Category: hfs-2011-double-dip-recession-study

What are Business Platforms and why they represent the future of outsourcing

The ability to develop some best-in-class processes as "Business Platforms", whether they focus on horizontal or vertical process clusters, is becoming a real differentiator in the market, as buyers seek more standardized solutions from their outsourcing engagements. The gauntlet being laid out to providers, with these Business Platforms, is their ability to support their clients’ transitions quickly and inexpensively. Simply selling “products” is not the concept of business platforms – it is the provider’s ability to work with their customers to facilitate and support the ultimate business outcomes of managing the processes associated with the Business Platform offering.Read More

Why outsourcing professionals must stay in touch with the 99%

Governments are very capable of passing measures very quickly to restrict outsourcing if things get really bad - and they won't have any choice if the 99% demand it. All outsourcing stakeholders - buyers, providers and advisors - need to focus, more than ever, on helping organizations approach outsourcing as one supporting component of a holistic solution.Read More

Double-Dip Dynamics, Part II: The new tenets of outsourcing – process standardization, global flexibility and better technology

What is motivating buyers to outsource in this current climate? While eliminating cost is still is a huge fundamental, buyers are even more focused on achieving greater flexibility to scale their global operations as a prime motivating factor. Clearly, many executives are getting more experienced and skilled at driving an sourcing initiative, and are confident they can use the endeavor as a change agent to promote and implement much-needed change in their businesses.Read More

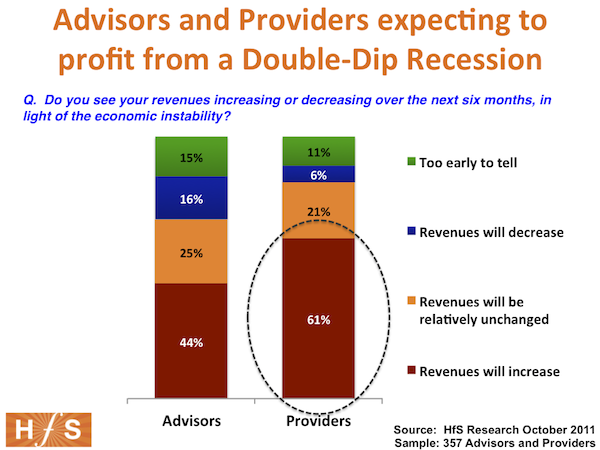

Double-Dip Dynamics, Part I: 70% of buyers are sitting on the fence with their outsourcing plans in the current climate

Our new study that covered the intentions and observations of 534 buyers, advisors and providers with their sourcing strategies in the event of a "Double-Dip" Recession reveals one major shift in the industry: most buyers now recognize what their businesses need to improve to drive productivity, they simply are struggling to figure out how to marshall their internal and external resources to help them get there.Read More

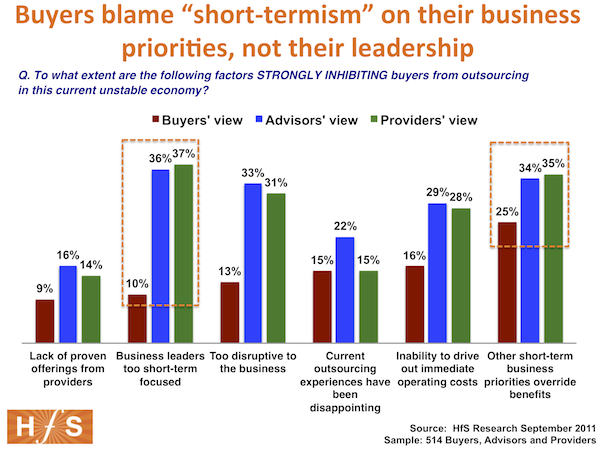

Too many providers and advisors are being myopic with their clients and failing to understand their business pressures

Our latest study shows that many buyer executives are, in actuality, in violent disagreement with many provider and sourcing advisor executives that they their business leaders are too “short-term focused”Read More

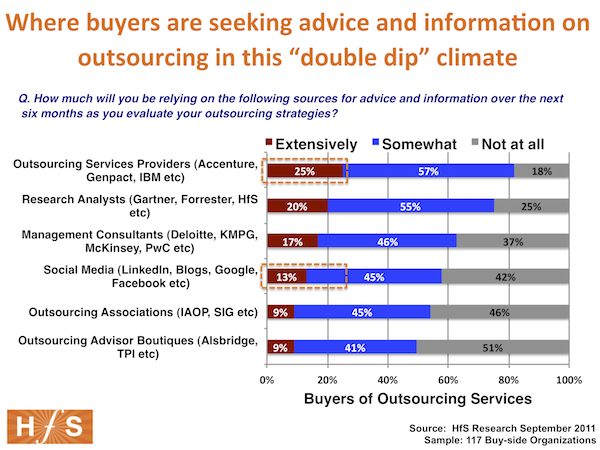

Cheap and quick please! Wizening buyers are seeking help from easily-accessible sources

When we ask them buyers they're foraging for help and information with outsourcing strategy-making in the coming months, the results are simple: they are turning to whatever sourcing are most easily-accessible and inexpensively-available to themRead More

Will a Double-Dip Recession reverse the trend of buyers “delaying outsourcing” during a slump? Here are 10 factors to consider…

Organizations have always been wary of outsourcing during recessions. While today it delivers cost-reduction to clients in spades (proven emphatically during our recent state-of-outsourcing study), many organizations have proven, in the past, to push it down the priority-list of radical cost-reduction measures, when they fear for their very existence. However, with the threat of a "Double-Dip" recession very much a grim reality, HfS believes this cycle is likely to be broken.Read More