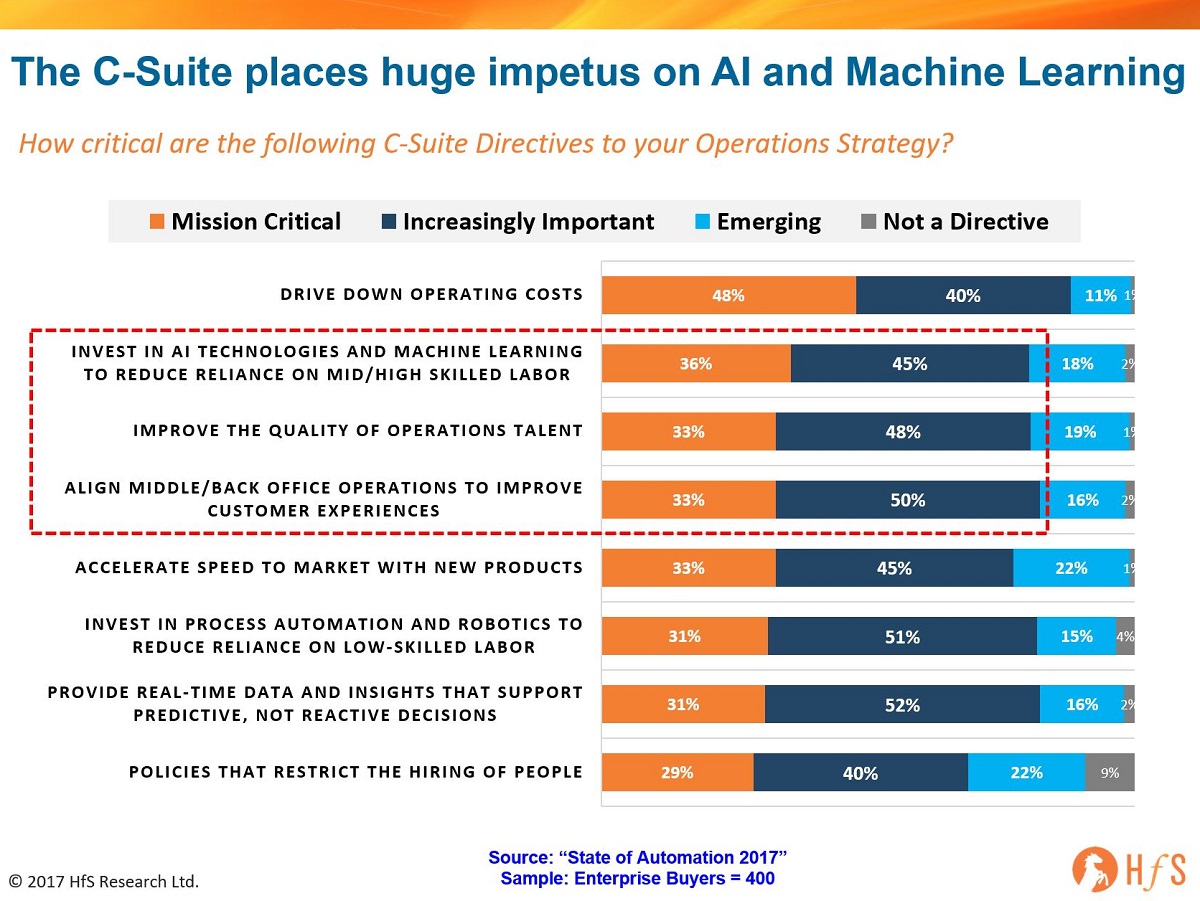

The State of Automation and AI Study 2017: 400 operations leaders air the real deal

HfS unveils the 2017 The State of Automation and AI study: The C-Suite's Number One Strategic ImperativeRead More

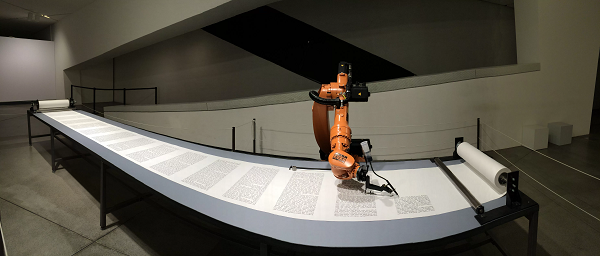

It’s here. The RPA Bible.

It's here. The RPA Bible.Read More

#NASSCOMBPM 2017: The Indian BPM industry graduates from biryani to bhuna, but needs to stop celebrating the past

Phil Fersht shares his takeaways from the 2017 NasscomBPM Summit in BangaloreRead More

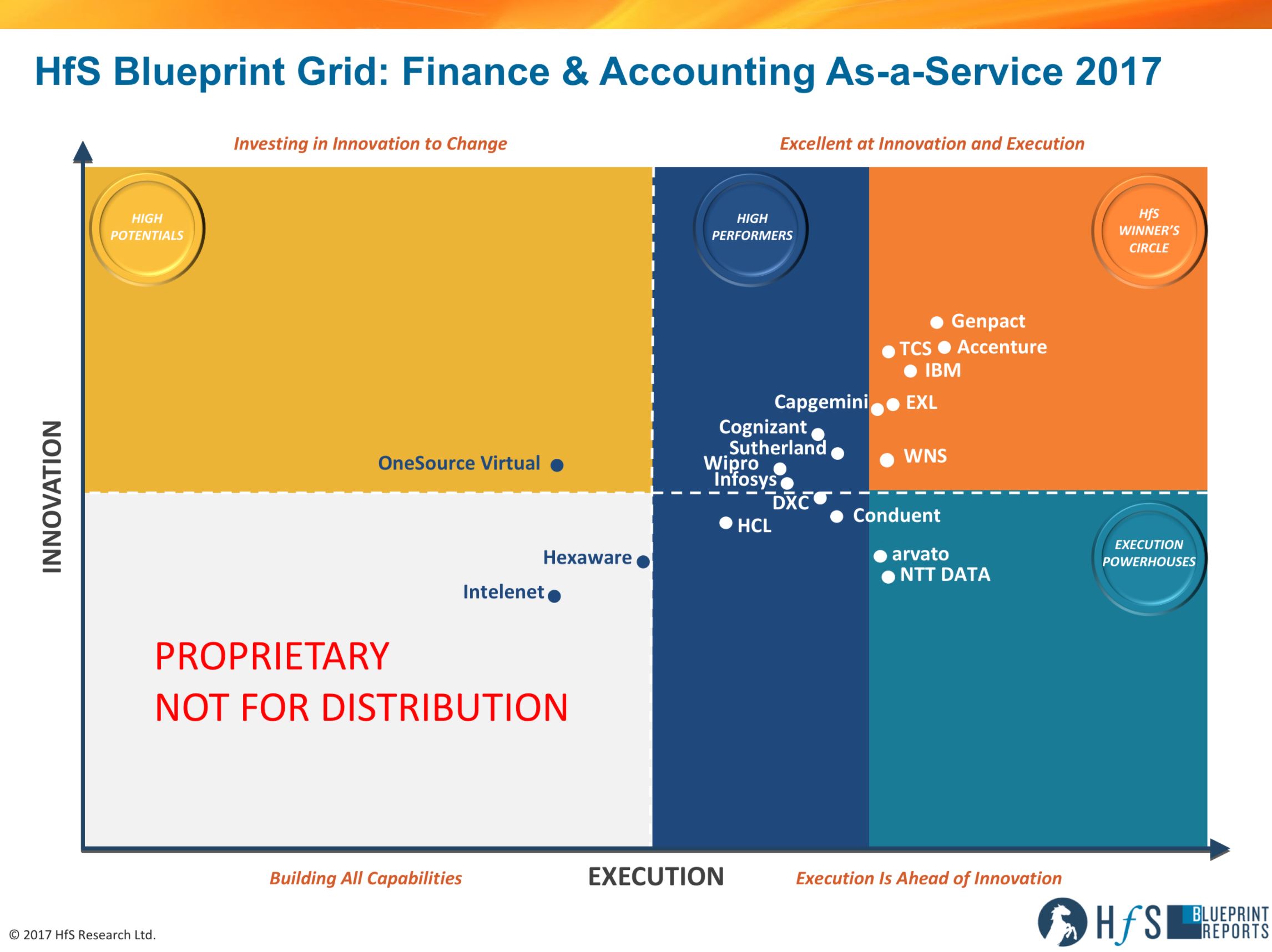

Meet F&A’s new Big Seven: Genpact, Accenture, IBM, TCS, EXL, Capgemini and WNS

On the Knife’s Edge: Do F&A Service Buyers and Providers Really Want Transformation – Or Just RPA Arbitrage?Read More

Got anything better to do Thursday? Come along to the #Nasscom summit in Bangalore

Phil Fersht will be speaking on the Future of Operation in the Robotic Age at NASSCOM BPM this ThursdayRead More

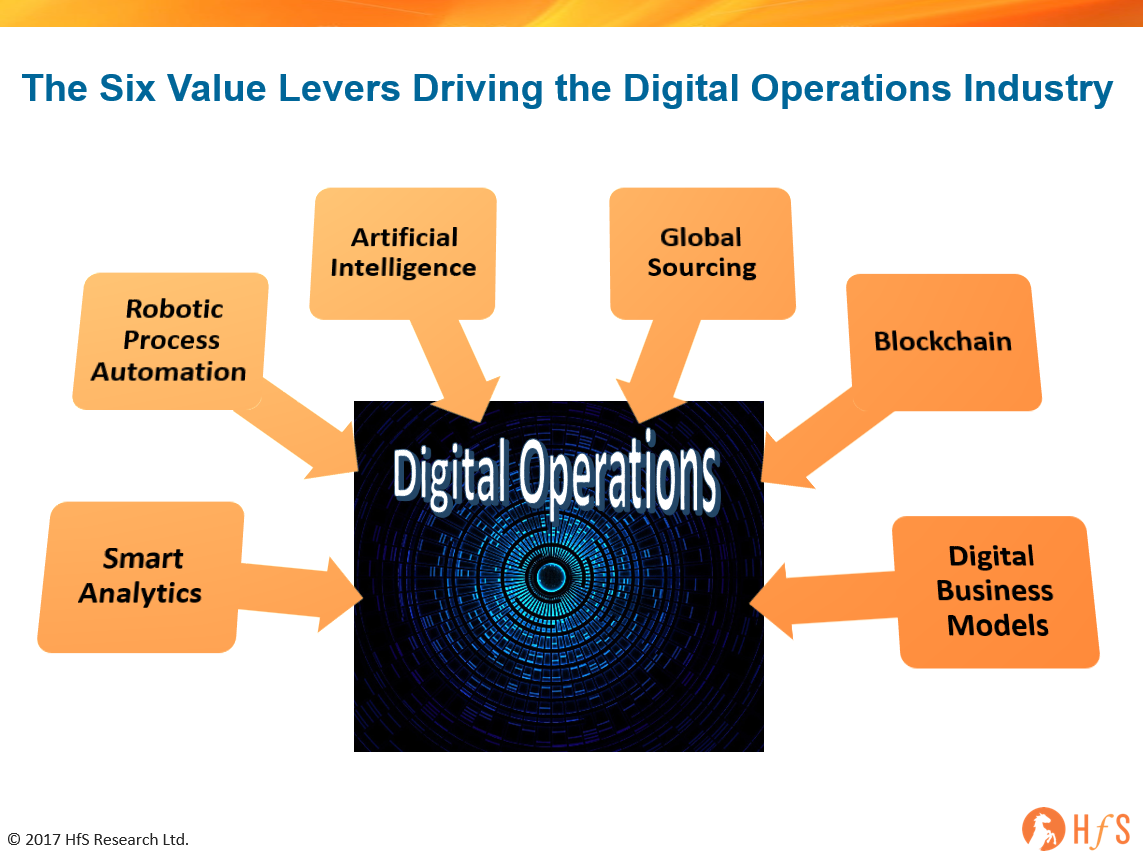

Have we finally become an industry? Have we become the Digital Operations Industry?

After years of trying define ourselves, have we finally emerged as the Digital Operations IndustryRead More

Meet Elena the analyst

HfS welcomes analyst veteran Elena Christopher back the the analyst foldRead More