Month: May 2014

Is it high time industry analysts are regulated?

One issue that is increasingly rearing its ugly head is the ridiculous - and often insane - demands industry analysts are placing on providers of technology and business services to pony up client references for their scatterplot charts.Read More

Why offshoring is hotter than ever

Close to a third of enterprises are increasing the offshore component with their service providers, and a fifth with their own shared servicesRead More

Time to stop the buzzword balderdash and become meaningful again

Our industry has started to lose the plot with the amount of buzz terms spewing aroundRead More

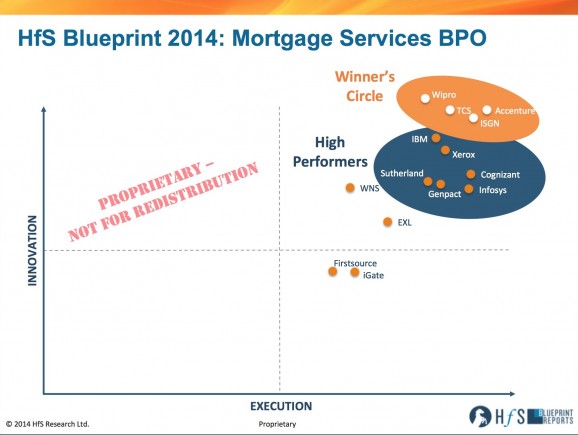

Accenture, Wipro, TCS and ISGN make the Winner’s Circle for Mortgage Services BPO

Accenture, Wipro, TCS and ISGN make the Winner's Circle for Mortgage Services BPO in HfS' latest Blueprint ReportRead More

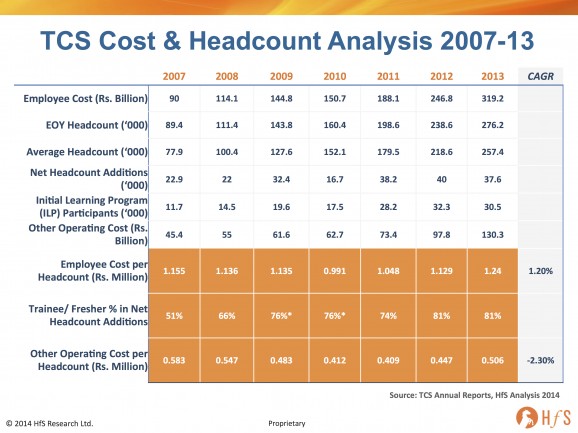

Defying disruption, or a ticking HR time-bomb? How TCS reduces its average cost per employee by 6.3% each year

Not only does TCS enjoy the highest revenue growth in the IT services industry, it is also the most profitable - so what's the secret sauce?Read More

Europe’s finest enterprise operators take on the USA at the Cambridge University Blueprint Sessions. Who’s sourcing smarter?

This June we are assembling the ultimate pool of European and American services talent to duke it out on the hallowed lawns of Cambridge's Gonville and Caius CollegeRead More

Capgemini’s new BPO General rocks up: Chris Stancombe

From geophysics to BPO... HfS' Phil Fersht interviews Capgemini's new CEO for BPO, Chris StancombeRead More

A little bit of HR heaven as Kutik tackles the toughie from Southie

Christa Degnan Manning talked with Bill Kutik about the Extended Enterprise, the Employee Experience, Workforce Enablement, and hybrid HCM systemsRead More

Outsourcing advisors must be governance experts armed with research if they want to survive

Advisors need to provider governance support and research in order to surviveRead More