Category: Security and Risk

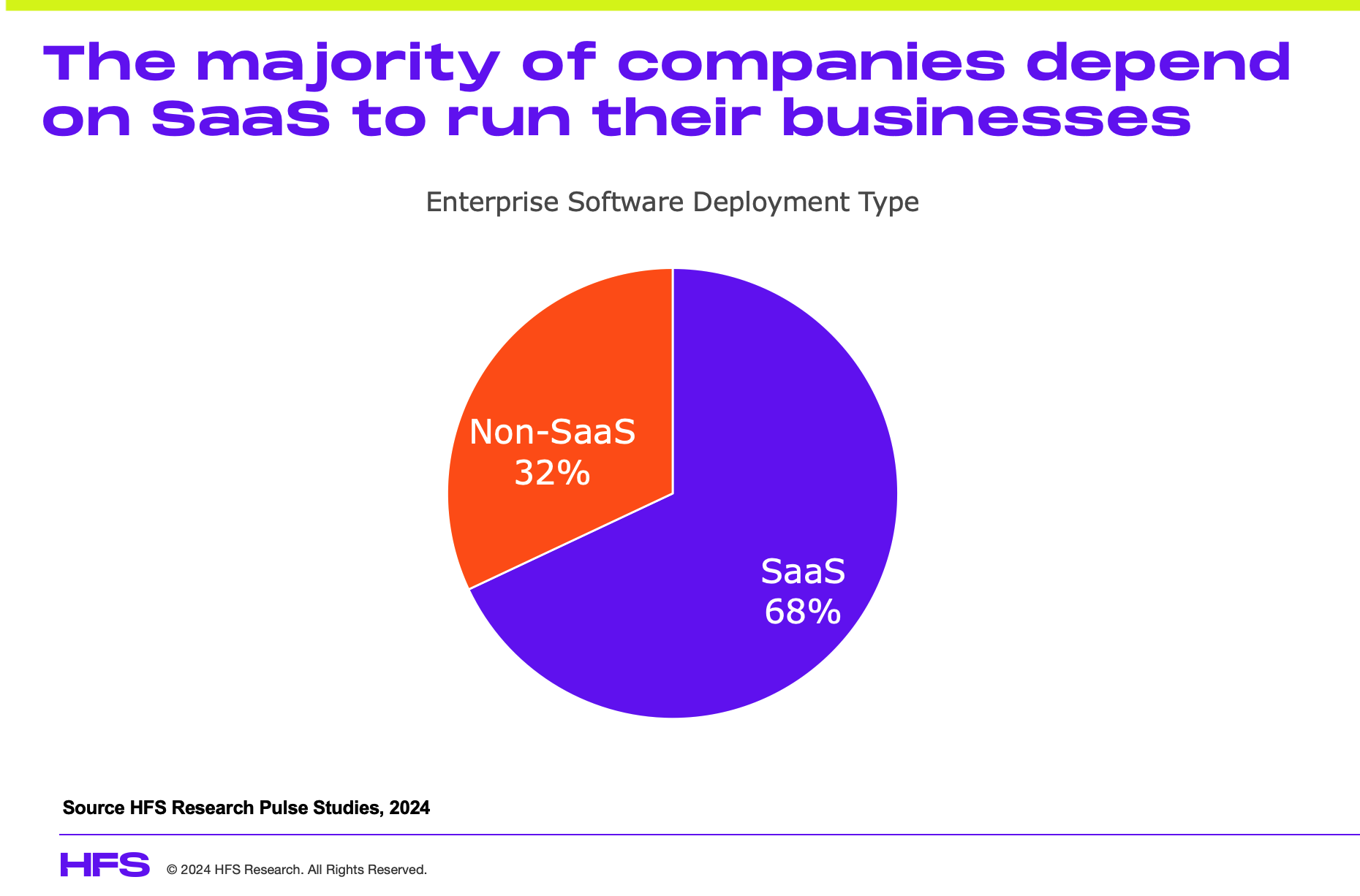

CrowdStrike is accountable for ITIL failure but Microsoft must manage its SaaS ecosystem more diligently

As the CrowdStrike outages illustrate, many IT departments are getting too complacent allowing their SaaS vendors to have full control of application management, updates, and automated delivery, especially when it comes to security updates. In addition, tech giants like Microsoft must be more diligent with their SaaS ecosystem partners.Read More

WannaCry emphasises the dire need for automation and cognitive in security

Too often, standards aren’t keeping up with the changing threat landscape - you’ll never collect the necessary data manually. Your automation investments must involve analytics to find patterns in the data so your team can take appropriate next stepsRead More

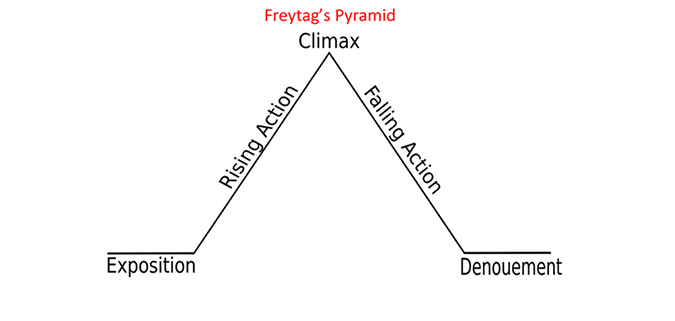

Once Upon A Time…To Hold Management Attention, Security Execs Became Storytellers

So what can a smart security executive do to capture and hold management attention on security issues? Become a great storyteller.Read More

Ask the Experts: Security Gurus Offer Their Advice for Non-technical Buyers

It’s important for sourcing teams to get smarter about security themselves to lessen their dependence on domain experts for preliminary RFP screening and downselecting.Read More

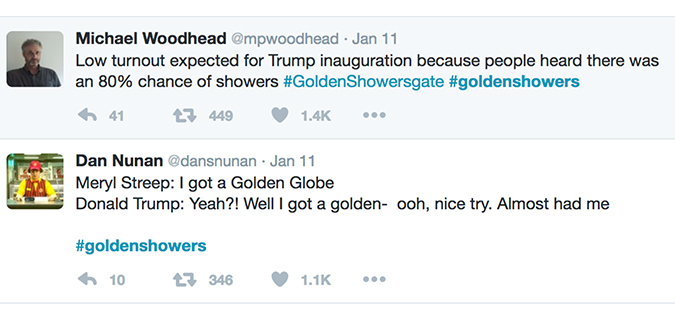

Trump Intel Story: A Stark Example Of A Predictive Security Management Dilemma

Predictive security management requires difficult decisions about treating incidents before they happen.Read More

Poach, diversify or upskill? What is the secret for sourcing security talent?

With the continued rise in cyber security threats, organizations across industries are scrambling to get their cyber security measures in order.Read More

Getting The “A” Team From Your Provider – Or, More Realistically, Getting The Team You Deserve

Delivery problems aren't always because of lacking provider capabilitiesRead More

New Year’s Resolution For All Of Us: Put More Business Into Our Security Discussions

Security discussions need more focus on digital trust, OneOffice, and shared responsibility.Read More

What does Tomorrow’s Cyber-Security Unicorn Look Like?

A look at how at the profile of security professionals is changing in a market underpinned by massive demand with limited supply.Read More

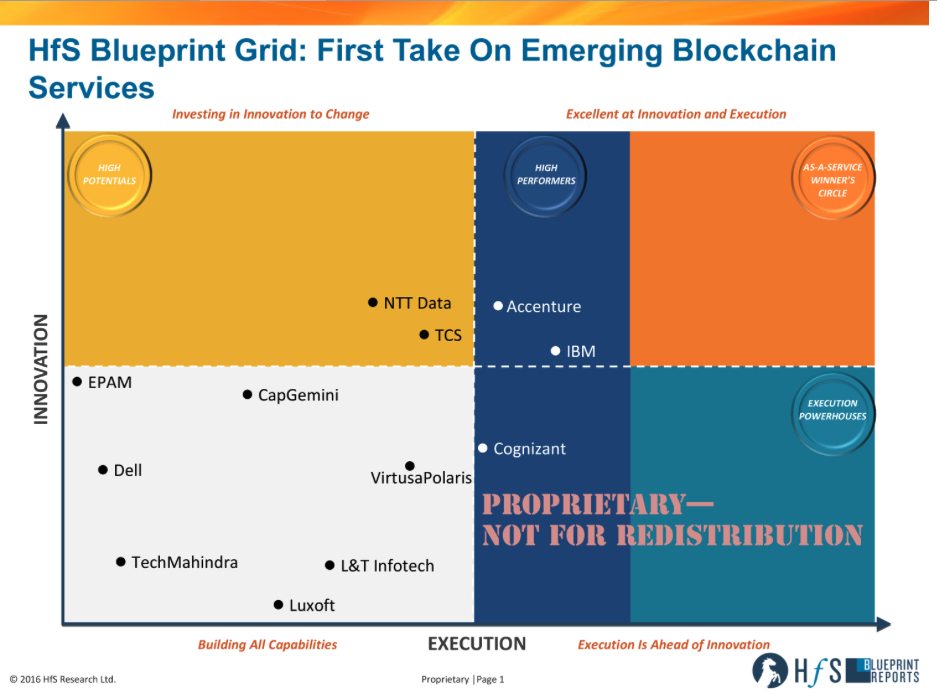

Accenture, NTT, IBM, Cognizant and TCS making the early moves with Blockchain Services

HfS unveils the first ever view of service provider capability with Block ChainRead More