Month: May 2012

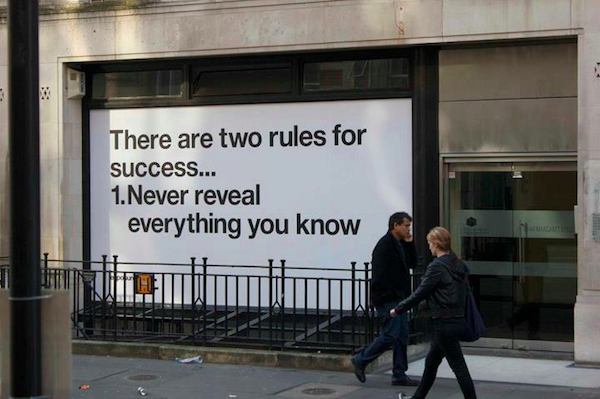

There are two rules for success… here’s one of them

There are two rules for success... here's one of themRead More

and on that topic of “ring-fencing”…

what to do with that bad offshore outsourcing engagement?Read More

Time to ring-fence “Lights On Outsourcing” and focus on “Business Transformation Services”

It's high-time to segment the industry so we can all focus on delivering value, and not solely cost-cuttingRead More

Ron Walker lands it safely on the green… with KPMG

Ron Walker, one of the original EquaTerra founding executives has lived the sourcing dream... from start up advisors and providers right through to a global management consultancy. So we thought it high-time we caught up with Ron to talk about his colorful career and how the EquaTerra/KPMG merger was faring over a year on... and how different the sourcing world is looking today compared to those crazy days of the outsourcing boom.Read More

SAP ruptures the procurement universe by scooping up Ariba

With its $4.3 billion cash offer, SAP answered every procurement technologist’s question, “Who is going to buy Ariba?” While this acquisition will rupture the procurement technology universe, HfS believes the real question that supply chain and finance professionals must ask is, “Now that SAP finally has a credible commerce network, can I eliminate and automate processes I’ve been busily outsourcing?”Read More

HP’s imminent shrinkage: Meg prepares for commodity competitiveness

So for the first time since the '08-09 crash, we're finally starting to see the impact of a commodotizing services market, as HP makes plans to shed 30K jobs this week. However, I believe HP is a symptom if a commodotizing and standardizing IT/business services industry - it's recent woes have forced it to take corrective action that many of its competitors will surely have to also take in the future. Read More

In case you felt you had something better to do during our Services-Savants webinar…

We still haven't quite forgiven those of you for not being one of the 1,200 people who signed up to hear six of the most influential IT and business services savants debate on the future of sourcing and services. I mean - what else were you doing? Was it really that important? However, in our spirit of forgiving even the unforgivable, here's a replay of the event.Read More

Blueprint 1.0 was blinding… now are you ready for Blueprint 2.0 this October?

The HfS 50 Blueprint Sessions 2.0 are a continuation of the hugely successful summit that took place at the Soho Grand in New York in April 2012, where 41 senior practitioner recipients of outsourcing services, joined by six of the leading outsourcing services providers on the second day, started the ground work for a Blueprint document that delivers a roadmap for the future direction of the outsourcing industry. Read More

Bring it on! ISG takes aim at Gartner

ISG analyst Stanton Jones points a nuclear missile at the credibility of Gartner's recent Magic Quadrant for Managed HostingRead More

Steering India’s services juggernaut in a Chevy Volt at 108 mpg

Phil Fersht interviews Basab Pradan and Gaurav Rastogi on their new book "Offshore: India’s Services Juggernaut"Read More